Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

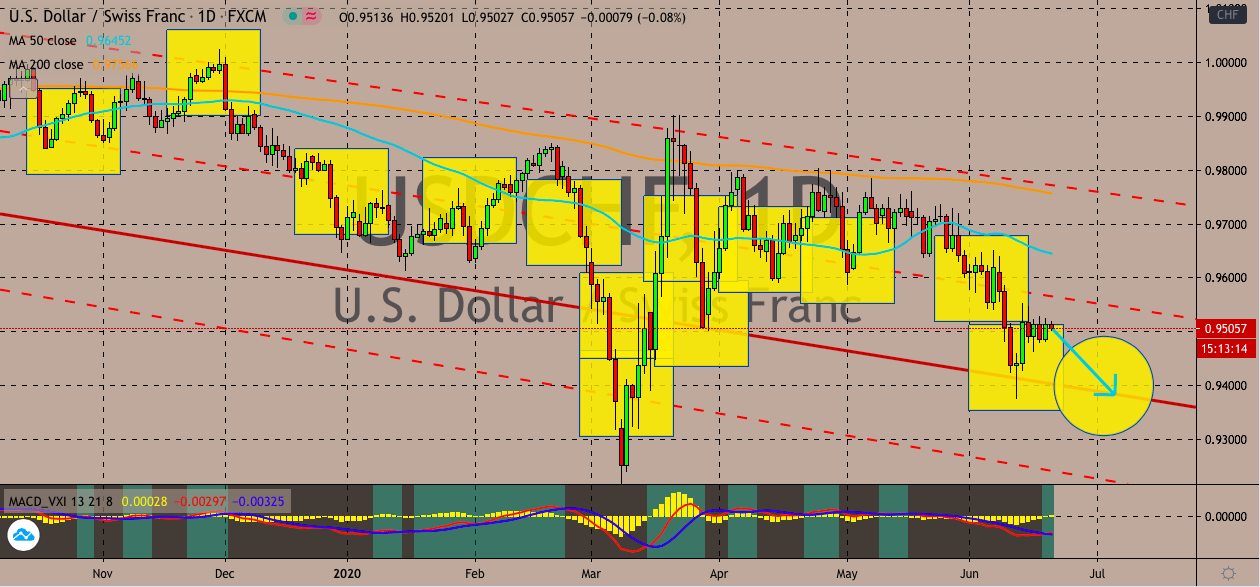

USDCHF

The Swiss franc momentarily weakened after the news about the Swiss National Bank’s monetary policy decision this June. The pair is seen struggling to gain proper momentum this Friday. Luckily for bearish investors, the pair is widely expected to head down towards its support levels in the trading sessions. Ans as the pair heads down, the momentum remains bearish as evident on the chart. See, the 50-day moving average is still trading significantly lower than the 200-day moving, this indicates a strong bearish sentiment for the trading pair. Moreover, investors weren’t surprised by the decision of the Swiss National Bank, hence, the pair didn’t surge from the news. The SNB opted to leave its interest rates unmoved at -0.75% as the economic uncertainties gets more and more concerning. Switzerland’s central bank currently holds the lowest interest rate in the whole globe and that is not stopping the Swiss franc from continuously appreciating against the buck.

