Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

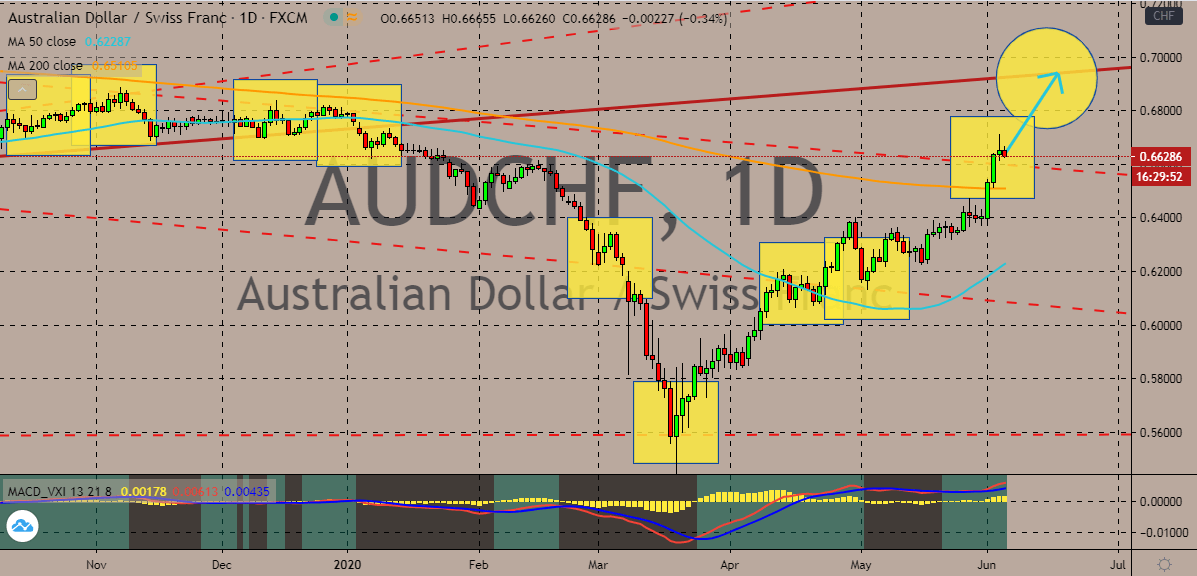

AUDCHF

The Australian dollar declines this Thursday against the Swiss franc despite the lack of demand for safe-haven currencies. Perhaps investors have finally digested the massive contraction in the Australian retail sales figures presented earlier yesterday. but looking at it, the figures still came in better than projections thus limiting the fall or impact to the Aussie. The Australian dollar to Swiss franc exchange rate is widely expected to continue its uphill journey in the coming sessions. It’s believed that the pair will eventually reach its resistance in the latter half of June. The Australian dollar is just having a rough time today as the devastating impact of the bushfires from earlier this year and the lockdowns ware reveal. An Australian official was asked whether the economy was in a recession, and the answer was yes. The recession is the first in three decades of strong growth from the antipodean country but is also expected to bounce back soon.

