Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

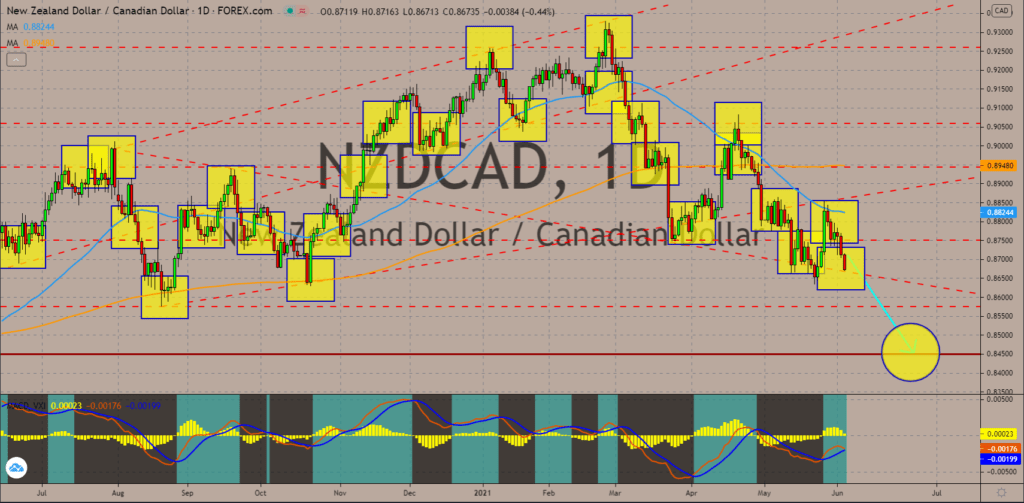

EURAUD

The appeal of the euro currency as a haven will start to fade in coming sessions. The EU and its member states on Thursday, June 03, published better-than-expected results for the purchasing managers index (PMI) reports. The Eurozone leads the advances after both figures from Markit Composite and Services PMIs increased from their prior record. The numbers were 57.1 points and 55.2 points, respectively. Germany’s composite data for the month of May also jumped to 56.2 points, which was in line with the estimate, from 55.8 points in April. Meanwhile, the country’s services sector stayed at 52.8 points. As for the EU’s second-largest economy, France, the Markit Composite was unchanged at 57.0 points and the Services PMI soared by 6.3 points to 56.6 points. Demand for the single currency increased in the recent days following the -1.8% GDP contraction in Germany. The pair is due for a pullback in the short-term as confirmed by the MACD indicator.

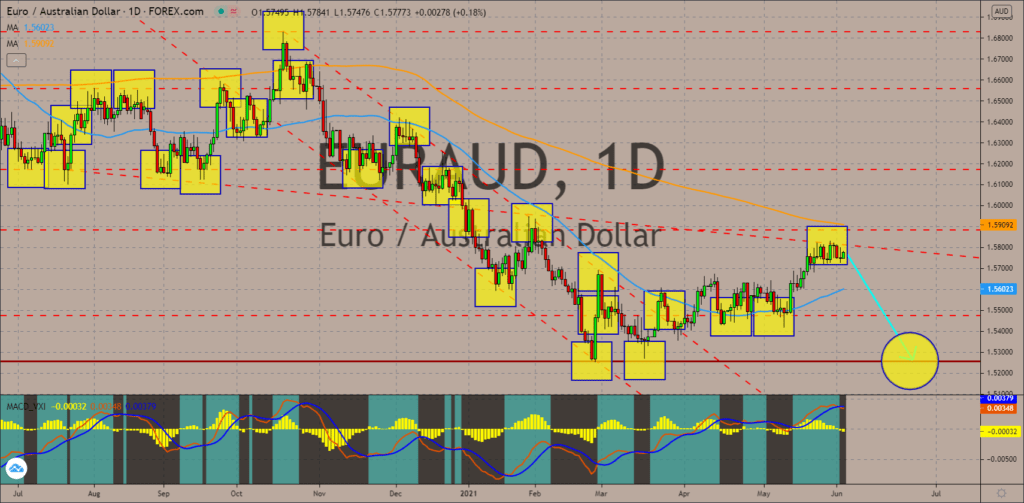

EURUSD

The optimism in the upcoming US labor data will boost the demand for the greenback. Analysts are expecting new milestones for the initial jobless claims report on Thursday, June 03. Following a pandemic-low result of 406,000 last week, consensus estimate was set at 390,000. If the actual figure were in line with the expectations, it would be the new record for the number of individuals filing for unemployment benefits over the course of the pandemic. At the same time, it will mark the first time that the published figure was lower than the 400,000 benchmark. Following the weekly report is the non-farm payrolls (NFP), which covers the month of May. Analysts were hopeful that April’s disappointing 266,000 jobs creation will be overshadowed by the expected 650,000 new jobs. The 50-bar and 200-bar moving averages failed to form a bearish crossover. However, the MACD indicator shows a possible decline in the EURUSD pair in the short-term.

