Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

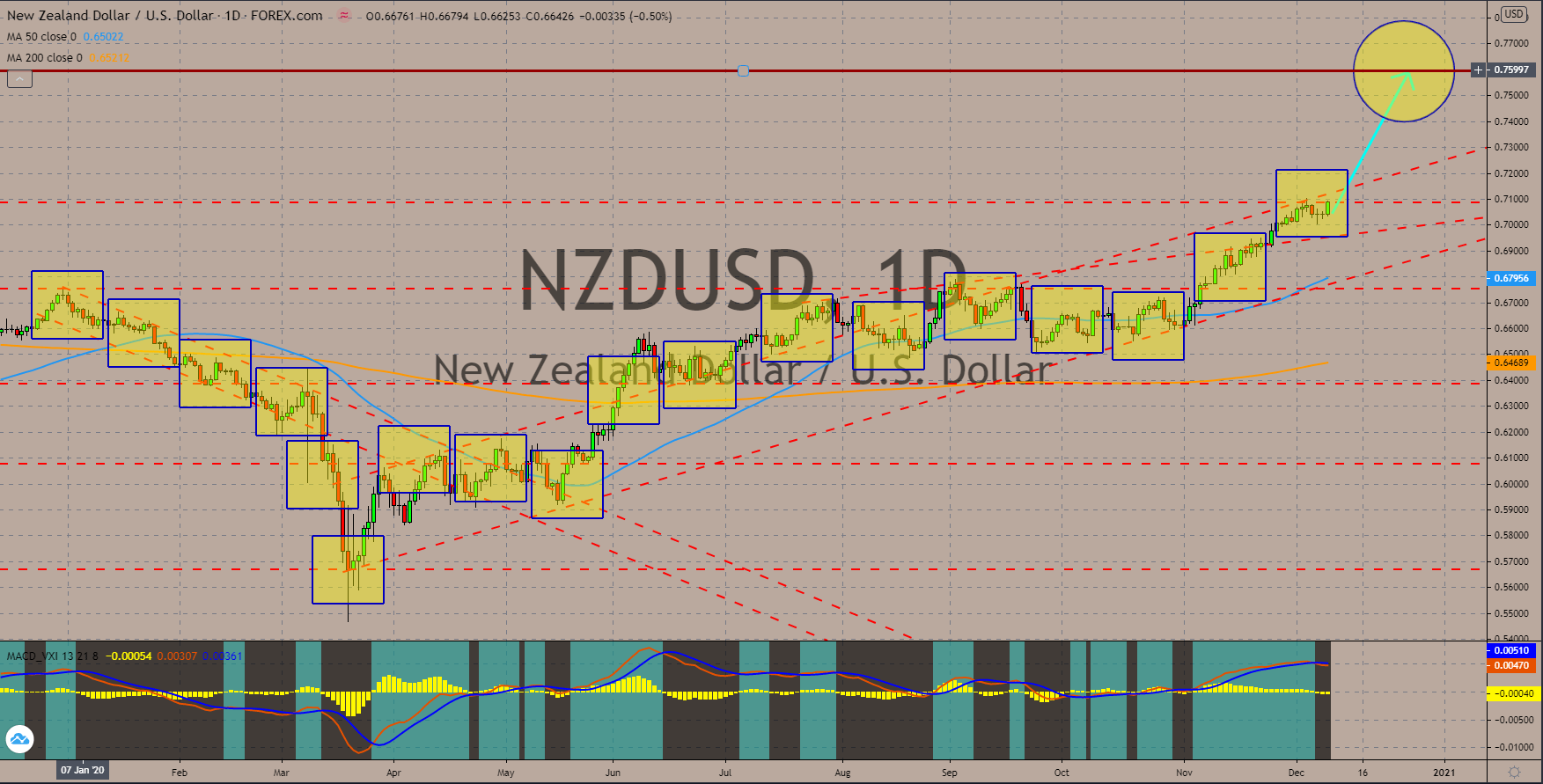

NZDUSD

The New Zealand dollar will continue to advance against the US dollar in coming sessions. This was amid the upbeat data on its recent reports and optimistic outlook from credit rating agencies. On Tuesday, December 08, Fitch Ratings ended the hopes of some economies after it said that it is unlikely to change the negative outlook it had on most of the industrialized and emerging economies in 2021. In addition to this, Fitch reaffirmed the positive outlook of Ivory Coast in Africa and New Zealand in Oceania. NZ was among the few countries who successfully contained the virus. Although the economy sharply declined, recent reports suggest the continuous recovery of the local economy. Among these reports were the Manufacturing Sales Volume in Q3, which jumped by 17.3%. This figure overshadowed the decline of -12.2% in Q2. Prices continue to advance despite the crossover in MACD. It is also trading above MAs 50 and 200.

