Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDCNH

The Chinese yuan continues to advance against the US dollar as the Chinese economy gradually recovers. The USDCNH trading pair’s prices are widely predicted to remain bearish and possibly reach its support level in the first week of August. Bears are hoping to force prices to the range last seen in early March before the pandemic worsened around the world. The main strength of the Chinese yuan comes from the recent reports that Goldman Sachs says that it sees the currency reinforcing itself against the US dollar in the next 12 months. However, the Chinese yuan’s strength suddenly felt a sudden stop this Monday after the People’s Bank of China announced its official interest rates this morning. Earlier this Monday, the PBoC announced that it has set its 5-year loan prime rate at about 4.65%, leaving it unchanged from a month earlier. Aside from that, the Chinese central bank also left its 1-year loan prime rate unmoved at about 3.85%.

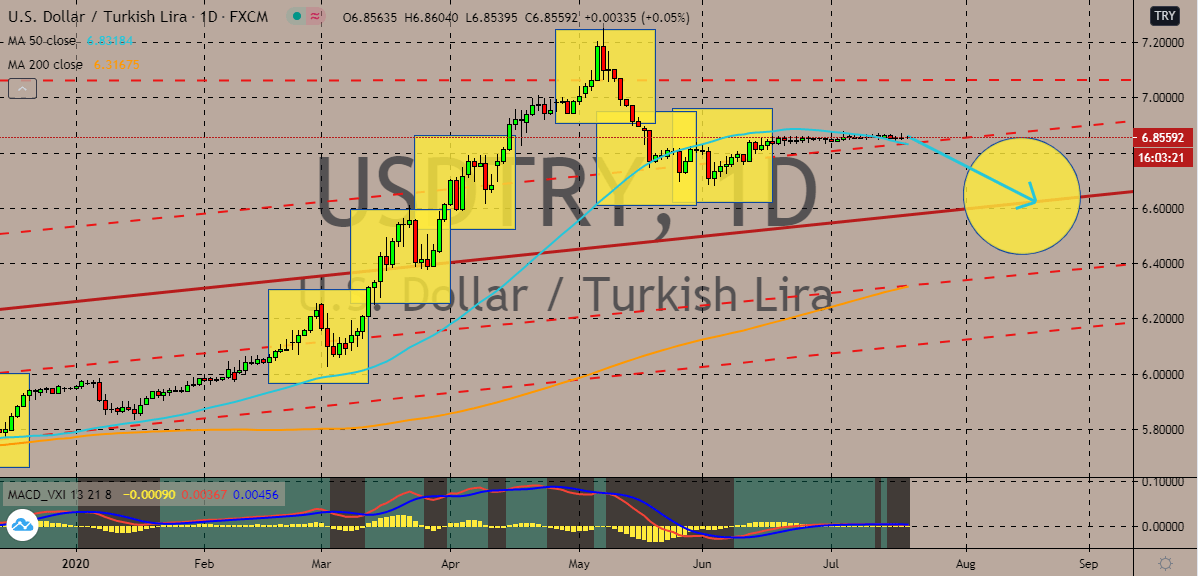

USDTRY

Bearish investors are looking for an opening to take down the already weak US dollar. The exchange rate is predicted to go down to its support level in the coming sessions as the greenback continues to weaken in the trading sessions. That should help bearish investors force the 50-day moving average to slightly go down towards the 200-day moving average. Just recently, it was reported that a former chief economist said that the Turkish central bank has no more room to lower its official interest rates. This comes after months-long of easing cycle that drove the inflation-adjusted borrowing costs to even below zero. The former bank official was fired last year when after Turkish President Erdogan fired the chief for not easing their rates. According to reports, the former bank official warned the risks brought by the dangerous combination of low interest rates, a big bond buying program, and the bank’s credit stimulus.

