Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

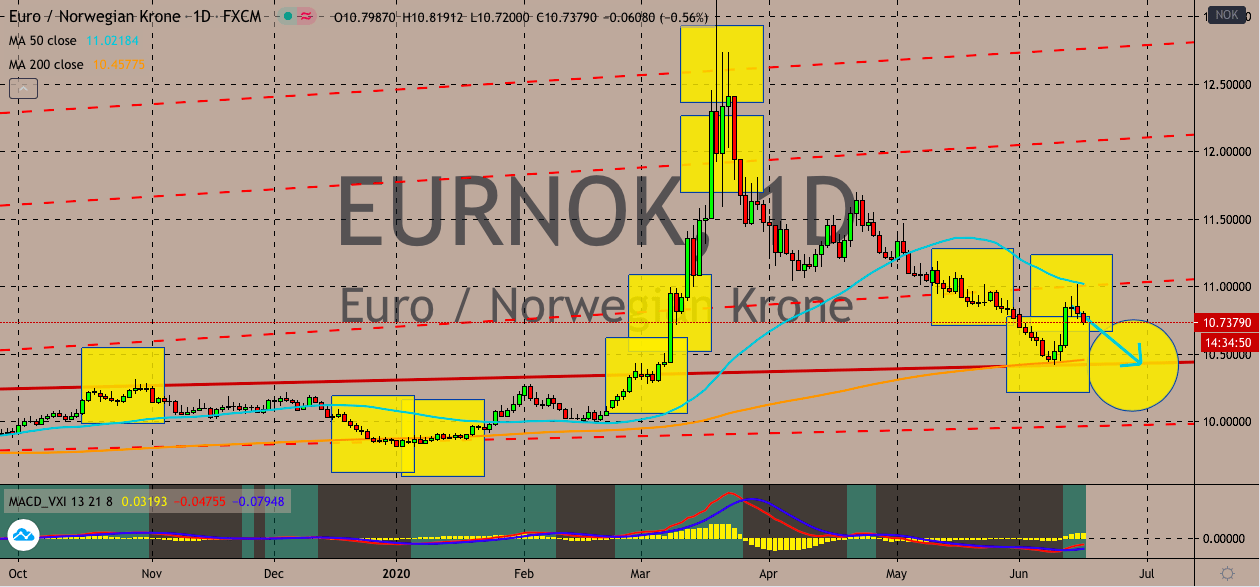

EURNOK

The euro to Norwegian krone exchange rate is heading downwards towards its support level. The pair is expected to once again reach its support by the end of the month as bearish investors take advantage of the euro’s weakness. The move should further push the 50-day moving average even lower and closer to the 200-day moving average. Bearish investors are hoping to run away this time and break past the pair’s support level as they try to recover their major losses from earlier this year. The Norwegian krone should take control from the euro as the risk sensitivity in the market dies. As reported last week, the bleak update of the United States Federal Reserve has shifted the dynamics in the global market, causing risk-linked currencies such as the euro to falter against other currencies in the market. And as for the Norwegian krone, the prices of crude oil in the commodity market is preventing it from buckling against the single currencies.

