Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

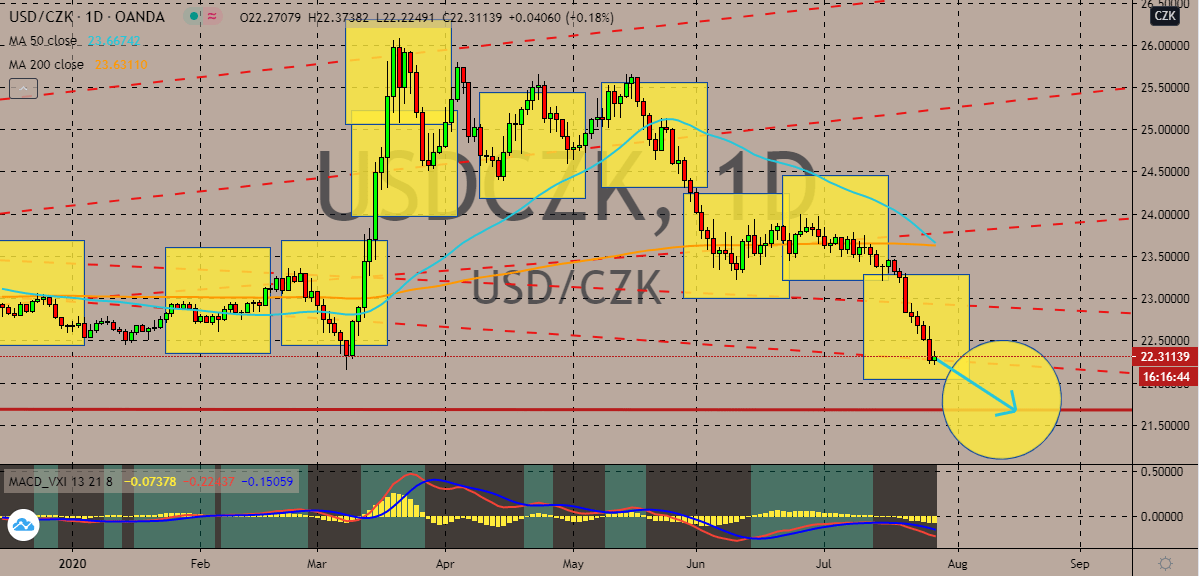

USDCZK

As bears touch their initial support level this week, the US dollar to Czech koruna exchange rate slightly bounces back. Unfortunately for bullish investors, their fate isn’t looking pretty good as the greenback is widely projected to remain significantly weak, hence, prices of the USDCZK trading pair should go down to their support level and finally reach ranges last seen in September 2018. A few weeks ago, Prague ended its coronavirus lockdown measures. However, last week, the Czech Republic reintroduced anti-coronavirus restrictions, obliging citizens to wear a face mask at events. Czech Minister of Health Adam Vojtech clarified that the authorities are not imposing any restrictive measures that would affect the economy. There are now more than 5,000 active cases of the virus in the country, the first time since the pandemic started. And on the other hand, those numbers still pale into comparison against other countries, mainly the United States.

