Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

USDZAR

The pair finds strong support from 50 MA, which signals that the pair is set for an uptrend movement. South Africa is losing its own game after the country failed to tame the members of the African Union, which is headed. South Africa became dependent on Chinese soft loans and grants making South African currency vulnerable to the trade war between the United States and Russia. Aside from that, despite being included on the BRIC (Brazil-Russia-India-China), a group of newly industrialized countries, South Africa was seen to be the weakest among the group with no leverage to trade by taking sides with the Maduro government as the legitimate president of Venezuela. The United States is currently deploying its military in Asia, Europe, the Arctic, and South America, with only Oceania (with Australia being a US ally) and South Africa, were not included. Histogram and EMAs 13 and 21 will continue to go up in the following days.

USDRUB

The pair was seen to break down of a major support line after the crossed over between MAs 50 and 200, which resulted in a “Death Cross”. Last Monday, March 05, Russian President Vladimir Putin officially suspends the 1987 nuclear pact, the INF (Intermediate-range Nuclear Forces) Treaty. The INF Treaty prevented the United States and the post-Soviet Russian Federation from developing a new generation of nuclear weapons that can reach Europe. The treaty was made during the defeat of the USSR (Union of Soviet Socialist Republics) from the NATO (North Atlantic Treaty Organization) Alliance during the Cold War. However, a new era of Cold War was brewing between the two countries with the comeback of Russia. Last year, Russia tops the United Kingdom to become the second-largest manufacturer of military equipment after the United States. Histogram and EMAs 13 and 21 were expected to reverse.

USDNOK

The pair will continue its rally following its bounce back from a major support line. The United States and Norway need each other to tame Russia. With climate change, the ice from the Arctic regions melts at a fast pace, opening the door for a new possibility of competition among nations who can prove that the greater part of the continent was theirs. Canada, Russia, Greenland, and the United States were major parties trying to take advantage of the region. Svalbard was one of the world’s northernmost inhabited areas. The Svalbard Treaty recognizes the sovereignty of Norway over the Arctic archipelago of Svalbard, at the time called Spitsbergen. However, all signatories to this treaty can exercise the right to use the area for economic reasons. Russia was a signatory and has the biggest influence over the region. Histogram poised to further go up, while EMAs 13 and 21 recently crossed over.

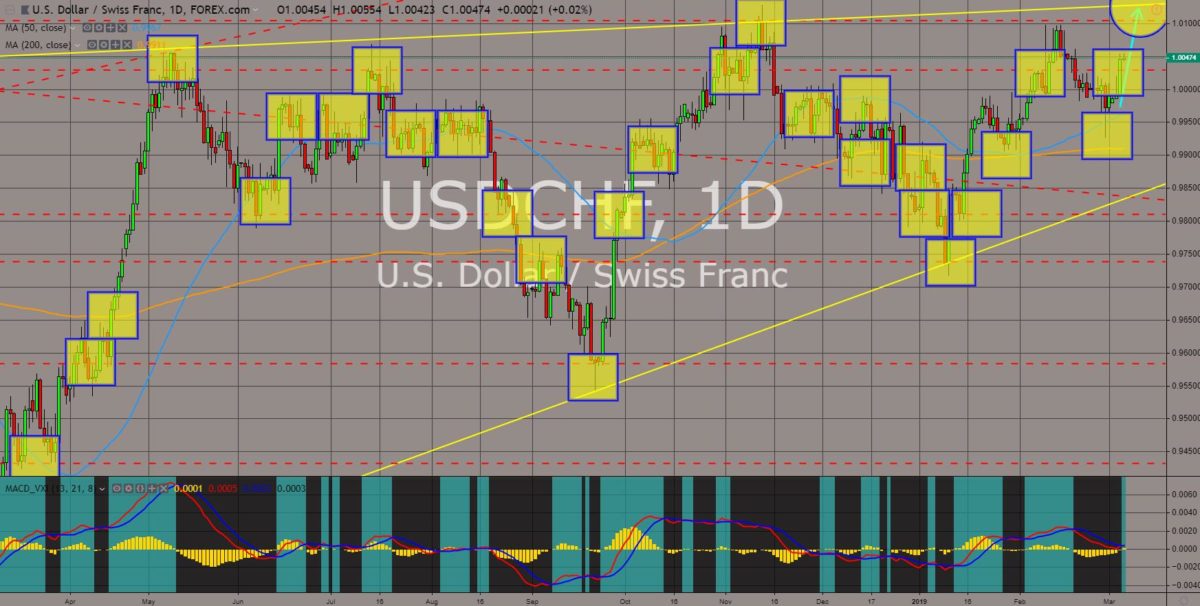

USDCHF

The pair were seen to retest its previous high after bouncing back from 50 MA, indicating a continued uptrend movement. As the European Union and the United States’ relationship continue to fall apart, the US pivots to non-EU members, including the EU members who are resistant to a Germano-Franco-led European Union. The United States was helping the Visegrad Group, an eastern and nationalist bloc facing Russia, to win the European Parliamentary election, while building its influence in non-EU members like Switzerland, the United Kingdom, and Norway. Switzerland continued to defy the EU by not signing a framework deal that incorporates all its bilateral trade agreements with the bloc while expressing its intention in making a bilateral trade agreement with the United States. Switzerland was the heart of the European region, and whoever it chose wins. Histogram and EMAs 13 and 21 will cross over in the following days.

COMMENTS