Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

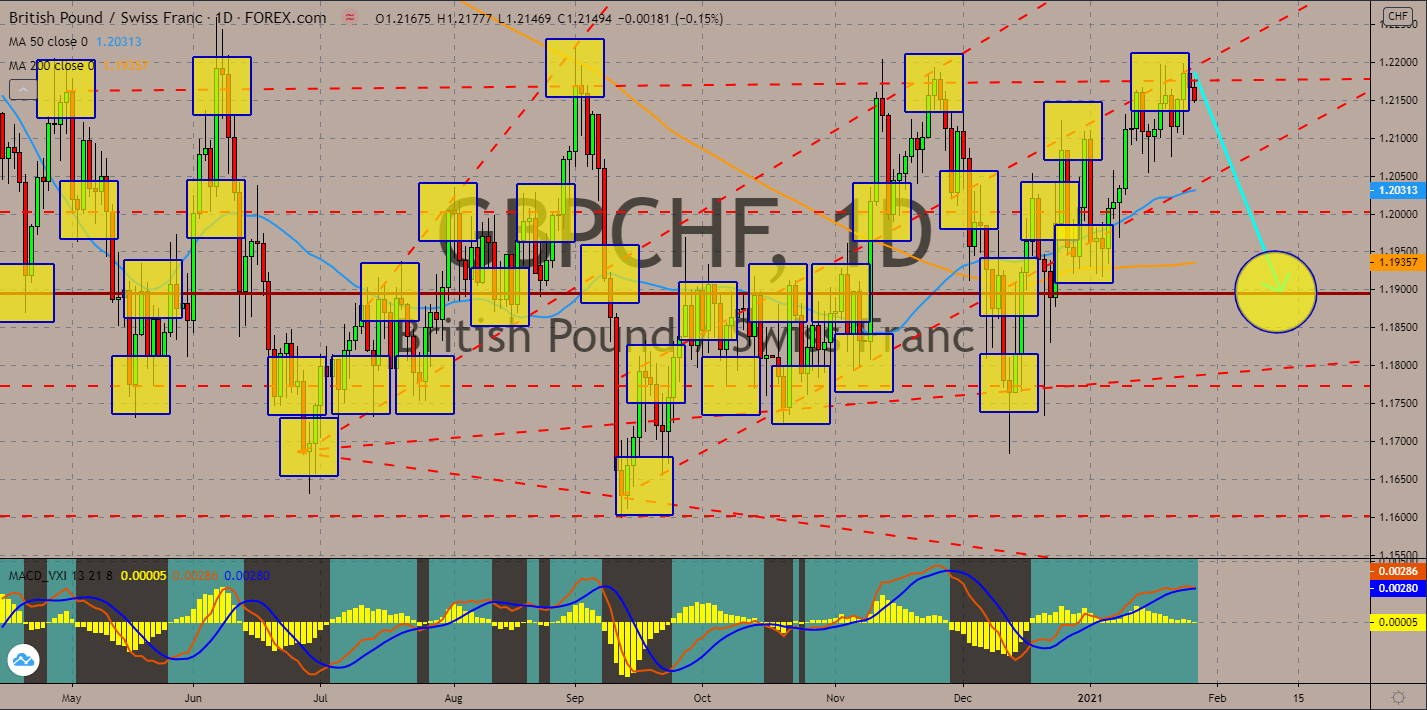

GBPCHF

Local currencies are soaring in Europe after the International Monetary Fund (IMF) downgraded European economies despite the improved global economic outlook. The financial institution now sees a 4.5% GDP growth for fiscal 2021, a 1.4% cut from October’s forecast of 5.9%. The revision on its forecast was due to the second wave of COVID-19 in Britain in the first month of Q4 2020. In addition to this, the third wave brought by the new strain prevents the British economy from recovering. On the other hand, the IMF expects the global economy to advance by 5.5% this year. Following the multinational institution’s announcement, the UK index fell by 166 points or -2.49% on Wednesday’s trading, January 27. The pound sterling advanced against other currencies except for the Swiss franc. Prices will decline towards the August to September range’s average. 200-day and 50-day moving averages will remain flat while MACD shows a bearish crossover.

