Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

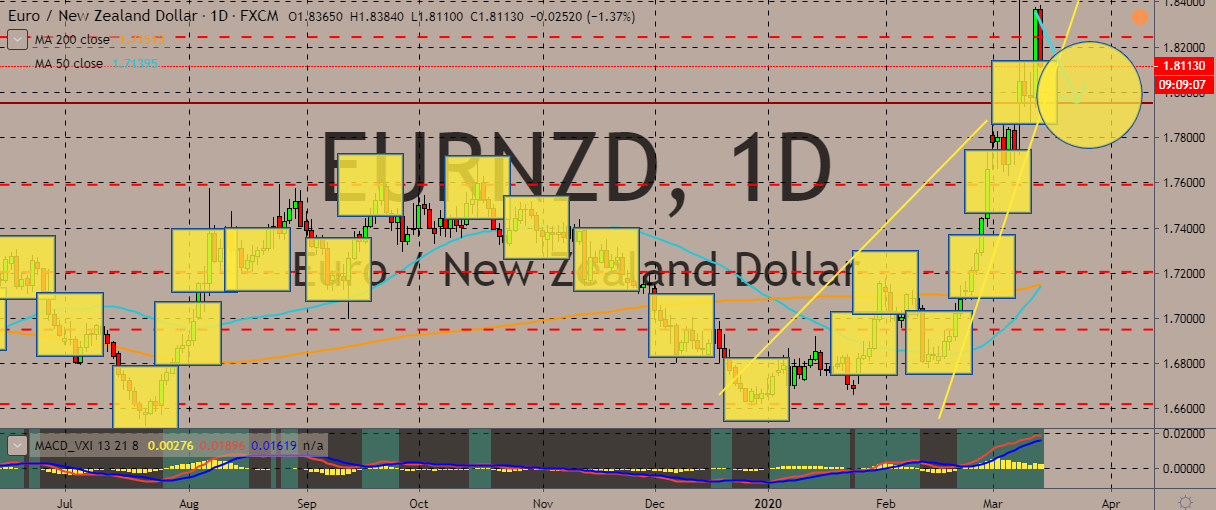

EURNZD

The pair has recently pulled back from recent highs, recording a wild swing in price after the staggering Black Thursday market crash of 2020. This halted the 50-day moving average’s apparent crossing above the 200-day moving average, cancelling the anticipated Gold Cross confirmation. Over in Europe, European Central Bank chief Christine Lagarde drew flak after refusing to echo her predecessor, Mario Draghi, and say the bank would do anything to protect the eurozone from a recession induced by the coronavirus outbreak. Lagarde suggested it was the duty of the governments to protect highly indebted eurozone countries instead of the central bank. The ECB then did not cut interest rates despite market expectations for a reduction amid the ongoing coronavirus chaos. It did announce, however, measures to support bank lending. It also announce an expansion of the asset purchase program by 120 billion euros, or $135.28 billion.

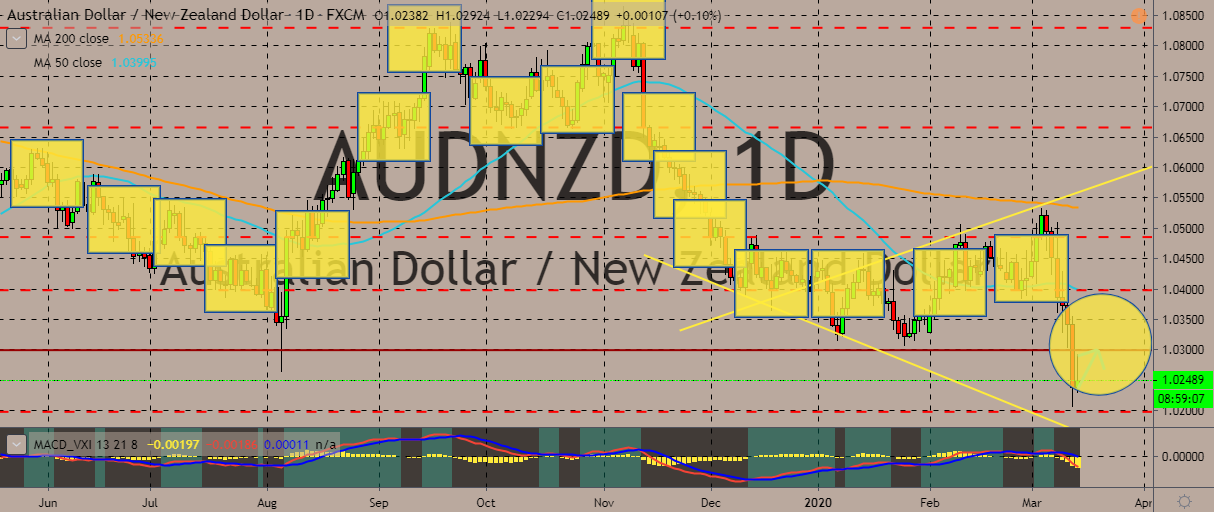

AUDNZD

The Australian and New Zealand dollar were both affected by the historic market crash last Thursday and the increasing number of virus cases and worsening economic impact of the coronavirus outbreak. Both were near their 11-year lows against the US dollar. The Australian dollar, however, is also weaker against its New Zealand counterpart, as investors fled risk in all forms and ditched currencies with high exposure to global trade or commodities. According to one analyst, the world market, including fx markets, are in the midst of a severe global downturn. This market crash greatly overshadowed the Australian government’s launch of a major stimulus package on Thursday aimed at sidestepping the first recession since 1991. However, there are still fears the package will not be sufficient enough for Australia to avoid a contraction in economic activity in both the first and second quarters, which is the technical definition of recession.

