Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

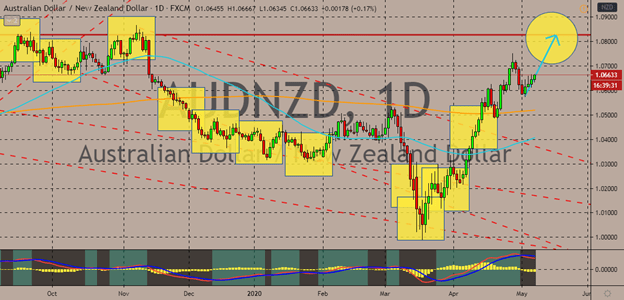

AUDNZD

Bullish investors of the AUDNZD trading pair are holding on to the momentum and are eyeing the pair’s resistance which currently stands on levels last seen in November 2019. Looking at the chart, it appears that the 50-day moving average has pivoted and is advancing towards the 200-day moving average which has consistently been on top since the beginning of the year. Trade tension between Beijing and Washington has an undeniable impact on the Australian dollar. As the tension escalates, the antipodean Aussie becomes more and more vulnerable. Recently, Washington has yet again considered slapping economic sanctions and measures against the Chinese government. Trump and his officials say that Beijing should be held accountable for failing to contain the novel coronavirus outbreak in Wuhan late 2019 which has now become a global problem as it expands into a full-blown devastating pandemic.

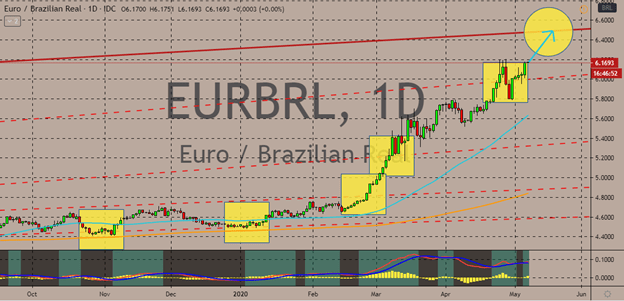

EURBRL

The euro to Brazilian real has continuously seen gains in the previous sessions. And fortunately for bullish traders, the pair is still projected to advance towards its resistance level. It appears that the fundamentals are working against the Brazilian real this time – the controversies about the country’s far-right president, the rising number of coronavirus cases and deaths in Brazil, the performance of its economy, and the interest rate decision of the Brazilian central bank yesterday. Traders of the pair were surprised when the Banco Central do Brasil announced that it has decided to slash its interest rates from 3.75% to just 3.00%. The move surprised investors as the rate cut was deeper than the projected 0.5 basis point cut, weakening the Brazilian real in the foreign exchange market. Moreover, bulls have seen an appreciation of almost 38% for the pair for a year as the Brazilian real evidently remains vulnerably on the defensive.

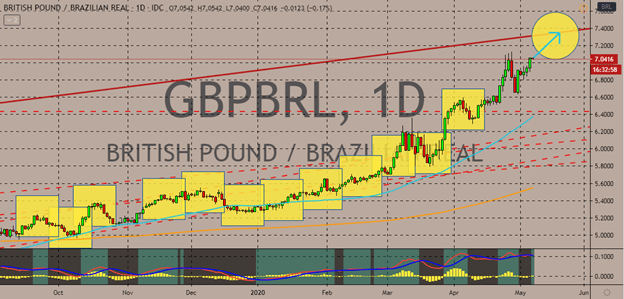

GBPBRL

The pair is currently steadying as investors brace themselves ahead of the Bank of England’s interest rate decision, inflation report, and MPC meeting minutes. However, looking at the odds of both currencies, it appears that the pound sterling has more steam in its engines to run the pair. It’s believed that bullish investors would regain their momentum and buoy the pair upwards to its resistance area. Later today, the Bank of England is set to unveil its interest rate decision and it’s widely projected that the bank will leave it unmoved. Yesterday was also harsh for the pound as it feels the tragic drop of the April construction PMI from around 39.3% prior to just 8.2%. Meanwhile, considering the deep rate cut unleashed by the Brazilian central bank, the real is bound to falter in the coming sessions. That, coupled with the current economic turbulence and political turbulence faced by Brazil, places the real in a rather complicated predicament.

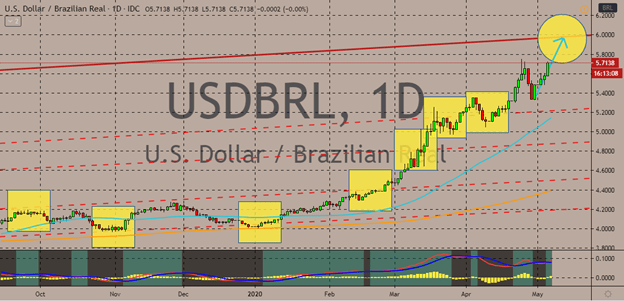

USDBRL

Thanks to the unexpected deeper rate cut from the Banco Central do Brasil, the US dollar to Brazilian real has gained a strong bullish momentum. The pair is heading towards its resistance and is expected to reach it before the second half of May. As of writing, the Brazilian real is viewed as one of the worst players among the most traded currencies in the foreign exchange market. Since this year, bears stood no chance as the Brazil real continues to depreciate. Yesterday, the Brazilian central bank unleashed a 0.75 basis point rate cut that caused the real to buckle against the buck. Meanwhile, the US dollar would most likely dominate the currency market according to recent poll on experts. Investors will continue to prefer the safety of the safe-haven asset for at least three more months as the global battle against the COVID-19 continue. This means that the Brazilian real will have complications in trying to recover its losses against the greenback.

COMMENTS