Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

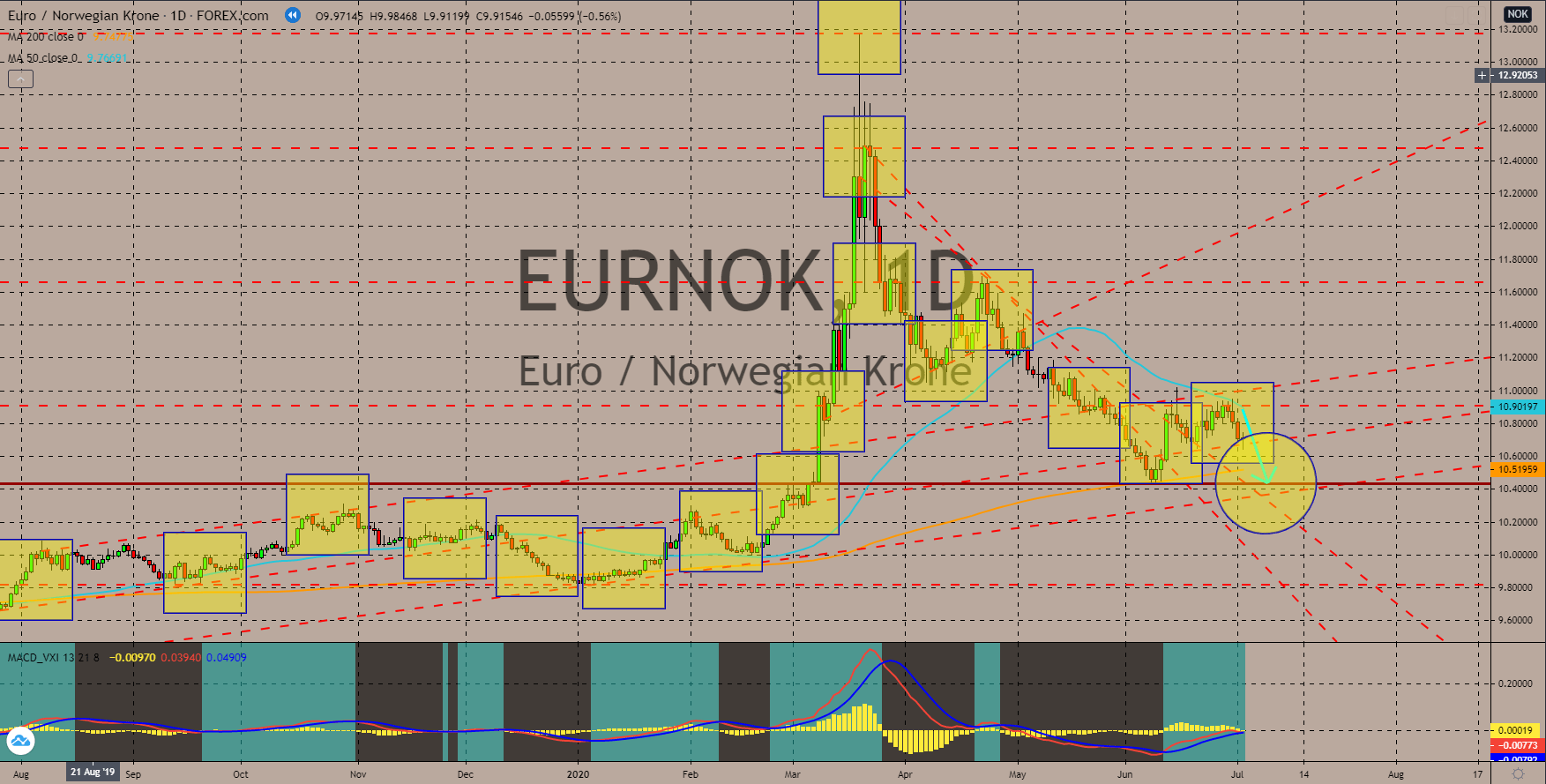

EURNOK

The mixed results from the eurozone are causing investors to flee the single currency. The European Union’s big four countries – Germany, France. Italy, and Spain – posted several key results today, July 03. France and Spain’s Services Purchasing Managers Index (PMI) report posted above 50 points figures at 50.7 and 50.2, respectively. This indicates that these economies’ services sectors are beginning to recover from the pandemic. On the other hand, Germany and Italy saw below 50 points figures at 47.3 and 46.4 points for Services PMI report today. Meanwhile, the eurozone posted 48.3 points, an improvement from 47.3 points in the prior month but below the 50 points level. Norway also posted its unemployment report today and June’s 4.80% rate is a major improvement from the prior month at 6.40%. Norway’s strong labor market will help it to thrive in these uncertain times and help the Norwegian krone against the euro.

