Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

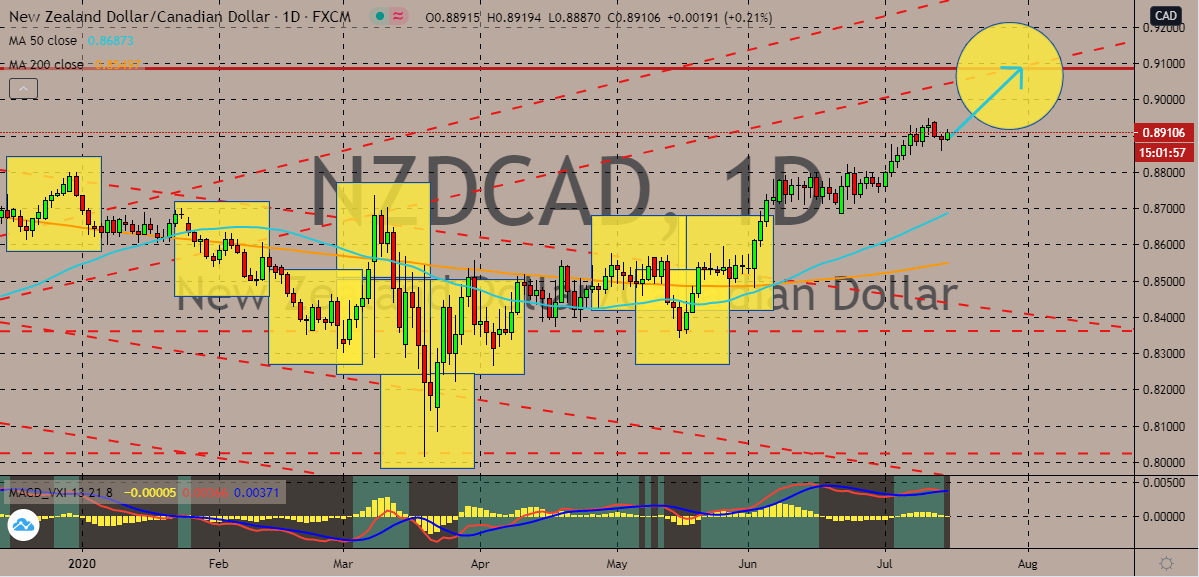

NZDCAD

The New Zealand dollar’s rally has slowed down this Wednesday as investors wait for Beijing’s response to Washington. Despite that, the NZDCAD trading pair is still predicted to climb higher eventually and reach its resistance later this month. Bullish investors are targeting to reach ranges last seen back in mid-April 2019. That should help maintain a strong bullish market for the New Zealand dollar as it will further buoy the 50-day moving average higher against the 200-day moving average. Moreover, it was just recently reported that United States Secretary of State Mike Pompeo said that China’s endeavors of pursuing offshore resources in some parts of the South China Sea are “unlawful”. Pompeo reportedly condemned the Chinese government’s “campaign of bullying” to take control of the area. Investors of the pair are concerned that this could trigger further turmoil between the two economic giants and their allied nations.