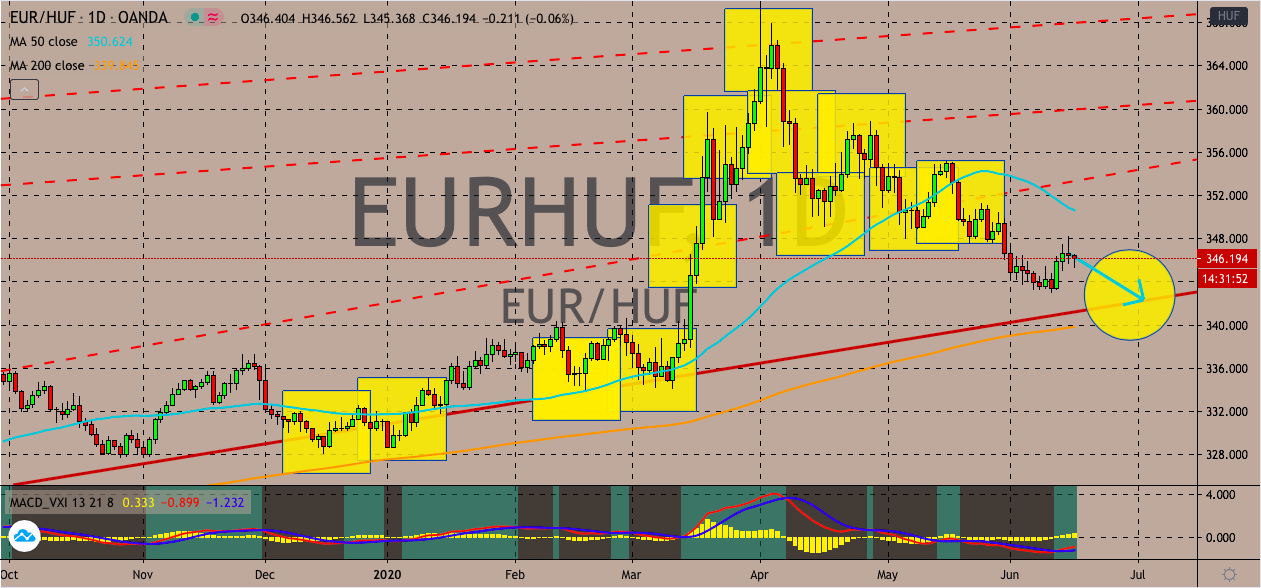

EURHUF

The Hungarian forint forces the euro to steady this week. The pair is seen inching down this Tuesday as the euro’s strength falters as the risk appetite continues to go down. However, the Hungarian forint is also weakened by disappointing data from the region, resulting in a stalemate-like run for the pair today. But ultimately, the tide is expected to turn in favor of bearish investors which will help force the 50-day moving average to go even lower in the trading sessions. Investors of the Hungarian forint hopes that the 50-day MA will crash or get nearer the 200-day moving average in the coming sessions. As of now, there aren’t any significant economic reports scheduled for the Hungarian forint, so it’s very much riding the flow of other Central European currencies. Last week, the euro saw an opening against the Hungarian forint when the country reported a massively alarming drop in its April monthly trade balance.