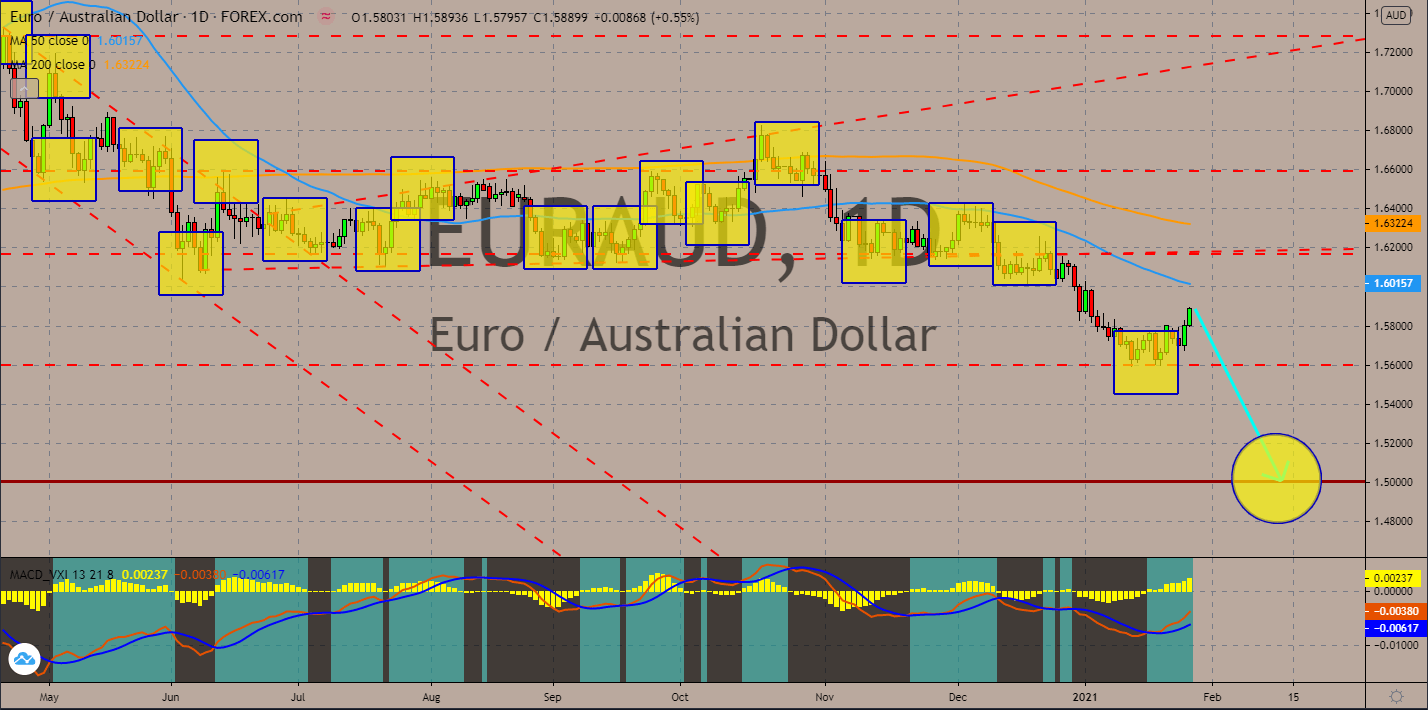

EURAUD

The EU and its member states published disappointing results this week. The EU’s Business and Consumer Survey report is expected to shrink to 89.5 points from 90.4 points. Consumer Confidence is anticipated to retain its previous record at -15.5 points. Meanwhile, both Industrial and Services Sentiment readings were negative figures at -7.2 points and -18.8 points, respectively. The same negative results can be expected with Italy’s confidence reports. Business confidence will inch lower to 95.6 points. Meanwhile, Consumer Confidence will shed 1.9 points to 100.5 points. As for Germany’s consumer price index (CPI), the YoY report is projected to increase by 0.7% against -0.3% data prior. In contrast to this, the MoM reading was lower at 0.4%. MA 50 will prevent the price from retesting its previous high while 200 MA will act as another buffer for the EURAUD pair. The histogram is in the overbought area, which signals bearish movement.

