Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

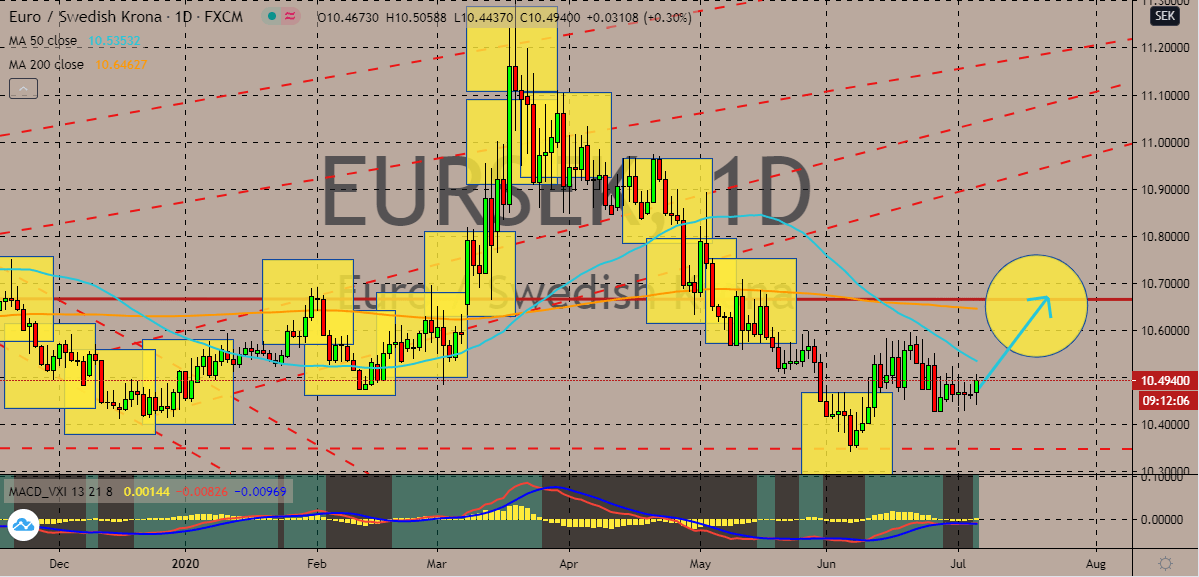

EURSEK

Earlier this month, Sweden’s central bank announced that it will be expanding its quantitative easing program. The news ultimately weakened the run of bearish investors in the trading sessions. However, bulls didn’t immediately take control of the pair as the euro also faced headwinds then. Luckily for them, the direction of the pair is looking pretty bullish once again thanks to the strong investor confidence in the eurozone. The euro to Swedish krona exchange rate’s prices are now widely on track to reach their resistance soon. Looking at the chart, it appears that the Swedish krona first had a grip on the pair. Although bears ultimately lost control, allowing bulls to regain their footing. If the pair climbs towards its resistance, bulls will once again force the 50-day moving average higher towards the 200-day moving average. But as of writing, the pair is in bearish territories considering that the 200-day MA is still dominant.