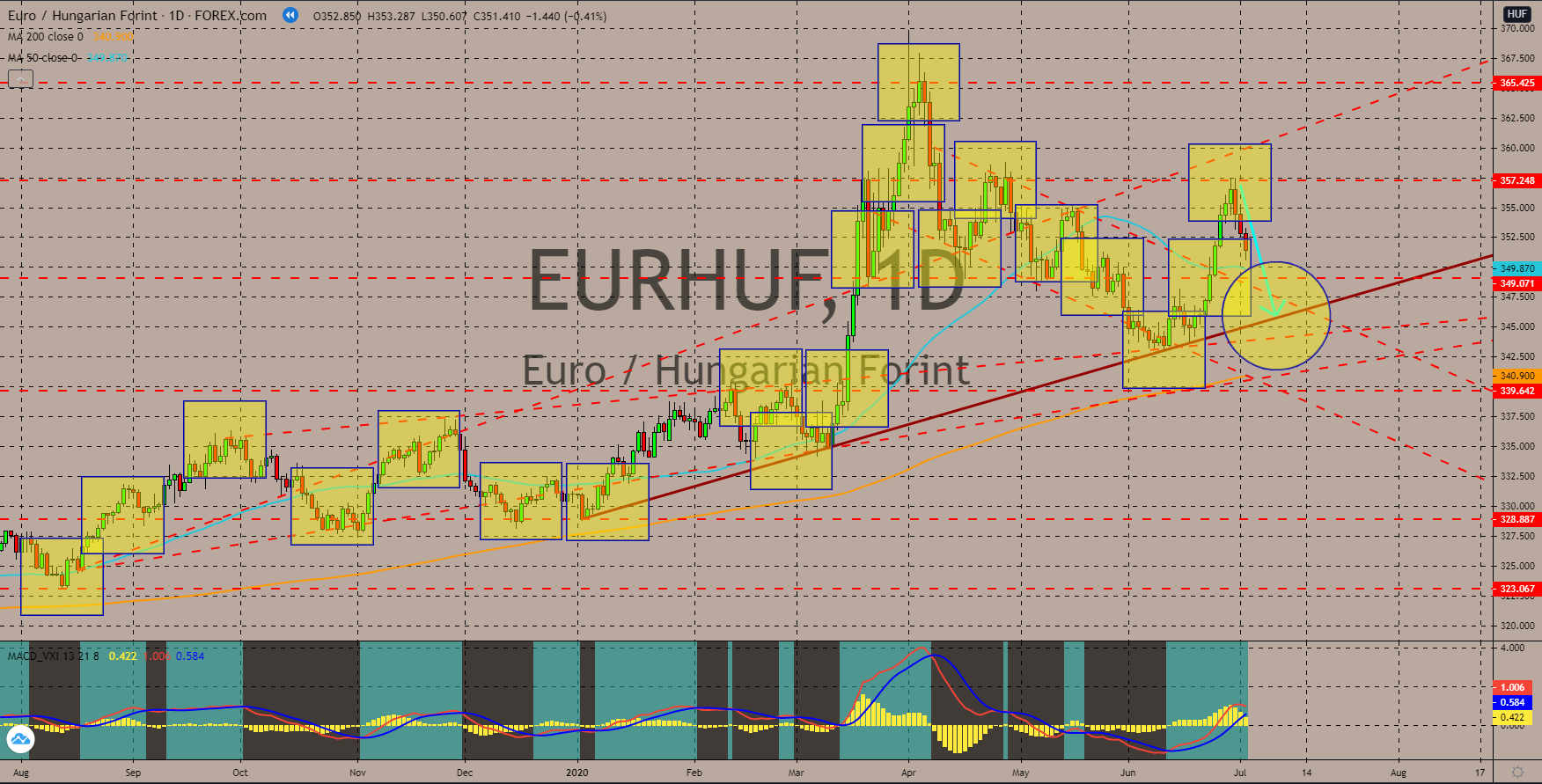

EURHUF

The strength of the euro currency in the past weeks will be overshadowed by the steep decline expectations for the pair. The bloc is divided not only politically but also economically. Member states don’t agree with the statement by Germany and France that they need to contribute more for the bloc’s economic aid. This disagreement between member states is reflected in several reports this week. Out of the four (4) big economies of the European Union, only France experienced expansion on its Manufacturing Purchasing Managers Index (PMI) report. The figure was 52.3 points compared to Germany, Italy and France’s figures of 45.2, 47.5, and 49.0 points, respectively. Hungary also reported below 50 points for Manufacturing PMI report at 47.0. However, analysts are more optimistic with the Hungarian economy following its 4.48 monthly points growth since April. This means that expectations for the August’s report was at 51.48 points.

