Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

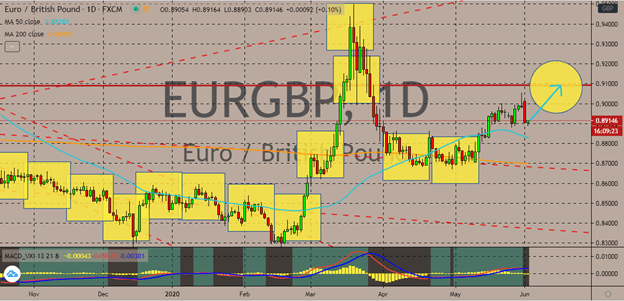

EURGBP

The euro to pound sterling exchange rate saw a sharp fall yesterday, starting the month on negative territories. Luckily for bullish investors, the pair is widely expected to continue on its green trajectories in the coming sessions. It’s believed that the pair will hit its resistance level in the first half of the month. Euro investors are hoping to take the momentum once again and force the 50-day moving average even higher against the 200-day moving average. Yesterday’s correction was very much supported by the resilient mood of the pound sterling on the current weakness faced by the US dollar. The drop yesterday also comes despite the improvement in risk mood. The British pound will likely remain on the defensive thanks to the scrutiny faced by the British government and its handling of the coronavirus pandemic. The intense impact on the United Kingdom’s economy has raised further speculations about extra easing from the Bank of England.

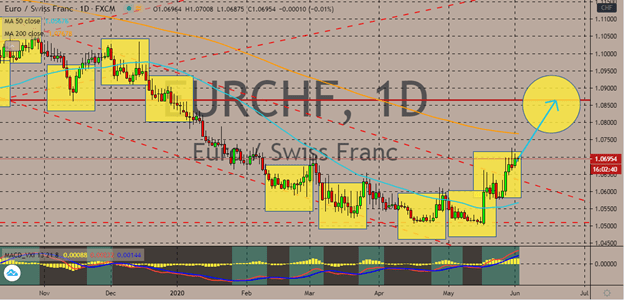

EURCHF

Safe-haven assets such as the Swiss franc are losing their most attractive trait, their security appeal thanks to improvements in the global risk mood. The euro remains on track to reach its resistance before the second half of the month starts. Bullish investors seek to take advantage of the mood to propel the 50-day moving average higher past the 200-day moving average. The latter MA was driven by bearish investors in the past sessions, and now that the Swiss franc is on its knees, it could make a reversal. The depreciation of the Swiss franc also comes in favor of the Swiss National Bank whom in the past has expressed its frustrations regarding the continuous rally of the pair. The euro to Swiss franc exchange rate is currently trading at levels last seen in early March before bears kicked into overdrive. If the risk mood continues to improve along with the reopening of economies, the pair should continue to see greens in the forex market.

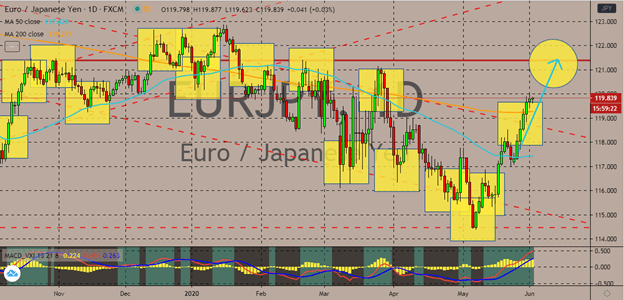

EURJPY

Once the news that the Japanese government announced that the economy is at a recession, the Japanese yen’s position immediately shifted on the defensive. Investors are really concerned by the critical situation faced by the Asian economic giant and the forecasts of an even deeper recession in the coming quarter are not helping the Japanese yen’s case. The euro to Japanese yen exchange rate should continue its upward rally and reach its resistance area in the coming days ahead. And considering its gaining momentum, it should reach it in no time. As of writing, the pair is seen snatching limited gains following the release of the manufacturing PMIs from the region including Germany’s, the bloc’s powerhouse. However, the results only came in slightly off than what was projected, giving hope for bullish investors. If the eurozone’s economic activities continue to show improvements, the pair should remain bullish in the short- and medium-term.

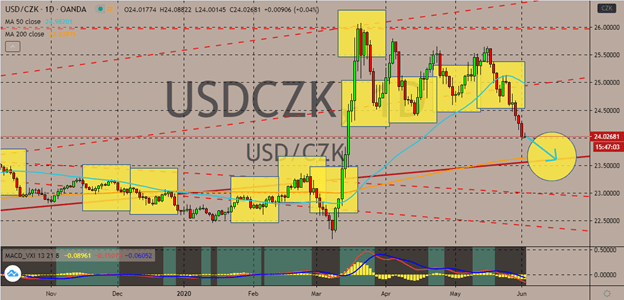

USDCZK

The US dollar to Czech koruna exchange rate is plummeting thanks to the faltering demand for safe-haven currencies. Looking at it, the pandemic is still ongoing and that geopolitical tensions all across the globe are continuing to escalate. But the demand for safe-haven assets such as the greenback is lost thanks to the determination of countries to reopen their economies. Bearish investors of the pair are hustling to force the pair lower and drag the 50-day moving average closer to the 200-day moving average. Perhaps, the pair will hit its support this first half of June judging from its current movements. It was just recently reported that Europe is starting to reopen its tourism, this could speed up the economic recovery of the region and give support to the Czech koruna and other currencies in the region. And as for the United States, the unrest and protests that are going on several states should slow down the recovery of the biggest economy.

COMMENTS