Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

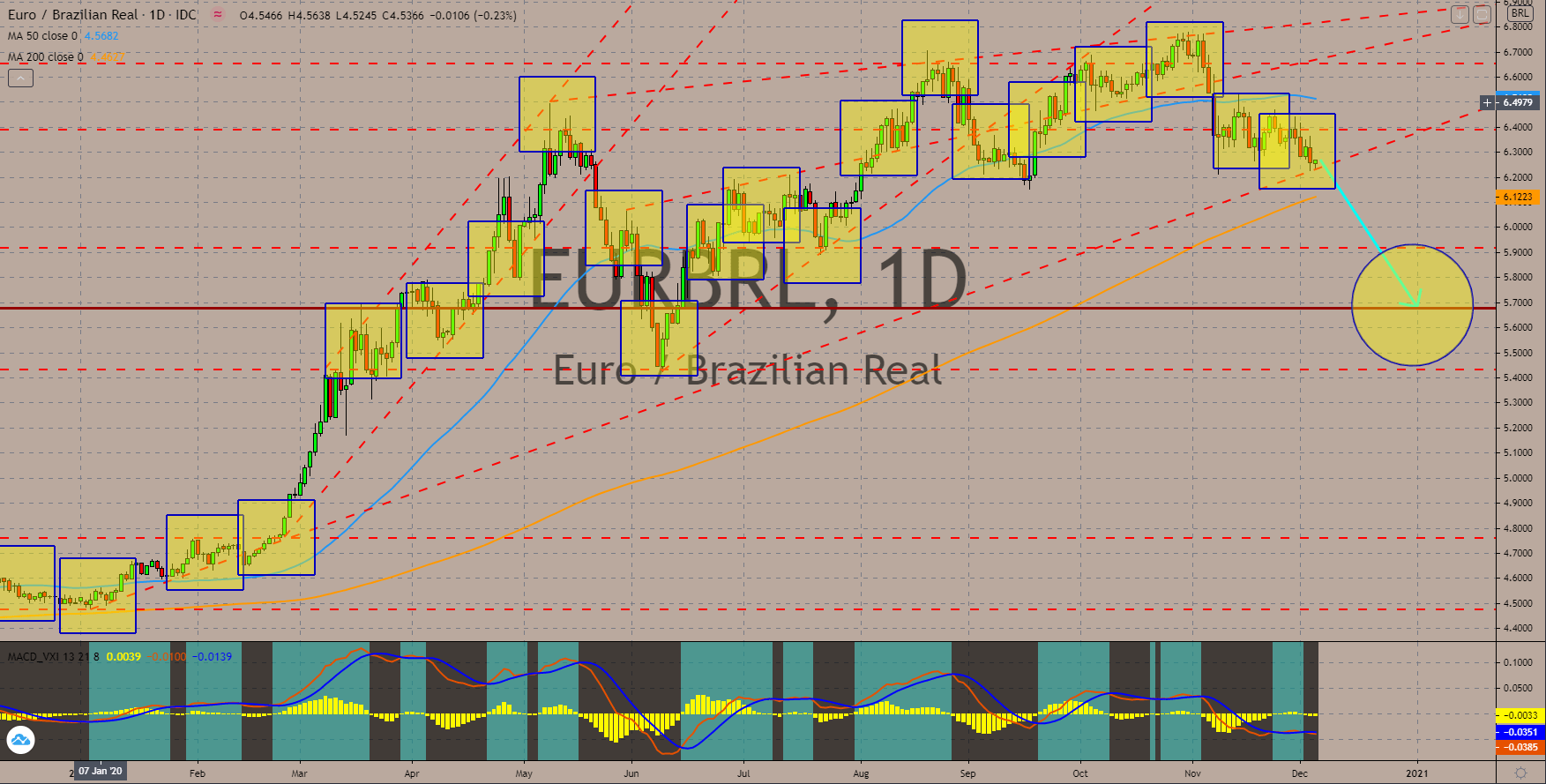

EURBRL

On Thursday, December 03, only one (1) out of nine (9) EU reports posted positive a figure. The German Composite PMI recorded 51.7 points, still a substantial decline from the prior month’s 55.0 points result. The reported figure is also lower than analysts’ consensus of 52.0 points. Meanwhile, some of the reports from the EU and its member states had better-than-expected numbers. However, these figures were below 50 points, which means that the sectors these reports are representing have contracted for the month of November. The reports which had the worst results were France, Italy, and Spain’s Services PMIs. Figures came in at 38.8 points, 39.4 points, and 39.5 points, respectively. In connection with these figures, the three (3) countries just mentioned were among the top 8 countries with the highest COVID-19 cases. The MAs 50 and 200 show a possible “Death Cross” formation.

