Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

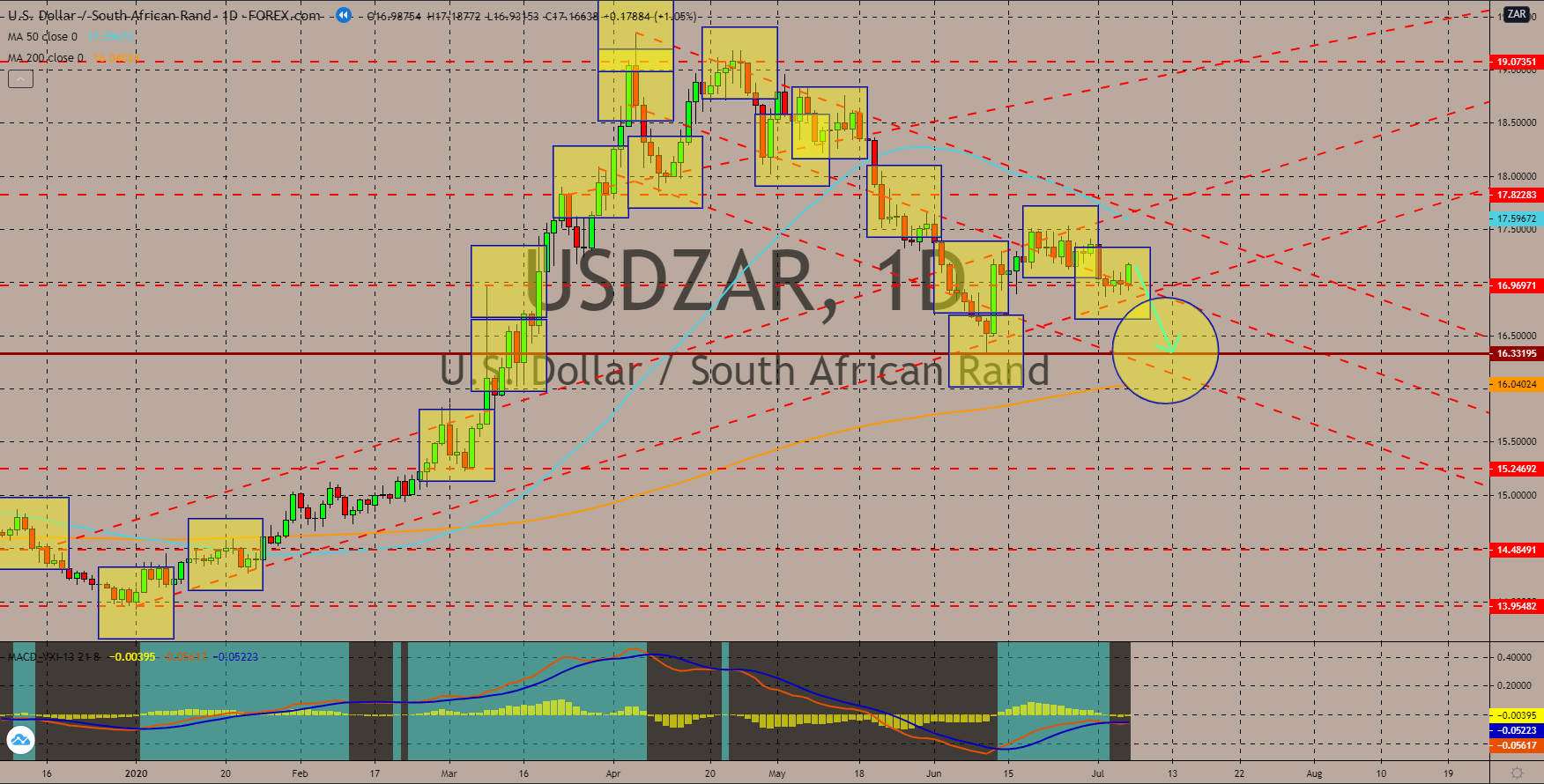

USDZAR

The increase in USD reserves by South Africa will help it to continue its strength against the greenback in coming sessions. SA saw a huge jump in its dollar reserves in the second half of 2019 but declined in the first half of 2020. Despite this, the rand posted 12.12% gain against the greenback since its April 06 low. Johannesburg has been using the dollar as a double-edged sword. It has been accumulating investments on the US currency especially now that the US dollar index just saw a massive decline. The stimulus by the US government and the Fed bazooka will hurt the US dollar in the short to medium-term. Aside from that, higher reserves will increase SA’s leverage on the IMF and the world bank. USD reserves build up in 2020 was $850 million or 1.89%. The huge deposit of US dollars will also help the country to mitigate the possible impact of the increasing tension between the United States and China.