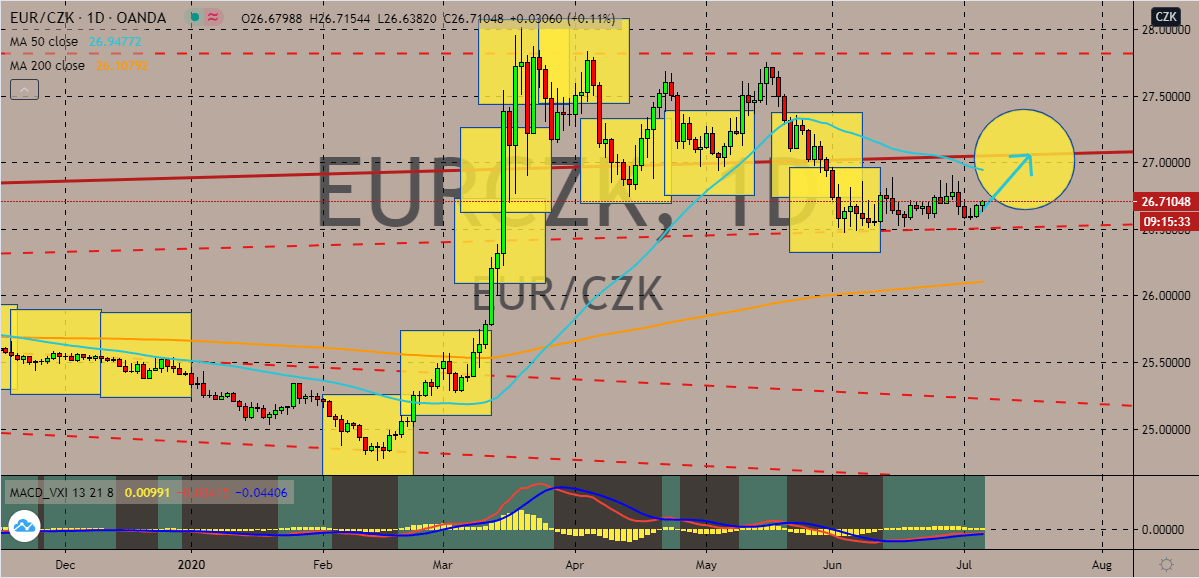

EURCZK

Positive news from the eurozone is buoying the beloved single currency against the Czech koruna. Bears will have trouble trying to push the pair downwards because the euro finally receives good news from its economic activities. The euro to Czech koruna trading pair should climb towards its resistance before the second half of the month starts. The move will help bullish investors maintain the dominance of the 50-day moving average against the 200-day moving average in the trading sessions. Moreover, The EU statistics agency announced earlier today that it believes that consumers have immediately returned to shops in May after the lockdowns were eased. The agency said that it estimates a sharp rebound in sales on the month following sharp declines in March and April. Aside from that, a survey found that investor morale in the bloc is starting to gradually recover after the coronavirus pandemic struck the region harshly.

