Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

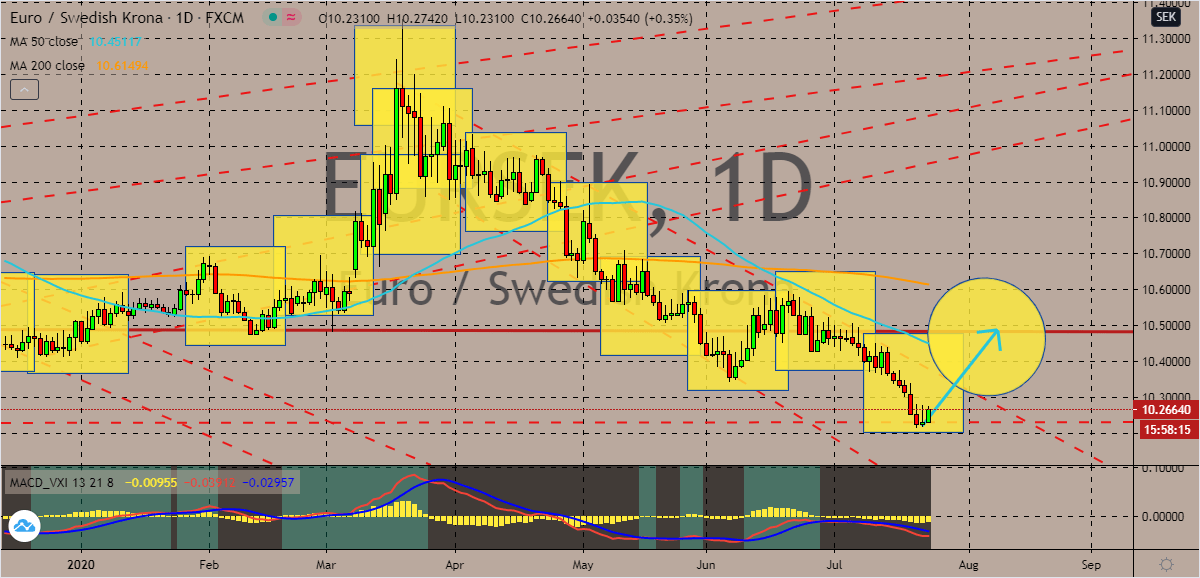

EURSEK

It’s time for bulls to regain their crown and take the reign from bears in sessions. The euro to Swedish krona is poised to make an excellent comeback and rise to its resistance level in the coming days. Prices are projected to recover from the monthly lows as the euro finally escapes some of the political chains that were weighing it down. The move should help bullish investors push the 50-day moving average and help ease the bearish pressure by buoying it towards the 200-day moving average. Moreover, it was just recently reported that the European Union leaders finally reached an agreement for a massive euro stimulus package that will help the economies in the region to recover. This will pump funds to countries severely struck by the coronavirus pandemic and help them recover simultaneously. The news is very beneficial for the euro as in the past, the political differences of EU leaders have caused it to buckle.

