Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

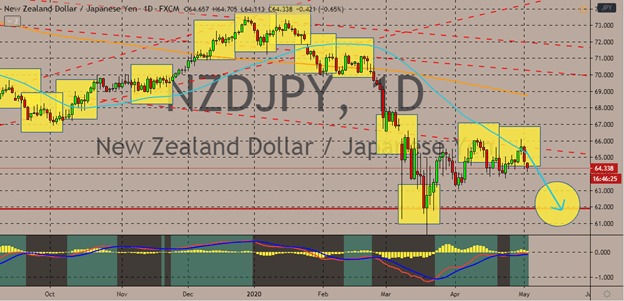

NZDJPY

The New Zealand dollar to Japanese yen exchange rate remains widely bullish despite the easing concerns regarding the global economy. The pair is heading towards its resistance level thanks to the recent news about the Bank of Japan last week. Bearish investors continue to hold the momentum of the pair as evident in the chart wherein the 50-day moving average plunged against the 200-day moving average. Moreover, the Bank of Japan expanded its monetary stimulus program last week. The threat of the US President Donald Trump to raise tariffs have slowed down the kiwi. Aside from that, the New Zealand dollar also suffers from the blow of the April ANZ business confidence report which reportedly sunk last week. The pair has the potential to make a sharp bullish reversal in the coming sessions as the New Zealand dollar receives support from the successful containment of the country’s government of the coronavirus.

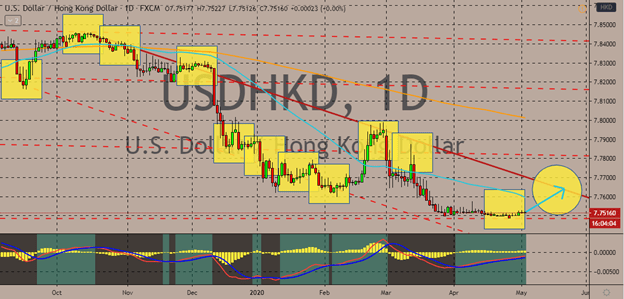

USDHKD

The Hong Kong dollar has endured a lot in the last year, yet it remains strong against the US dollar. However, the pair is expected to slightly rebound in the foreign exchange market as the Hong Kong dollar feels the pressure. Looking at the chart, the pair is widely bearish considering that the 50-day moving average remains significantly lower than the 200-day moving average. However, it’s worth noting that the HKD is pegged to the USD with the Hong Kong Monetary Authority maintaining it at its target rate. The Hong Kong dollar is also affected by the suffering US economy, which is currently facing its greatest economic crisis. To make matters even worse for Hong Kong, its economy might enter a tougher recession than prior projections. Hong Kong’s Finance Chief recently warned that the country’s gross domestic product for the first quarter could contract by 4% to 7% this year thanks to the ongoing coronavirus pandemic.

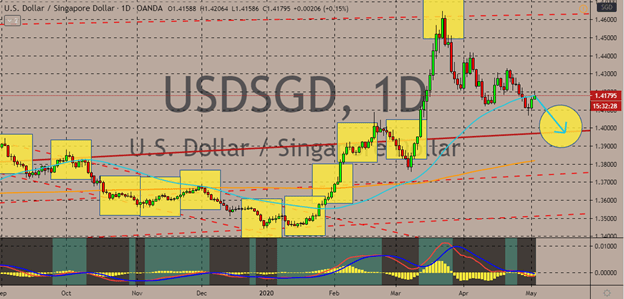

USDSGD

The USDSGD pair is currently gaining thanks to the renewed safe-haven appeal of the US dollar thanks to the threat of retaliatory tariffs from the US President Donald Trump. However, looking at the odds, the Singaporean dollar has better fundamentals to support it in the coming sessions. Late last month, the Singaporean economy produced better-than-expected results from its economy and compared against the US economy, it’s doing better. The pair’s current rally is only expected to last for a short time before it has a bearish reversal. Singapore’s unemployment rate only went up by 0.1% from 2.3% o just 2.4% in the critical first quarter of the year. Compared to the results produced by the American economy, Singapore’s figures are a relief to investors. Also, bearish investors of the pair are waiting for further guidance from the Singaporean manufacturing PMI for April which is scheduled to be released later today.

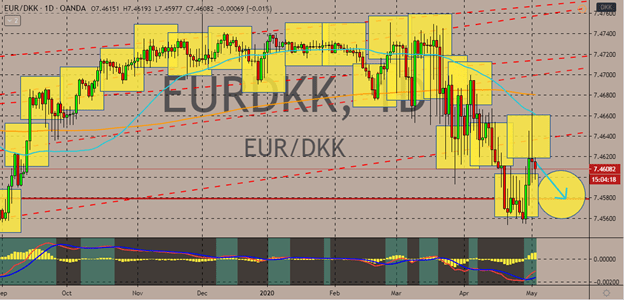

EURDKK

The singe currency to Danish krone trading pair is heading back down to its support levels once again. The pair is expected to hit the support are by the second half of the month. Bearish investors brushed off the devastating hit from the unexpected loss of the Danske Bank in the first quarter of the fiscal year. According to reports, it’s the first loss of the bank since 2014 and this time, a jump in impairment charges were triggered by the coronavirus pandemic. Investors are looking at the brighter side of the spectrum. See, since Denmark loosened its coronavirus lockdown restrictions mid-April, the spread of the virus has fortunately not accelerated. Two weeks ago, the country gradually reignited its economy, reopening daycare centers, schools, hairdressers, and other small businesses. Scientists and experts say that the are no signs that the gradual reopening caused a bigger spread of inflation in the country and that there are no signs of another wave of cases.

COMMENTS