Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

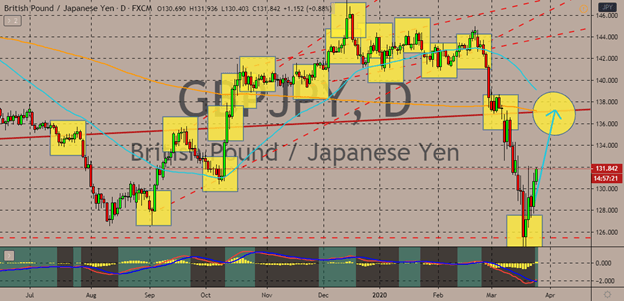

GBPJPY

The British pound’s recovery is looking promising as ever and it may continue to rally as support continues to hold. At first, bears thought that they would have this in the bag as the 50-day moving average pivots and appears to be heading lower. Fortunately for investors of the British pound, the Japanese yen has buckled earlier this week due to the latest announcement of the United States Federal Reserve. The safe-haven appeal of the beloved yen faltered as the risk appetite for major currencies such as the British pound starts to resurface again. In the United Kingdom has unfortunately seen its largest spike in daily death counts from the deadly novel coronavirus. A 26% death toll spike was seen in just 24 hours, increasing Britain’s death toll from 335 to about 422. According to the health secretary of the United Kingdom, Matt Hancock, the country should have its peak in coronavirus spike in a few months.

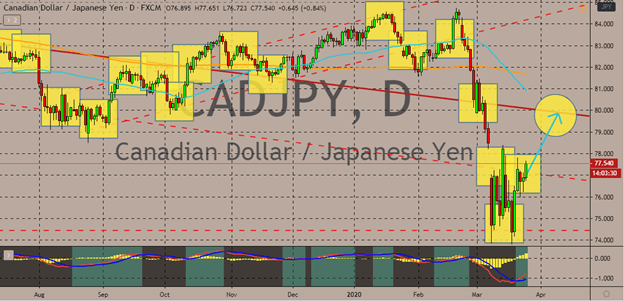

CADJPY

The Japanese yen is back on the defensive against the Canadian dollar because of two main factors. First, the slow rebound of oil prices in the commodity market. Second, is the regenerating risk appetite for other major currencies courtesy of the latest announcement of the US central bank to support the economy. Both Brent oil and WTI crude are seen fluctuating in the oil market in recent weeks. However, as of today, prices of the commodities are seen up again. Also, Japan’s economic activity is expected to shrink because of the impact of the virus this month. The concerns of a domestic and global recession are adding pressure to the country as it will disrupt major supply chains, shutdown some factories, and lessen spending as tourists refrain from traveling. All of which will heavily affect the Japanese yen. Exports are certain that the Japanese economy will spiral into a recession as the export market remains paralyzed because of the virus.

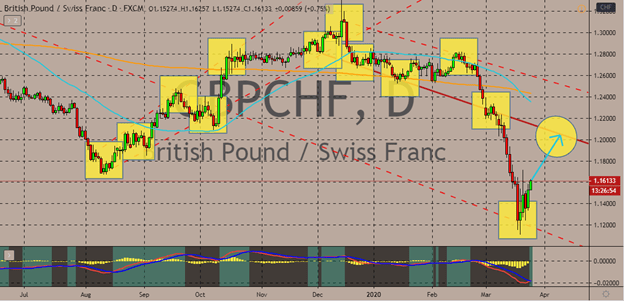

GBPCHF

Bulls managed to pull the GBPCHF pair upward again, making a significant recovery in the foreign exchange market. However, looking at the chart, the 50-day moving average just recently dipped lower against the 200-day moving average, signaling that it’s still in a bearish direction. However, that’s about to turn around as the support continues to hold the British pound against the Swiss franc. As for the precious safe-haven franc, it will continue to falter in the market as major central banks from across the globe start to boost their interventions to support the global economy and prevent a deep plunge to an unfortunate recession. Looking at it, the safe-have appeal of the franc could actually diminish as Switzerland is also at the brink of a recession. Just last week, the Swiss National Bank announced that it would heighten its foreign currency acquisitions to avoid a reckless and uncontrollable surge in the Swiss franc’s value in the forex market.

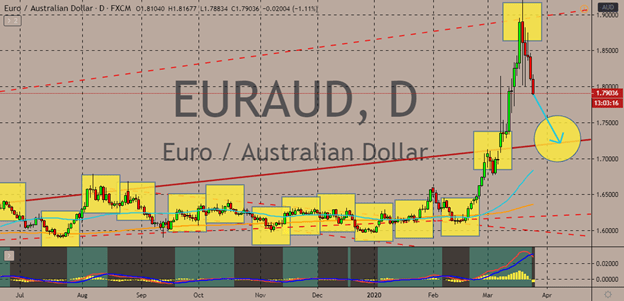

EURAUD

The Australian dollar is back on a roll. After hitting its resistance levels in previous sessions, bears managed to turn the tables around and force the pair downwards. The Aussie is looking lower the 50-day moving average, below the 200-day moving average. It’s widely expected that the pair would soon reach its support levels by the first few days of April. The stimulus measures of the RBA appear to be working and considering that Europe was declared as the center of the pandemic, the odds are definitely against the bulls. Just recently, the Reserve Bank of Australia ramped up its semi-government bond market for the first time since it launched its quantitative easing program. The Australian central bank reportedly bought about AU$2 billion worth in semi-government bonds that were issued by the state and territories. The maturities of the said semi-government bonds range between early 2026 to around June of 2030.

COMMENTS