Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

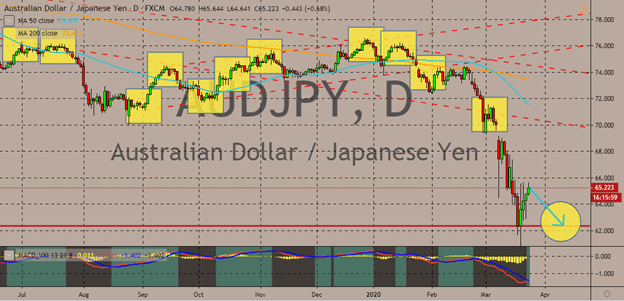

AUDJPY

In recent sessions, the Australian dollar has managed to pull itself back up against the Japanese yen. However, things are unfortunately projected to turn around for the exchange rate. Over the past four sessions, the pair has made a strong rebound as bulls remain determined to pull prices back up. Perhaps the recent strength of the Aussie this week came from the also recovering pick-up in global traders and investors’ sentiment courtesy of the latest measures of the Federal Reserve to support the United States economy. Although it’s still believed that more turbulence is ahead for the pair, suggesting that prices would eventually slip in the near-term trading. Meanwhile, bears are recharging, hoping not to rely much on the Japanese yen’s safe-haven appeal but rather nat the better-than-expected manufacturing PMI data. As of writing, investors are hanging tight and are waiting for further guidance from the Bank f Japan’s core consumer price index due later today.

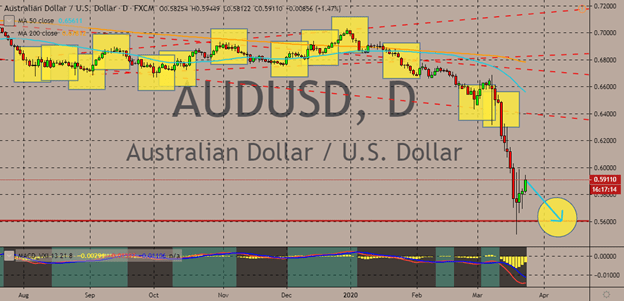

AUDUSD

The US dollar is slipping against the Australian dollar after a steep plunge for the AUDUSD pair. The pair recently collapsed to its lowest level since the first half of 2003. It’s evident that the pair’s direction is largely bearish considering that the 50-day moving average is well below the 200-day moving average. Although as of writing, the Australian dollar is seen making a recovery courtesy of the latest move of the United States Federal Reserve which weakened the US dollar this week. Still, despite the slight rebound, it’s forecasted that the Aussie will remain on the defensive against the greenback. Just recently, the Reserve Bank of Australia injected about AU$6.9 billion, or approximately $5.92 billion, into the country’s own financial system to help buoy the economy. Meanwhile, the US Fed intensified its rescue plans yesterday, announcing an unlimited bond-buying program, more credit facilities, and a Main Street lending program.

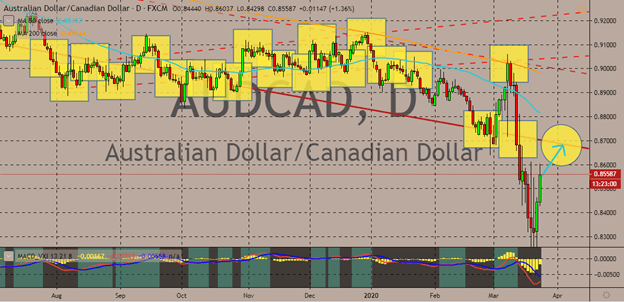

AUDCAD

The Canadian dollar is back on the defensive against the Australian dollar as bulls attempt to make a recovery in sessions. Following the announcement of the Reserve Bank of Australia earlier today, investors of the Aussie have regained their confidence. Looking at the chart, it’s seen that the 50-day moving average is indeed trading lower than the 200-day average, meaning that bears are still in control of the pair. Earlier this Tuesday, the RBA announced that it has injected billions worth of Australian dollars to the local economy and will be buying billions more in government bonds. Since March 12, the RBA has flooded the financial system with support and stimulus to prevent the economy from spiraling into a recession. And considering the strength of the Australian dollar and the state of the country right now, so far it has been successful. However, the question of whether the Australian dollar could break its resistance level is unknown.

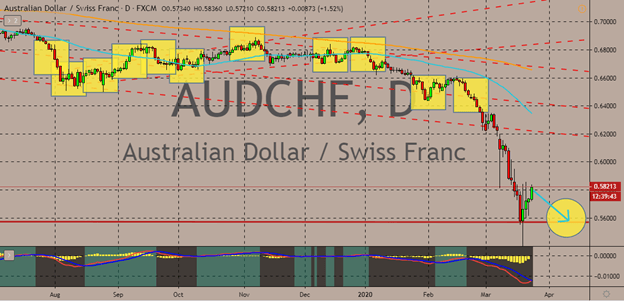

AUDCHF

Despite the Swiss franc trading higher against other major currencies today, it’s no match for the Australian dollar’s drive to bounce back. Investors of the Aussie are thrilled with what the Reserve Bank of Australia has been doing to support the economy. The efforts of the RBA are paving the way for the rebound of the AUDCHF in the market. However, things remain rather uncertain for the pair as turbulence could still come ahead for the Australian economy and the Australian dollar. Meaning to say that things aren’t certain, and experts are still widely expecting the pair to slide lower again in the coming sessions. it’s been reported that the Swiss National Bank increased its foreign currency interventions to the maximum or highest level since 2016 during the groundbreaking Brexit referendum. Just last week, Swiss sight deposits jumped by approximately Fr6 billion according to the Swiss National Bank’s official statement.

COMMENTS