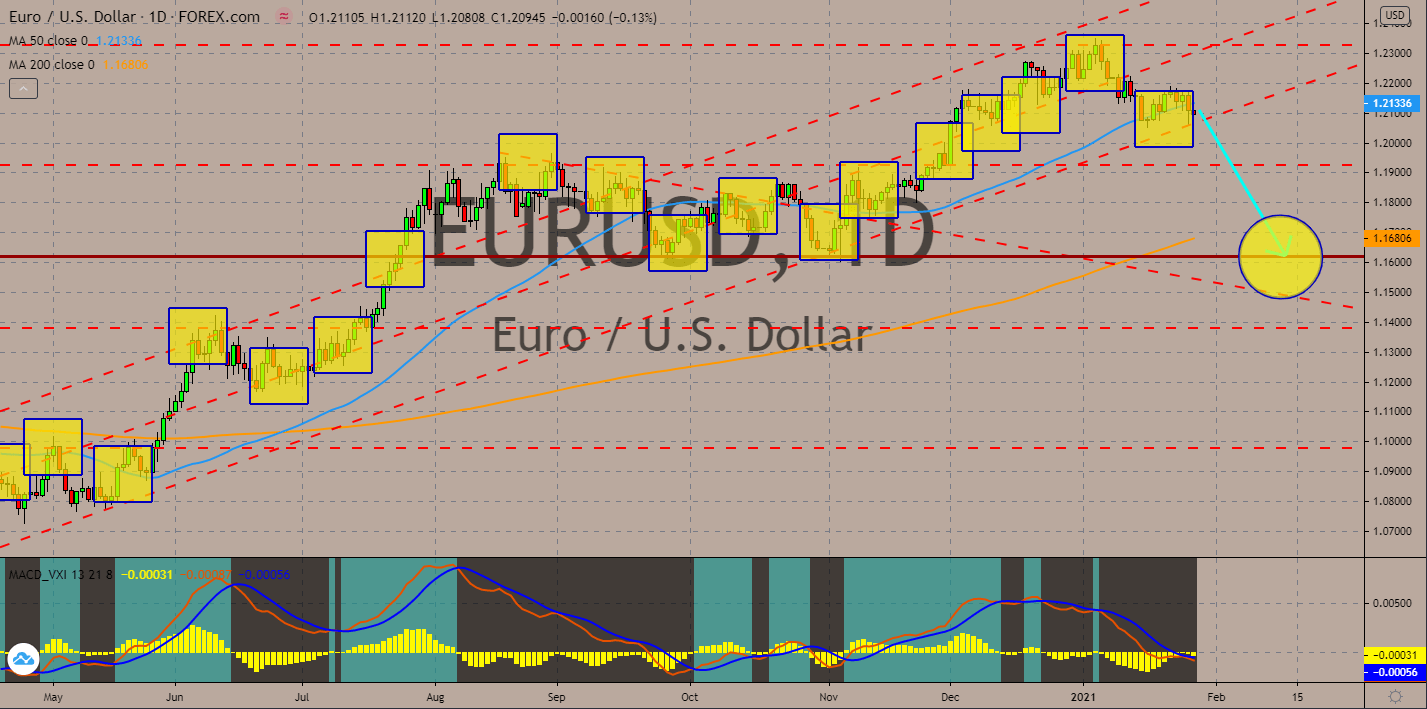

EURUSD

The US economy had a major upgrade from the International Monetary Fund (IMF). The global financial institution revised its economic outlook for the world’s largest economy. The IMF now expects GDP to grow by 5.1% in 2021 from the 3.4% reading in October. In addition to this, the multinational institution said that US President Joe Biden’s $1.9 trillion stimulus proposal will boost America’s output by 5.0% over the next three (3) years. Following the optimistic outlook for the US economy, however, the Federal Reserve remains mum on the expected economic aid from the central bank. The silence had sent the S&P 500 index lower on Wednesday’s trading, January 27 by -2.575 or 98.85 points. On the other hand, the US dollar will benefit from this as the greenback’s supply in the global market will be lower-than-expected. The EURUSD pair is now trading below the 50 MA and MACD failed to form a bullish crossover.

