Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

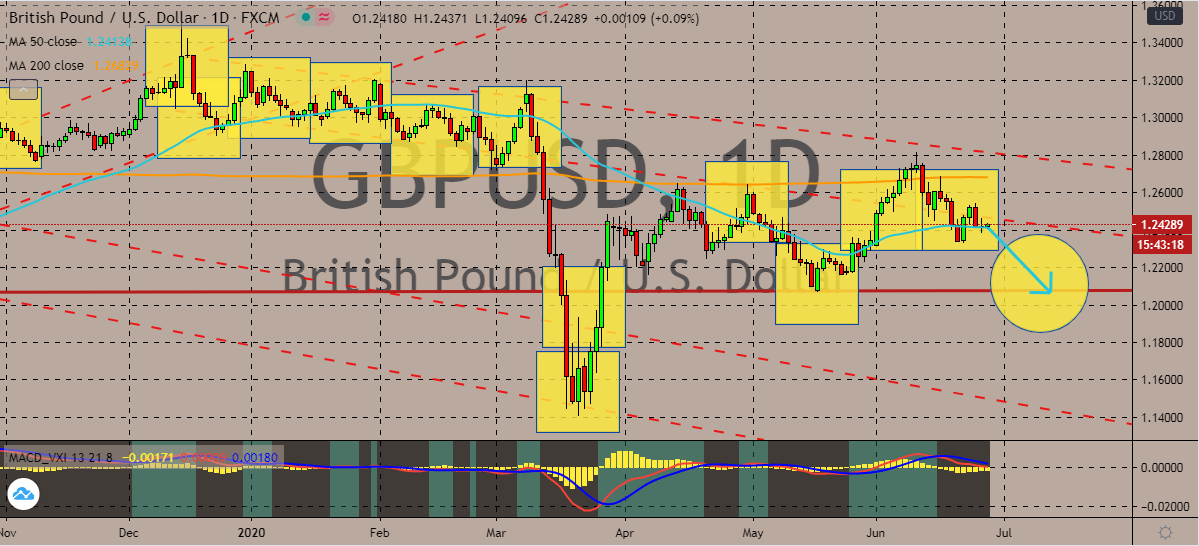

GBPUSD

The US dollar is targeting the GBPUSD’s support level just above the 1.20000-mark in sessions. The pair is currently seen trading steadily this Friday as both bullish and bearish investors try to gain momentum. Ultimately, the prices’ trajectory should remain widely bearish considering that the safe-haven appeal of the beloved greenback is effortlessly countering the positivity brought by the recent reports from the United Kingdom’s economy. The pair should reach the support level by the first few days of July, pushing the 50-day moving average significantly lower than the 200-day moving average. The positivity that radiates from the recent Brexit deal hopes isn’t enough to help the British pound sterling. Perhaps the biggest concern of the market right now is the increasing number of new cases in some states in America. And the confidence of the US President Donald Trump isn’t enough to ease the concerns of investors.

