Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

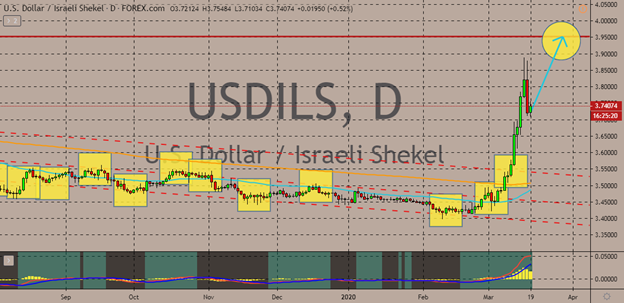

USDILS

After the Israeli shekel rebounded yesterday, bulls immediately stepped on their gas pedals to prevent the Israeli shekel from dragging the pair downwards again. Looking at it, the 50-day moving average is still below the 200-day moving average, suggesting that bulls haven’t actually prevailed yet. Although, it’s also worth noting that the two MAs are now close to intersecting wherein traders of the US dollar are hoping the 50-day MA rises above the 200-day MA. The announcement of the US Federal Reserve earlier this week, on Tuesday, set the tone for the greenback. According to reports, the Fed will reinstate a funding center or facility used during the financial crisis back in 2008. The facility will help to directly provide credit to businesses and houses that are in great need. And just recently, it was just reported that the Ban of Israel made a loan that is worth billions of shekels to support the country during this pandemic.

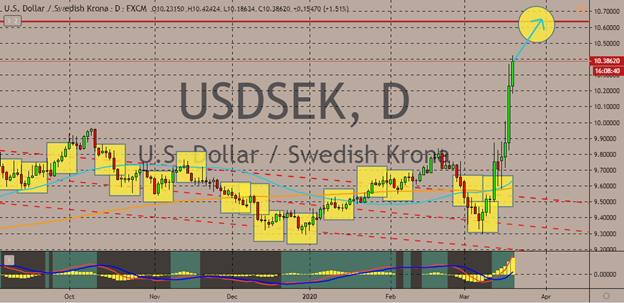

USDSEK

The greenback successfully propelled itself against the Swedish krona in the foreign exchange market. The 50-day moving average just recently surpassed the 200-day moving average, signaling a bullish run for traders of the USDSEK pair. The Swedish krona remains on its back foot in the market and has seen great losses yesterday against the US dollar. Measures from the Riksbank that were unveiled to further support the country’s economy failed to shield the Swedish krona against the strengthening US dollar. Some of the plans that were promised include offering more loans to local banks on lighter and more favorable terms. Riksbank also promised to increase its asset purchases. Earlier this week, the members of the monetary policy board of the Swedish central bank had an unscheduled meeting to discuss actions to take to counter the impact of the deadly virus such as reducing its overnight lending rate to local banks.

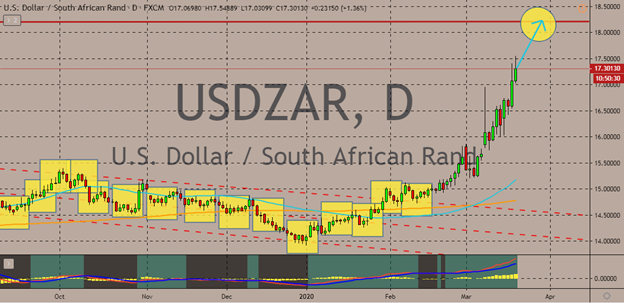

USDZAR

The pair has risen steeply from recent levels with the exchange rate stacking up in favor of the dollar. Sentiment for the dollar is largely robust as investors and traders seek the buck’s liquidity amid the ongoing stock market crash, coronavirus pandemic, and oil supply glut. In Johannesburg, the rand is facing intense pressure as domestic stock markets sunk back to levels last seen in 2013. The rand’s performance against the greenback is symptomatic of emerging market currencies’ tendency to sink amid worldwide disruption. With major currencies weaker, it is expected EME currencies will also be weaker. The South African Reserve Bank is now expected to implement a rate cut to prop up its weakening economy. This move would be similar to the global trend of rate cuts among central banks. South Africa’s economy slipped into recession in the final quarter of 2019, and 2020 hasn’t been particularly nice to the world’s economy.

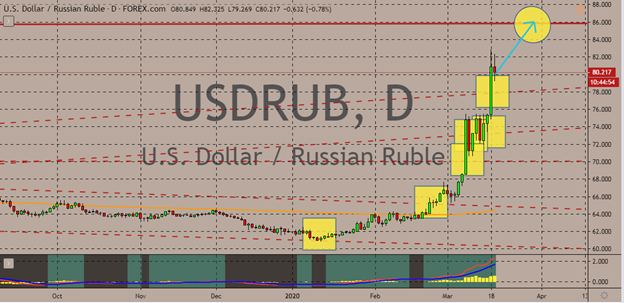

USDRUB

And just like the ZAR, the Russian ruble isn’t having any luck as well against the dollar. The exchange rate has skyrocketed in recent sessions, with the ruble down 20% so far this year against the buck. Among emerging market currencies, the ruble has seen the worst losses as of yesterday. While most riskier currencies are being upstaged by the dollar, the ruble has suffered the shorter end of the stick as Russian President Vladimir Putin locked horns with Saudi Arabia and engaged in an oil price war. Although major central banks around the world have adopted emergency rate cuts to buoy their sinking economies, Russia is expected to buck the trend. Surveys show Russian central bank governor Elvira Nabiullina to end the series of six rate cuts. Rates are now expected to be on hold this Friday as the bank tries to avoid the further weakening of the ruble. For a few economists, however, a rate cut of at least 50-basis points is still possible in the future.

COMMENTS