Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

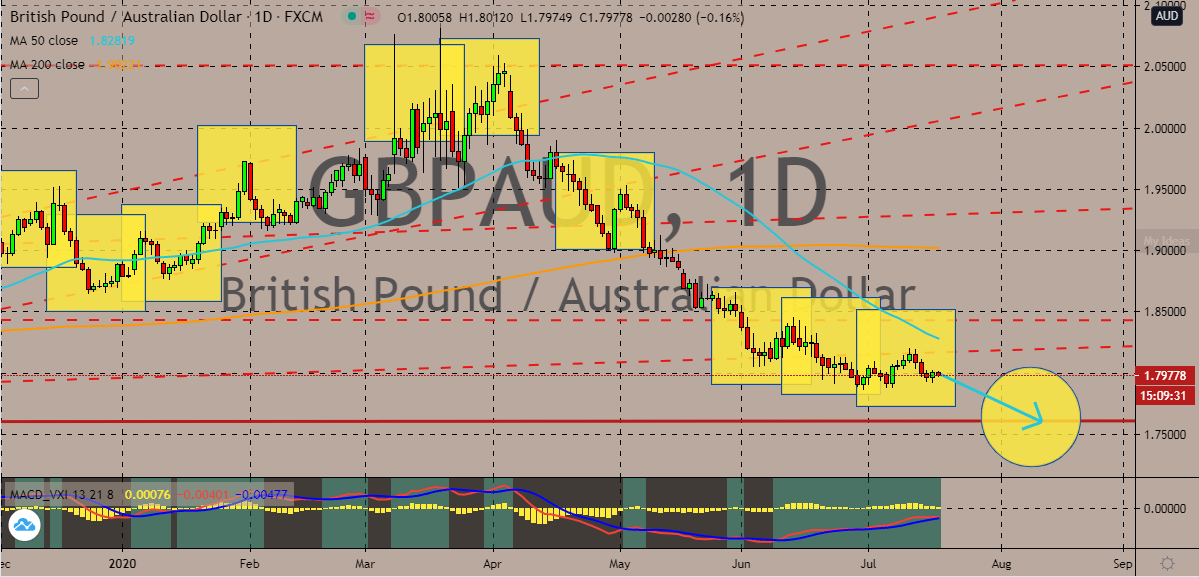

GBPAUD

The Australian dollar slightly loses its steam thanks to the alarming number of jobless people recorded by the antipodean country. Despite that, the British pound to Australian dollar exchange rate is widely projected to climb down to its support level by the first half of August because the sterling is significantly weaker than the Aussie. Brexit deal-related pressure is causing bullish investors to struggle in the market. If the pair continues to decline, the 50-day moving would further slide lower against the 200-day moving average, further defining the bearish sentiment on the pair. Despite seeing record highs, the Australian unemployment rate came in just as expected, climbing from 7.1% to about 7.4% in the month of June. Aside from that, the country also recorded an impressive employment chance in June, with figures surging from about -227.7K to approximately 210.8K, topping prior projections of about 112.5K.

