Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

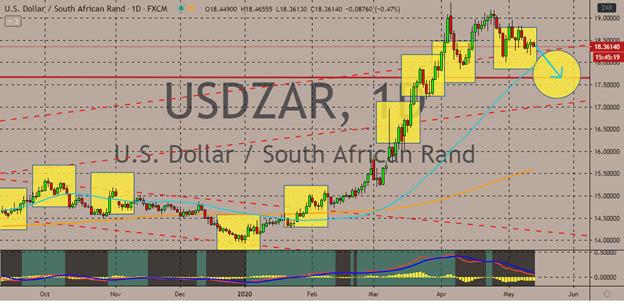

USDZAR

Thanks to the adjustment in South Africa’s lockdown, which allowed some industries to continue operating, the US dollar to South African exchange rate eases. The move allows the rand to keep the greenback on its back foot as it maneuvers to take back its losses. Since March, bullish investors have successfully propelled the 50-day moving average significantly higher than the 200-day moving average, and now bears are determined to stop it from further advancing. Moreover, the South African government has lowered the closure restrictions, allowing sectors such as ports, essential maintenance, and basic material sectors to resume their production or activities. However, the recovery of the economy and sectors re expected to remain protracted. Experts also question whether bullish investors have enough strength to force the USDZAR trading pair lower as the 400 trillion-rand stimulus package weighs on the South African currency.

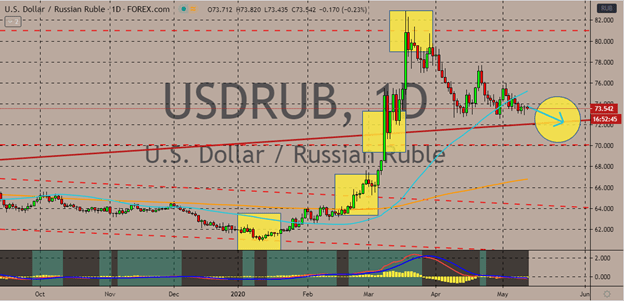

USDRUB

The Russian ruble continues to force the US dollar on the defensive as it takes the chance to strengthen along with the rebounding oil market. The favorable sentiment in the Russian stock market, or Moscow Exchange, is helping launch the Russian ruble in the foreign exchange market. Bearish investors are preparing to reel in the pair to its support levels later this month as they attempt to recover their losses from the US dollar’s rally in March. Technically speaking, the pair is still widely considered bullish as the 50-day moving average is seen advancing farther away from the 200-day moving average. Although bears are looking to prevent further advancements and possibly even curve the direction of the 50day MA. The Russian ruble is also significantly supported by the recent interventions of the Russian central bank on behalf of the country’s Ministry of Finance, buying 193 billion Rubles from the market until early June.

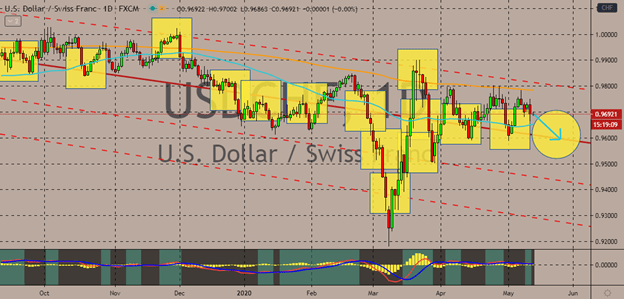

USDCHF

Despite the tremendous frustrations of the Swiss National Bank about the continuous appreciation of the Swiss franc, the USDCHF exchange rate remains bearish. The pair is evidently on track to hit its support level later this May as the downside pressure builds up. As of writing, the pair is currently steady as both currencies appear to be neutral. After climbing in the previous sessions, the US dollar has started to decline and slow down thanks to the concerns of investors about the possibility of the United States Federal Reserves pushing the official interest rates below zero. Adding further pressure to the greenback is the fresh struggle reported in the US Treasury bond yields. But looking at the bigger picture, it seems that the pair won’t be break past its support area thanks to the heightened efforts of the Swiss National Bank to deviate the safety inflows which will help halt the appreciation of the beloved safe-haven currency.

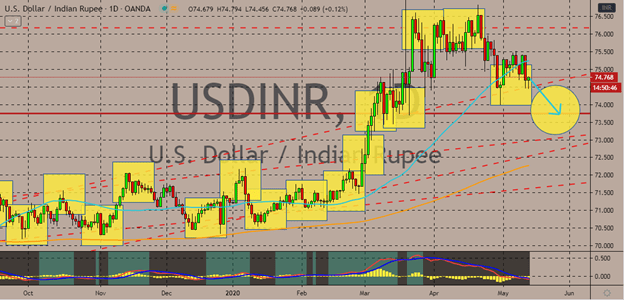

USDINR

Even with the upset faced by the Indian rupee this Wednesday’s trading, the USDINR pair is projected to crash to its support level soon. The relative weakness of the Indian rupee today is the recent downside in the country’s stock market. However, looking at the fundamentals, it has more potential than the US dollar. The precious safe-haven currency is feeling the burn of concerns about negative interest rates from the US Federal Reserve. And the gradual reopening of other major economies across the globe has also helped deteriorate the safety appeal of the buck. As for the Indian rupee, another factor that’s holding it back is the billion-stimulus relief package announced by Indian Prime Minister Modi yesterday. According to local reports, the authorities have prepared a staggering 20 trillion Indian rupee economic stimulus, or about $265 billion, that will be allocated for labor, land, small, and medium-sized businesses affected by the pandemic.

COMMENTS