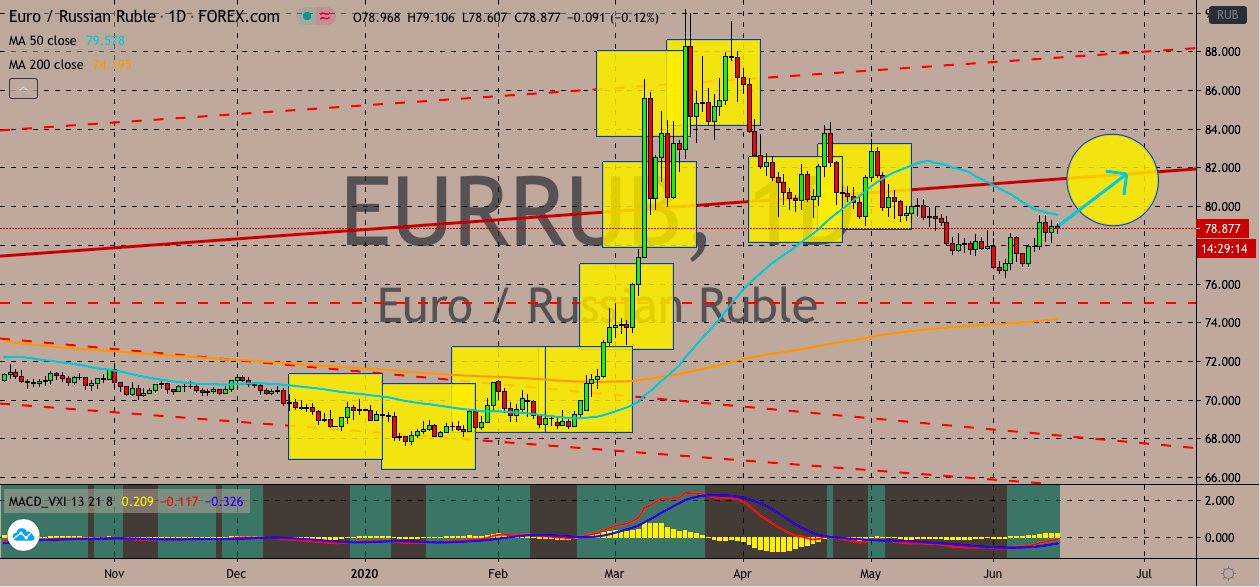

EURRUB

Discussions about possible interest rate cuts to Post-Soviet record low rates have surfaced, this places the disadvantage towards the Russian ruble in the foreign exchange market. The euro to Russian ruble trading pair is now widely projected to climb to its resistance level despite the support that bears should have gotten from the commodity market. Looking at the charts, it’s evident that the pair is highly bullish considering that the 50-day moving average is significantly higher than the 200-day moving average. The weak economic prospects from the IMF for the outcome of the Russian economy are raising speculations on whether the central bank will step in to offset the alarming economic slump. Bullish investors of the pair are closely waiting for the Bank of Russia’s interest rate decision that is due later this week around Friday. This will be monumental as the bank has previously raised its short-term rates to counter inflation.

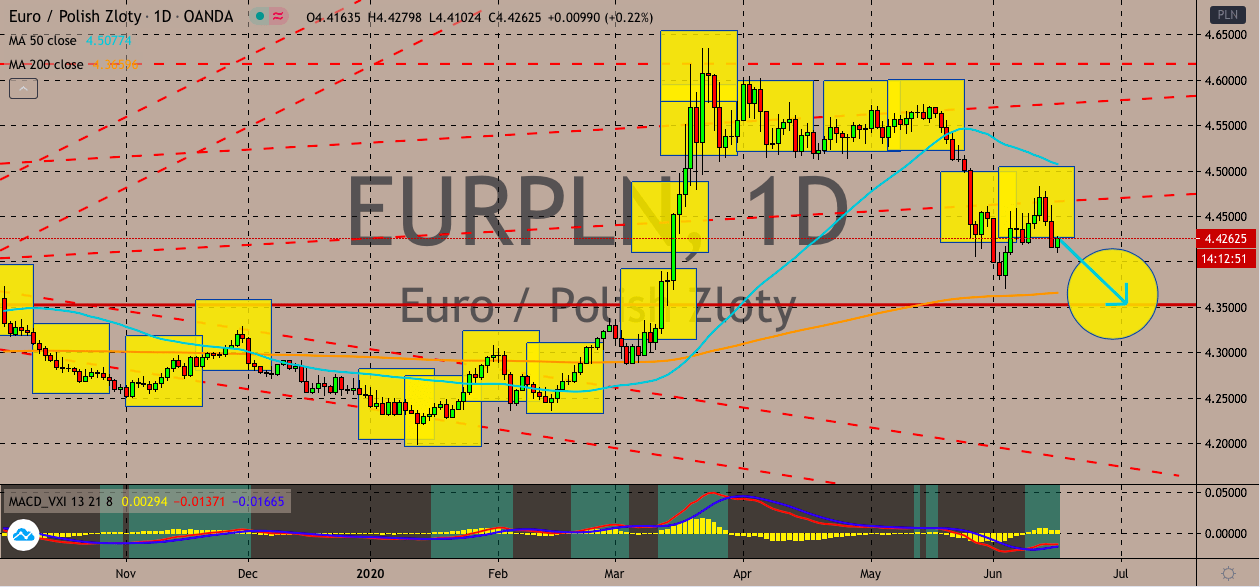

EURPLN

The positive data from the Polish economy that were reported yesterday paved a way for a strong rally for bearish investors. However, as of writing, the euro to Polish zloty trading pair is seen steady in the market. Luckily, the direction is expected to turn bearish again. The pair is still on track to contract to its support level, hitting prices last seen in early March before the euro floored its gas pedals. Yesterday, it was reported that Poland’s current account for April dropped from €2,438M to around €1,163M. Fortunately, the figures came in better than prior projections of about €1,060M. Meanwhile, the country’s monthly and annual consumer price index dropped as expected, providing a short sense of relief for investors. As for the euro, investors are feeling the pressure as the eurozone sees its lowest trade surplus in almost a decade this April thanks to the coronavirus pandemic. This is unfortunate news for the bloc as it’s an export-heavy economy.

COMMENTS