Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

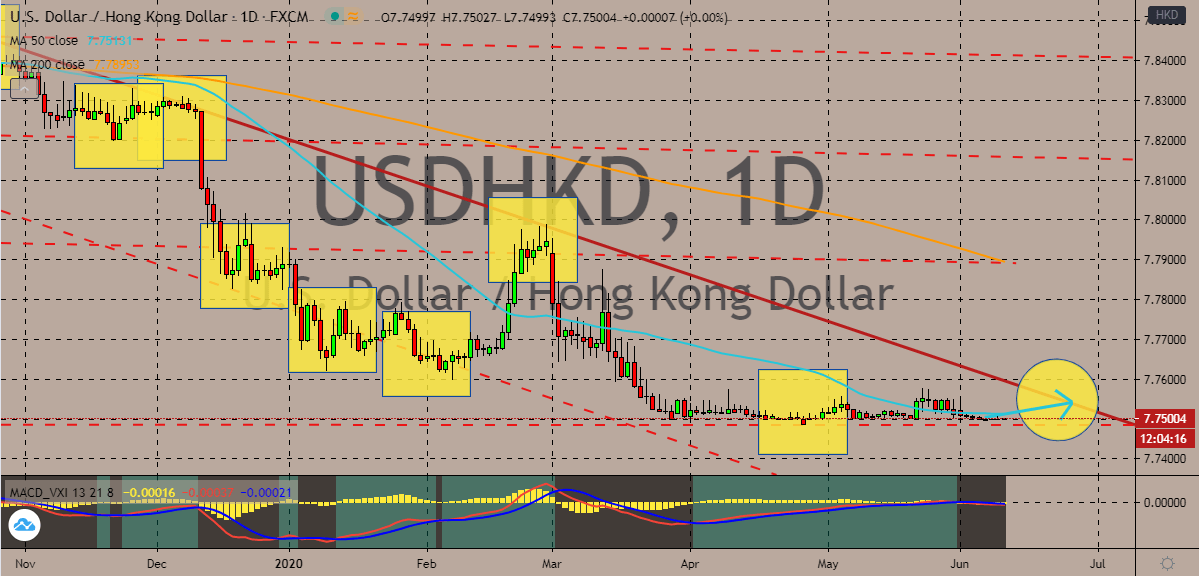

USDHKD

The pegged currency continues to hold bullish investors on the defensive. The Hong Kong dollar to US dollar exchange rate remains flat near its support line in trading sessions as seen in the chart. It appears that the pair will ultimately inch its way to its declining resistance level in the coming sessions. That will then form a new resistance in the coming weeks. The pair is evidently bearish as the greenback continues to see reds in trading. The earlier attempt of the buck to recover was futile, the 50-day moving average remains well below the dominating 200-day moving average. Bearish investors of the USDHKD pair are quite confident that the pegged currency will maintain its hold despite the ongoing trade tension between Beijing and Washington. Also, the ongoing anti-Beijing protests in Hong Kong are doing very little to take away the confidence of bearish investors. The protestors mark their first anniversary of defiance against China yesterday.

