Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

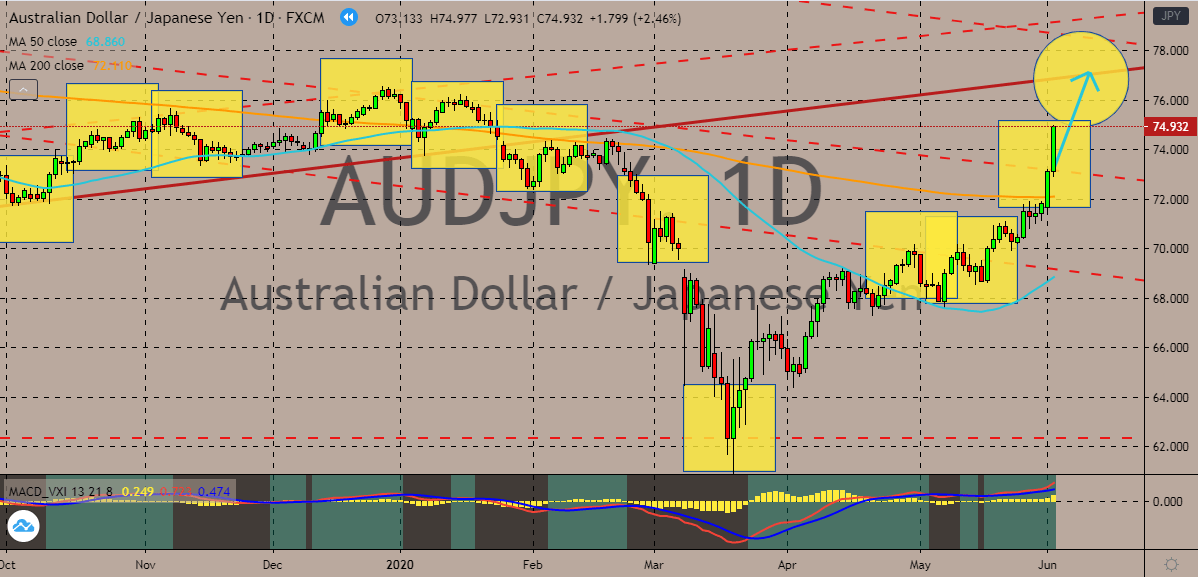

AUDJPY

The strong risk appetite in the foreign exchange market and the global market is very much boosting the confidence of the Australian dollar. Bullish investors of the pair are determined to push the pair higher towards its resistance in the coming sessions. Australian dollar to Japanese yen exchange rate should touch its resistance in the first half of the month as the Japanese yen remains highly vulnerable in the currency market. Meanwhile, the stock market in the United States has just closed higher yesterday, which further lightens the mood for risk-on currencies such as the antipodean Australian dollar. Then on the other hand, that is bad news for the Japanese yen which is struggling to keep up with other currencies especially following the news about a recession in Japan. It appears that investors are shrugging off some of the negative results from economies and are focusing more on the brighter outlook post-pandemic.

