Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

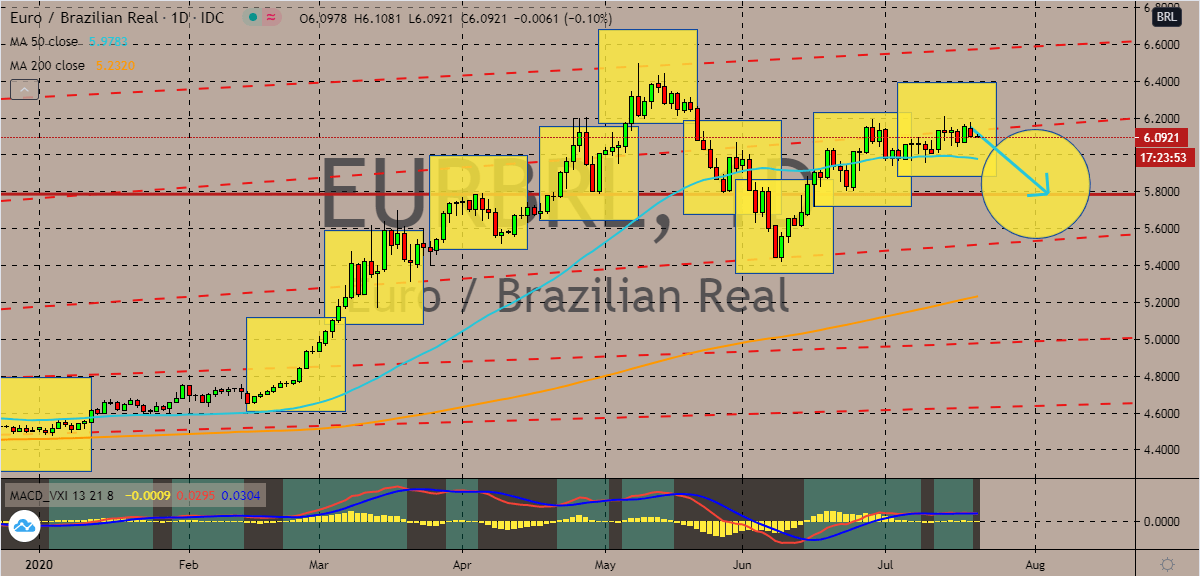

EURBRL

The euro struggles to prop itself against the Brazilian real and the trading pair is seen flirting with a critical resistance level. Prices are widely projected to turn bearish and the Brazilian real is looking to redeem itself. If prices actually go down to its support level, bulls would still have control as the 50-day moving average won’t totally fall against the 200-day moving average. However, it’s worth noting that the European Union leaders have finally agreed on a landmark 750-billion-euro recovery deal. Earlier today, EU leaders approved a stimulus package to help the eurozone economies fight the aftershocks brought by the coronavirus pandemic to the region. The highly anticipated deal was finally sealed after four days and nights of intense discussions that even had drama when the Netherlands was already at the brink of walking out. Just after that, EU Council Chief Charles Michel immediately tweeted out “Deal!” in excitement.