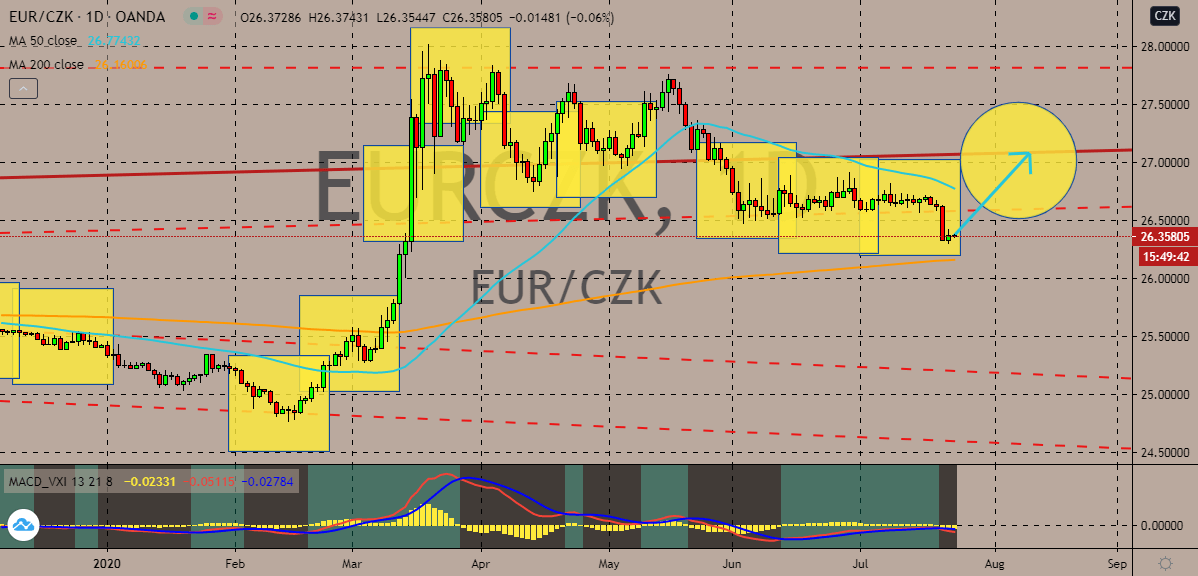

EURCZK

Finally, bulls are seeing the light again, and this could be a crucial chance to regain their gaining momentum. The euro to Czech koruna exchange rate is projected to climb up towards its higher resistance after it just broke through its initial support. Bulls are hoping to maintain their hold on the market and the surge should help them prop up the 50-day moving average higher against the 200-day moving average. Over the past few days, bears have been struggling to force the pair lower despite the euro being very vulnerable during those times. This suggests that the koruna does not have enough power to even hold itself the euro. The koruna is bombarded with woes regarding its economy. Last week, the koruna feels the pressure when the Czech Republic reports weaker than expected results from its producer price index. And then later next week, Prague is set to release its second-quarter GDP which is projected to go down from -2.0% to -2.3%.