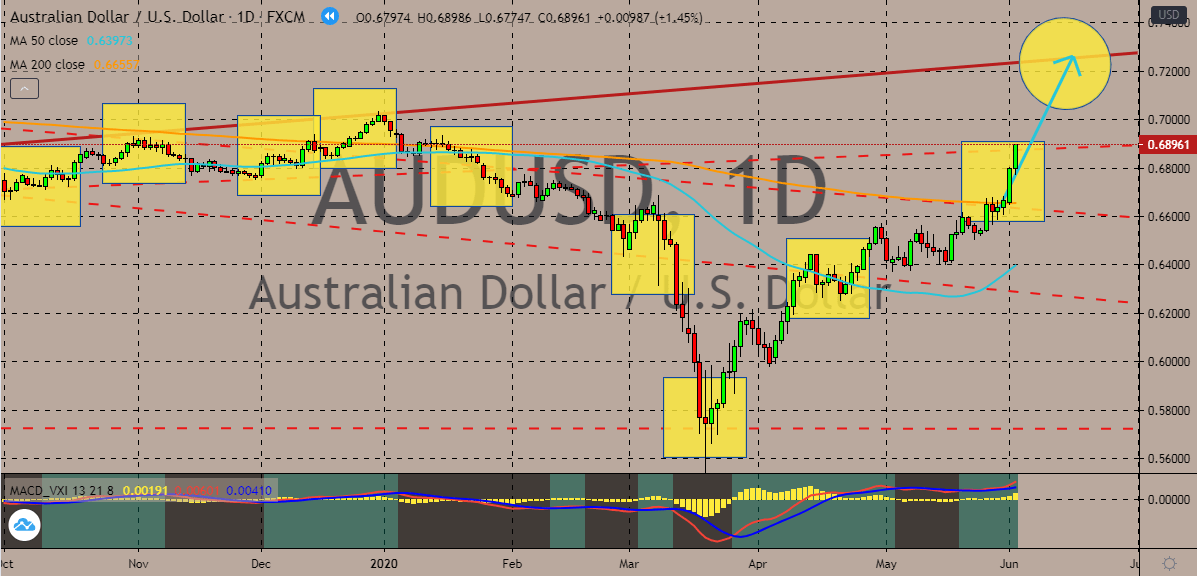

AUDUSD

Just like its rally against the Japanese yen, the Australian dollar also takes down the US dollar. Investors of the antipodean currency are somehow unstoppable as they continue to dominate over other major currencies in the market. The pair should continue its rally and ultimately reach the resistance level in the coming sessions. The Australian dollar is gaining strength from the positivity in the global market, which also fuels the risk appetite of investors. This means that the US dollar will be greatly outweighed by the Aussie. The surge should help propel the 50-day moving average against the now still dominant 200-day moving average. If that would be the case, the tides will finally turn in favor of bullish investors. However, some experts also believe that the pair is now oversold, and that it’s forming a great potential for a reversal once it hits its resistance. Meaning that the pair’s price could repel off from its resistance level once it finally hits it.

