Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

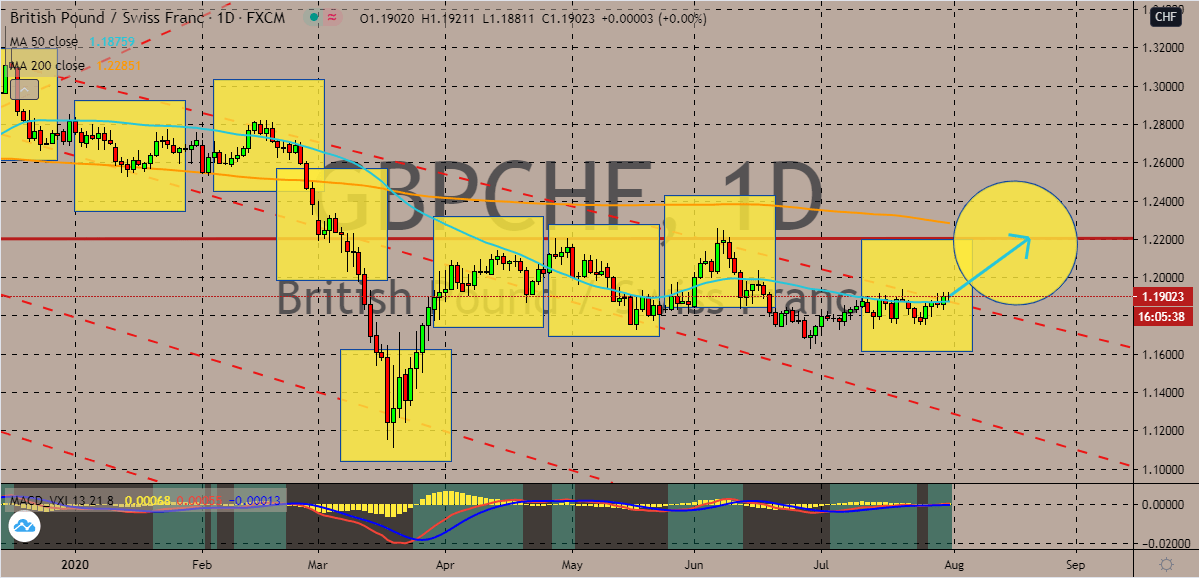

GBPCHF

The British pound to Swiss franc trading pair recently broke past its resistance and bulls are targeting higher ranges. It’s now widely believed that the pair could go to as high as 1.22000 ranges as the British pound continues to gather strength. Bulls are trying to advance despite the Brexit and global economic concerns. The climb towards its resistance should help bulls ease the bearish market by buoying the 50-day moving average higher against the 200-day moving average. Looking at it, the sterling has been performing greatly against other currencies, even those safe-haven assets. Analysts are even perplexed by the strength of the pound and some factors are pointed out from its rally. The sterling’s rally comes despite several hurdles such as falling stocks and weak investor risk appetite. It’s mainly getting power from the weakening stance of the beloved greenback, allowing it to be one of the best performers this busy week.

