Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

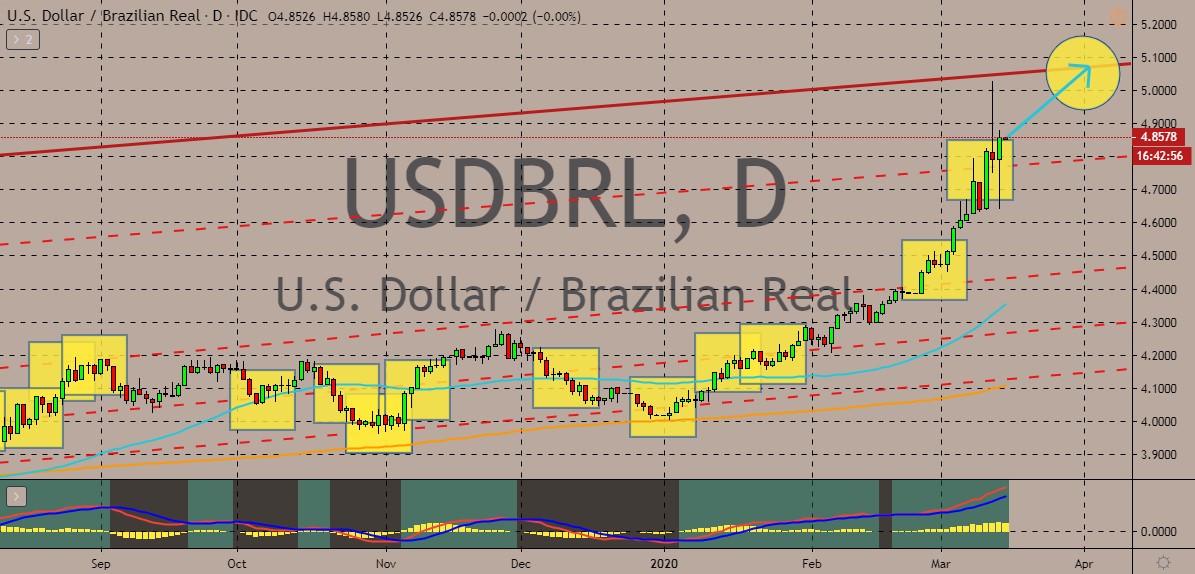

USDBRL

The recent rate cut from the United States Federal Reserve yesterday is bound to slow the bullish run of the USDBRL pair. However, the pair is still expected to gradually advance as the greenback remains stronger than the Brazilian real. Bulls continue to thrive as the 50-day moving average continues to inch farther away from the 200-day moving average. Yesterday, the US Fed unleashed another stimulus package as it eases its official interest rates from 1.25% to just 0.25%, doubling down on the prior 0.5 basis point emergency cut. As of writing, the Brazilian real is seen catching a breather against the US dollar. Although, despite the rate cut from the US Fed, the real isn’t able to push the pair lower, suggesting the US dollar is still dominant against the real. It is also worth noting the recently reported positive results from the Brazilian economy are also failing to support the Brazilian real against the buck.