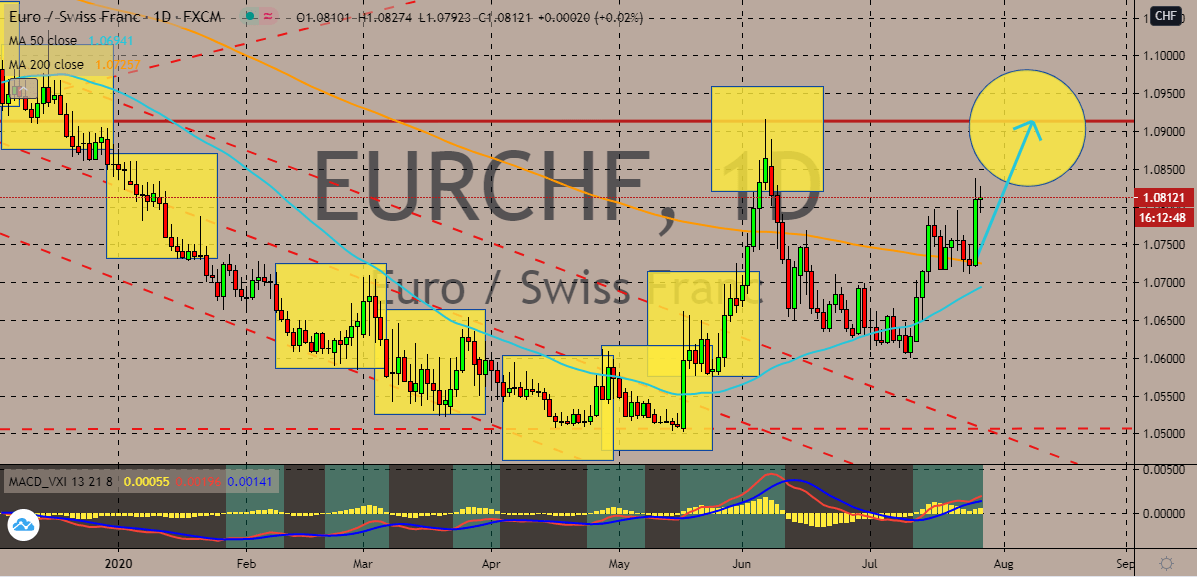

EURCHF

The euro to Swiss franc exchange rate slows down this Tuesday after the massive rally in yesterday’s trading sessions. Prices are still projected to climb up towards their resistance as the safe-haven appeal of the Swiss franc fails to attract euro investors. Yesterday, the risk appetite fueled the tanks of bullish investors and the positive German economic data further added optimism. Germany, the bloc’s biggest economy, released its Ifo business climate index for July yesterday and official figures show an improvement from 86.3% to about 90.5%, exceeding prior forecasts of about 89.3%. Aside from that, the country’s July business expectations report also showed an improvement from 91.6% to 97%, undeniably going beyond early projections of 93.7%. Bulls are waiting for further guidance from Berlin’s economy, mainly from the German unemployment change which is expected to go down from 69K to around 43K.