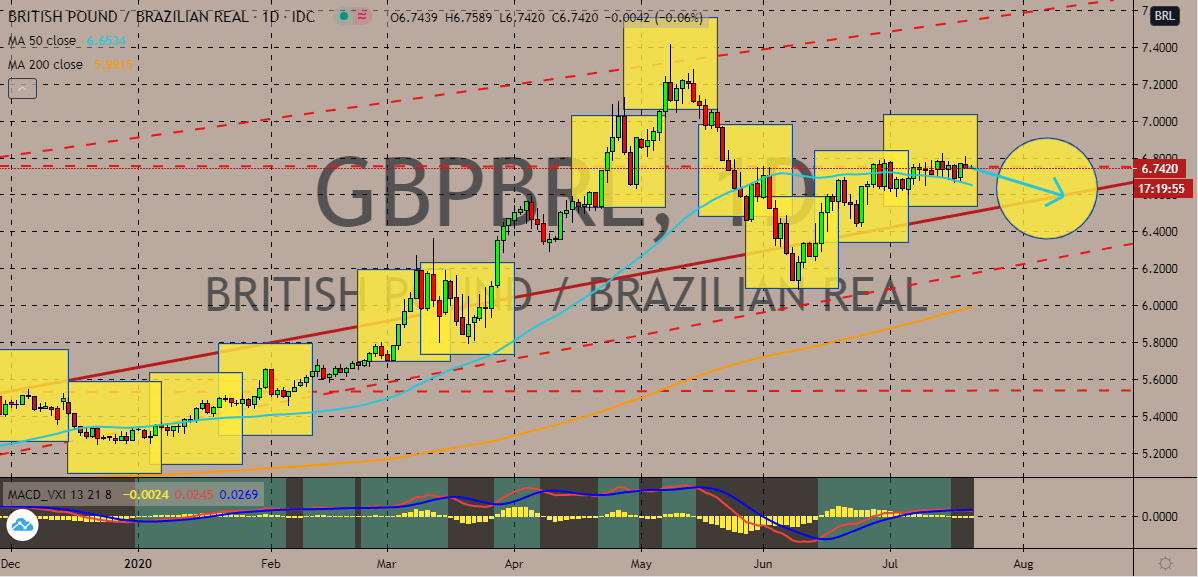

GBPBRL

After the Brazilian president himself was confirmed positive with the coronavirus, the British pound spiked. But now, the pound to the real exchange rate is seen struggling to break a critical resistance level, which it clearly struggles to break past. Now that bulls get capped, prices are projected to go down towards their support levels in the coming sessions. Although the fall isn’t that big, it’s still an opportunity for the Brazilian real to redeem itself. Bears are hoping to force the exchange rate lower than its initial support level. Looking at it, the British pound is feeling Brexit-related pressure as the two sides struggle to find common ground. Just recently, it was reported that EU fishermen are demanding the same access to British waters for the Brexit deal. The demand is severely conflicting for Brexiteers who want to restrict EU fishermen. The negotiation will continue this Tuesday and traders are waiting for further updates.