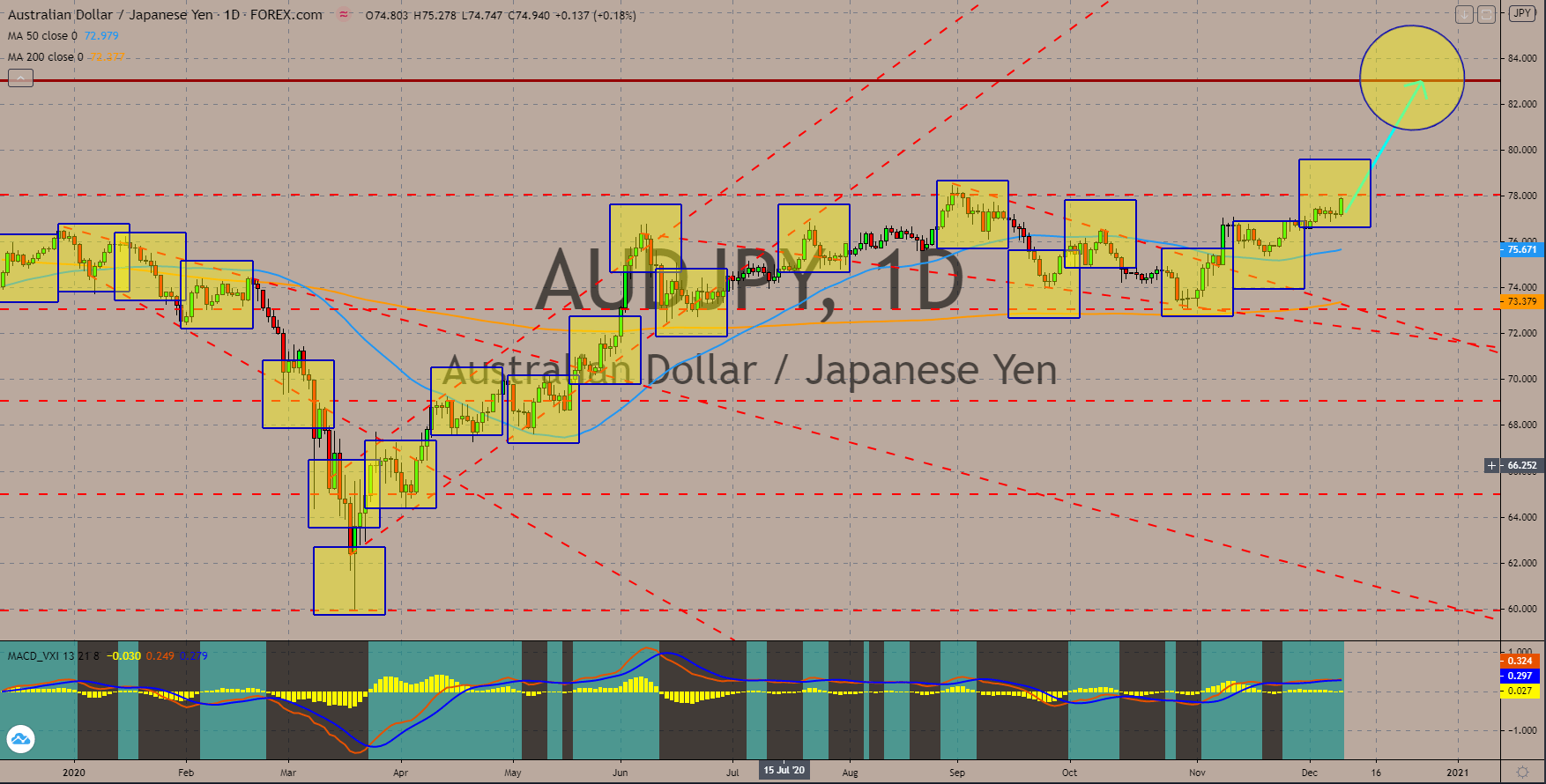

AUDJPY

Japan’s M3 Money Supply for the month of November increased to 1,925.3 trillion yen from 1,918.7 trillion in the previous month. This means more money is in circulation brought by the largest fiscal stimulus in Japan’s history. In May, Japan unveiled a $1.1 trillion stimulus package under former PM Shinzo Abe. Meanwhile, the incumbent prime minister, Yoshihide Suga, had his first stimulus at $294 billion. These efforts by the government were well-reflected in Japan’s reports. The country’s GDP QoQ for the third quarter increased by 5.3% while it expanded by 22.9% on an annual basis. Core Machine Orders YoY and Machine Tool Orders YoY were also up by 2.8% and 8.0%, effectively bouncing back from the negative results in their prior reports. While the overall economy is recovering, the Japanese yen is underperforming. The AUDJPY pair broke out from a downtrend resistance line and from 50 MA.