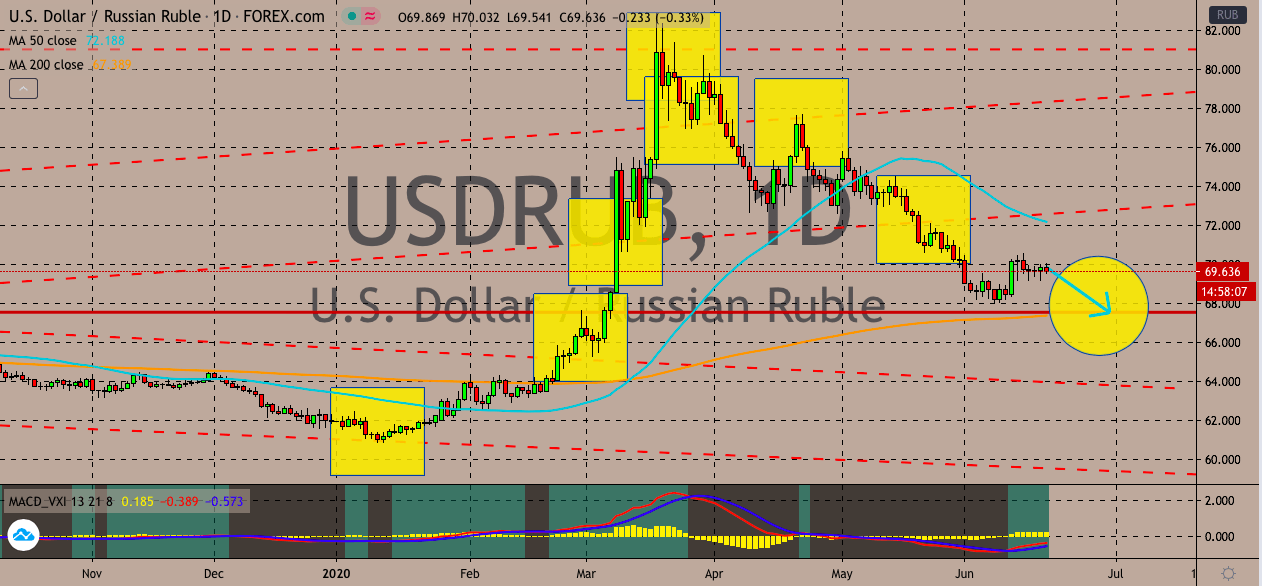

USDRUB

The Russian ruble is deemed as one of the underdogs in the currency market during coronavirus pandemic. The currency has taken major blows from the buckling Russian economy and is very much weighed on by the conditions in the commodity market. Yet, as of writing, the currency is seen forcing the US dollar to steady. This shows the robust nature of Moscow’s currency as it rides the recovery wave of the global market. The US dollar to Russian ruble exchange rate is forecasted to head lower and reach its horizontal support level by the end of June. The move should help push the 50-day moving average towards the 200-day moving average in sessions. Considering that over the past few years, the Russian ruble has been gradually depreciating against the US dollar, its current performance is quite impressive. Some forex experts even say that the Russian ruble has been performing beyond their expectations since March.

