Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

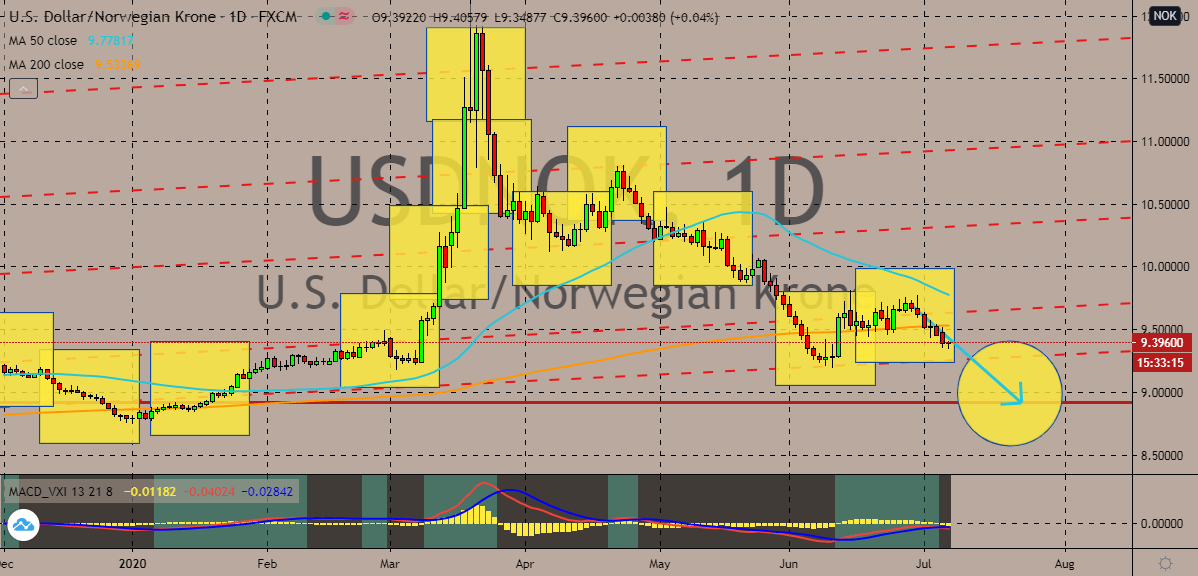

USDNOK

The Norwegian krone looks to extends its rally against the US dollar thanks to the good news from the crude market. Bearish investors are taking advantage of the broader weakness faced by the US dollar ad are seizing the opportunity to force the pair’s prices towards its support. The US dollar to Norwegian krone exchange rate should reach that support past the halfway mark of the month as the US dollar is defending efficiently too. If the pair actually goes down, the 50-day moving average should plunge towards the 200-day moving average, ending the once dominant reign of bulls. Moreover, bears found strength when crude prices soared thanks to the tighter supplies in the global market. Just recently, the Organization of the Petroleum Exporting Countries and its allies vowed to further ease their production to just about 9.7 million this July. Aside from that, crude oil operations in the United States fell to their all-time low for the ninth week.