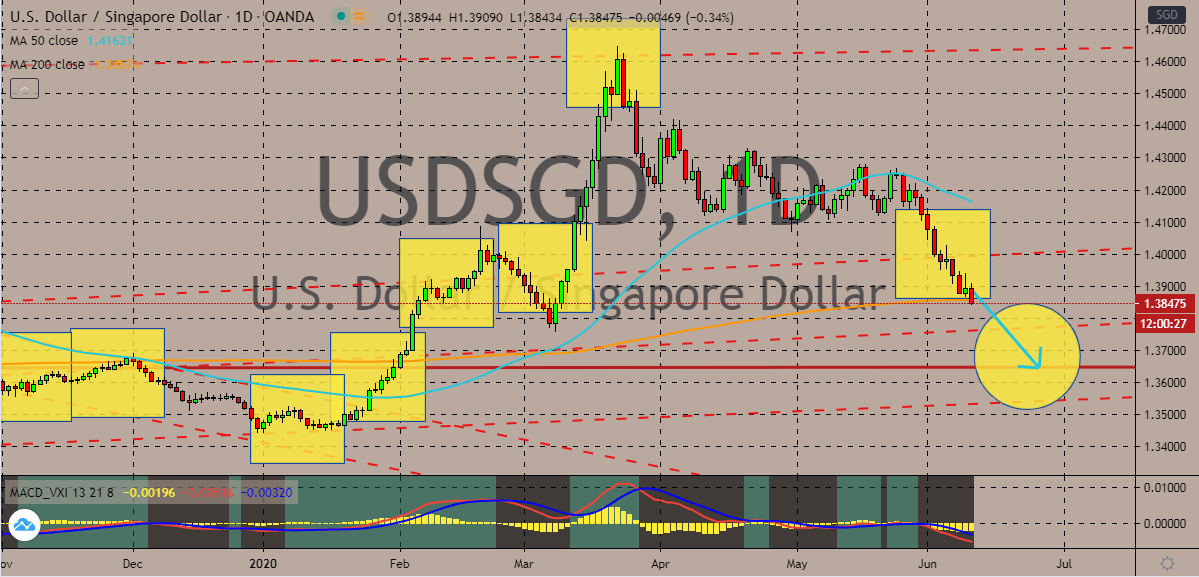

USDSGD

The Singaporean dollar eyes the lower support level and locks in with determination to drag the US dollar. Bearish investors are taking advantage of the risk sentiment in the global market that’s causing the safe-haven appeal of the US dollar to crumble in sessions. The US dollar to Singaporean dollar trading pair should continue its downward track in the market and eventually hit its lower support level later this month. However, the reopening of the economy amidst the rising number of cases leaves the Singaporean dollar very vulnerable. If things turn south, the Singaporean dollar could lose its grip against the US dollar. Just this Wednesday, the strong yet small country reported more than 450 new confirmed coronavirus cases including seven cases in the community. The preliminary daily update of the Singaporean Ministry of Health states that the number of confirmed coronavirus cases in the country is now around 38,965.