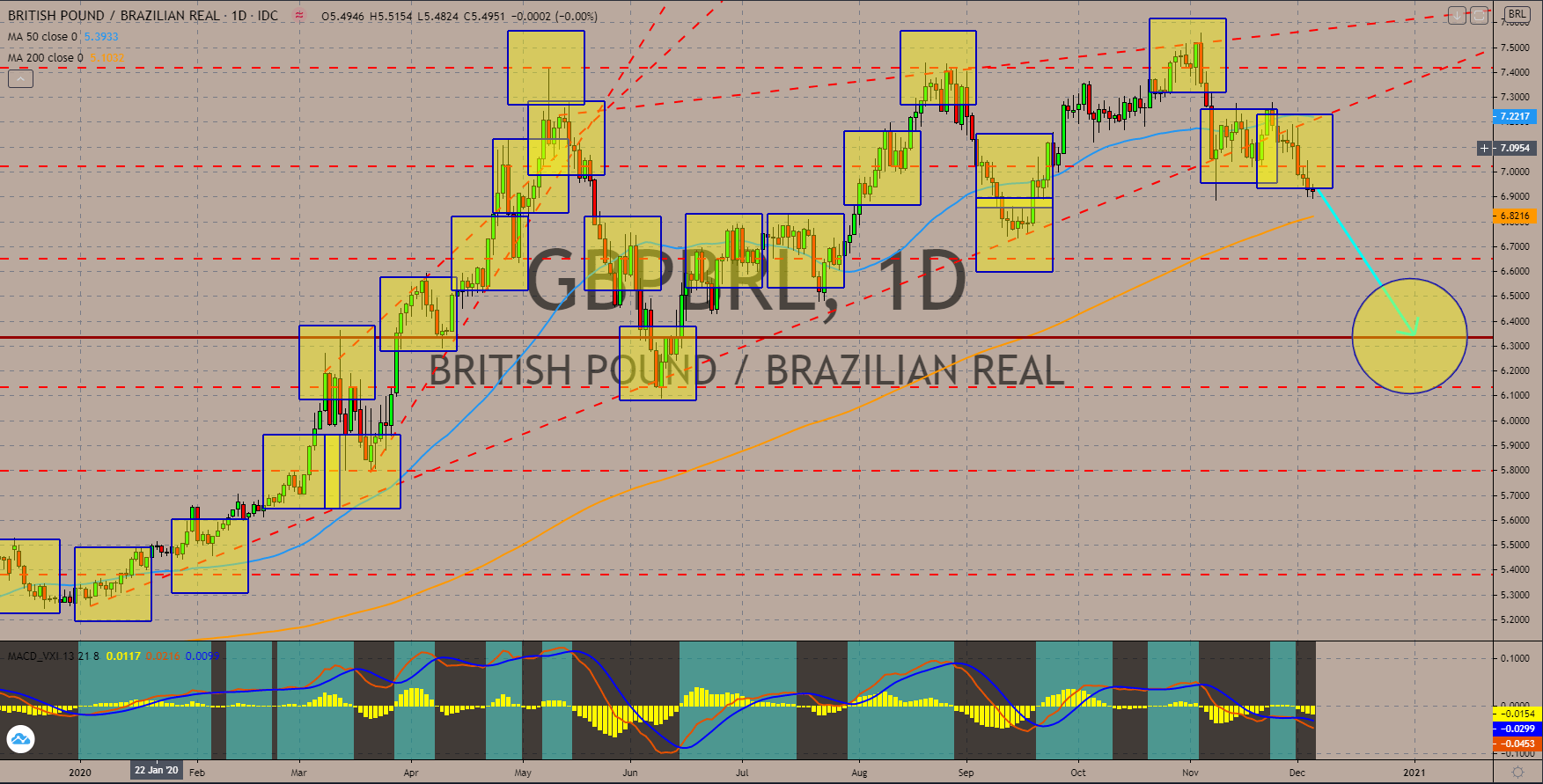

GBPBRL

The uncertainty surrounding the Brexit negotiations will push investors away from the British pound. With only 27 days remaining before the Brexit transition ends, the UK and the EU has yet to finalize their post-Brexit deal. Some analysts even suggest that the UK will crash from the EU without a deal, costing Britons $25 billion by 2021. As for the figures in the UK’s recent reports, Manufacturing remains unchanged at 55.6 points on Tuesday’s report, December 01. However, both Composite and Services PMIs fell below the 50 points benchmark. Figures came in at 49.0 points and 46.7 points, respectively. Brazil has also its own version of the report, all of which turns out positive. Composites, Manufacturing, and Services PMIs had 53.8 points, 64.0 points, and 50.9 points results. The pair is currently trading above 200 MA after the 50-day moving average prevented the GBPBRL pair from retesting its previous high at 7.5339 resistance level.