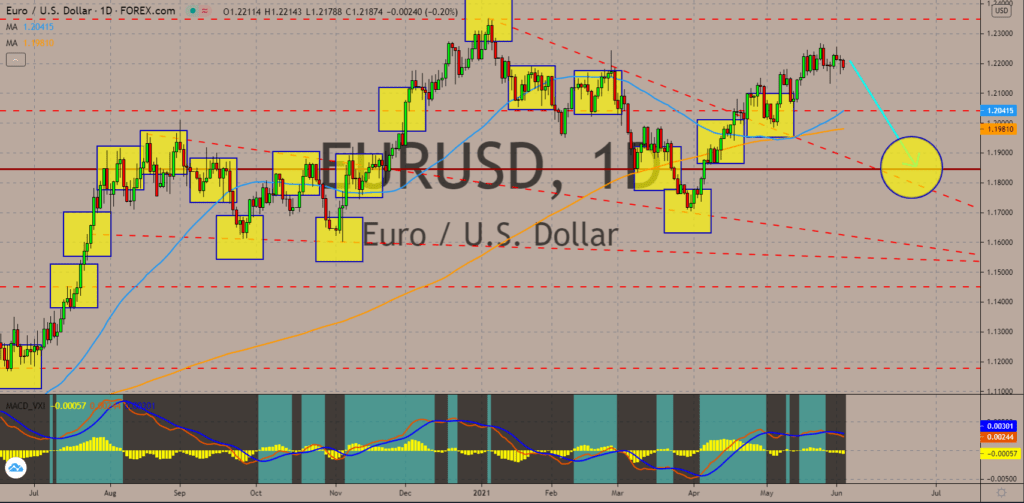

USDJPY

Japan’s Services PMI has slowed down in May after three (3) consecutive months of improvement in the sector. The figure was still below the 50.0 points benchmark, which separates contraction and expansion. The pessimism in outlook for the world’s third-largest economy is reflected in foreign funds, which had a net outflow of 908.7 billion last month. While investment in stock was up by 181.5 billion, the decline in fixed-income bonds was higher at -1,090.0 billion. As for the consumption per household, analysts see a -2.2% drop in April as the surging cases of COVID-19 resulted in less economic activity in Tokyo. On a year-over-year (YoY) basis, household spending is anticipated to expand by 9.3%. The 50-bar moving average at 109.228 will provide support for the pair as it moves towards the target price of 113.000. The MACD and Signal Lines, and Histogram are expected to move towards the same direction with the lines skewed to the upside.

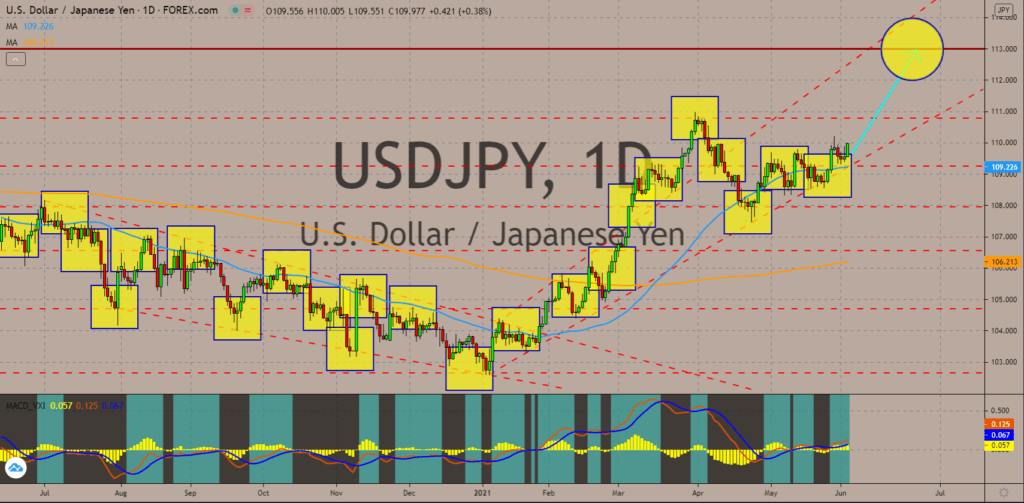

NZDCAD

Canada’s GDP growth has slowed down to 1.4% in the first three (3) months of fiscal 2021. This was following the 2.2% expansion in Q4 2020. The annualized figure was also below the estimates of 6.7% with an actual result of 5.6%. The market is expecting robust recovery in Ottawa as its southern neighbor, the United States, expanded by 6.4% in the first quarter of the year. As a result, investors will put their cash on the Canadian dollar in anticipation of weak performance in the equities market. Also, the market might be on the sidelines and keeping their assets liquid as the real estate market continues to show massive increase in prices. The accommodative policy by the Bank of Canada (BOC) with low interest rate and massive stimulus causes a spike in investors’ appetite over mortgage. On May 26, the NZDCAD pair failed to advance past the 50-bar moving average. The MACD line and Signal line is expected to form a “bearish crossover” on June 04.

COMMENTS