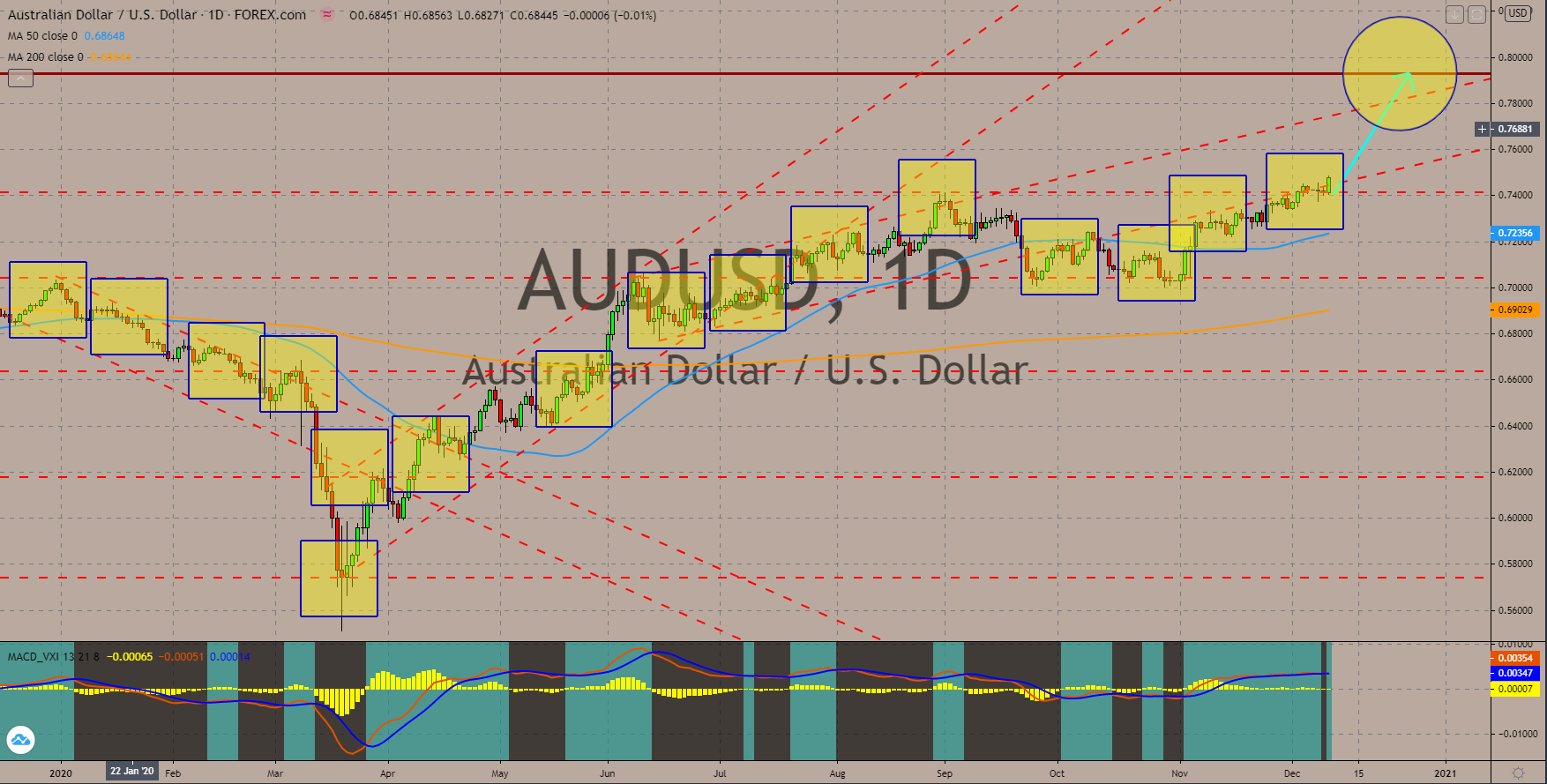

AUDUSD

The US Nonfarm Payrolls on Friday, December 04, fell below analysts’ estimates. The figure came in at 245,000 while its previous record shows 610,000 jobs added. The 60% decline between October and November showed the impact of the resurgence of COVID-19 in the country. In addition to this, the government and the US Congress haven’t reached a deal for the proposed $2.2 trillion stimulus. Economists are worried that it might be too late when the US institutions finally agreed on the economic aid. Further weak labor market reports should be expected in the coming days. The JOLTs Job Openings on Wednesday’s report, December 09, is expected to add fewer openings for the month of December at 6.3000 million. On the other hand, analysts expected the number of unemployment benefit claimants to increase by 725,000 on Thursday, December 10. MACD and signal line were flat suggesting a continued minimal increase in the AUDUSD pair.

