Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

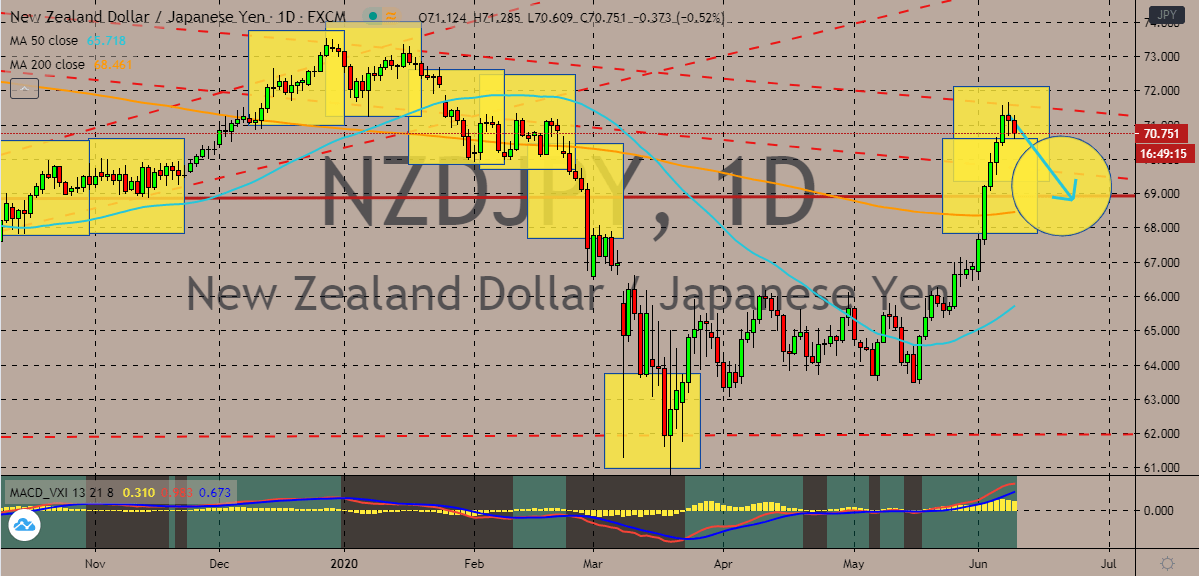

NZDJPY

The Japanese yen finally regains its footing in the forex scene. The New Zealand dollar to Japanese yen exchange rate eases this week after registering consecutive gains in the previous sessions. Based on the current strength of both currencies, it appears that the Japanese yen is poised to regain some of its major loses against the New Zealand dollar. The NZDJPY pair should go down to its support level as bearish investors try to prevent the 50-day moving average from climbing towards the 200-day moving average. Reports say that the Bank of Japan is most likely to maintains its projections about the recovery of the country. Such news has reinforced the expectations of Japanese yen investors and also strengthens the notion that the BOJ will forgo a bold or aggressive monetary easing policy this June. This also comes after the Bank of Japan and the Japanese government unveiled a series of support packages for corporations and businesses in the country.

