Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

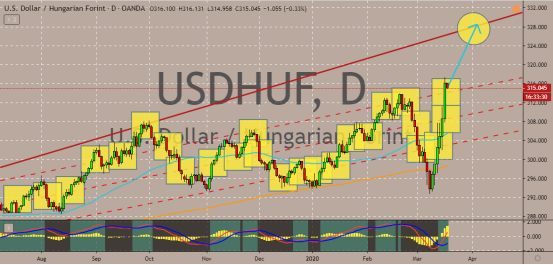

USDHUF

The Hungarian forint is steadying against the US dollar after bulls forced the pair to reach its strongest level yet. The 50-day moving average appears to be climbing higher and farther away from the 200-day moving average. The USD made a swift recovery against the HUF after plunging during the latter part of February. And now, bulls are looking to touch the resistance level by early April. Looking at it, the US dollar is seen strengthening as the US stock market scrambles to find liquidity. Concerns about the massive economic impact from the deadly novel coronavirus continued to affect the risk appetite for the US dollar. Also, the effort of major central banks, including the US Federal Reserve, have cut their pricing on their respective swap lines to help supply US dollars to various financial institutions.

USDMXN

The US dollar is on a roll. After trading on a narrow sideways trend for months, the US dollar breaks several resistance levels and is looking to force the Mexican dollar to its weakest level in the foreign exchange market. The 50-day moving average and the 200-day moving average recently crossed paths, intersecting yesterday. Bulls are hustling to propel the 50-day moving average even higher in coming sessions as the collective efforts of major central banks and the US Fed gives the buck a helping hand. In fact, the Mexican peso is seen crashing not just against the buck, but also to most of its rival in the FX market. Perhaps the rising concern that the efforts of major central banks aren’t enough to pacify the global market amid the coronavirus pandemic is putting intense pressure on the backs of Mexican peso investors.

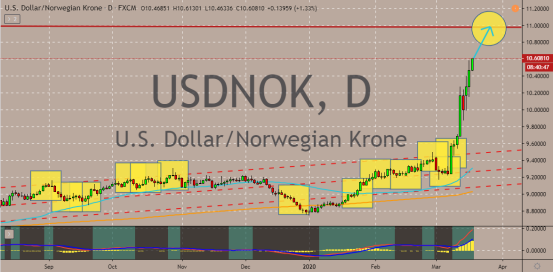

USDNOK

The Norwegian krone has just reached its weakest level against the US dollar. The USDNOK pair is currently trading at record highs as the US dollar thrives in the global market. Bulls continue to hold on to their momentum, causing the 50-day moving average to climb farther away from the 200-day moving average. The oil-susceptible krone remains in trouble as the commodity market still doesn’t look stabilized yet. It’s believed that the pair will climb its resistance before the month ends. The US dollar is seen standing tall and proud in the foreign exchange market thanks to the deadly novel coronavirus fuels the concerns and the rush for funding. Yesterday, the United States Federal Reserve said that it would reinstate a funding center to help get credit directly, a move that raised the spirits of USDNOK bulls.

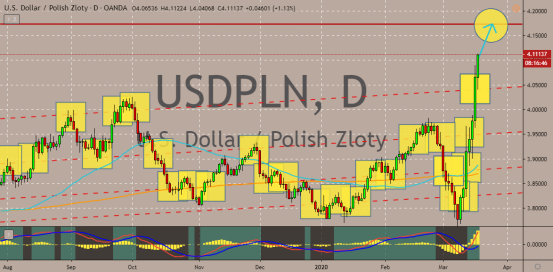

USDPLN

Bulls are on a roll and are hustling hard to force the pair higher. In no time soon, the USDPLN pair is expected to reach its resistance as the US dollar looks to reach price levels last seen in late 2016. Just this week, the 50-day moving average finally topped the 200-day moving average, signaling bulls that it’s time to rally. The US dollar stressfully extends its rally today as worried investors and companies rush towards the world’s most beloved and liquid currency. Another reason that’s supporting the greenback is the strong and bold efforts of major banks and financial institutions to keep money markets working against the intense pandemic. Looking at it, the rate cuts from the United States Federal Reserve should have stopped the momentum of bulls. But instead, it paid off for it, giving the US dollar its much-needed edge.

COMMENTS