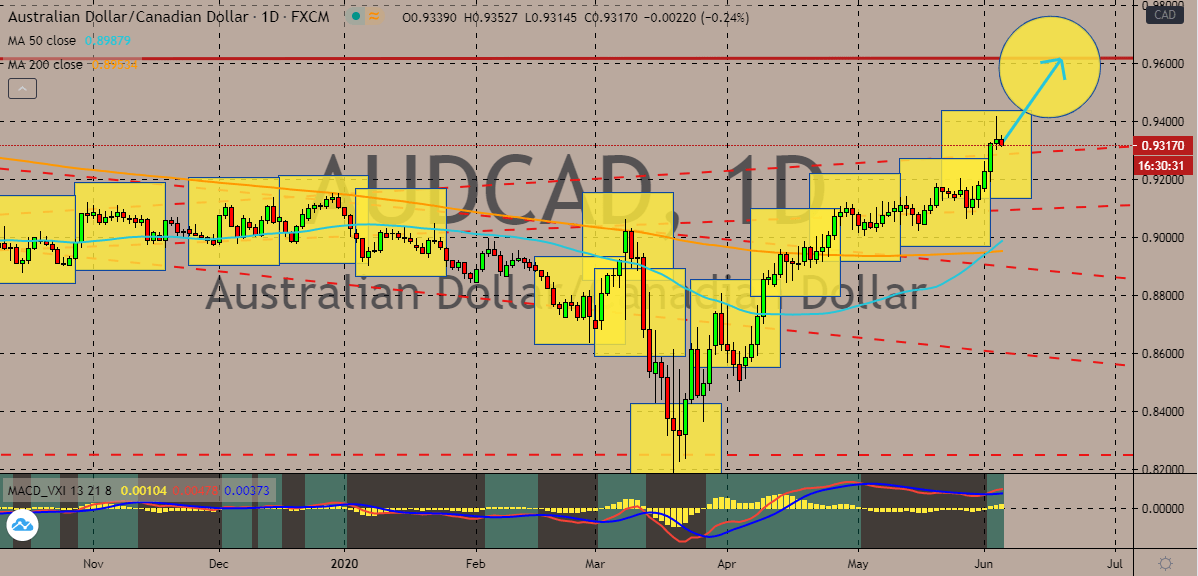

AUDCAD

The pair has slightly slipped this Thursday thanks to the broader weakness of the Australian dollar. The reason? The economic impact of the unfortunate events this 2020 was revealed in the Australian retail sales report. But luckily for bulls, their fall was limited thanks to the weakness also faced by the Canadian dollar. The loonie is also seen weakening this Thursday as oil prices contract in the commodity market. but the recent decision of the Bank of Canada to leave its rates flat has prevented the Canadian dollar from feeling a massive downward jolt nor a gaining momentum. The pair should regain its upward momentum and climb to its resistance level in the halfway mark of June. Bullish investors are looking to successfully push the 50-day moving average even higher against the 200-day moving average. Looking at the charts, its seen that that 50-day MA has just recently crossed the latter MA, this signals a bullish trend for the pair.