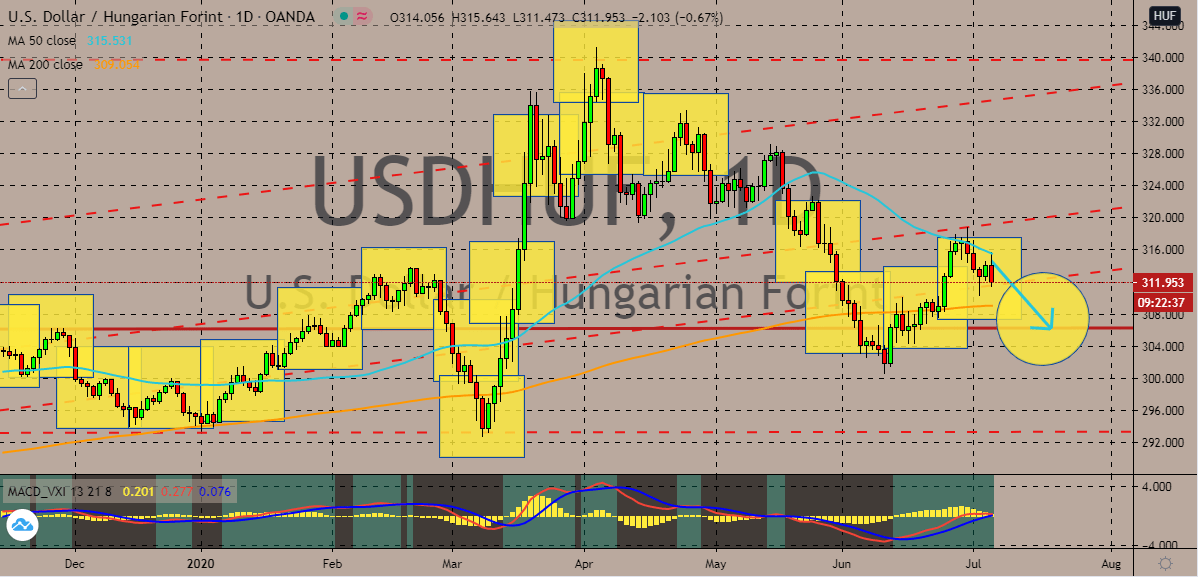

USDHUF

Late last month, the National Bank of Hungary unleashed an unexpected cut in its base rate. However, the move failed to prevent the Hungarian forint from crushing its opponent in the trading sessions. Looking at it, at first glance it appears that the news would work well for bulls considering that a rate cut would weaken the currency and that the greenback’s safe haven appeal should have shined thanks to the geopolitical tensions and still rising number of cases. But that is not the case. It’s evident in today’s run that bears are significantly dominant and that the USDHUF trading pair’s prices would eventually go down towards its support. Once the pair goes down, the 50-day moving average should further drop towards the 200-day moving average. Moreover, the National Bank of Hungary’s Monetary Council optimistically decided to ease its base rates by 15 basis points to about 0.75%, pushing its rates to its lowest levels yet.

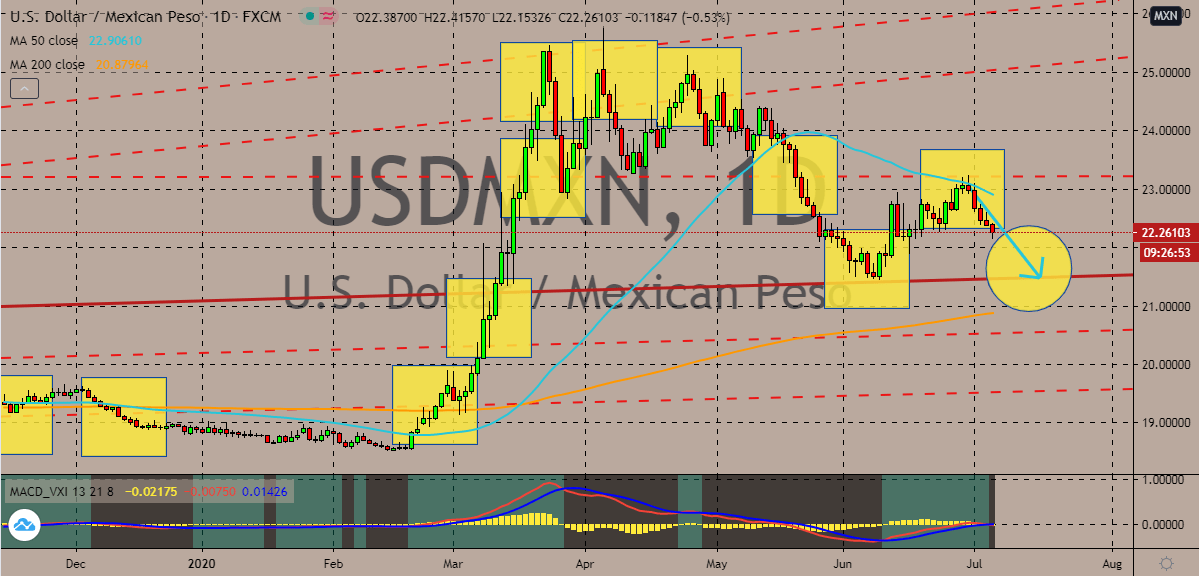

USDMXN

The risk appetite in the global market is strong and the Mexican peso is riding its wave. The pair extends its loss as the Mexican peso looks to redeem itself against the US dollar. Bearish investors of the trading pair are hoping that this time, they would break past the support level and not just bounce off. If that would be the case, bears will be able to force the 50-day moving average lower against the 200-day moving average, forcing the momentum to gradually turn into their favor. Also, if the risk appetite in the market continues to proliferate, the pair might see a bearish trend in the coming sessions. As for the US dollars, it’s seen pulling back against a bunch of currencies, not just the Mexican peso, as the expectations of a speedy global economic recovery. However, the rising numbers around the United States and in other countries around the world are countering that hence the US dollar to Mexican peso’s slow movement or decline.

COMMENTS