Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

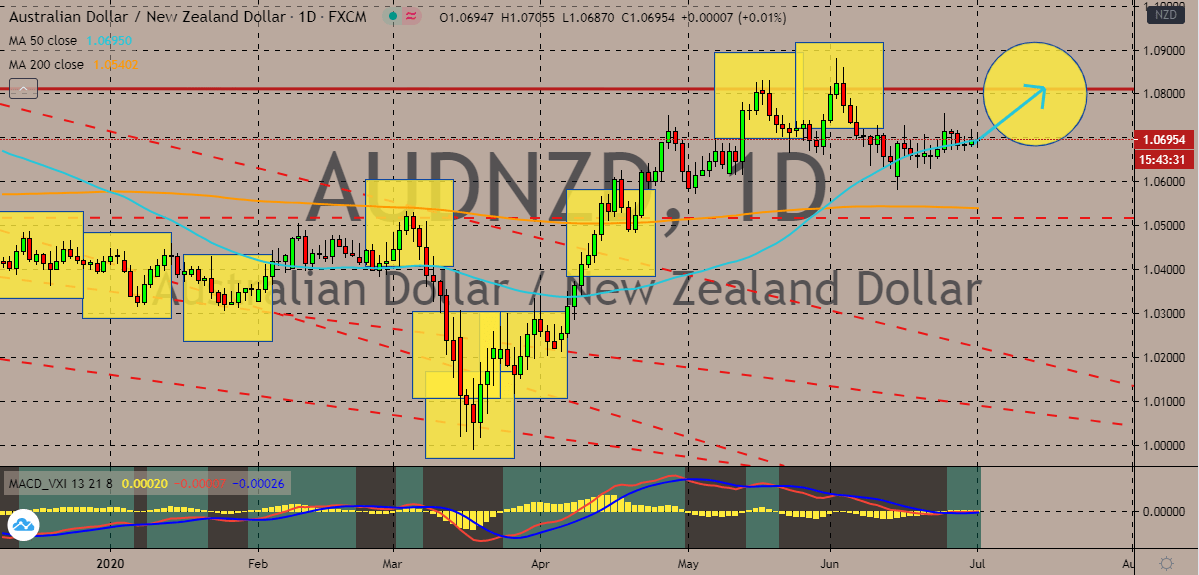

AUDNZD

The Australian dollar is struggling to push the New Zealand dollar higher towards its resistance level. However, the tides are still in favor of the Australian dollar, and the pair is widely expected to continue its climb towards its resistance in the coming sessions. Bullish investors on track to gradually secure more gains and push prices higher this first half of July. That would then force the 50-day moving average significantly higher than the 200-day moving average, signaling a bullish market for the Australian dollar to New Zealand dollar exchange rate. Looking at it, it appears that both of the antipodean currencies are one of the best-performing assets in the currency market. And in the matchup between the two, the Australian dollar has the upper hand despite polarities in the coronavirus cases and economic conditions of Australia and New Zealand. In Australia, the number of new coronavirus cases is rising in some of its major cities.

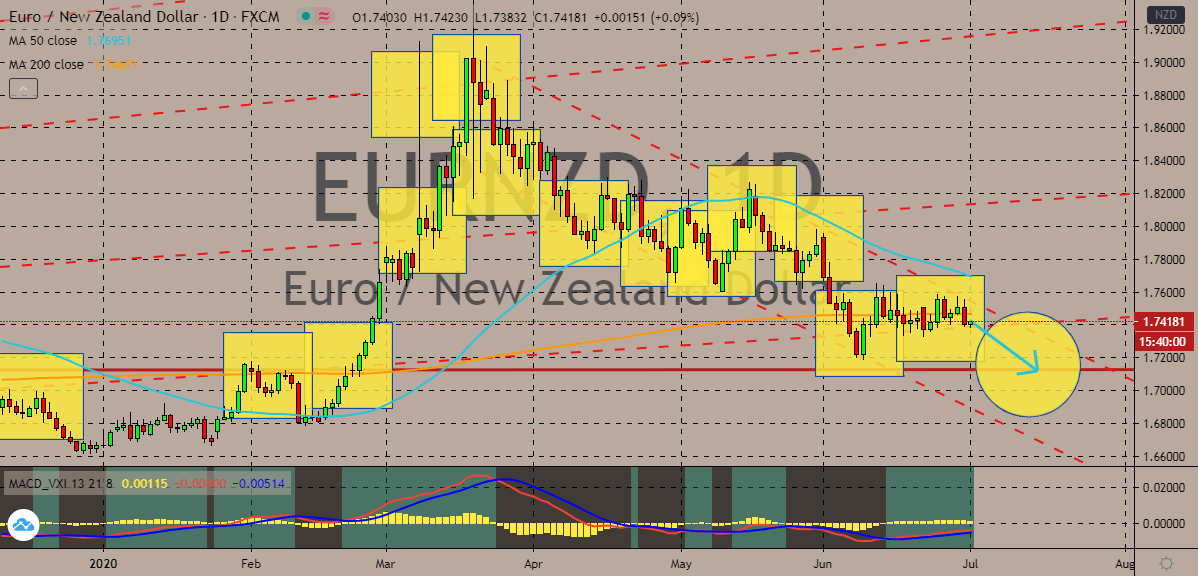

EURNZD

The euro is slowed down by the grim economic results presented by the bloc’s economy. As of writing, the pair is seen slightly gaining in the sessions, but it would ultimately go down as the euro is still deemed weaker. The euro to New Zealand dollar exchange rate is flirting with a critical support level, and it’s predicted to go down to its lower support level soon. That should force the 50-day moving average towards the 200-day moving average, signaling bears that they could have control over the prices’ momentum. Looking at the charts, it’s evident that the euro has been greatly struggling to hold on to its gains as it would initially rally then lose it eventually. This opens the floor for the New Zealand dollar which is greatly benefitting from the recovery of its economy. However, the correction in the stock markets is weighing on both of the currencies as it blocks the hope for a speedy global economic recovery.

USDCNH

Earlier this week, the US dollar was seen sliding against the Chinese yuan thanks to the upbeat results from mainland China’s economy. Unfortunately for the Chinese yuan, it wasn’t able to hold on to its gains in the sessions thanks to the recent news about rate cuts from the People’s Bank of China. The pair is now projected to rally towards resistance level in the coming sessions, a feat that should bolster the 50-day moving average against the 200-day moving average. Earlier this week, the Chinese manufacturing PMI from June showed a gradual improvement from 50.6% to about 50.9%, topping projections of about 5.4%. Aside from that, the Caixin manufacturing PMI for June also showed an increase in the private manufacturing sector from 50.7% to about 51.2%. the main source of the yuan’s weakness is the decision of the PBOC to set its midpoint rate earlier today, giving room for bullish investors to thrive in the trading sessions.

USDTRY

The Turkish lira is putting up a fight against the US dollar. However, it’s relatively weak compared to the safe-haven currency. The optimism from the Turkish economy contributes greatly to the strength of bearish investors as they work hard to prevent the pair from rallying. Unfortunately for them, the greenback is significantly stronger and more dominant, and because of its safe-haven appeal, prices should eventually rally towards their resistance level. The pair is widely forecasted to go up higher in the sessions, forcing the 50-day moving average higher against the 200-day moving average. Bears are hoping to gain support for their rally from the upcoming monetary policy meeting minutes from the Central Bank of the Republic of Turkey which is due tomorrow. Aside from that, what keeps bears going today is the notable improvement from the Turkish manufacturing PMI from June that was released earlier this Wednesday.

COMMENTS