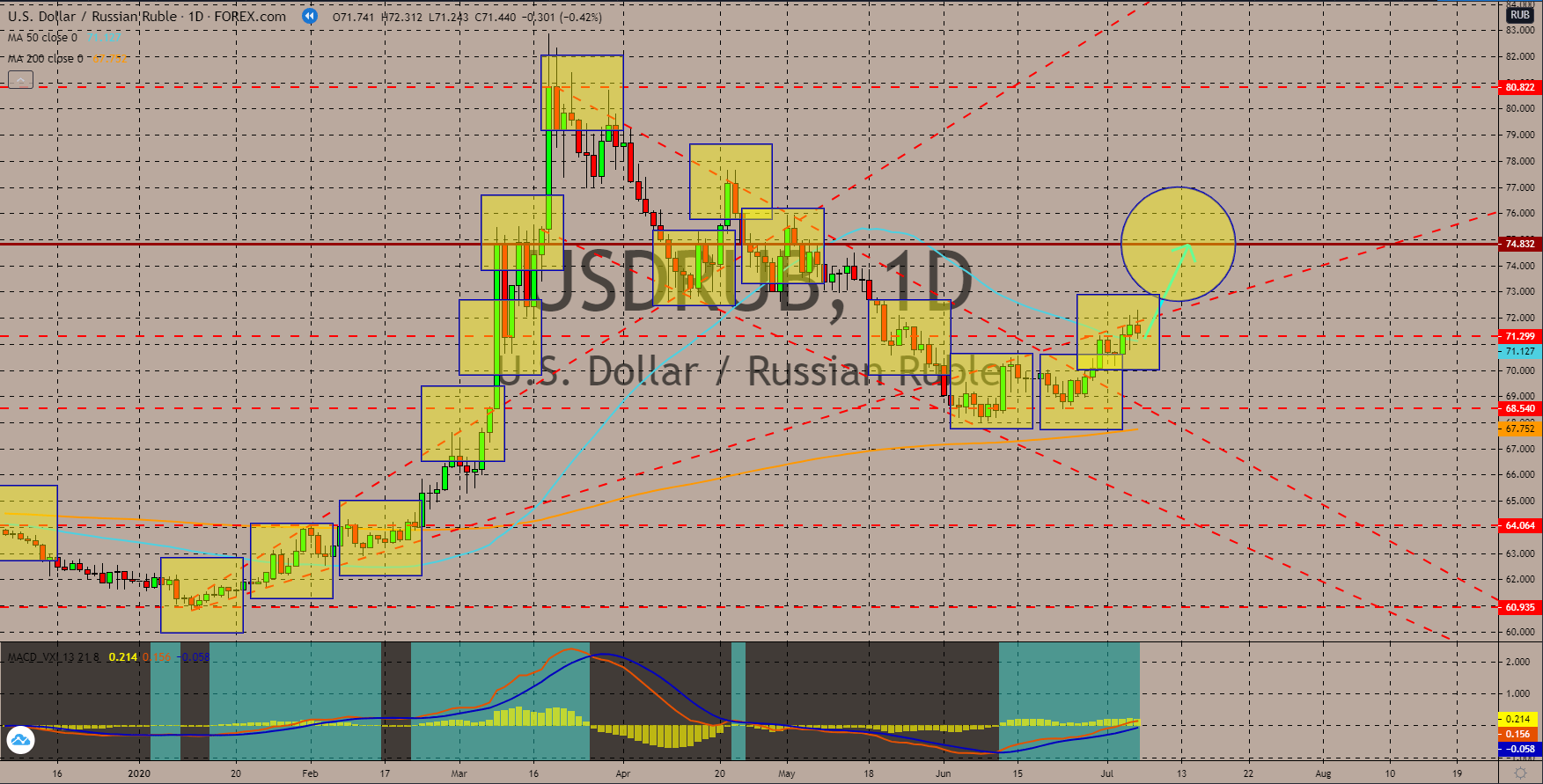

USDRUB

The mixed signals from Russia’s reports will send the ruble down against the US dollar. Russia released its Consumer Price Index (CPI) reports – MoM and YoY – today, July 08. CPI YoY showed an improvement of 0.2% for the month of June compared to May’s figure. However, MoM report posted a bearish number. Growth from the report was only 0.2%, lower from the prior month’s 0.3% figure. These figures are also low compared to the average CPI of European countries. Meanwhile, the US is showing a massive improvement with its Consumer Credit report. For the month of April, consumer credit dropped by $68.78 billion. Meanwhile, May’s figure came in at -$18.28 billion. As more US states began to reopen their businesses in late May, expectations for June’s report were high. Analysts have a range of $0 to $10 billion in consumer credit for June. This expectation will help the pair to go back to its April’s high.

