Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

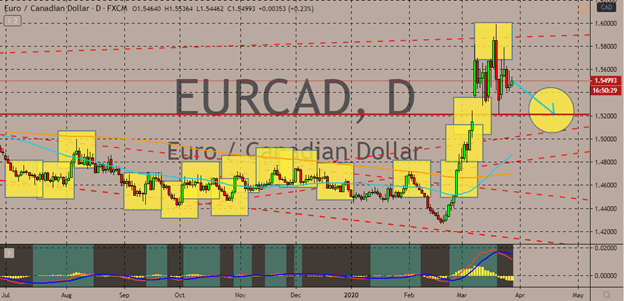

EURCAD

It’s a tight tug of war between the euro and the Canadian dollar. However, it’s expected that the Canadian dollar will first have the upper hand in the coming sessions. At the chart, it’s seen that the 50-day moving average has actually strayed higher than the 200-day moving average. Looking at it, the massive stimulus plan of some of the members of the bloc is bound to drain the strength of the euro. Dubbed as the corona bonds, it’s a highly controversial plan that involves gathering and combining securities from the region to serve as a super stimulus that will help cushion the impact of the virus. Meanwhile, the Canadian dollar is widely projected to rebound because of the improving sentiment as a direct result of the stimulus measures of the Canadian government and the fiscal and monetary efforts of the G-7. This week, Canada announced that it will be implementing an 82-billion Canadian dollar stimulus program to support the economy.

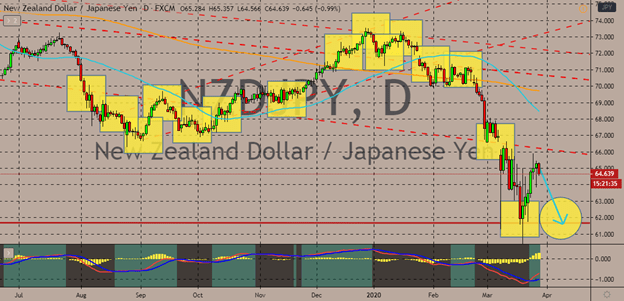

NZDJPY

As the number of cases in the United States surge, surpassing even mainland China, it could raise the safe-haven appeal of other major currencies such as the Japanese yen. Meaning that the yen could probably strengthen as the US dollar receives a major blow courtesy of the virus. Thus, the NZDJPY pair would eventually slide lower back to its support levels. Looking at the chart, it’s seen that bears have taken control of the direction of the pair as they drag the 50-day moving average significantly lower than the 200-day moving average. Meanwhile, as the number of new cases also jumps in New Zealand, the kiwi is bound to weaken in the forex market. 76 new cases have been confirmed in New Zealand, raising the country’s total to around 368. Although it’s still significantly lower than other countries, it still doesn’t mean that it won’t have a significant strain on the New Zealand dollar’s exchange rate.

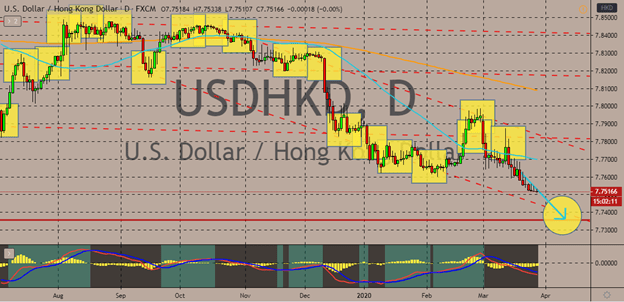

USDHKD

Despite the US dollar recently dominating other major currencies in the foreign exchange market, its prowess failed to work against the Hong Kong dollar. Bears are literally taking control of the pair with a firm grip. And it appears that the unprecedented support that the US dollar has been gaining has not affected the USDHKD that much. It’s seen on the chart that the 200-day moving average is significantly far from the 50-day moving average, which, unfortunately for bulls, is still heading downwards. Technically, Hong Kong was the very first country that reported a case of the COVID-19 outside of mainland China. Although at first, it appeared as if a miracle and the number of cases in Hong Kong started to dwindle. But the rising number cases abroad forced borders to close, including Hong Kong’s. So, travelers rushed to return to Hong Kong and now the number of new cases is traced to those who have travel histories.

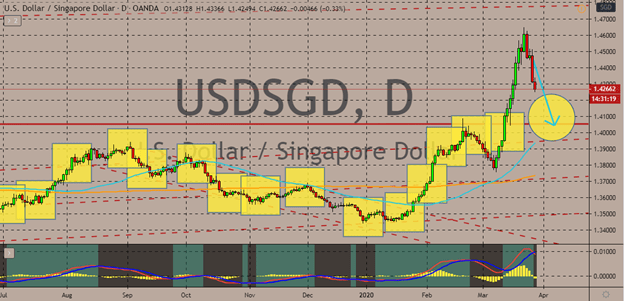

USDSGD

The massive spike in unemployment claims in the United States doomed the US dollar in the trading sessions. The all-mighty greenback felt a powerful jolt after the US Labor Department reported that the number of Americans displaced and are now jobless reached a whopping 3.28 million as of last week. The increase is so massive that it easily crushed the figures from the Great Recession in 2009 and the former all-time highest record back in 1982. As businesses shut down, the US economy is surely paralyzed. And to make matters even worse for the investors of the greenback, the unemployment count isn’t the only result that spiked, the number of new cases also jumped in the US. As for Singapore, the government has allotted another SGD48 billion to support local businesses and households affected by the virus. The new stimulus comes a month after the prior SGD6.4 billion package to support the economy and health-care measures.

COMMENTS