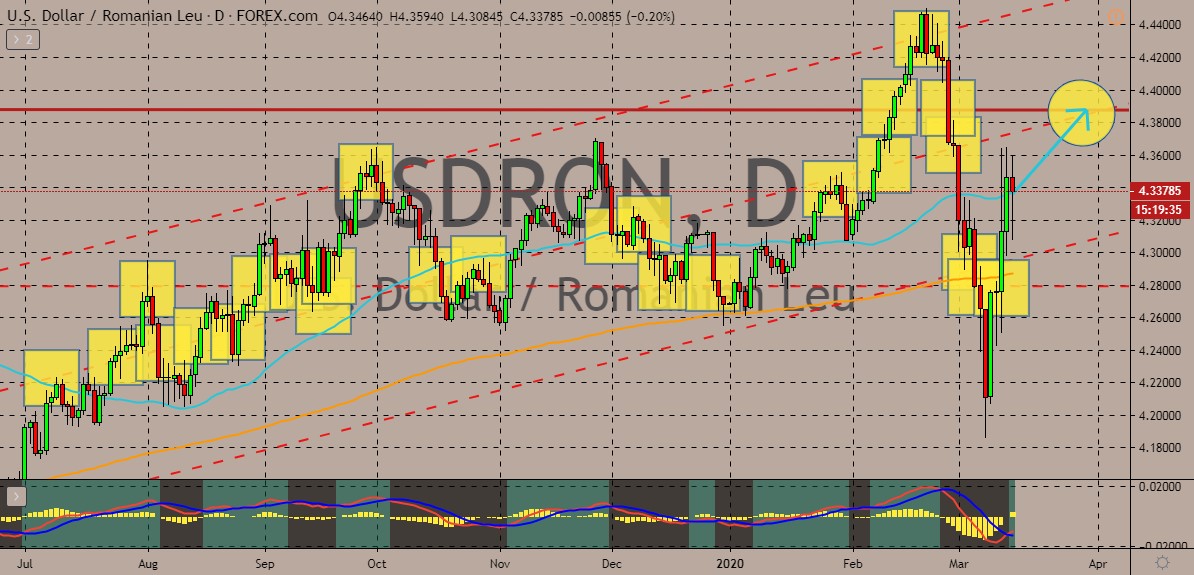

USDRON

The US dollar is slightly losing its footing today against the Romanian leu following the surprising rate cut from the United States Federal Reserve yesterday. Looking at it, the USDRON’s 50-day MA is still well on track to continue gaining. Perhaps the coordinated response of major central banks across the globe lessened the impact of the massive Fed rate cut on the US dollar. In fact, the Bank of Canada, Bank of England, European Central Bank, Bank of Japan, and the Swiss National Bank’s efforts cushioned the greenback, preventing it from collapsing against the Romanian leu is the market. Bears couldn’t benefit from the Fed rate cut and the jump in Romania’s industrial production index. The Romanian National Institute of Statistics recently reported an improvement from -0.1% to 2.0% on the January industrial production report of the country. Unfortunately for the leu, the greenback is still expected to take the USDRON pair higher.