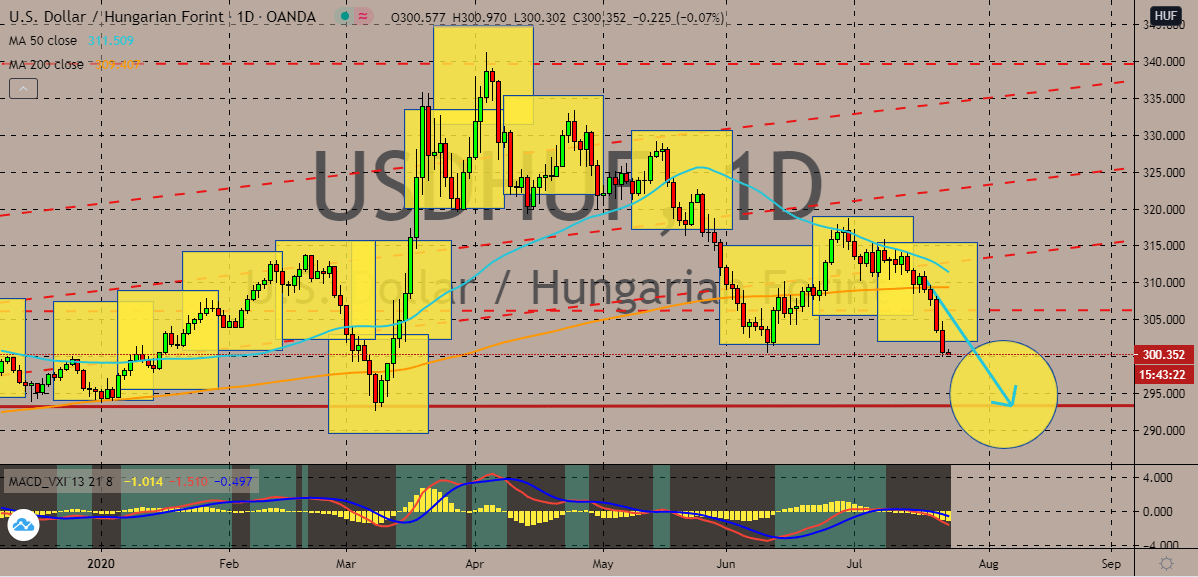

USDHUF

The policymakers of the National Bank of Hungary unleashed an expected rate cut this week that slightly weakened the Hungarian forint. Unfortunately for bulls, the rate cut will not stop bears from pushing the pair lower and lower. The trading pair is expected to go down towards its support very soon and that should push the 50-day moving average down past the 200-day moving average. Moreover, it was reported that the Hungarian central bank unleashed a 15-basis point rate cut to about 0.6% during its monthly monetary policy meeting earlier this week. The rate cut obviously slowed down the Hungarian forint, but the US dollar is significantly weaker. Looking at it, the greenback’s safe-haven appeal if slowing diminishing thanks to the seemingly uncontrollable rise of coronavirus cases in the US. And add to that is the hopes for a coronavirus vaccine which revives the firepower of a number of assets in the market including the forint.

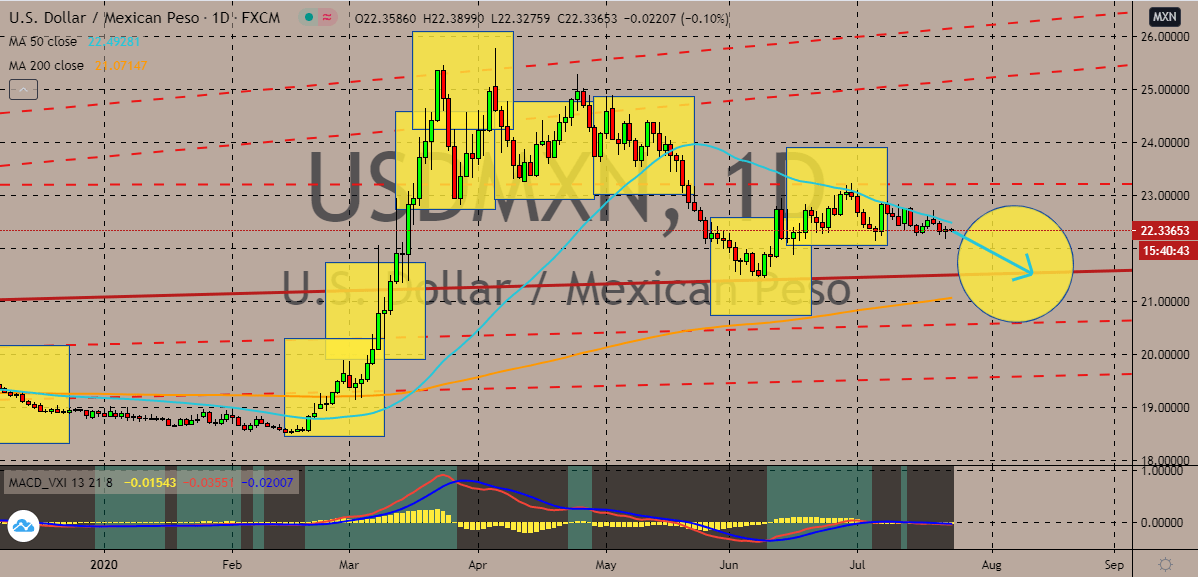

USDMXN

Questions over the risk appetite in the global market are affecting the direction of the US dollar to the Mexican peso exchange rate. The trading pair is widely projected to gradually go down towards its support level as the US dollar steadily weakens. However, there is still a potential for upside once the pair reaches its supports. This is because traders are greatly concerned about Mexico’s economy and its impact on the outlook of the peso. Initially, the market sentiment should drive the pair in the sessions, this allowed other assets to gain significantly against the US dollar. However, that’s not the situation faced by the Mexican peso as it only acquires limited gains. According to experts, the pair isn’t driven by fundamentals but rather technical insights that depend on speculators. This makes it hard to guarantee whether the pair’s prices could surge or not in the absence of any significant market events or economic reports.

COMMENTS