Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

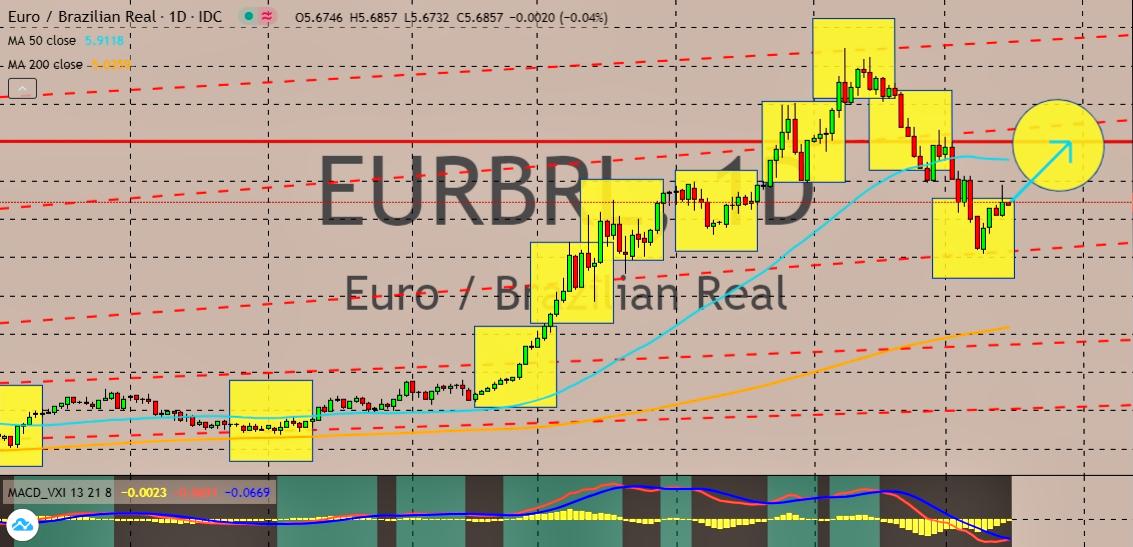

EURBRL

The euro to Brazilian real trading pair is back on its bullish track in the sessions after it reached its support level earlier last week. Although as of writing, the pair is seen steadying as the Brazilian real works to defend some of its gains. However, it’s widely predicted that bullish investors will once again push the momentum towards their favor, reaching its resistance in the latter half of the month. The euro should continue to excel despite the rising concerns about another wave of coronavirus infections. Over the next few days, the European Union is scheduled to discuss about the massive and game changing €750 billion recovery package for the joint debt issuance and grants to the heavily struck countries in the region. Of course, there will be a ton of pressure on the euro, but it’s very much poised to hold on to its gains against the Brazilian real. Since the coronavirus reached Europe, leaders of the region have been debating over a joint grant or loan.