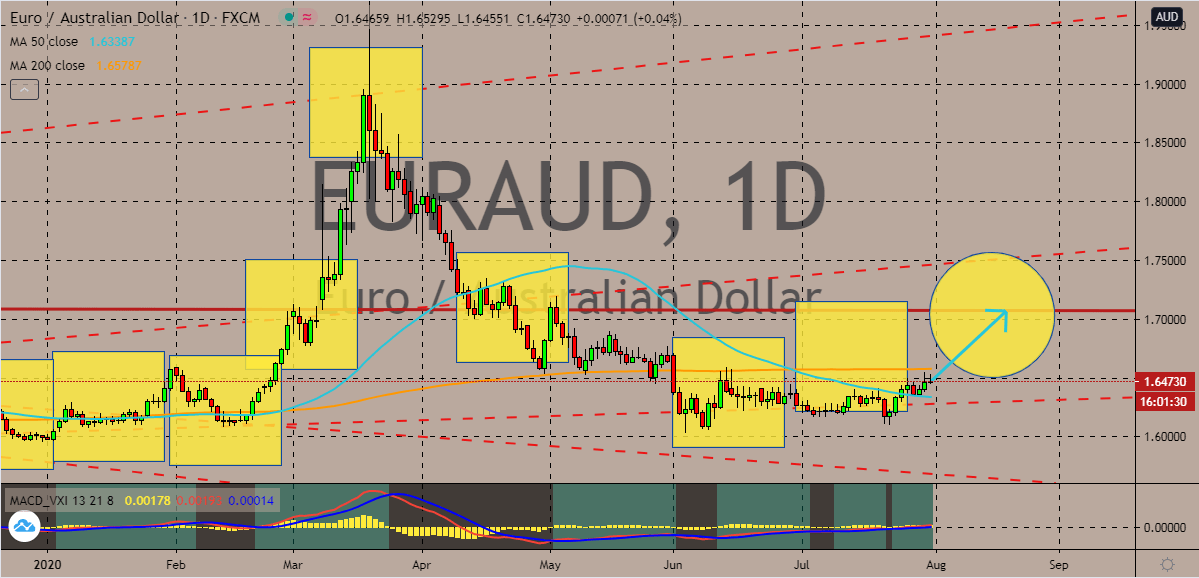

EURAUD

The gravitational pull of the alluring Australian dollar has been working well for the bears over the recent weeks. However, as Australia’s economy continues to get battered by the ongoing coronavirus pandemic, the chances for an uptrend is most likely. The euro to Australian dollar trading pair is widely projected to climb higher towards its resistance level, reaching prices last seen in early May. That should help bullish investors get even again with bears as it would support the 50-day moving average, preventing it from further sliding against the 200-day moving average. Next month is predicted to be a tough month for the Australian dollar. In the past few months, the Australian dollar has been a great performer, dragging most of its match up, and its strength was very much due to how Australia, and China, handled the coronavirus outbreaks in their country. This gave optimism for the Aussie but now, it could finally end.