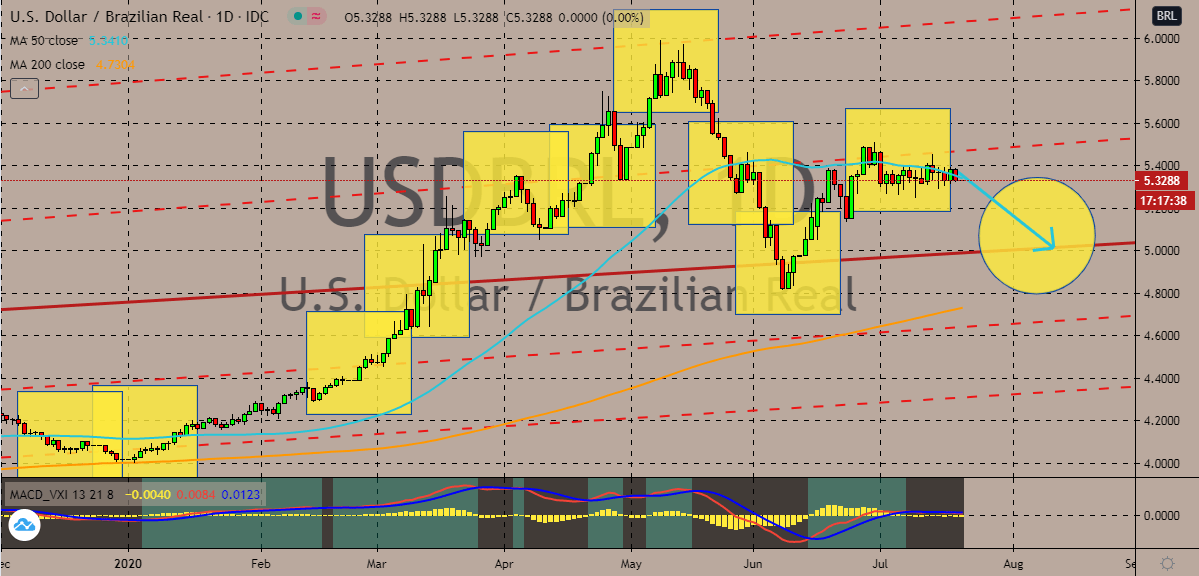

USDBRL

The US dollar to Brazilian real is expected to plunge towards its support level in the coming sessions. That fall should force the 50-day moving average towards the 200-day moving average, but it wouldn’t totally shift the dynamics and the pair would most likely remain a bullish market. Looking at it, the US dollar is significantly weakening thanks to hits it has been taking from the coronavirus pandemic. Experts believe that the US dollar index is poised to plummet. On the other hand, the Brazilian real is starting to regain its footing all thanks to coronavirus vaccine news. More and more investors are starting to look at other assets such as the real as the optimism in the market gets revived. Investors were delighted when it was reported that two more COVID-19 vaccine candidates have tested safe for humans. According to reports, the vaccines produced strong immune reactions among their tested patients involved in their trials.

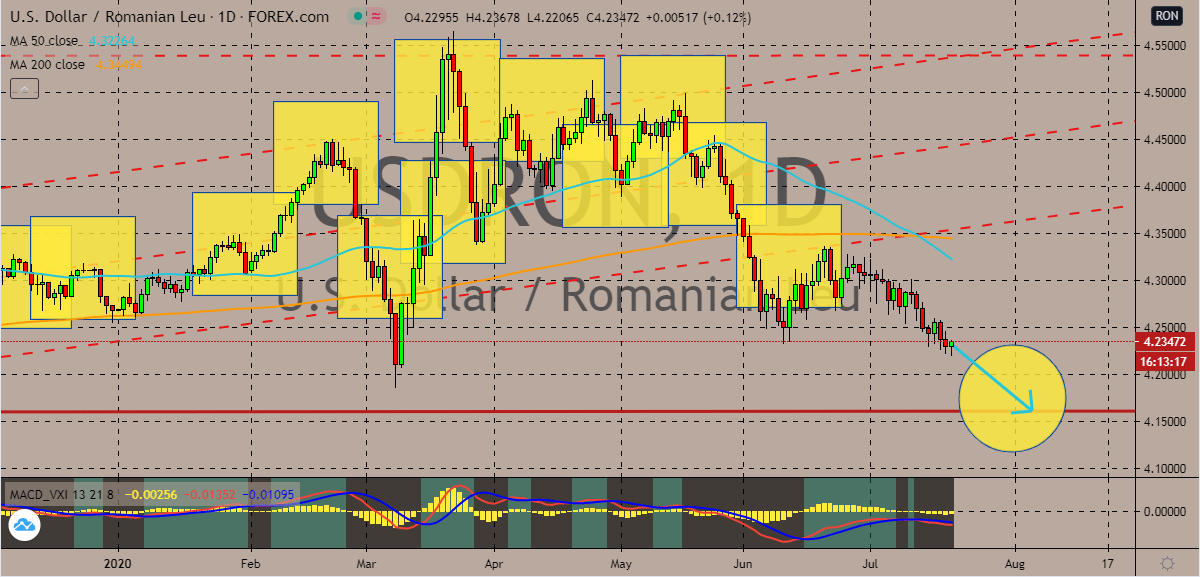

USDRON

The Romanian leu losses its footing this Tuesday against the US dollar. But the pair remains stuck on its downward trajectory and prices are highly predicted to go down towards their support level, hitting ranges last seen in early July 2019. The US dollar is extremely weak against other currencies especially those from Europe. Most experts believe that the US dollar index is set to fall in the coming sessions, strengthening the notion for bearish investors in the market. The fall should help bears maintain their dominance and pull the 50-day moving average significantly lower against the 200-day moving average. Romania’s economy is starting to recover, and investors were delighted by the news of another billion-euro stimulus package to help microenterprises and SMEs. Last week, the Romanian government discussed an emergency ordinance for a grant package worth 1 billion euros and the measures are to be adopted this week.

COMMENTS