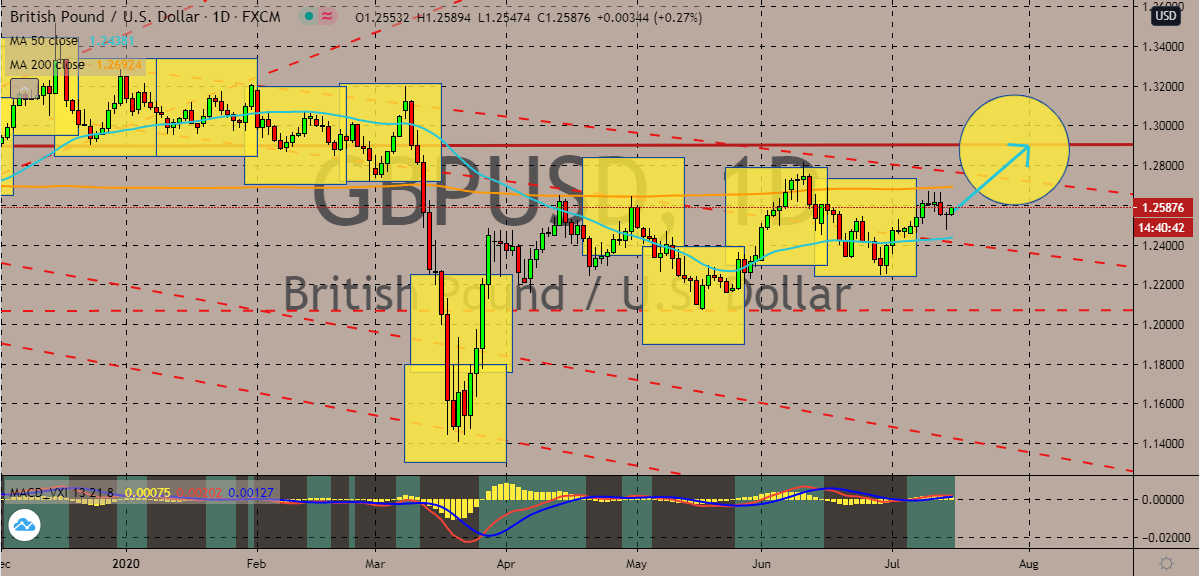

GBPUSD

The British pound to US dollar trading pair is full of fundamentals and it’s widely expected to climb up in the coming sessions. Although some investors believe that the technical factors could be enough to help bearish investors regain their footing. Still, the pair is projected to climb up higher in the trading sessions as bulls try to buoy prices to ranges last seen before the coronavirus outbreak struck the market. The rally should help bulls prop the 50-day moving average higher against the 200-day moving average. Investors are tuning in on Brexit updates and some are feeling the anxiety brought by the high-profile divorce. Just last week, the European Union’s chief negotiator, Michel Barnier said that there are still “significant divergences” on the negotiation table. However, bears are gathering strength after the German Chancellor Angela Markel warned bloc members about a no-deal Brexit which would be detrimental for the sterling.