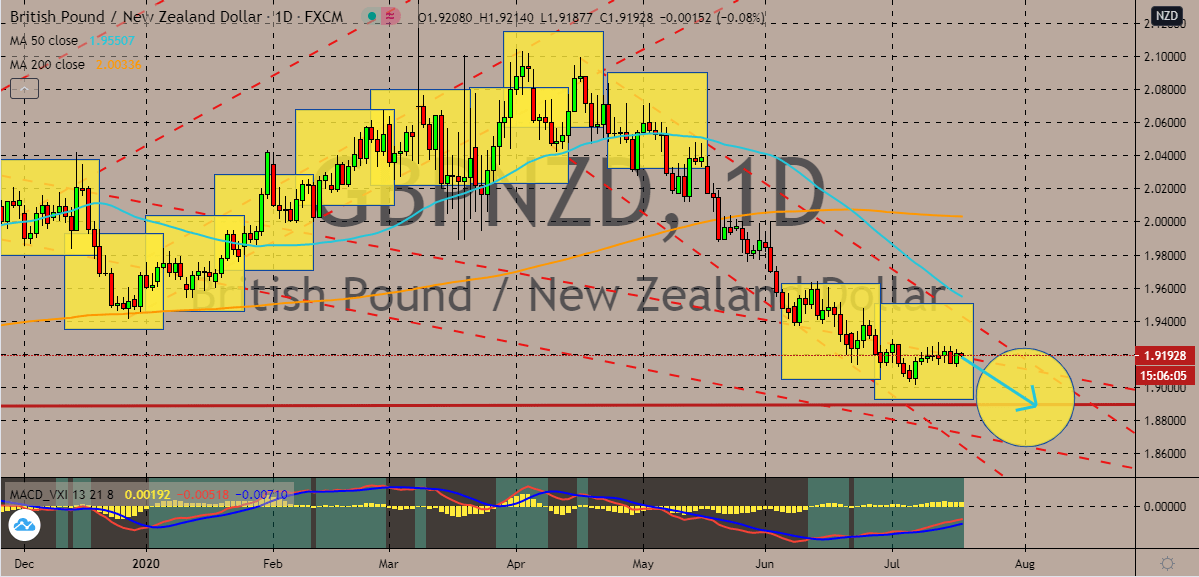

GBPNZD

Just like its performance against the Australian dollar, the British pound does not have enough strength to buoy itself against the New Zealand dollar. The trading pair is projected to drop to its support level in the first few days of August. That should help bears maintain their momentum, keeping the 50-day moving average grounded against the 200-day moving average. Bearish investors are glad that the poor economic data produced by the country failed to stop their momentum. Earlier this week, New Zealand’s consumer price index for the second quarter of the year dropped from about 0.8% to about -0.5% on a quarter-over-quarter basis, in line with prior projections. However, there is a great upside potential for the pair to bounce back once it touches its support level. This is because the risk-on sentiment continues to falter thanks to the massive increase of coronavirus cases in the Americas, main in the United States and Brazil.

