Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

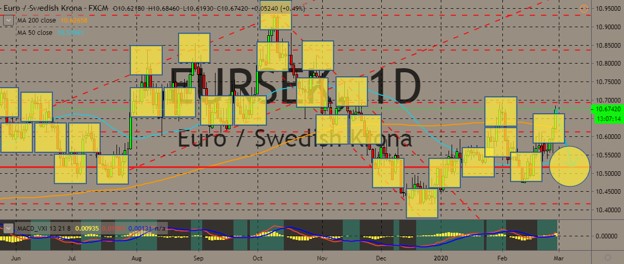

EURSEK

The pair will fail to breakout from its previous high, sending the pair lower below MAs 200 and 50. France followed Germany in posting disappointing figures for their gross domestic product (GDP) growth. For the fourth quarter, France published a negative GDP growth of 0.1%. Earlier this month, Germany also disappointed investors after its growth became stagnant at zero (0) percent. As the two (2) largest economies in Europe post zero and negative figures, they became candidates for a recession. Technical recession happens when growth was flat and negative for two (2) consecutive quarters. Another challenge facing the European Union is the withdrawal of the United Kingdom. The absence of UK forces the largest trading bloc to pressure member states to increase their contribution in the EU funds. However, Sweden – known as the EU’s frugal four along with Austria, Denmark, and the Netherlands – criticizes the EU for the decision.

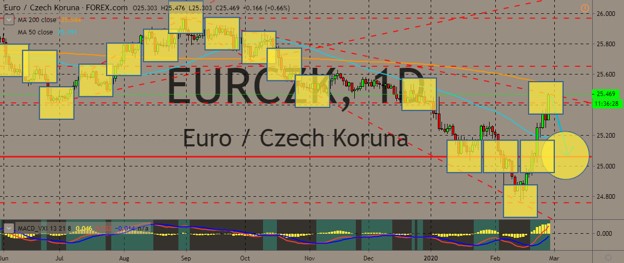

EURCZK

The pair failed to breakout from a downtrend resistance line and from 200 MA, sending the pair lower. The Eastern Europe led by the V4 nations are on the rise against the Western Europe by the Germano-Franco Alliance. Germany and France lost the third largest economy in Europe, the United Kingdom. Meanwhile, Visegrad Group – Hungary, Poland, Czechia, and Slovakia – is leading the Enlargement Portfolio of the European Union. Its efforts were directed towards integrating the West Balkan in the European Union. Recently, finance ministers of Czechia and North Macedonia held talks to discuss bilateral relations and accession of the country inside the bloc. France was among the leading opposition in accepting new member states until their economies meet the EU standard. The economic weakness of the Germany and France will dim the attractiveness of the single currency.

USDHUF

The pair will continue to move higher in the following days towards an uptrend channel resistance line. The United States and Hungary both posted fourth quarter gross domestic product (GDP) growth that meet analyst expectations. GDP grew to 2.1% and 4.5%, respectively. For the US, it retained its current growth momentum from the third quarter of 2019. Meanwhile, Hungary slipped 0.5% from its December results. Hungary also published its Quarterly Unemployment Rate yesterday, February 27. For the fourth quarter, unemployment in Hungary rose. Analysts expect the data published this week to affect the Hungarian forint. Hungary’s economy is also under pressure as it might become subject to the US tirades with its increased ties with China. The eastern bloc benefits from the US presence in the region. America is strengthening its defence in Europe to counter the rising military influence of Russia.

USDMXN

The pair will continue its rally towards its previous high after it broke out from MAs 200 and 50. Banco de Mexico cut its benchmark interest rate for the fifth consecutive time since the second half of 2019. The central bank is now sitting at 7%, 75-basis points from its August 2019 high. Governor Alejandro Diaz de Leon said the purpose of the cut was to stimulate the country’s economy. He further cited the impact of coronavirus as one of the reasons why Mexico’s economy should have an accommodative monetary policy. However, this also translates to the weakness in Mexican peso in sessions. The country is also looking forward for the ratified version of NAFTA (North American Free Trade Agreement). The US officially approved the new NAFTA deal after President Donald Trump signed the agreement. However, many economists from Mexico and Canada view the deals as one sided, something that will benefit the United States.

COMMENTS