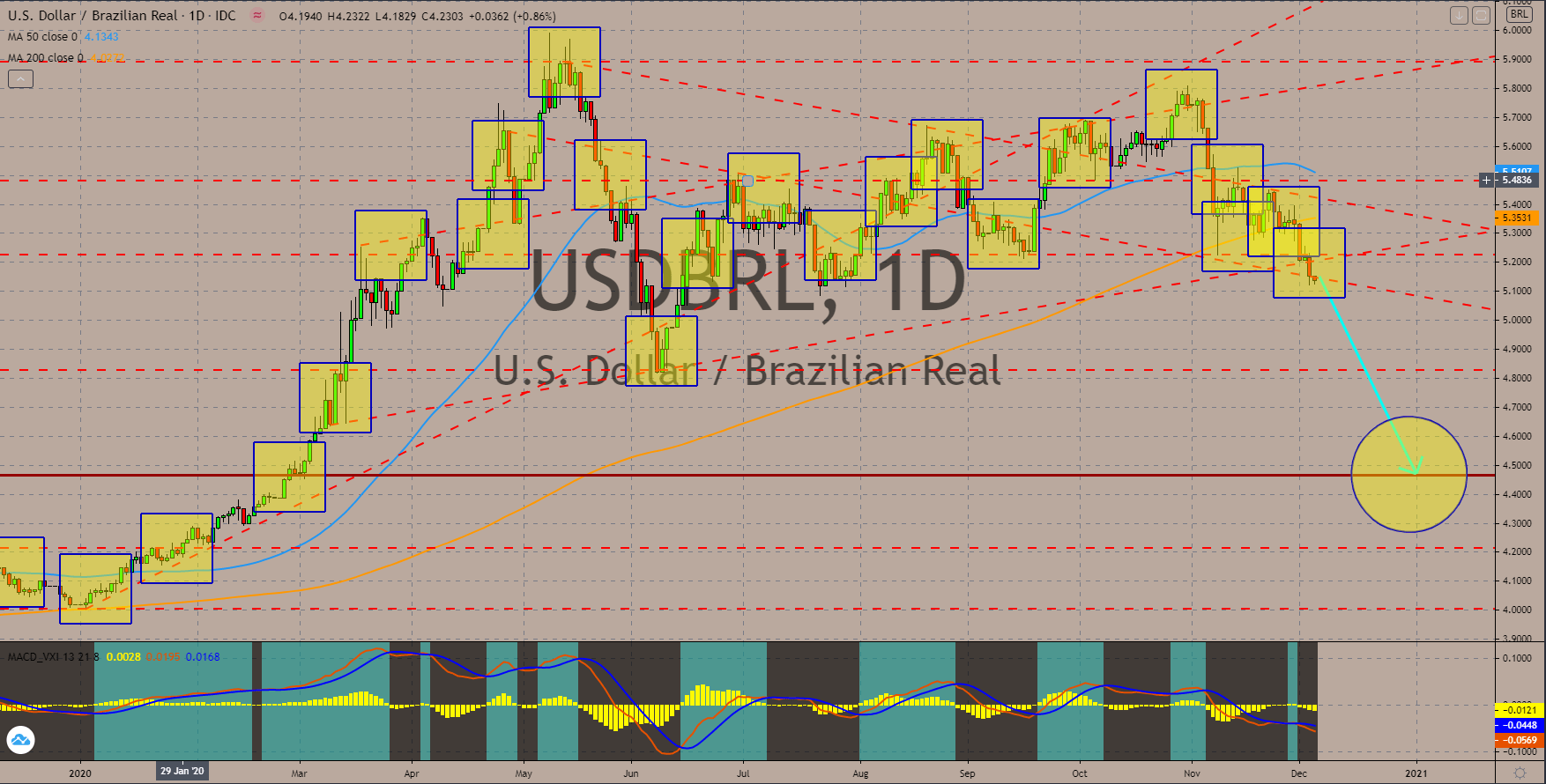

USDBRL

The US labor force will remain as the key catalyst for the USDBRL pair. The mixed result on initial jobless claims from the four (4) weeks of November led to the ADP Nonfarm Payrolls to report 307,000 jobs addition in November against 404,000 in October. The US NFP is expected to mirror the ADP report’s decline with 469,000 expectations on Friday, December 04, compared to October’s 638,000 result. This represents a 26.5% downside potential for the report. Analysts are expecting a consensus miss to continue on the upcoming initial jobless claims this December until the proposed $2.2 trillion stimulus has been passed in the US Congress and signed by the sitting US president. Prices are now trading below the 200 and 500 moving averages. Meanwhile the MACD indicator is expected to edge lower in coming sessions.