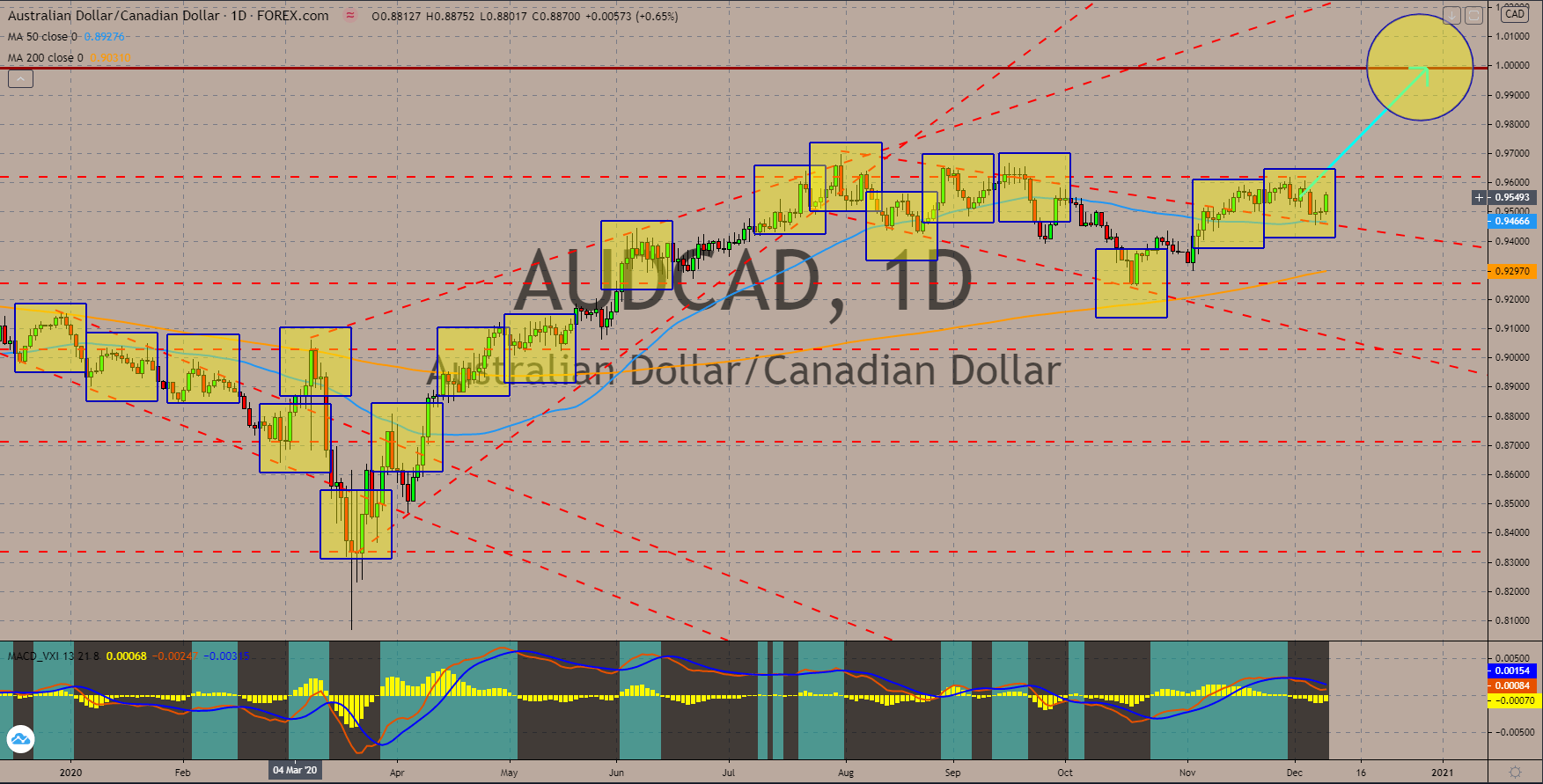

AUDCAD

Canada recorded a 40.1% increase in its gross domestic product for the third quarter of fiscal 2020. This figure outshines the 38.0% decline it incurred in Q2 2020. Despite this, recent reports show some slow down in Canada’s economy. The Ivey Purchasing Managers Index (PMI) report on Monday, December 07, posted a 52.7 points result, below the 54.7 expectations. This was the first time that the report missed analysts’ estimate for the past seven (7) months. Also, a worse-than-expected result was the lowest recorded figure in the past six (6) months. On the other hand, businesses and consumers are optimistic with the current performance of the Australian economy. Westpac Consumer Sentiment rose by 4.1%, NAB Business Survey at 9 points, and NAB Business Confidence at 12 points. Worries by traders were eased after MA 50 supported the previous decline after failing to break out from a major resistance line.

COMMENTS