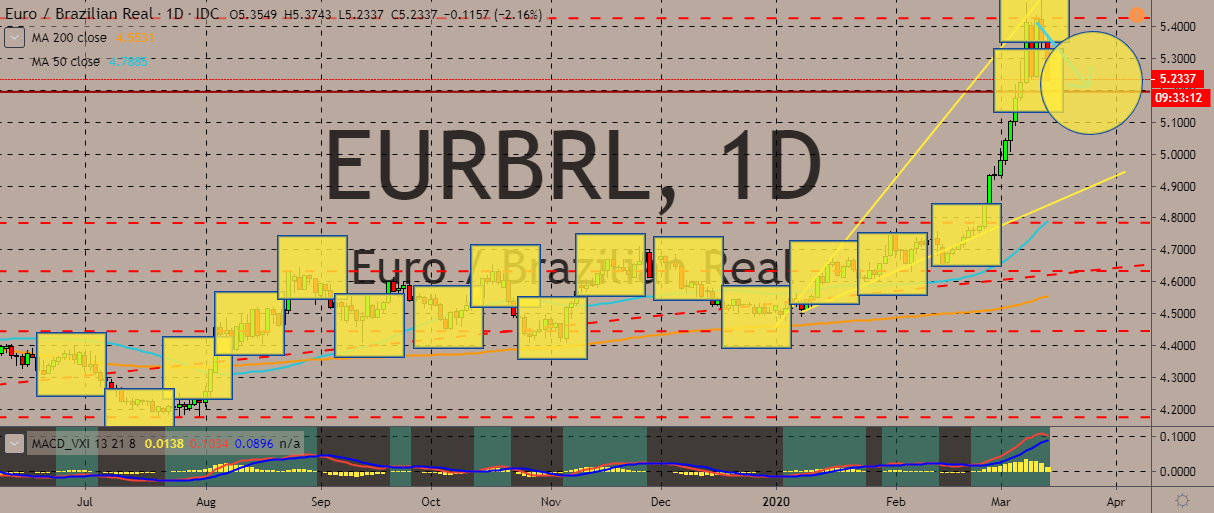

EURBRL

The Brazilian real is near record lows now after the catastrophic drop in equities market, although it is slowly gaining ground against the euro now. Thursday saw the country’s Sao Paulo stock exchange close down 14.78%, a worst day in a terrible week as Brazil struggled to deal with a market crash because of the fallout of the new coronavirus pandemic. News of US President Donald Trump’s shock ban on travel from mainland Europe. The latest bad news could not be welcome for Brazilian President Jair Bolsonaro and economy minister Paulo Guedes, who both expressed confidence in their governance. Meanwhile, Brazil’s central bank said its interest rate decisions would revert to being announced right away after the monetary policy committee called the Copom ends its meetings. The changes will be effective starting Copom’s two-day meeting next week, which will end on Wednesday, March 18.

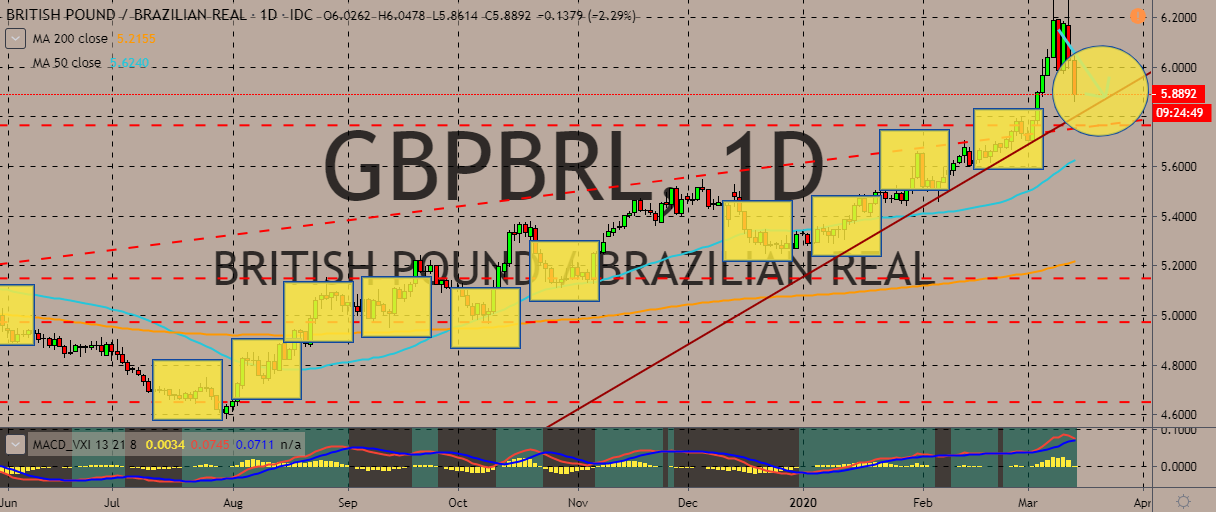

GBPBRL

The British pound is weakening against the Brazilian real, off recent highs that saw prices cross the 6.0000 level. With a largely bullish sentiment for the pair, the price has a lot of room to go up and down. But the current short-term sentiment, obviously, is negative, so the British pound is being sold broadly across markets and against many other currencies. It doesn’t help that the Bank of England just recently implemented an emergency rate cut of 50 basis points, just like the Reserve Bank of Australia, US Federal Reserve, and Bank of Canada. The BoE said the cuts were to fight the “economic shock” from the coronavirus outbreak. It also announced a new Term Funding plan to help small and medium companies, financed by bank reserves. All this paints a clear picture: the British pound’s recent bullish run after the Brexit saga and amid UK-EU negotiations has been fragile. As a result, it broke easily when the markets crashed.

COMMENTS