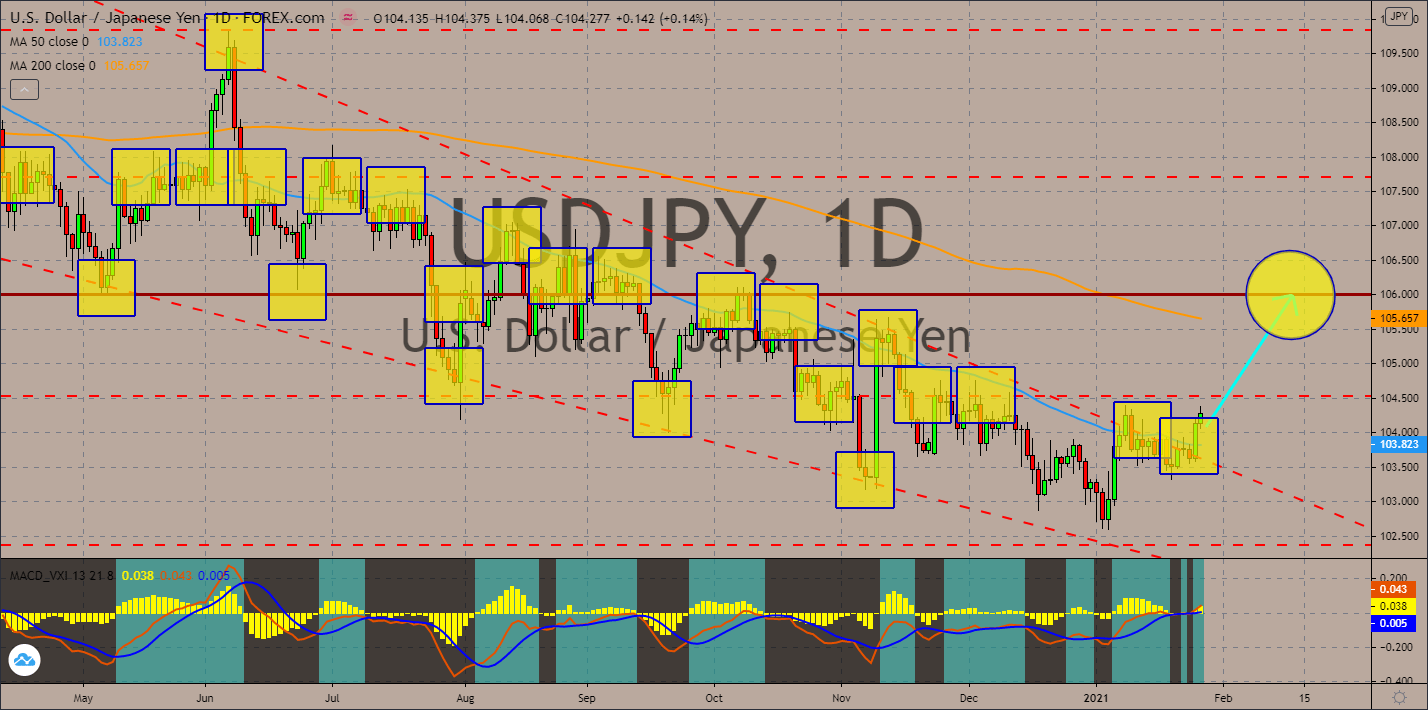

USDJPY

The powerful Japanese lower house approved the 19 trillion Japanese yen extra budget or $185 billion. A majority of the budget will be used as discounts for domestic travels and the government plans to make the 2021 Olympics successful. However, the opposition called out Japanese Prime Minister Yoshihide Suga’s decision. Critics argued that the funds should be spent on COVID-19 treatments instead. In addition to this, Japan insisted on drugs to undergo clinical trials first before a rollout will be conducted. Leading vaccines from Pfizer and Moderna are currently on Phase 3 of the clinical trial test. But the vaccines were already approved for emergency use authorization (EUA) in other countries. Despite this, the IMF projected the world’s third-largest economy to grow by 3.1% in 2021. Prices now trade above the 50-day moving average. Meanwhile, MACD failed to form a bearish crossover as the lines skewed to the upside.

COMMENTS