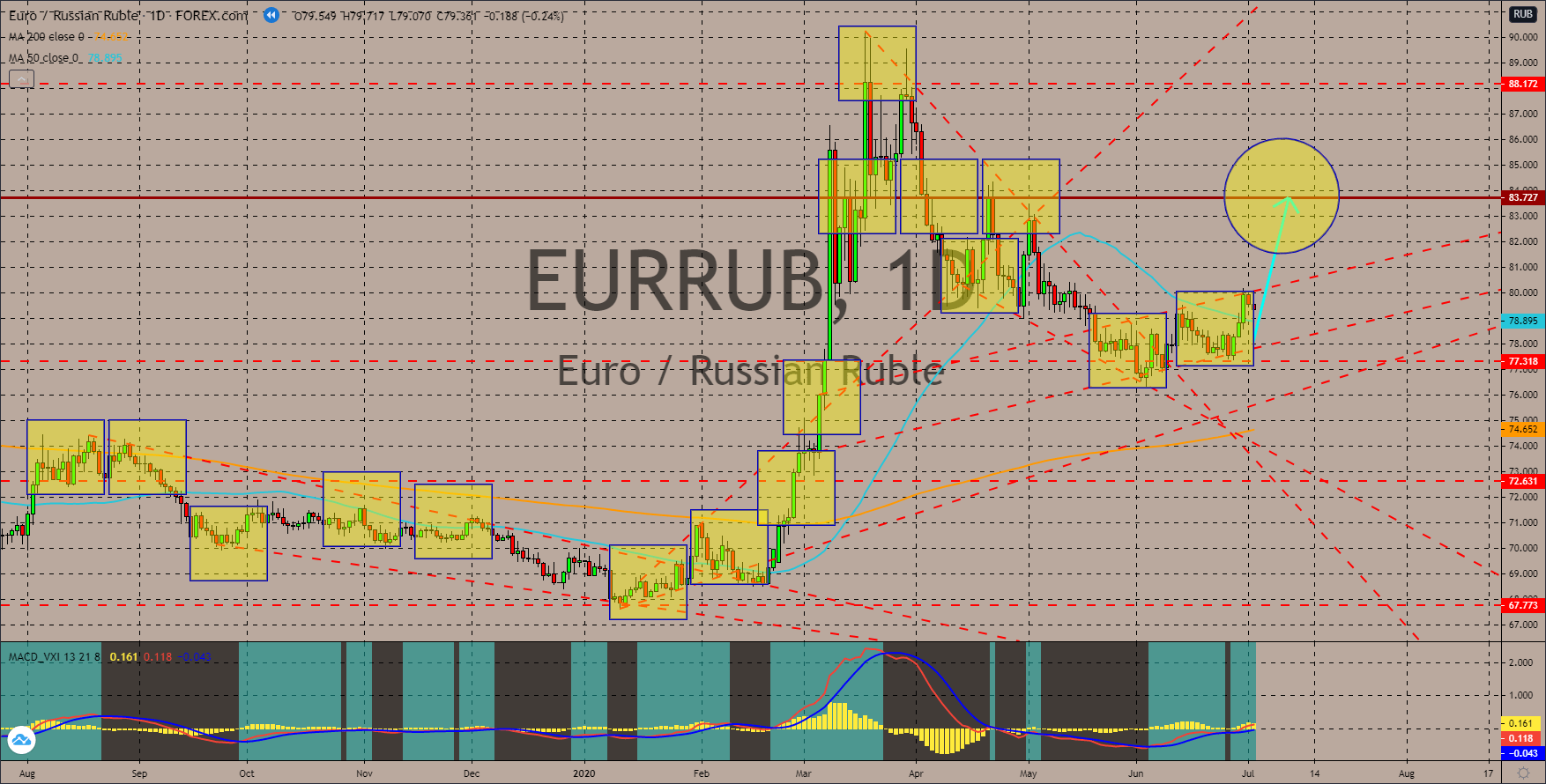

EURRUB

The single currency is bound to go up against the Russian ruble despite its weakness against other European currencies. Russia’s central bank is slowly building up its USD reserves after it uses some of them for the country’s economic program for COVID-19. However, now might be a bad time to do that given that the US dollar index just dropped by 7.66% from its March 20 high. USD reserves went up by $500 million in the past week. Also, the country’s Markit Manufacturing and Services Purchasing Managers Index (PMI) report grew from the month prior but still below 50 points. Figures were recorded at 49.4 and 47.8 points, respectively. The European Union, on the other hand, was divided with their economic response on COVID-19. However, Germany and France are expected to step up to stop the single currency from bleeding. Germany recently introduced several stimulus packages that were worth more than half of its 2019 GDP.