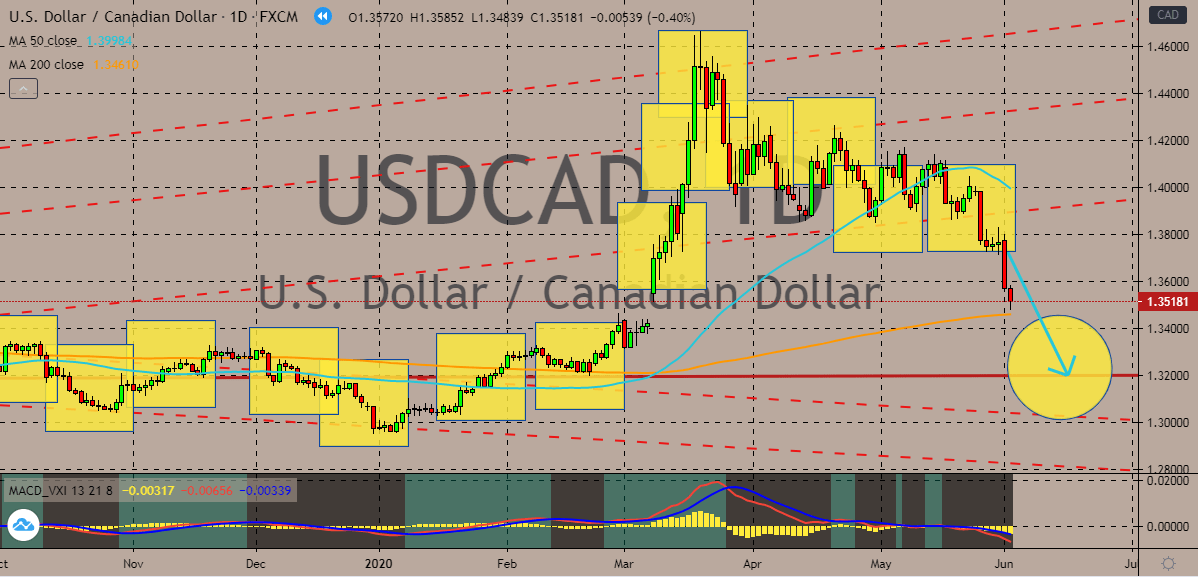

USDCAD

The Canadian dollar extends its gains against the US dollar in the sessions. The main supporting factor for the currency is the recent rejection of the Bank of Canada on the idea of negative rates. The Bank of Canada may not have tightened their interest rate, but it sure did reinforce the hope of the market when it swatted the idea of negative rates to fuel the economy. According to the central bank, the economy appears that it has avoided a deeper economic slump from the coronavirus pandemic. The bank also decided to leave its official interest rates unmoved this June as it waits and observes the impact of the previous rate cuts that it has unleashed. The bank also left its target for its overnight rate unmoved today, saying that it is as low as it can go already. The news gave an opening for the Canadian dollar to maneuver against the US dollar, allowing bears to force the 50-day moving average lower towards the 200-day moving average.

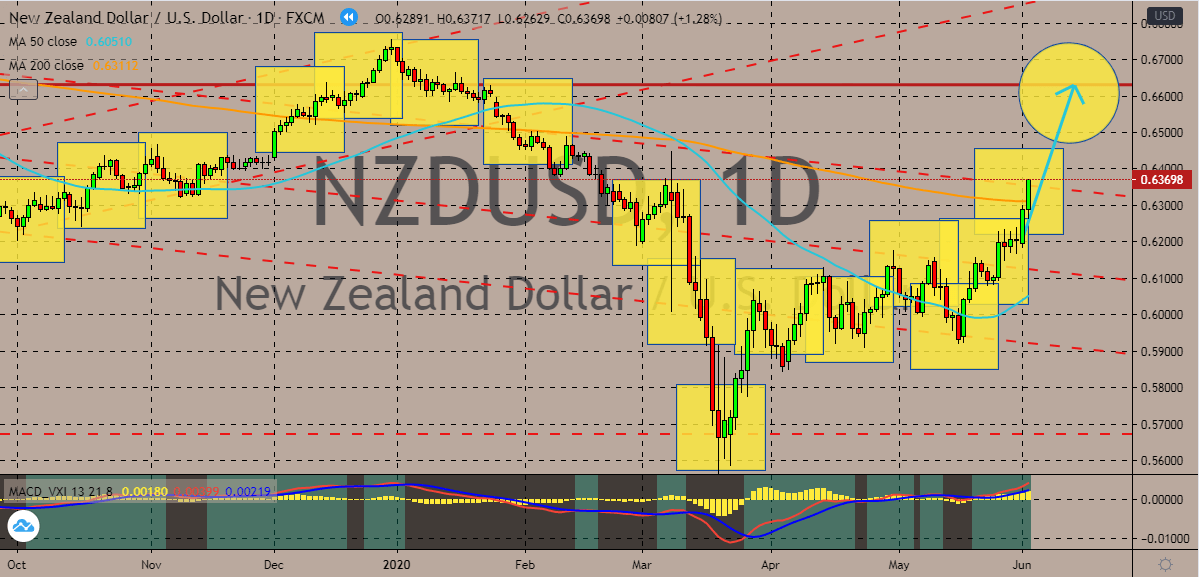

NZDUSD

The New Zealand dollar also takes down the US dollar. It appears that the beloved greenback is depreciating as its safe-haven appeal fails to work against most major currencies. The good news from the stock market is one of the main sources of weakness for the buck. The pair is widely projected to continue its upward momentum this first half of June wherein it’s expected to reach its resistance level. That should help the 50-day moving average to finally go up against the 200-day moving average. Upbeat economic data from mainland China is helping to fuel the confidence of NZDUSD bulls during the trading session in Asian hours. Bearish investors are also closely waiting for the regularly scheduled nonfarm payroll which is projected to show stronger results. If that would be the case, the safe-haven appeal of the greenback should further deteriorate. And if it does not come in better, it would raise concerns for another possible economic stimulus.

COMMENTS