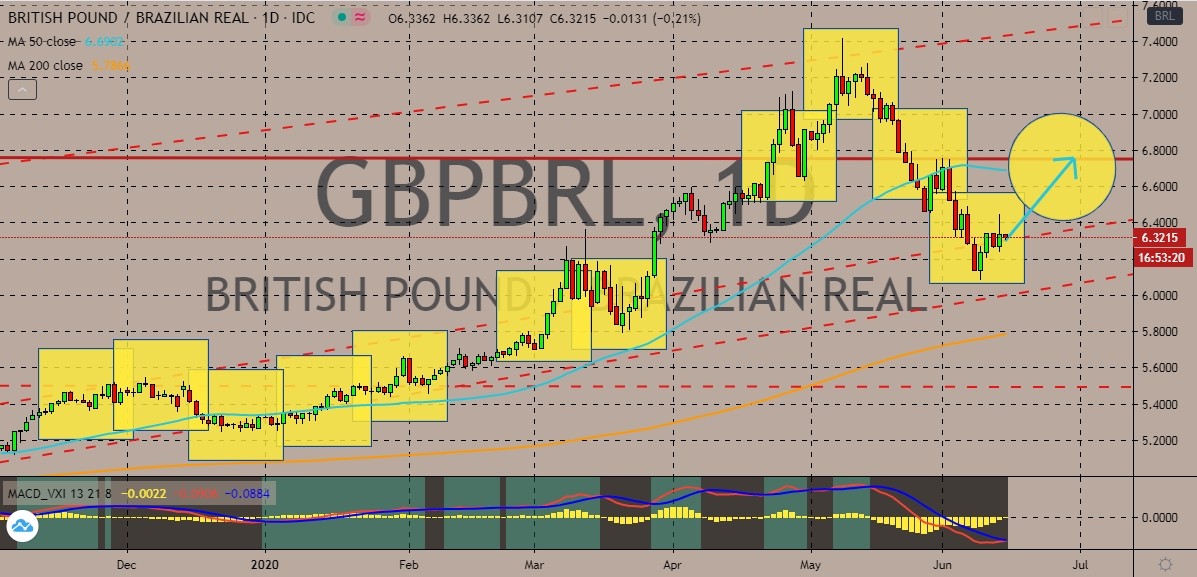

GBPBRL

Volatility is predicted for the British pound to Brazilian real pair. Both currencies are shaken by their fundamentals. But the tide is meant to turn for the British pound as the Brazilian real once again weaken. The exchange rate recently touched its support area and unfortunate for bears, the price just bounced off. The rebound prevented the 50-day moving average from plummeting towards the 200-day moving average. The loss of risk appetite has dampened the run of both currencies and have turned the attention to safe-haven currencies instead. Both currencies were affected by the recent update from the Fed about the economy. Aside from that, investors are also worried about the possibility of another wave of infections across the globe. And it’s worth noting that the situation in Brazil is still critical and as of writing, the number of confirmed cases already reached more than 868,000 and the death has climbed beyond the 43K mark.