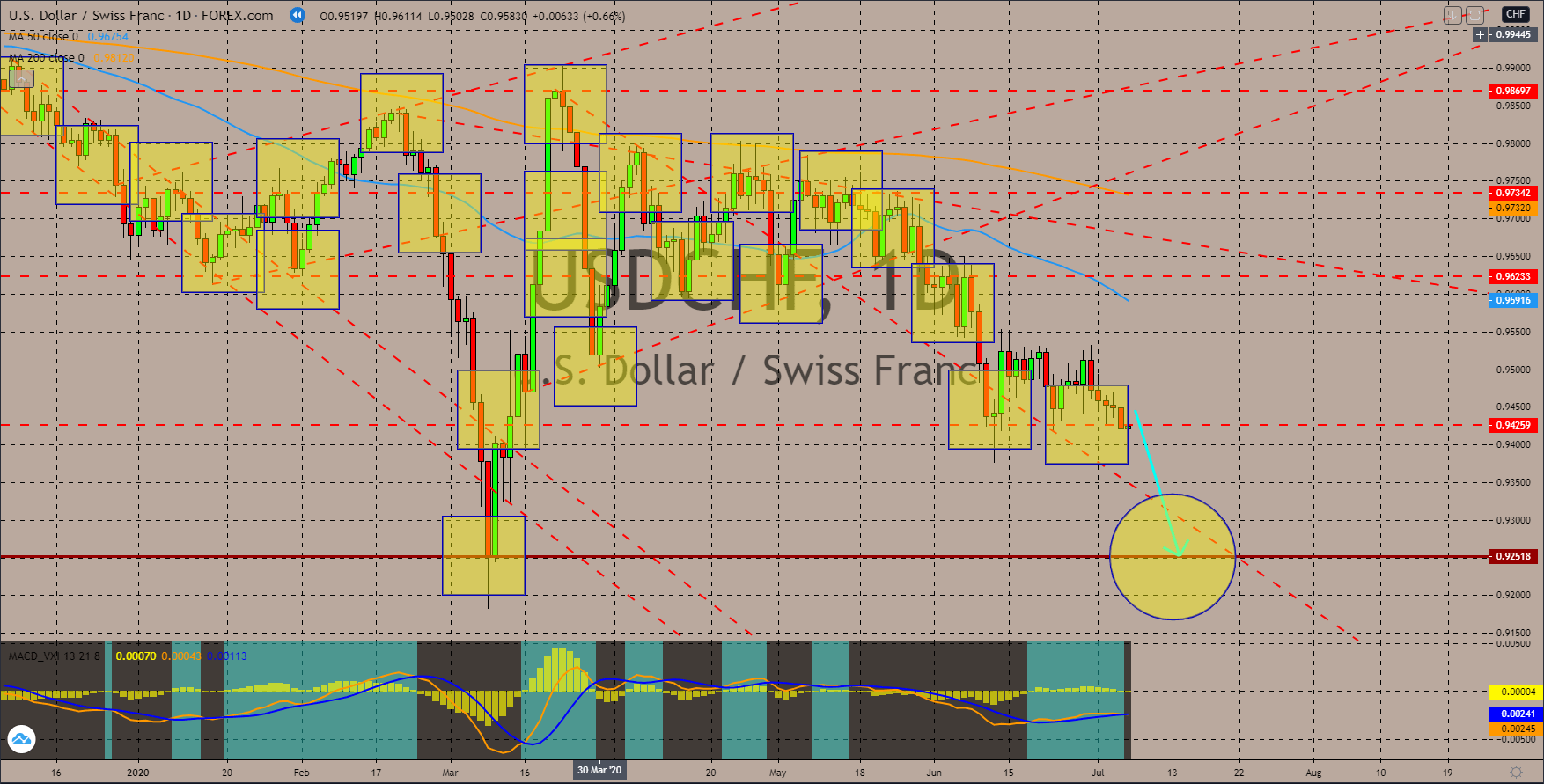

USDCHF

Switzerland’s unemployment rate dropped to 3.2% in today’s report, July 08. This was an improvement of 5.88% compared to May’s 3.4%. Investors are optimistic that the figure will continue to go lower given the current trend. This, in turn, will attract investors to put their money back to the safe-haven currency Swiss franc. Meanwhile, investors will ditch the US dollar as the other regions recover faster than the largest economy in the world. The continuous rise in coronavirus cases and continued intervention by the US government and central bank will drag the US dollar lower against the Swiss franc. The US dollar index already lost 6.32% from its March high to date. The stimulus package by the US government and Fed Bazooka will continue to drag the greenback. Meanwhile, the prospect of a second wave of coronavirus cases in the country will hurt investor’s confidence. This, in turn, will further drag the US economy.

