Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

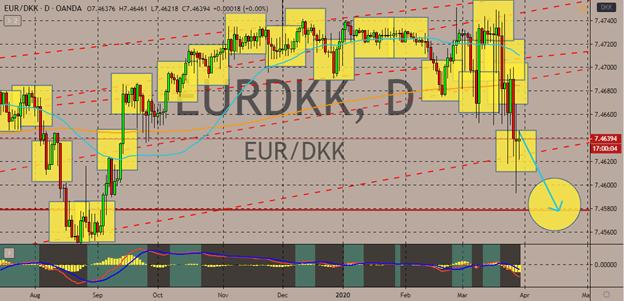

EURDKK

The euro is on the defensive against the Danish krone in the market. It appears as if the bulls have finally lost grip as 50-day moving average pivots and is now heading nearer the 200-day moving average. However, all remains uncertain as the number of coronavirus cases rally in Denmark, entering the country sooner than expected by health officials. This means that the Danish krone has the potential to extend to its resistance but is unknown whether it has the strength to break past it. As of writing, it’s reported that Denmark now has over 2,000 confirmed cases of COVID-19, rising faster than expected. Although, health officials fear that the first case of the virus has already been in Denmark long before it was confirmed. Suggesting that it could have already infected more, spreading unknowingly to people. And as for the bloc, its members have continuously called out for stimulus measures and support as the death toll continues to climb up.

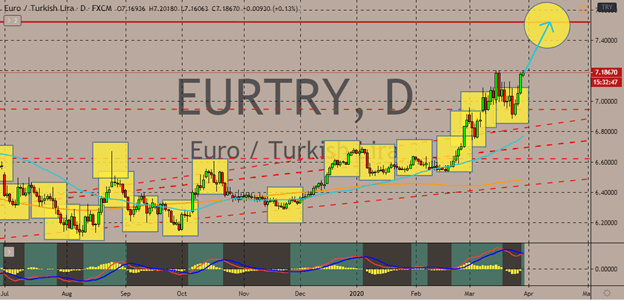

EURTRY

Apparently, despite the softer economic blow that Turkey will have, the Turkish lira remains on its backfoot against the single currency. The euro has been seen flattering against major currencies and other European currencies, but its performance against the Turkish lira remains widely bullish. According to a ce4ntral bank official from Turkey, the economy may be one of the least damage countries due to the pandemic. The Deputy Governor Oğuzhan Özbaş of the Central Bank of the Republic of Turkey said that the Turkish economy is still projected to post a better growth rate in the first quarter of the year. According to Özbaş, the strong January and February performance of the country will help buoy its GDP for the earliest quarter of the year. Meanwhile, the euro has recently seen its best week in more than 10 years against a number of currencies despite the major threat faced by the eurozone’s economies.

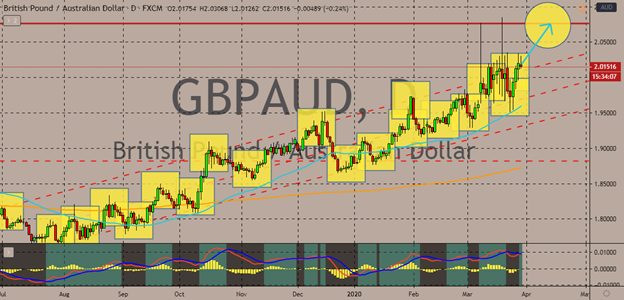

GBPAUD

The British pound continues to prevail against the Australian dollar despite the massive hurdles faced by the United Kingdom. Bulls remain on top as the 50-day moving average runs farther and farther away from the 200-day moving average, signaling continues upward momentum for the GBPAUD pair. Unfortunately for investors of the British pound, a rough road is expected at the British government says that the lockdown in the United Kingdom will last for months. England’s deputy chief medical officer said that things may not return to normal until Autumn, adding that even if the curve is already flattened, Britain must not suddenly revert back to the normal way of living. Meanwhile, the Australian dollar caused the pair to steady this Monday as it strengthens in the forex market. The Aussie is seen advancing against major currencies including the sterling. Support for the bears come from the hopes of further economic stimulus from the government.

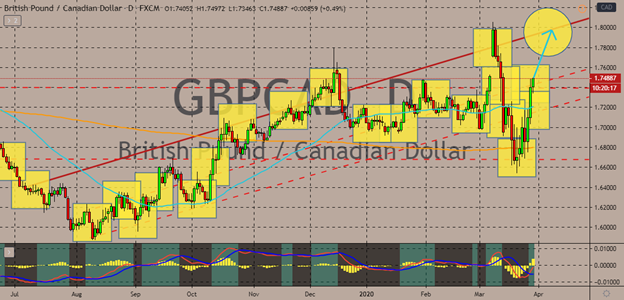

GBPCAD

The Canadian dollar is on the edge of its seat as bullish investors floor their gas pedals and push the pair higher in the forex market. Looking at the chart, it still looks like that the British pound has the momentum as the 50-day moving average advances further from the 200-day moving average. The sterling’s strength comes after investors benefited from the broad retreat of the US dollar. And the shocking news that Prime Minister Boris Johnson and the British Health Secretary Matt Hancock have contracted the virus didn’t deny the pound a strong finish against the Canadian dollar. Meanwhile, as the oil market continues to collapse this Monday, all isn’t well for the Canadian dollar. And despite the efforts of CAD investors to ride the risk asset recovery last week, the British pound remained on top. However, it’s still unknown whether the pound could actually break its resistance as the lockdown in Britain is reportedly expected to last longer.

COMMENTS