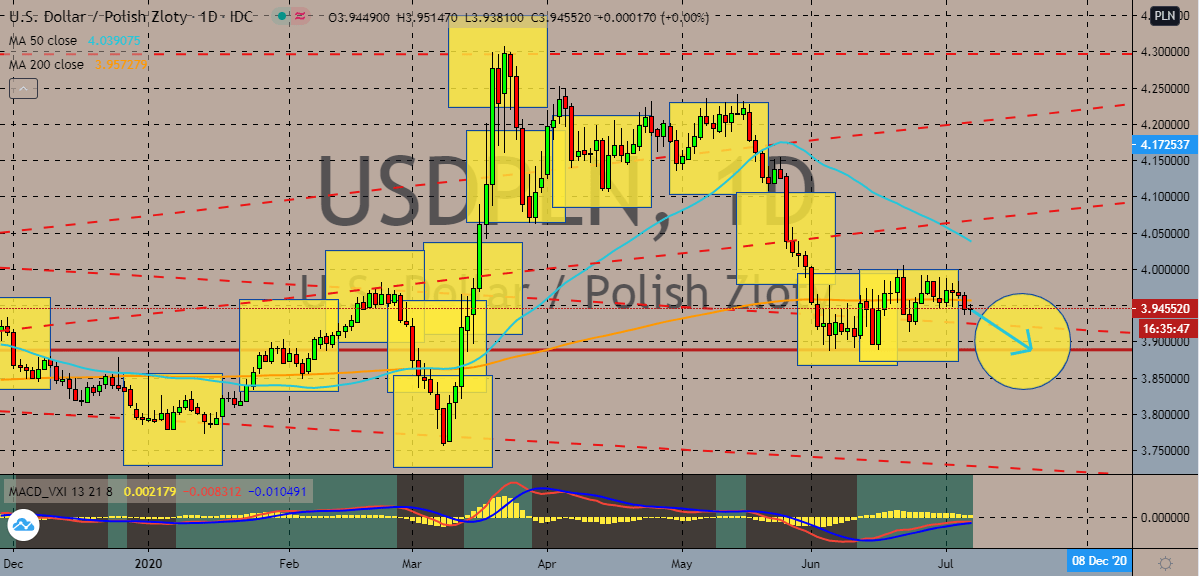

USDPLN

The Polish zloty has been trading resiliently against the US dollar in the past few trading sessions. The pair is currently seen neutral as bulls and bears struggle to gain momentum this Tuesday. Luckily for the Polish zloty experts believe that the pair has what it takes to continue strengthening against the US dollar. The pair should go down towards its support level on the halfway mark of the month. According to Eryk Lon, a member of the Monetary Policy Council of the National Bank of Poland, the zloty has great potential to dominate due to the impeccable resiliency of the Polish economy to the damages brought by the coronavirus pandemic. Lon added that the Monetary Policy Council always considers the strength of the zloty as a factor when making decisions. Aside from that, the central bank official, a strong Polish zloty can actually substitute for tightening the bank’s official interest rate and vice versa when weakening.