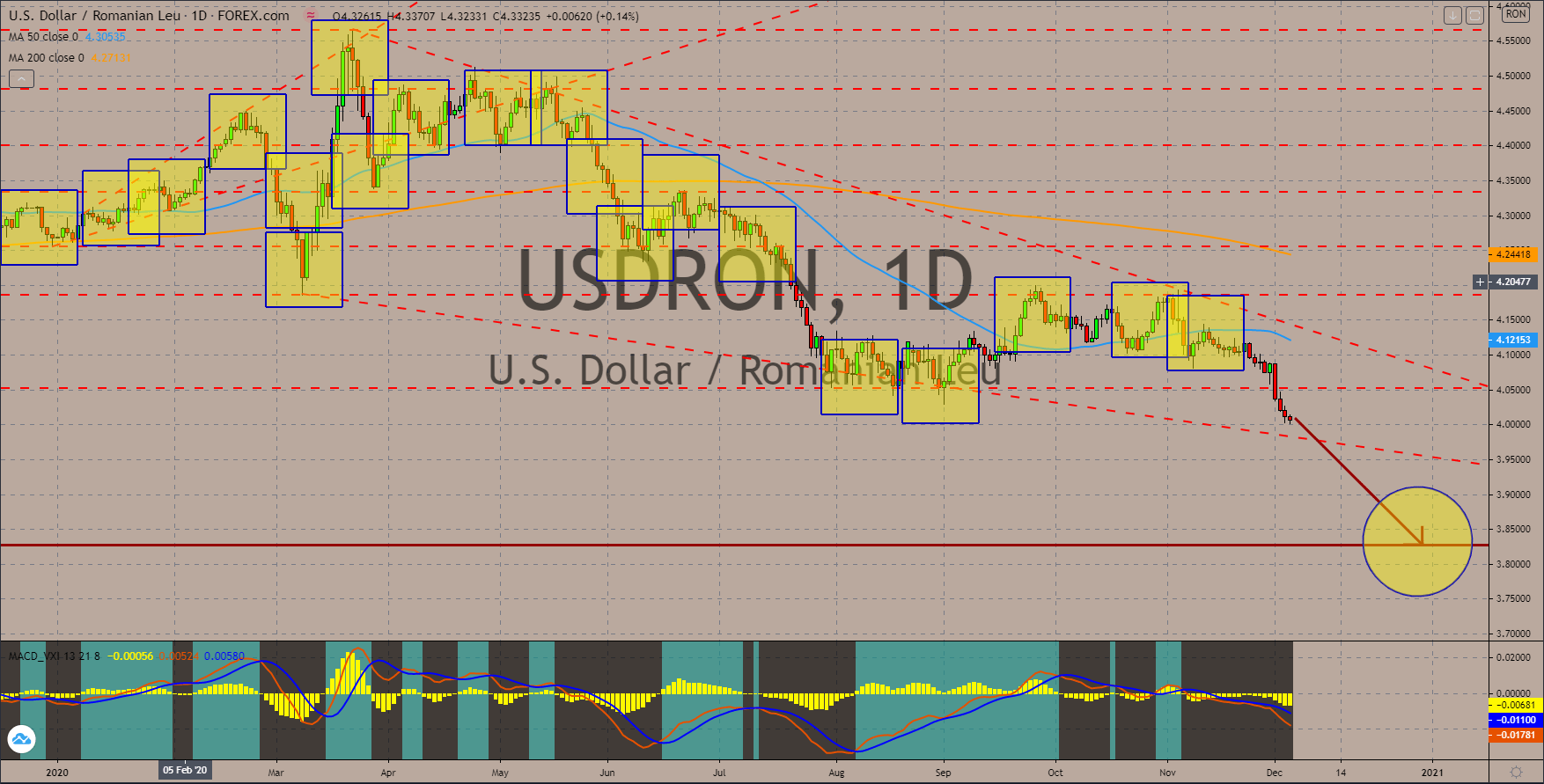

USDRON

Romania’s Finance Minister Florin Citu announced a higher tax revenue for the government in November. Although Citu haven’t mentioned any official figure for the report, the recent growth in tax revenue for the month of November of 2.9% year-over-year indicates the continued recovery of the country from the pandemic. From January to October this year, government revenue from tax is still down by 4.5% and Citu’s optimistic tone is expected to increase hopes among investor. In relation to this, Romanian President Ludovic Orban promised that the country will not return into a lockdown. Also, he expressed his support for the United Kingdom even after Britain officially leaves the bloc with or without a deal. A bearish formation from the 50 and 200 moving averages, a break down from a major support line, and an extension of the downward movement in MACD confirms a continued decline in the USDRON pair.

COMMENTS