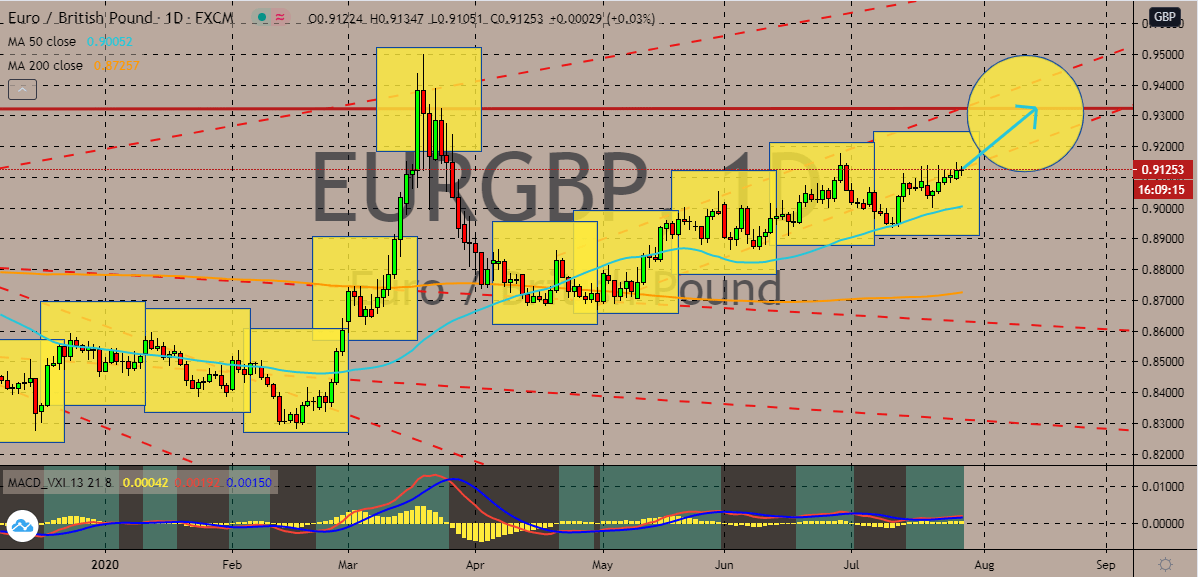

EURGBP

The stubborn stance of both the United Kingdom and the European Union is making it even tougher for the British pound to defend itself against the euro. Traders are closely tuning in on the Brexit negotiations which have now turned grim due to the unwavering differences of the two sides. Moreover, France was criticism for its hard stance on fishing demand and the suggestion of French President Emmanuel Macron is feared to scupper a post-Brexit deal. Macron has insisted that the United Kingdom should agree with a “balanced and sustainable” fishing deal in which EU fishermen would have the same access to British waters. Both Hungary and Lithuania have argued that the hard stance or demand could block the chances of settling an agreement with the British government. Since Brexit talks have begun the two sides have been negotiating their ends on all aspects, from security to trade, and fishing rights are one of the key hurdles for the two sides.

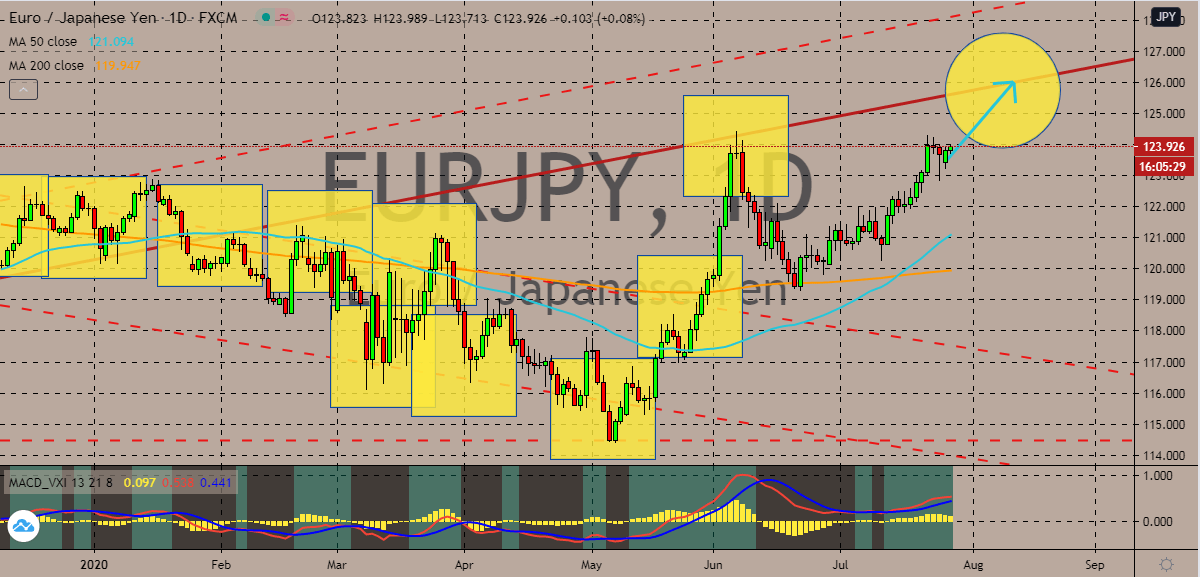

EURJPY

Bullish investors of the euro to Japanese yen trading pair are mainly riding on the weakness of the US dollar and the limited positivity from the risk-on sentiment. The trading pair remains on an ascending channel and prices are widely projected to hit their resistance level soon. Bulls are aiming to reach price ranges that were last seen March, during the peak of the coronavirus pandemic. That move should help maintain the bullish sentiment in the market and buoy the 50-day moving average much higher against the 200-day moving average. Unfortunately for bears, the poor economic data produced by the Japanese economy isn’t helping the cause of the Japanese yen. Yesterday, Japan reported its lending index which rose from 77.7% to about 78.4% but still came in short from prior expectations of around 79.3%. Today, there are no scheduled reports while tomorrow, BOJ Deputy Governor Amamiya is scheduled to give a speech.

COMMENTS