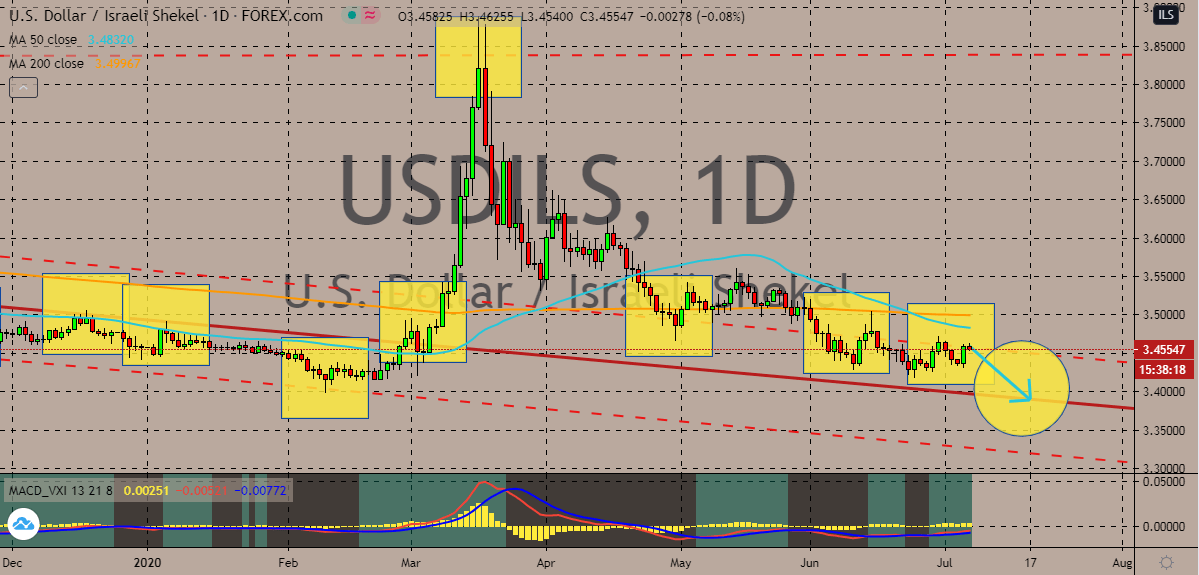

USDILS

The Israeli shekel faces serious hurdles this Tuesday against the US dollar. Israel’s currency has slowed down following the news about the central bank’s interest rate decision and announcements. The US dollar to Israeli shekel exchange rate’s is on track to go lower and hit its support level this July. If that happens, bearish investors can ensure their dominance as the 50-day moving average will further plunge against the 200-day moving average. Moreover, the Israeli central bank held on to its interest rates as expected, leaving it at 0.1%. Aside from that, another factor that caused the exchange rate to steady is the decision of the central bank to adjust its forecasts. According to reports, the central bank forecasted an economic contraction of about 6% this 2020, and compared to its prior projections of a 4% contraction, the adjustment was indeed alarming. Governor Yaron said that the health situation in the country is becoming more severe.

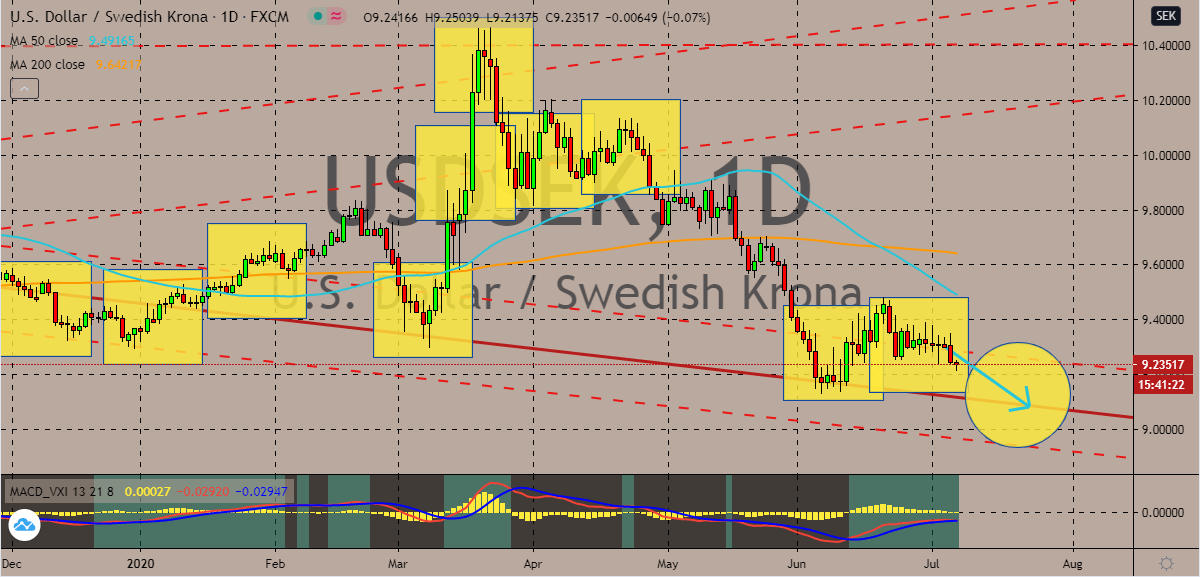

USDSEK

The Swedish krona is looking to extend its rally against the US dollar. The exchange rate should continue to plunge as bears take advantage of the weakness faced by the greenback. Looking at it, among the currencies in the region, the Swedish krone has the best gains at it not only redeemed its losses but also gained more against the US dollar. When Europe started its lockdown, Sweden took a different approach which didn’t help it against the US dollar. And according to foreign currency experts, the lockdown has nothing to do with the strength of the Swedish krona. Of course, the pandemic still struck the country and affected its economy, thus Sweden’s central bank ramped up its quantitative easing program to buoy the economy. But as of today, bears are facing trouble as the number of rising cases around the world could soon prompt economies to enforce harsh lockdown measures again. The more would prevent bears from break past the support.

COMMENTS