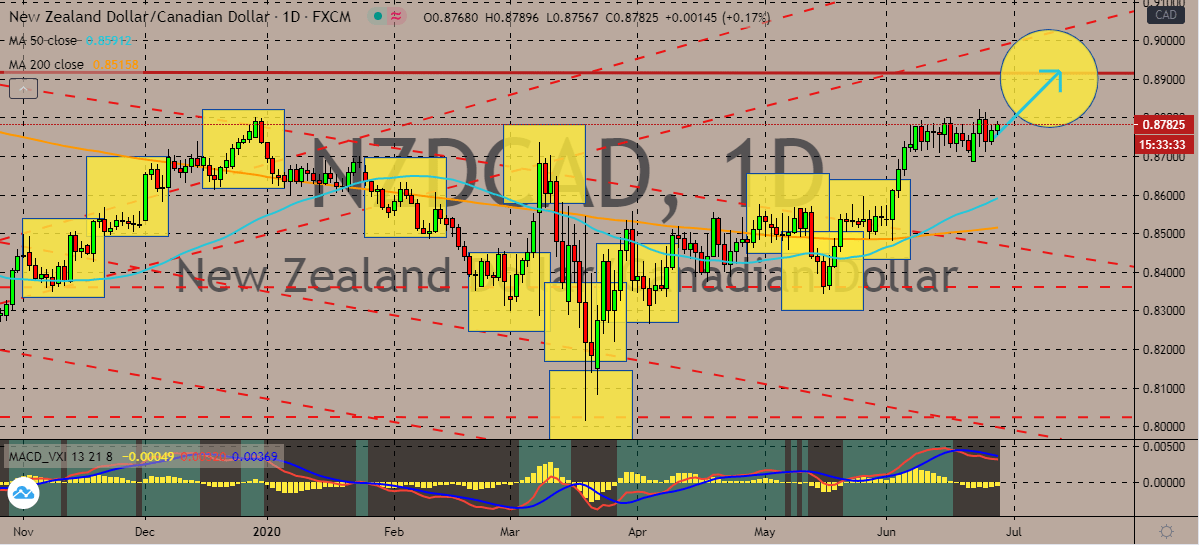

NZDCAD

The recent decision of the Reserve Bank of New Zealand to hold on to its low interest rates despite the already recovering state of its economy has failed to prevent bullish investors in the sessions. In fact, the exchange rate is bound to extend its gains to its resistance level by the first half of July. The move should further strengthen the bullish sentiment of the exchange rate as it would help the 50-day moving average advance higher against the 200-day moving average. The Canadian dollar is weighed on by several factors, among them is the unending endeavor of the Trump Administration to inject tariffs to its rivals. Just recently, it was reported that the White House was considering imposing levies on European products that will be worth about 3.1 billion US dollars each year. The tariff news threatens the recovery of the Eurozone and the global economy, making it harsher for commodity-linked currencies such as the Canadian dollar to recover.

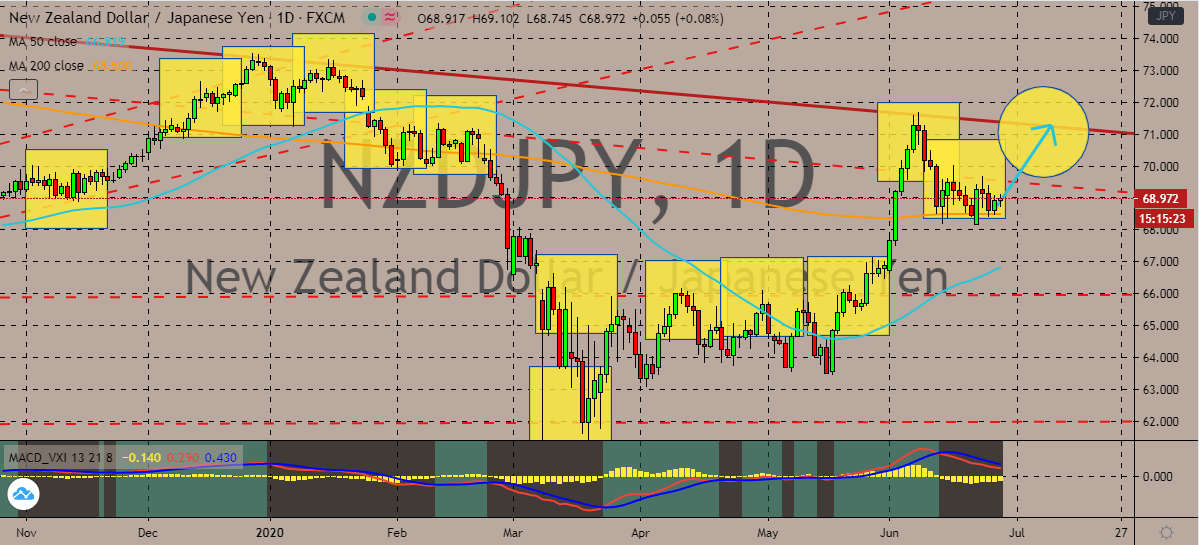

NZDJPY

The New Zealand dollar is currently struggling to push the Japanese yen past the trading pair’s support-turned-to-resistance line. However, the pair is widely projected to turn out bullish as the kiwi continues to appreciate in the global market. Bullish investors of the trading pair are looking to propel the 50-day moving average towards the 200-day moving average in the sessions, and potentially cross the latter MA, indicating a strong upward trajectory. The main fundamental that is seen supporting the New Zealand dollar now is the gradual rebound of the US equities market. this is because traders are very much focused on the support measures of the US authorities for the economy and the actual reopening of the economy. As for the Japanese yen, investors are greatly concerned about the expectations that the Bank of Japan would cut its economic forecasts once again. The lackluster figures presented by the Asian giant isn’t also helping the yen’s case.

COMMENTS