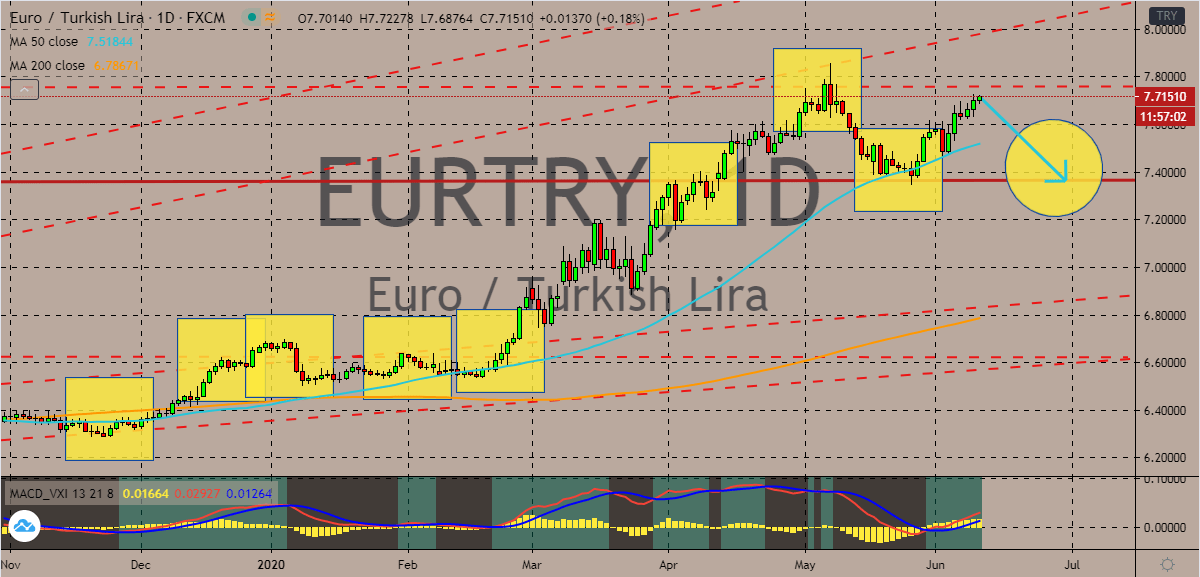

EURTRY

Unlike in its performance against the US dollar, the Turkish lira is having a rather tough time against the euro. However, looking at it, it appears that the exchange rate is currently testing a crucial resistance and has a huge potential for a downside. The Turkish lira is predicted to force the euro lower to its support levels in the coming sessions. Meanwhile, Turkey’s central bank is back to import-cutting investments. The authorities in the country seek to continue backing investments and companies that would lessen the importation of goods in the country. Apparently, Turkey is looking to boost its exports and support domestic companies with a maximum maturity of 10 years. Just last week, the Turkish Central Bank announced that the Turkish lira rediscount credit will be extended to exporting companies. The aforementioned rediscount credit is reportedly around 60 billion Turkish liras, which is approximately 8.9 billion US dollars.

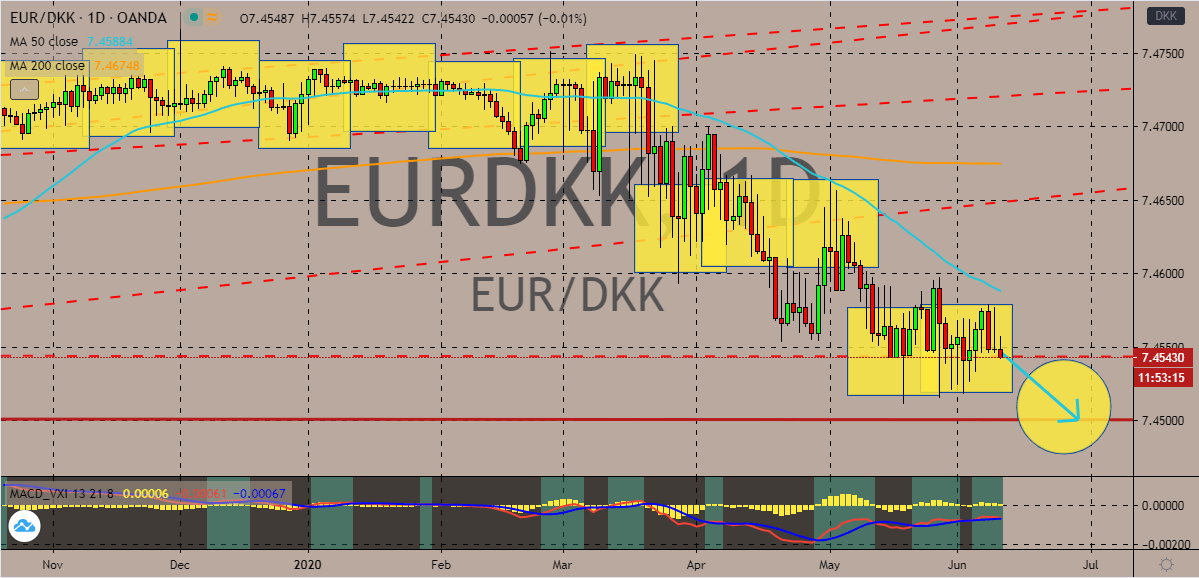

EURDKK

The Danish krone is currently flirting with an important support level for the EURDKK trading pair. It’s widely believed that the pair will go down to that lower support level by the latter part of the month as the Danish krone continues to appreciate. The pair is significantly bearish, considering that the 200-day moving average is significantly higher than the 50-day moving average. And looking at the performance of the euro, it looks like it’s starting to show signs of exhaustion against the Danish krone. Bullish investors of the pair continuously struggle to buoy the exchange rate and every time the pair goes up, the Danish krone immediately regains those gains. Bearish investors are supported by the reopening of the Danish economy. In Denmark, the authorities plan to lift the set limit on public gathers to about 50 to 100 people by next month. Then to around 200 people by August as it gradually eases the pressure from the economy.

COMMENTS