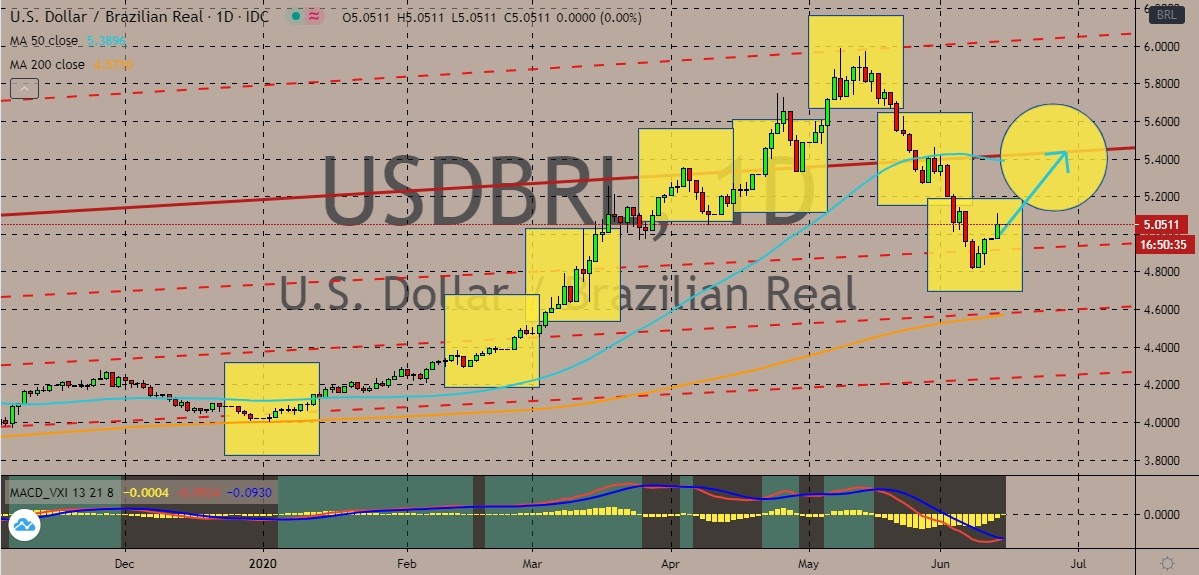

USDBRL

The US dollar is back on the driver’s seat. The safe-haven currency is thriving in the foreign exchange market thanks to the update of the Federal Reserve late last week. In fact, after the Fed released its update, the dynamics in the global market has shifted – affecting not just the foreign exchange scene, but also commodities and stocks. The globe has also been more concerned about another wave of coronavirus cases, mainly in the US wherein political unrest which was sparked once again after the death of George Floyd. Meanwhile, Brazil climbs to the second place for the highest number of coronavirus deaths. Last Friday, the Latin American powerhouse overtook Britain according to the World Health Organization. Dr. Mike Ryan, WHO’s top emergencies expert, said hotspots for infections are seen in some heavily populated areas in the country. And the virus has already reached remote tribes and killing a number of indigenous people.

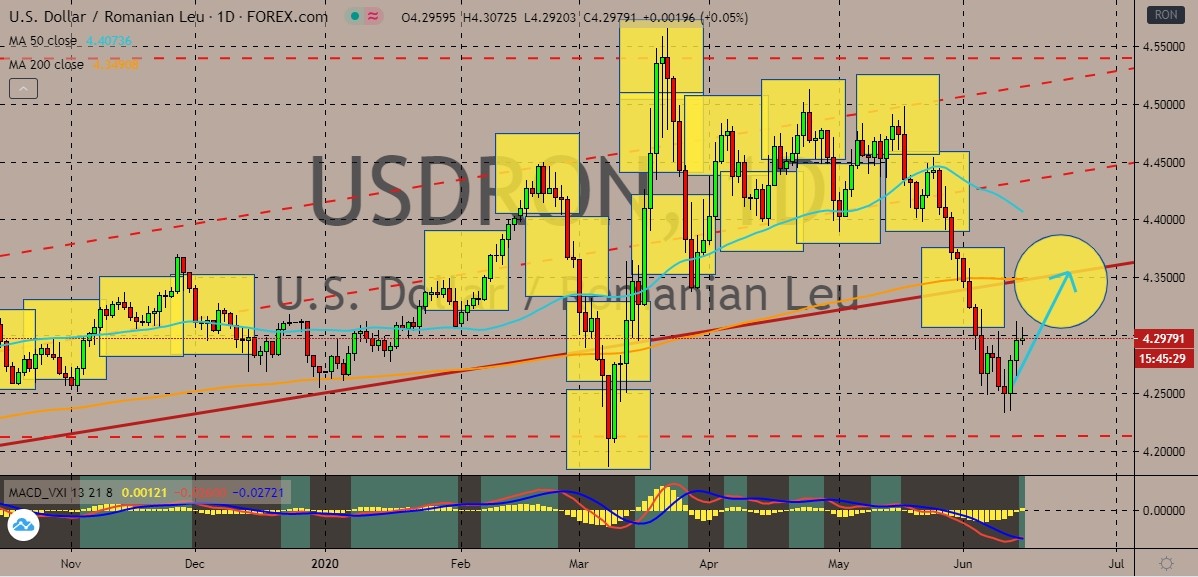

USDRON

As of today, the US dollar to Romanian leu exchange rate is seen steadying in the trading sessions. However, as the risk aversion rises, the probability that the US dollar will once again dominate the pair strengthens. It’s expected that the 50-day moving average will remain dominant against the 200-day moving average. Safe-haven currencies such as the US dollar are back in focus, as well as commodities such as gold thanks to the latest update given by the US Federal Reserve. Most currencies from Europe, including the Romanian leu, were seen down last week following the Fed report. The gloomy projections about the recovery of the biggest economy in the globe has battered the confidence of traders and investors all around the globe – stock markets have fallen, along with the risk appetite. Gains of other assets were immediately erased following the news. Reports are also suggesting that the concern over another wave of infections is making the market anxious.

COMMENTS