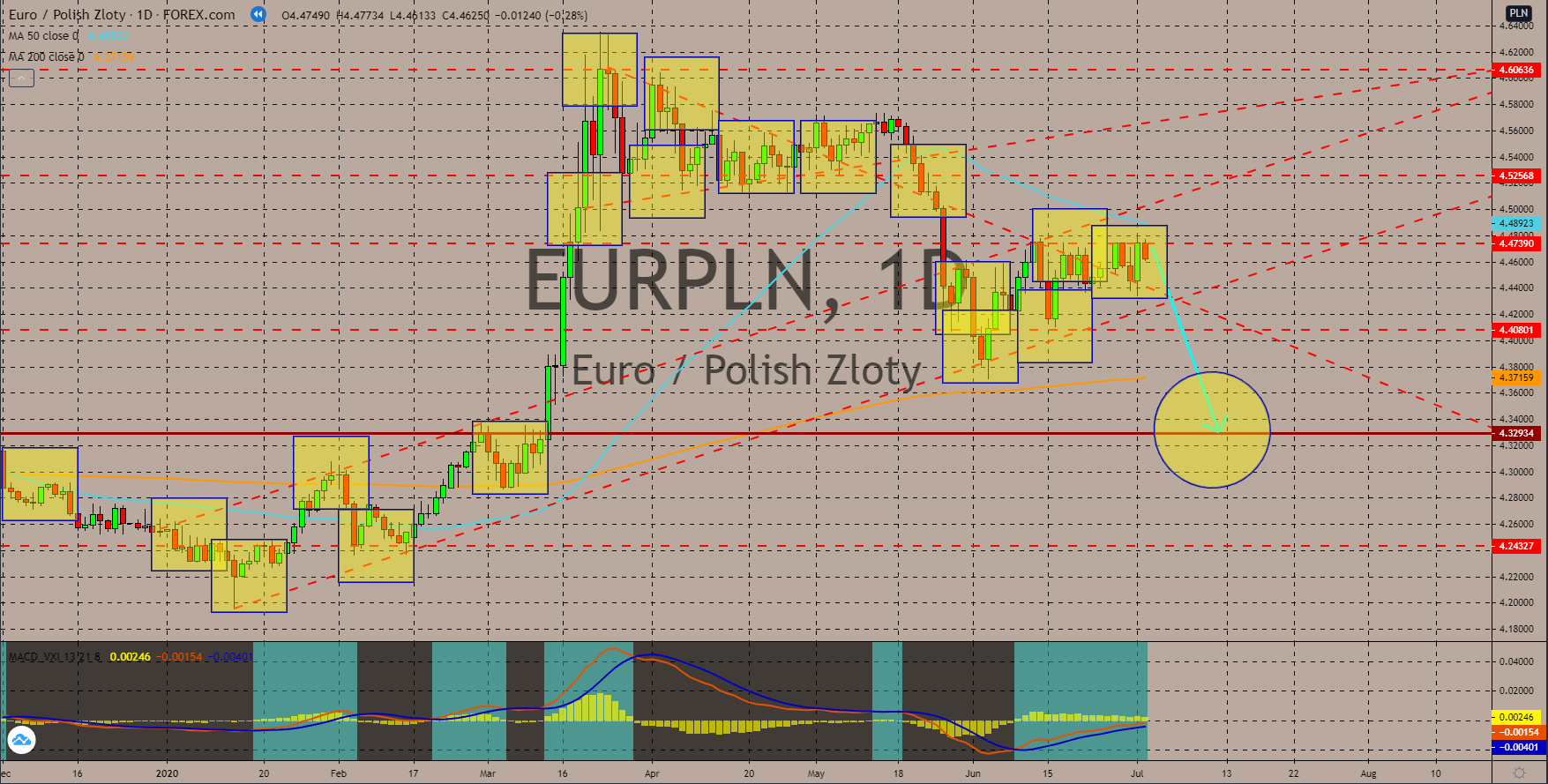

EURPLN

Poland took over the presidency of the Visegrad group this month from Czech Republic. Along with this was his call for the European Union to be more generous for the CEE (Central and Eastern Europe) for the next 7 years. The increasing influence of the Visegrad Group inside the bloc was evident on the recent appointment of the representatives from the V4 nations. Most of them became VPs in the European Commission. The country’s influence could further advance Poland’s economic agenda. The country was among the fastest growing economies in the EU with GDP growth in 2019 at 4.3%. During the global lockdown, its economy is expected to withstand the coronavirus pandemic. The EU forecast for Poland’s 2020 GDP was a decline of 4.6% while Fitch Ratings agency see a drop of just 3.2%. Meanwhile, the forecast for Germany and France, the EU’s economic powerhouses, this 2020 were declines of 6.3% and 10.6%, respectively.

COMMENTS