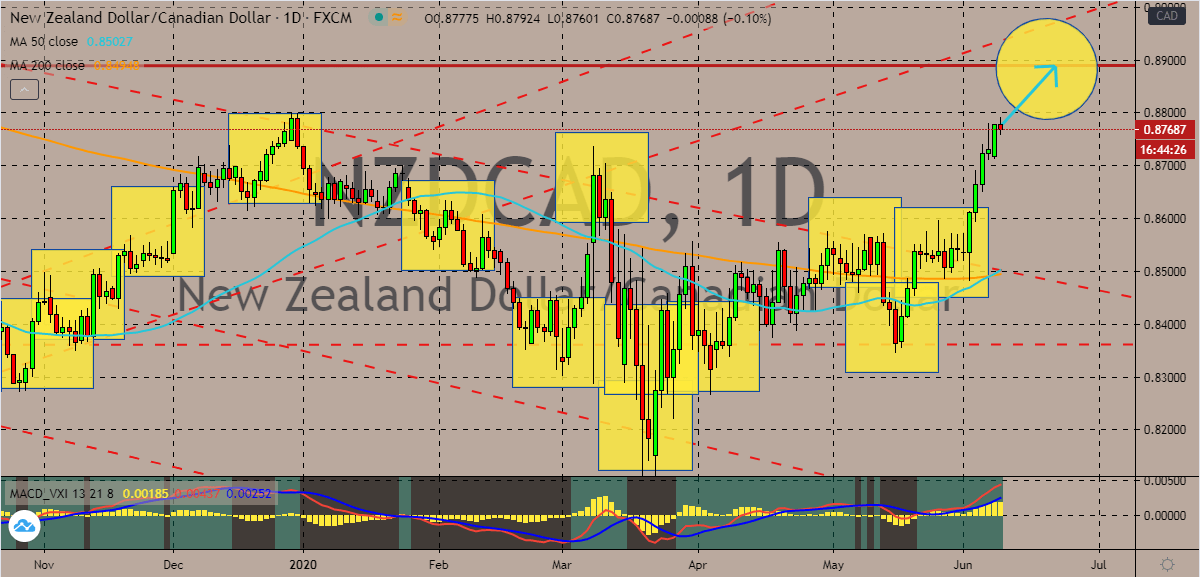

NZDCAD

Bearish investors force the pair to steady this Tuesday after seeing continuous losses in the previous sessions. However, the pair is still widely projected to continue its upward trajectory as the New Zealand dollar remains fortified by domestic and global factors. The NZDCAD trading pair should advance to its resistance in the latter half of the month. Looking at the chart, it’s evident that bullish investors have finally successfully pushed the 50-day moving average past the 200-day moving average in sessions. Last week, the Canadian dollar failed to take advantage of the impressively stronger than projected results in its employment change data. And this week, there are no significant reports due to be issued, so the Canadian dollar will need to rely on other factors aside from the economy. As for the kiwi, it’s forecasted to become dominant as the country records no new cases and active cases, along with the reopening of its economy.