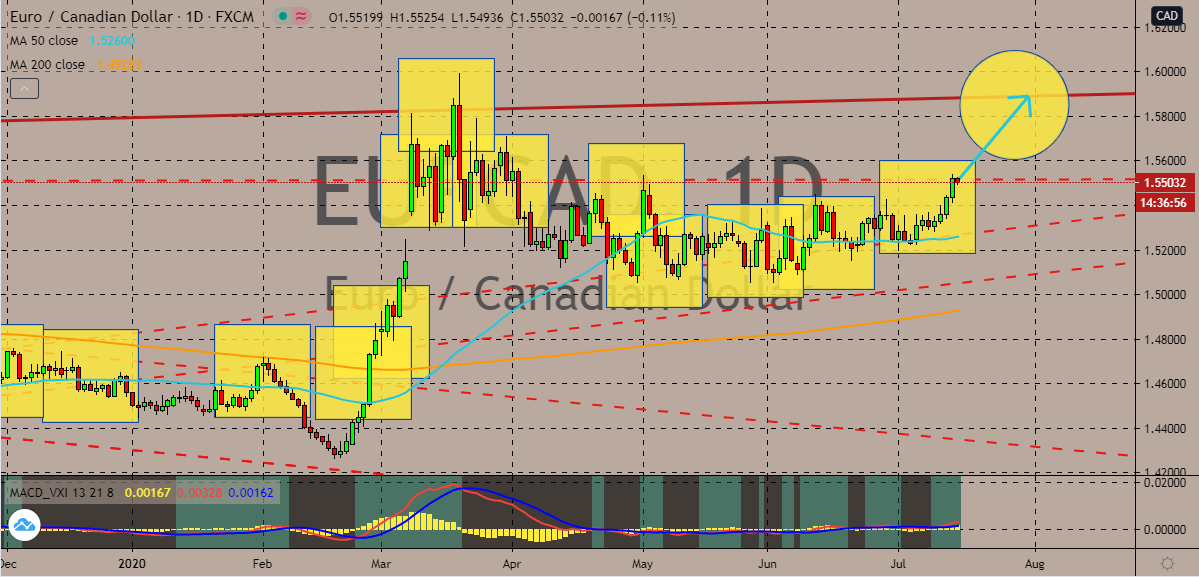

EURCAD

The euro rallies yesterday against the Canadian dollar. However, as of today, the Canadian dollar is seen forcing the euro to steady as the pair hits a resistance line and slows down. Still, the euro to Canadian dollar exchange rate is widely expected to climb higher as the bullish tone continues to be powerful. Yesterday, the euro powered through other major currencies such as the US dollar and its neighbor the Canadian dollar. Bullish investors received support from the growing hopes that European Union leaders would eventually agree on a consensus stimulus package and deeper fiscal integrations to help the bloc’s struggling economies recover from the devastating pandemic. On the other hand, the Canadian dollar is weakening as bears feel the pressure from the concerns about a pro-longed travel ban. Traders are weighing in the extension prospects of the travel restrictions between the United States and Canada, putting pressure on the Canadian economy.

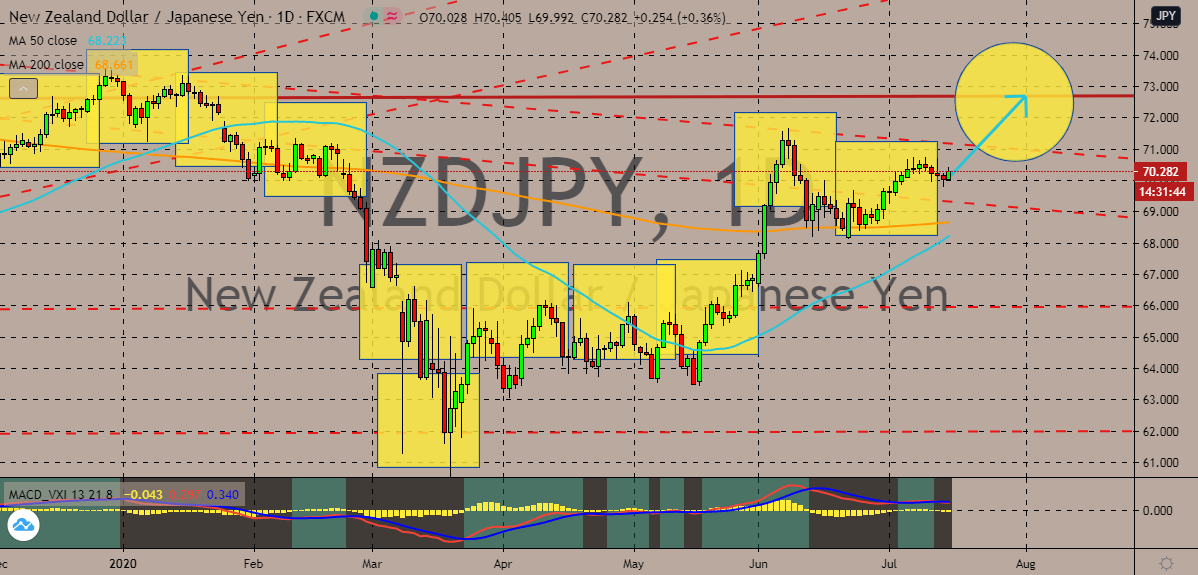

NZDJPY

The New Zealand dollar continues to drag the Japanese yen this Wednesday. The pair is widely expected to head over to its resistance level this July, reaching prices last seen in January this year. The exchange rate’s main fundamentals include the Sino-US tensions and the Bank of Japan’s latest interest rate decision. Just yesterday, the Japanese central bank announced its decision to hold on to its famous negative interest rates at -0.10% as the country’s economy struggles to recover from the pandemic. The interest rate decision failed to provide a helping hand for the Japanese yen and the moderate recovery view also presented yesterday is making it more difficult for bears. In its quarterly outlook report, the Bank of Japan said that the economy is expected to gradually improve in the latter part of the year. Adding that the pace of its recovery is rather modest as the ripples of the global coronavirus pandemic continue to disrupt it.

COMMENTS