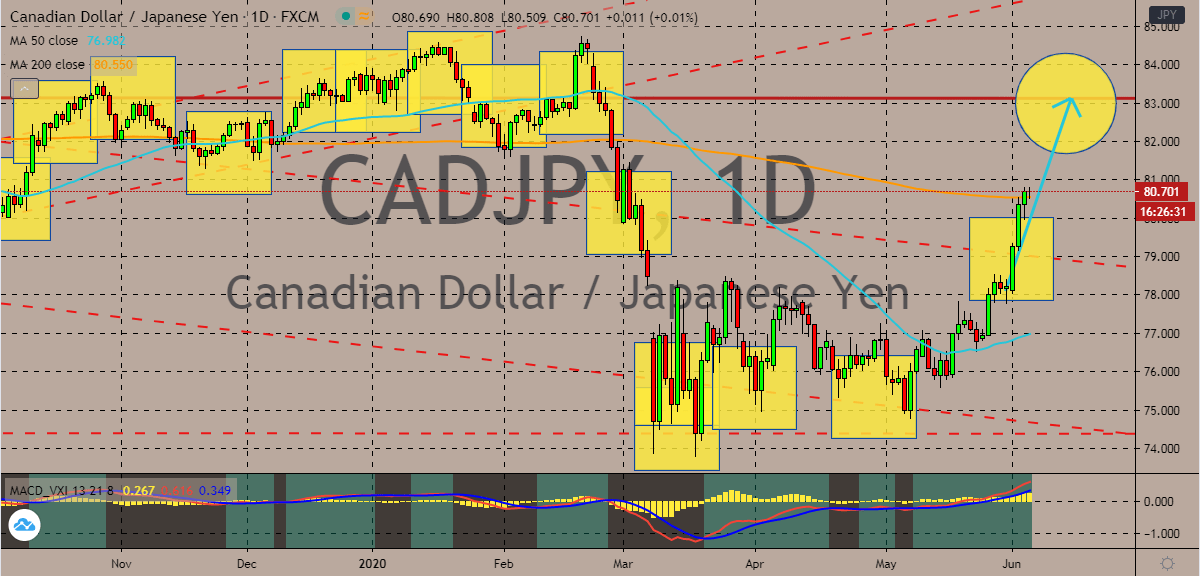

CADJPY

Despite the relatively broader weakness faced by the Canadian dollar, the Japanese yen still failed to take advantage. The pair is currently steady as the Canadian dollar momentarily loses steam thanks to the retreat in the oil market. Bulls are deadlock on their target, which is the resistance line of the pair. And its widely believed that the Canadian dollar will once again floor its gas pedals to force the momentum back to its favor. Meanwhile, the Japanese yen is seen struggling to gain a good grip as the markets hold on to the risk-on appetite. The sharp bounce of the Caixin China Services PMI has further strained the strength of the already falling Japanese yen. The current readings from China are reviving hopes that other economies could also bounce back hard after strict lockdown measures to support their weakening economy. The said hopes are outweighing the geopolitical tensions that should have supported the Japanese yen to begin with.

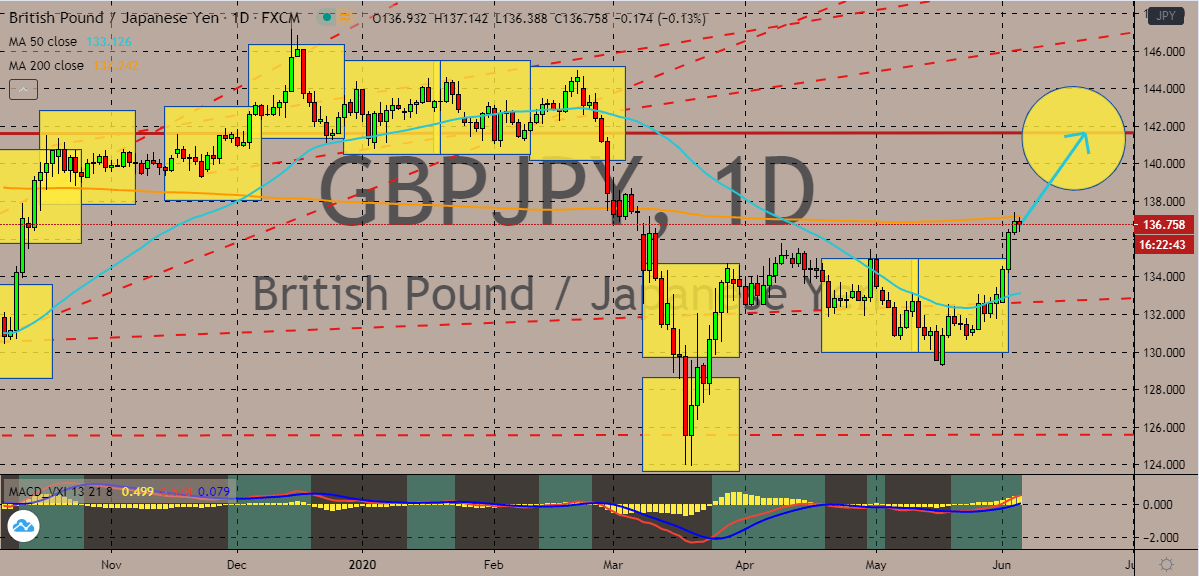

GBPJPY

The rally of the British pound to Japanese yen exchange rate has halted this Thursday. But based on the current circumstances, it appears that bullish investors will soon regain their upward momentum and push the pair even higher. Looking at the charts, it’s quite obvious that the pair is still bearish considering that the 50-day moving average is still well below the 200-day moving average. And it will still take some time for bulls to actually maneuver pass the latter MA. Yesterday, the British pound snatched significant gains, unfortunately, it didn’t have the same fate as today. Investors of the exchange rate are speculating whether the pair will break past its resistance or just simply bounce off. The factor that is being weighed for this is the Brexit. Just recently, the governor of the Bank of England has warned that the bank is stepping up its no-deal Brexit plan amidst the growing concerns that the talks have reached an impasse.

COMMENTS