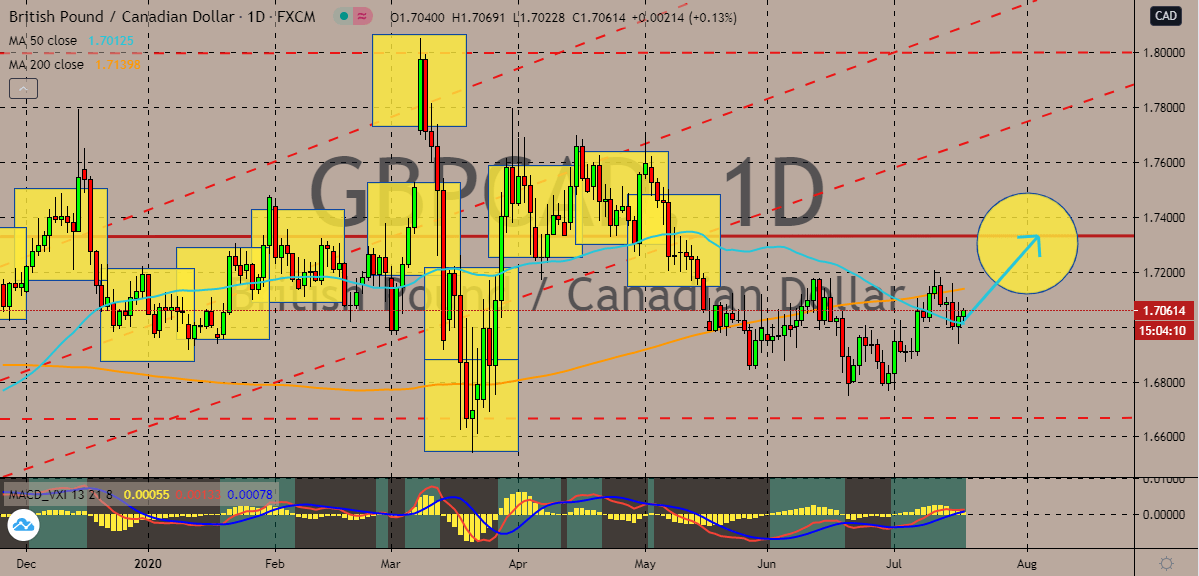

GBPCAD

Oil price concerns are causing the British pound to Canadian dollar exchange rate to climb up towards its resistance. Fortunately for the sterling, the concerns for the loonie are really weighing down on the performance of bearish traders. Prices are now projected to climb up to its resistance by the first few days of the month. Looking at it, the Canadian dollar initially rallied earlier this week, but it failed to hold on to its gains against the sterling. The main reason why the loonie primarily rallied is the reopening of Toronto’s economy. The news that there won’t be any rate hikes until 2023 is also pressuring the Canadian dollar. Just recently, it was reported that the Bank of Canada decided to leave its interest rates unchanged at 0.25%. The BOC also promised that it will keep its benchmark interest rates until the country’s unemployment rate falls to pre-coronavirus pandemic levels and inflation to start picking up.

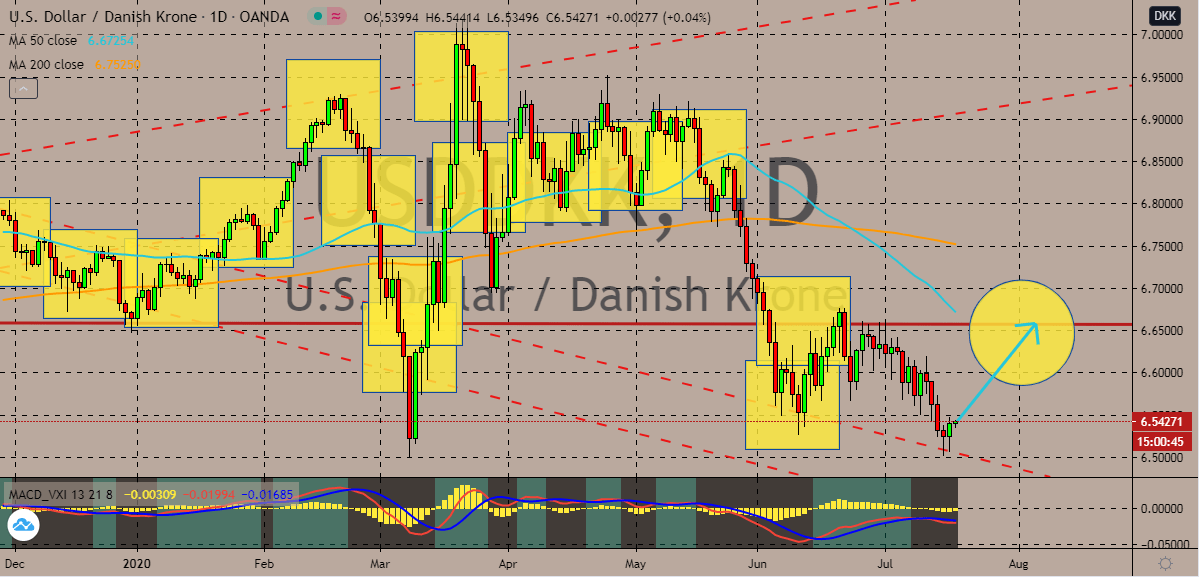

USDDKK

The Danish krone lost its winning momentum against the US dollar in the trading sessions this week. Bulls now see an opportunity to bring the pair higher after their losing streak in the last few weeks. Prices are bound to gradually advance towards their resistance level in the first week of August, helping the 50-day moving average from plummeting lower against the now-dominant 200-day moving average. However, there is a huge chance that the US dollar would once again lose its footing once it hits its resistance. This is because investors are turned off by the poor performance of the United States economy and the alarming climb of COVID-19 cases in the country. What’s more alarming for investors is the secrecy of the US government that is crippling the attempts to contain the spread of the coronavirus in the country. Looking at it, the US is seeing a significant rise in 39 of its states, and only 2 states recorded improvements.

COMMENTS