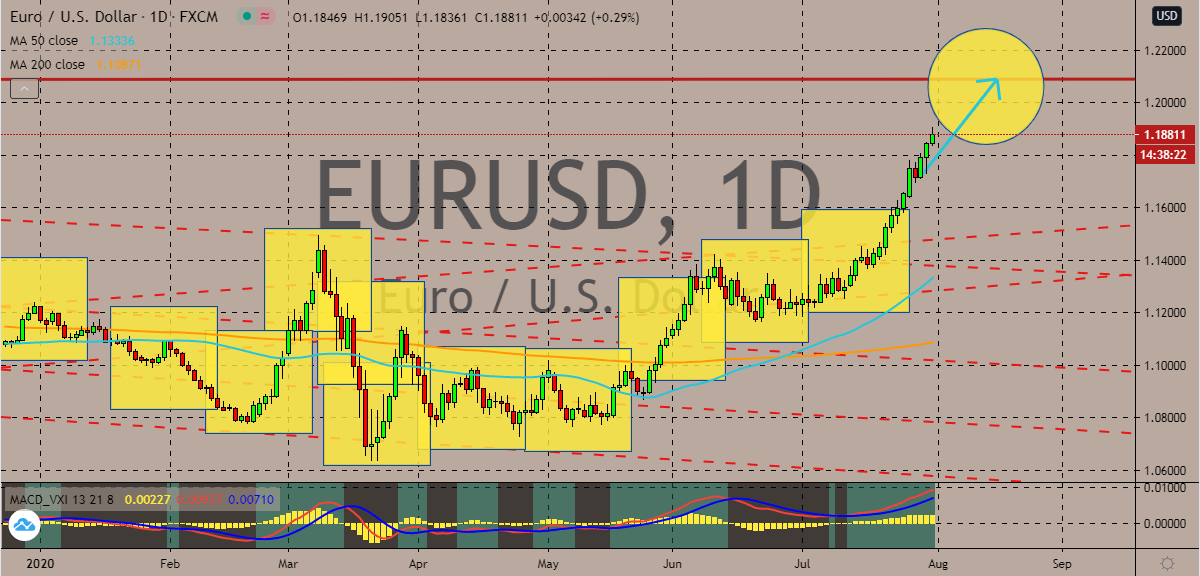

EURUSD

Bulls have stepped on their gas pedals and have floored the weak greenback in the past few weeks. Bearish investors can’t even prevent the euro from completely dominating the trading pair’s path. And now, the question is, does the euro still have enough has to continue, or is this the end of its rally? Well, the single currency still has a lot of gas in its tank. The exchange rate is widely projected to continue climbing higher in the coming days as the markets continue to turn its back against the precious US dollar. The surge should solidify a strong bullish market for the pair, propelling the 50-day moving average even higher against the 200-day moving average. The newfound sense of cohesion from the eurozone’s leader is arguably the main fundamental that’s pushing the pair even higher. The leaders from the bloc have finally come together to help the entire region recover from the coronavirus pandemic’s impact on the economy.

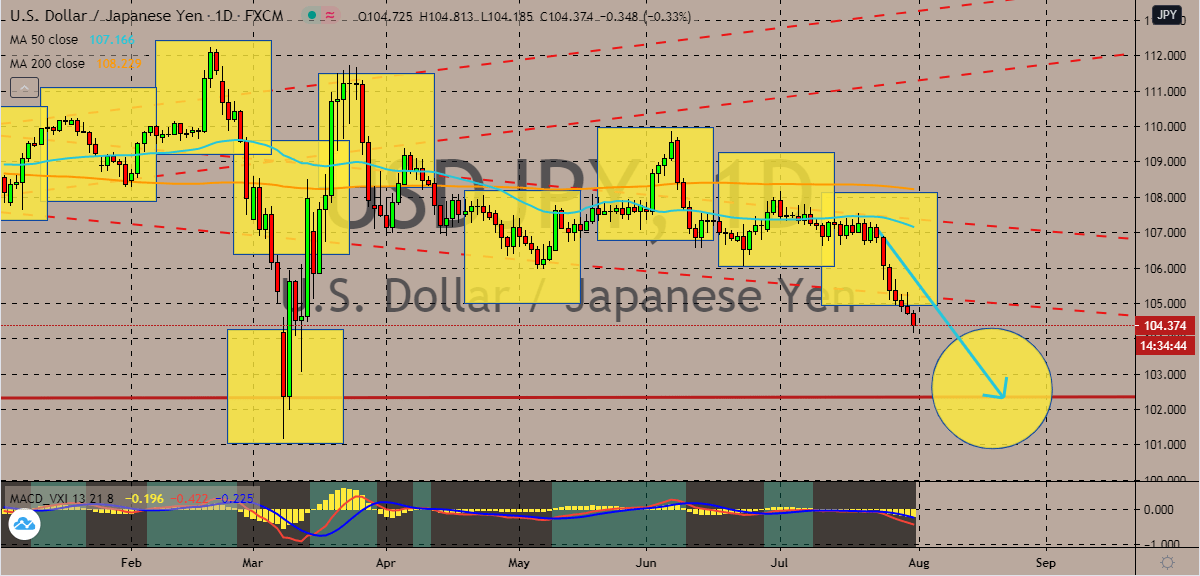

USDJPY

The US dollar continues to fall sharply against the Japanese yen. The trading pair is expected to crash to its support, seeing ranges last seen back in March this year. Signs point to the concerns for the greenback and its safe-haven appeal isn’t working anymore. The market is shunning the once-prominent currency and is now preferring other safe-haven assets such as the Japanese yen. There are so many concerns for the greenback – political rifts, the intensifying tensions with the Chinese government, the worsening economic slump of the United States, and the still uncontrollable number of COVID-19 cases there. Yesterday, investors were more turned off when US President Donald Trump suggested a possibility of stalling the presidential elections due later this year in November. Potus tweeted that the election could wait until people can securely and safely vote, as he continues to claim mail-in voting can lead to fraud.

COMMENTS