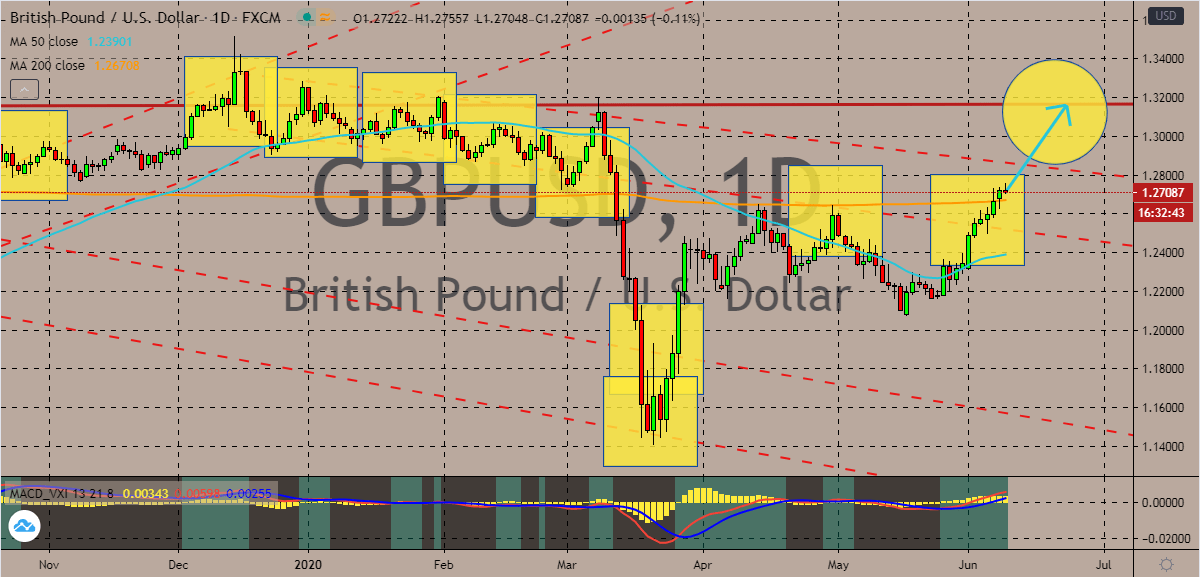

GBPUSD

The British pound to US dollar exchange rate is on track to its strong resistance in the coming sessions. Bearish investors remain on the defensive and are currently forcing the pair to steady. However, the US dollar is unfortunately doomed as it’s believed to lose its dominance soon. Bulls take control as they force the 50-day MA past the 200-day MA. Although it’s worth noting that the pair is also forming a huge potential for a reversal once it hits its resistance because of the looming Brexit deal date. The Bank of England has already warned that it’s ready to step up in case of a hard Brexit and it has been preparing for possible measures. Signs that the trade talks between the United Kingdom and the European Union have reached an impasse has also pressed pressure on the Bank of England and the British pound. Reports also say that there is still no consensus about negative interest rates among the monetary policymakers in the Bank of England.

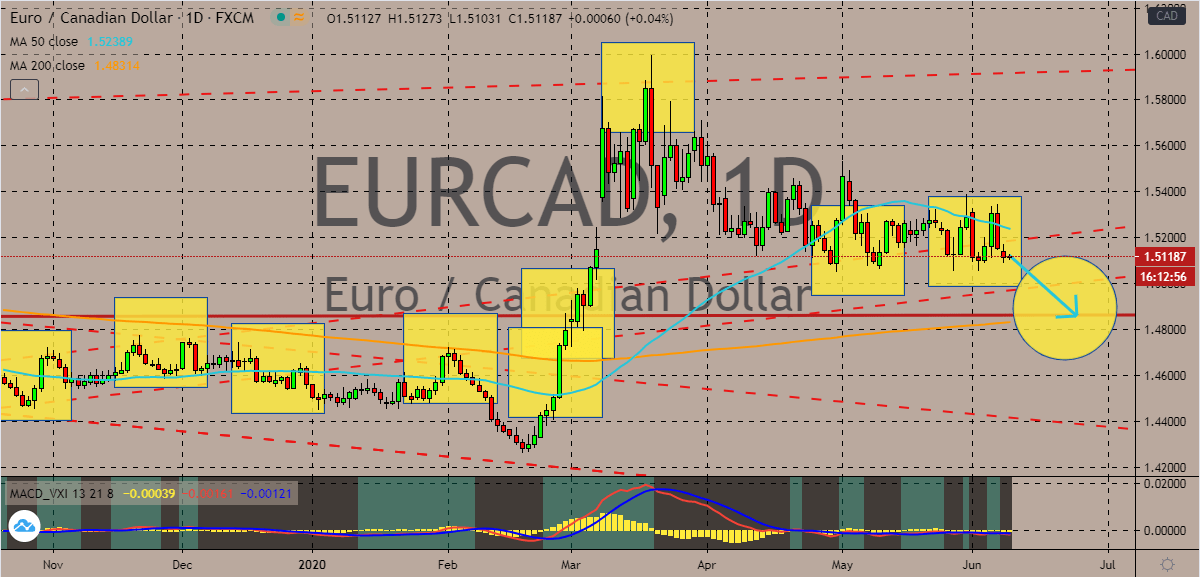

EURCAD

Despite not having any luck with the New Zealand dollar, the Canadian dollar is expected to gradually push the euro lower and lower in sessions. The EURCAD trading pair is projected to go down to its support level in the latter half of the month. Bearish investors are relying on the risk sentiment that is further reinforced by the hopes for the Canadian economy’s speedy recovery. Based on the performance of the euro, it’s believed that it is finally showing signs of exhaustion. The euro has gone back and forth in the recent sessions, some experts take this as a signal that the currency is overbought and that a pullback is coming sessions. Although the recent announcement of the European Central bank about the expansion of its Pandemic Emergency Purchase Program is preventing the euro from falling sharply against the Canadian dollar. Aside from that, the ECB also allowed its bond purchases to continue into the coming year.

COMMENTS