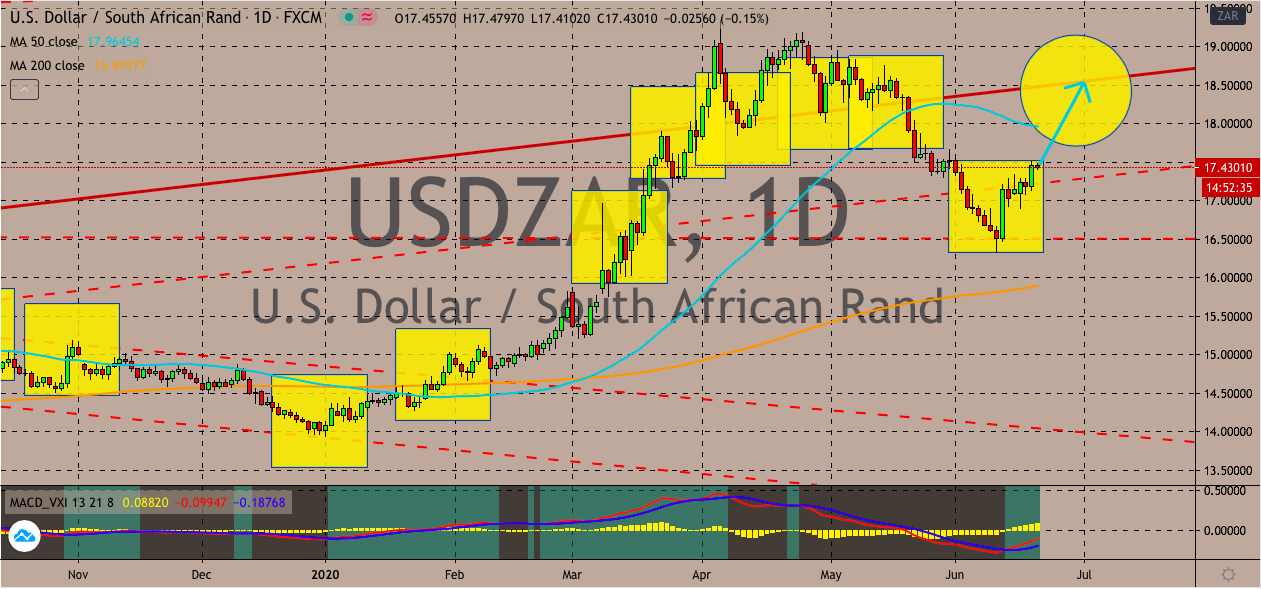

USDZAR

After reaching its lower support levels at around 16.50000, the US dollar hustled to defend itself against the South African rand. However, the rand is seen advancing slightly against the US dollar as of writing as investors wait for the highly anticipated unemployment rate from South Africa due next week. The exchange rate should climb even higher in the coming sessions once the report is released next week. Looking at the chart, it appears that the South African rand lost its momentum after the pair reached its lower support level. This gave the US dollar a wide opening to dominate the rand once again. The recovery of the buck allowed the 50-day moving average to remain on top of the 200-day moving average, signaling that the momentum of bulls is still strong. See, South Africa has one of the highest unemployment rates now, and the upcoming report should give another glimpse of the status of the country’s labor force and economy.

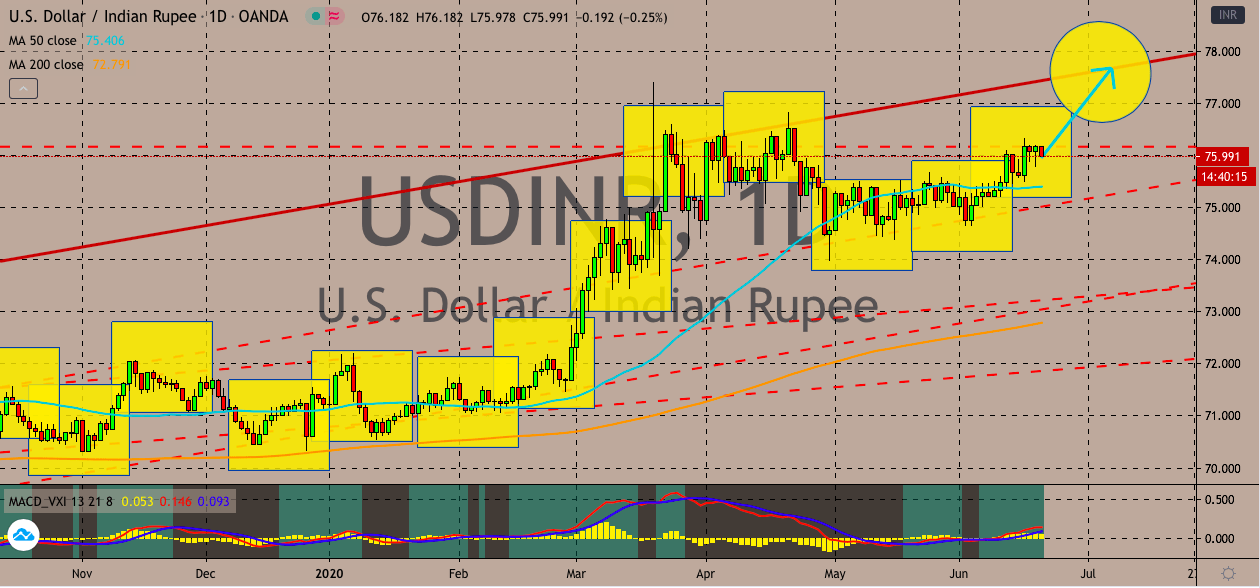

USDINR

The Indian rupee manages to stall the US dollar and prevent it from breaking past a critical resistance level in current sessions. Fortunately for the US dollar, its safe-haven glow is bound to attract more investors soon as the economic prospects of India is predicted to get gloomier and gloomier. Bearish traders are clearly struggling to push prices lower and every attempt to break past its diagonal support level is rejected. This suggests that the odds will eventually turn more and more bullish. Although the Indian rupee is seen advancing at the moment, predictions about India’s economy are bound to weaken it and give the US dollar a wide opening. It was just recently reported that a rating agency found that the pandemic’s impact to the economy should significantly weaken the rupee. This is because as the economic slump gets deeper and deeper, the rupee will be more exposed to challenges that are associated with the rising debt burden of the Asian country.

COMMENTS