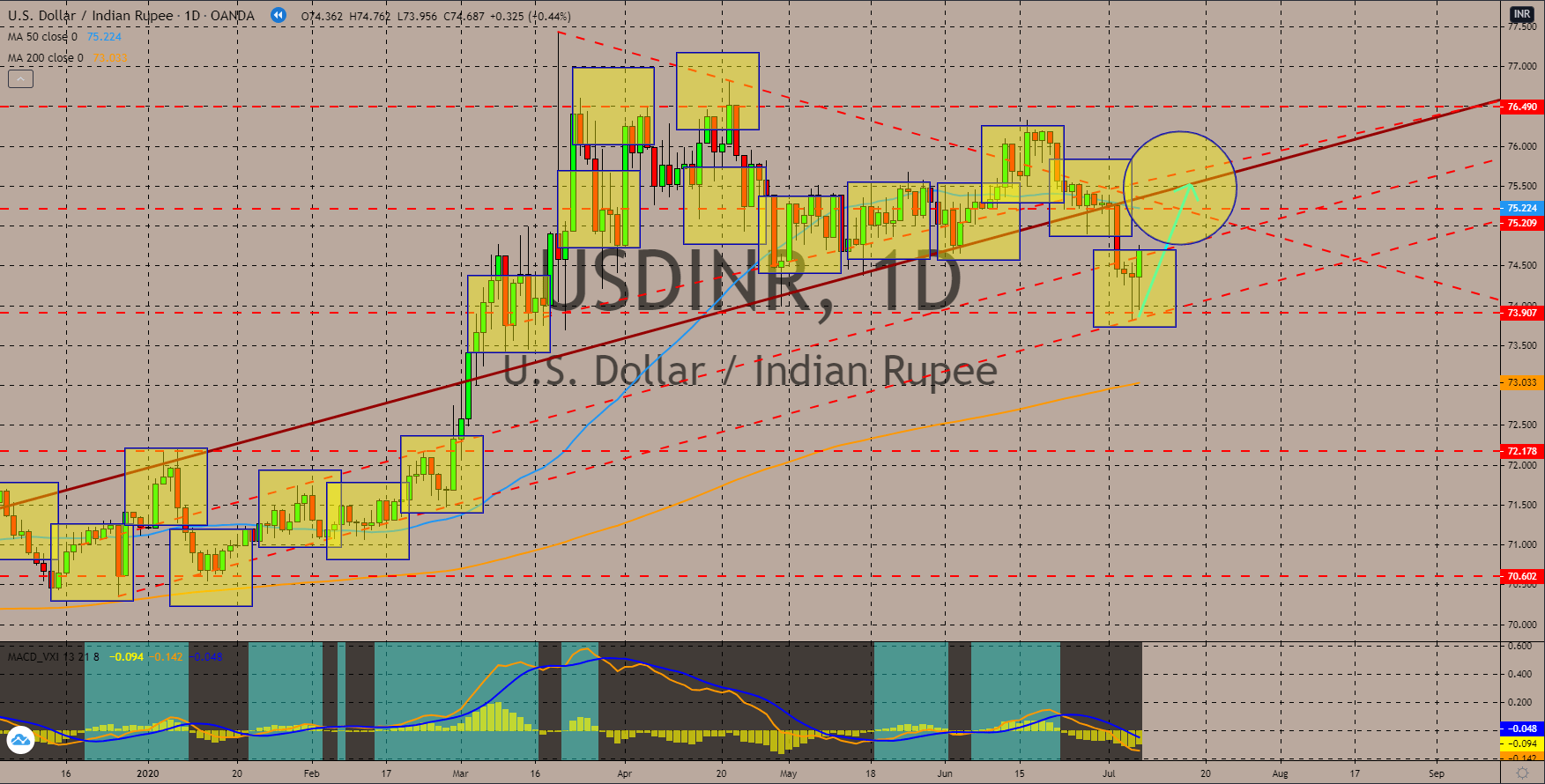

USDINR

India’s 2020 growth varies on government and investment institutions. The more modest outlook came from the World Bank with only 3.2% decline expectations. The International Monetary Fund (IMF) projected 4.5% decline, while the Asian Development Bank’s (ADB) forecast was at 4.0%. Credit rating agencies S&P 500 and Fitch Ratings were both anticipating a 5.0% decline with the sixth largest economy in the world. Meanwhile, India ratings saw a steeper decline at 5.3%. The State Bank of India has the worst projection for economic outlook at 6.8%. The bigger the decline, the longer it will be for India to reach on the rank of the 5 largest economies in the world. This might also derail the growth projection of India in the coming years. On the other hand, the US will continue to thrive with the strong support of the central government and the central bank. Cumulatively, the two (2) institutions injected more than $6 trillion in the local economy this year.

COMMENTS