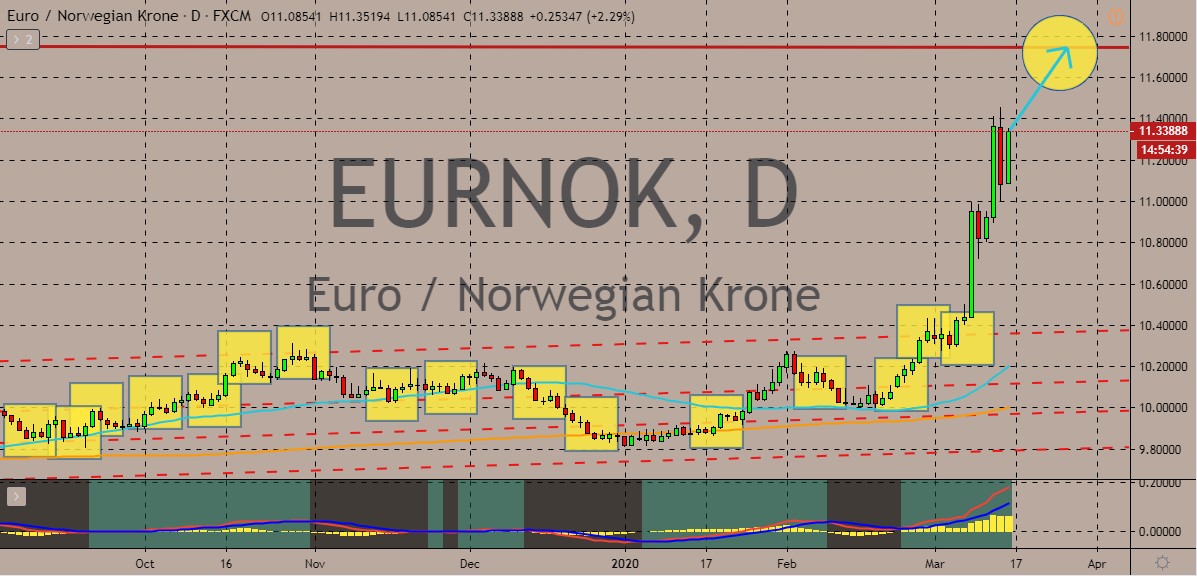

EURNOK

The recent rate cut from the Norwegian central bank sealed the fate of the Norwegian krone in the foreign exchange scene. The EURNOK is trading above the 50-day moving average and is still expected to continue that bullish path. The euro is forecasted to force the Norwegian krone upwards, pushing the pair to its highest level ever. Traders of the common currency breathed a sigh of relief after the European Central Bank announced that it will leave its official interest rates unmoved for the month of March. This gives the euro space, preventing it from weakening against the Norwegian krone. Bad news for bears also came after the Norges Bank slashed its interest rates by 0.50 basis point, lowering it from 1.50% to just 1.00% late last week. The Norwegian central bank delivered the emergency rate cut to counter the impact of the coronavirus to the economy following the moves of other major banks across the world.

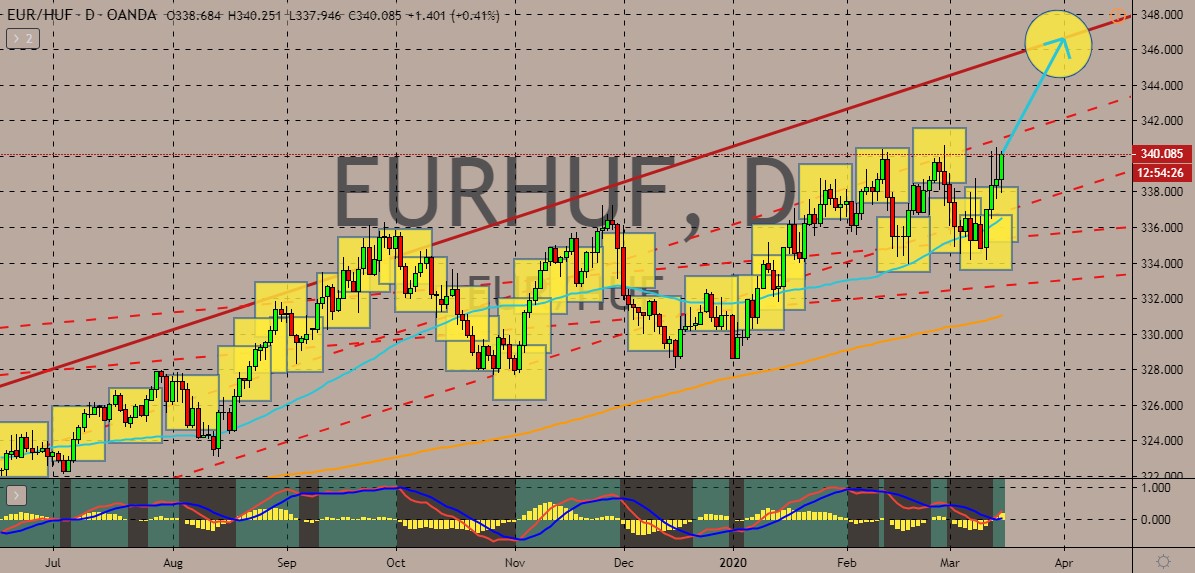

EURHUF

The Hungarian forint is on the defensive against the euro. Signs point to the concerns on COVID-19’s impact on the Hungarian economy. Bulls are prevailing, successfully maintaining the 50-day moving average above the 200-day moving average. The Hungarian Democratic Coalition recently came up with proposals for the school shutdowns in the country and full wage payments for workers to support them amidst the virus. The escalating fear in Hungary is paving a way for the single currency to gain against the forint. It’s also worth noting the negative results recorded from the Spanish economy were easily countered by the positive figures produced by Berlin’s economy in recent reports. Plus, the decision of the European Central Bank to hold on to its interest rates prevented the euro from tumbling down against heavy concerns about the eurozone’s economies, particularly the virus-struck Italy.

COMMENTS