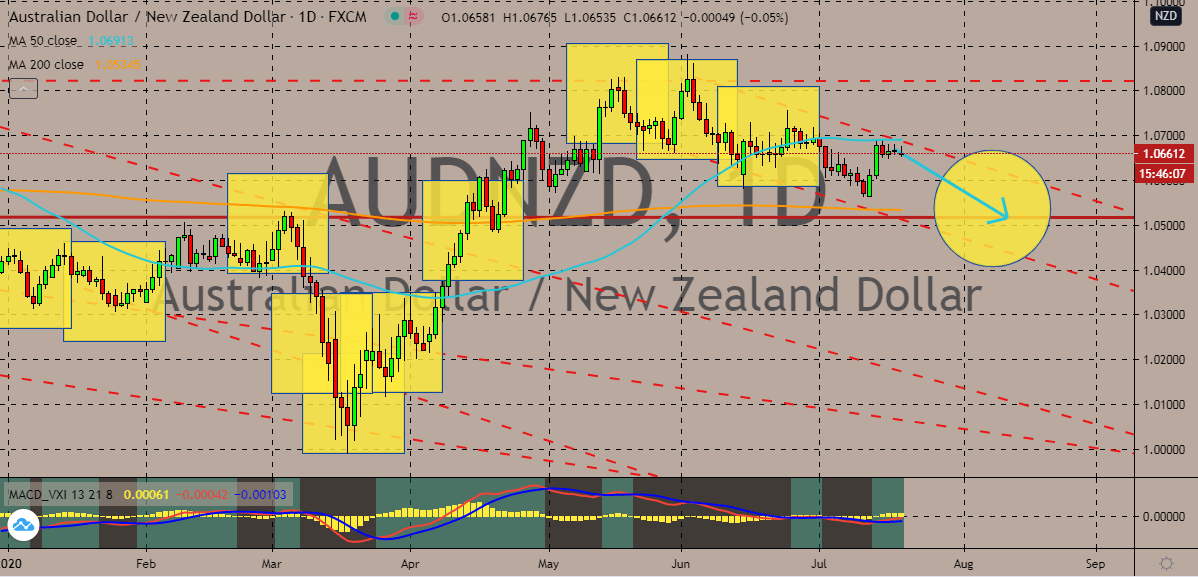

AUDNZD

The Australian dollar is starting to slow down against the New Zealand dollar. As of writing, the pair is seen slowing down in the trading sessions and bulls continue to break through the resistance level. The Australian dollar is widely on the defensive as Sydney, one of the country’s largest cities, heads to a lockdown. Investors are getting more and more concerned for the economy of the antipodean country which allows the kiwi to steadily push the 50-day moving average towards the 200-day moving average. Just recently, it was reported that the surge in Australia might take weeks to finally subside despite the lockdowns and measures to enforce face masks. This is according to the country’s acting chief medical officer. The country is now seeing its second wave of infections and New Zealand, its neighbor, is praying that it won’t face the same fate. Australia has only recorded less than 12,000 cases, a fraction of what other countries faced.

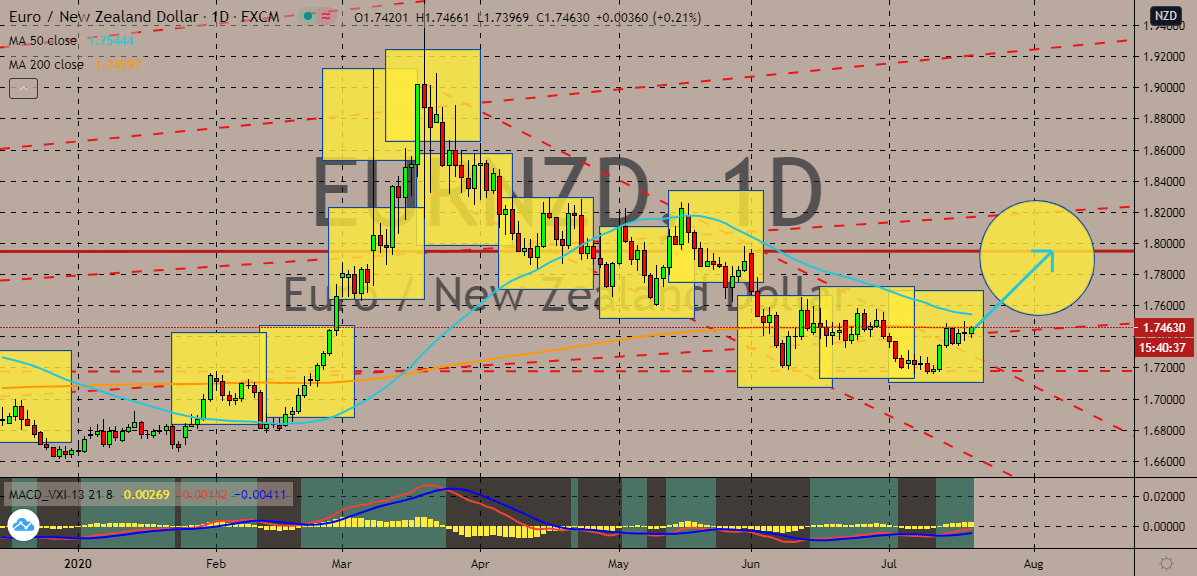

EURNZD

As of writing, the pair is seen flirting with critical ranges and if bulls manage to break past it, the EURNZD might see big bullish gains. Prices are projected to hit their resistance level next month. The bloc’s single currency is once again starting to get back up to its feet as leaders from the region get closer to agreeing on a recovery fund. European Union governments are inching closer and closer to settling their difference to help the eurozone recover faster. The news is helping bullish investors to prevent the 50-day moving average from completely plunging against the 200-day moving average. Just recently, it was reported that Australia, Denmark, Sweden, and the Netherlands were already satisfied with the 390 billion-euro funds that will be made as grants. On the other hand, bears are working hard to defend their gains as they gather strength from the optimism in the equity markets to power the New Zealand dollar against the euro.

COMMENTS