Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

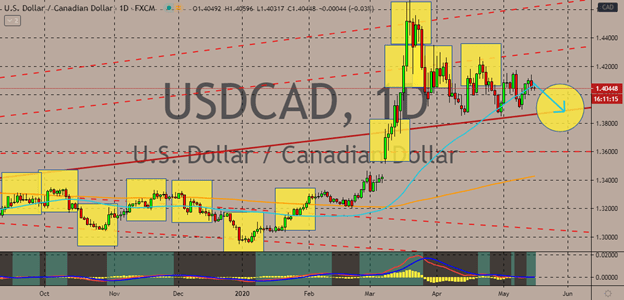

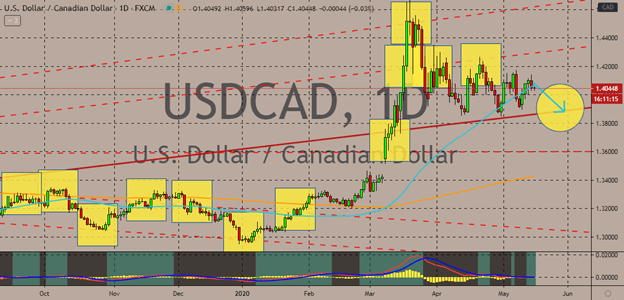

USDCAD

The US dollar to Canadian dollar exchange rate is back on bearish tracks this Friday. The Canadian dollar continues to outperform most of its currency pairs in the forex market including the also strengthening US dollar. As of writing, the pair is seen steadying as bulls work to lessen the gains of bears. However, the USDCAD pair is widely expected to crash down to its support level in the coming sessions as the strong sentiment in the crude market supports the loonie. It’s very evident that the pair is bullish since the 50-day moving average remains dominantly above the 200-day moving average. But the Canadian dollar is hustling to halt further appreciation for the USDCAD pair. Moreover, despite the dismal results from the US economy, the greenback is also building up thanks to the recent comment of the US Federal Reserve’s Chairperson, Jerome Powell. The Fed boss eased the concerns of investors and assured that negative rates aren’t in the table.

NZDUSD

The kiwi to greenback trading pair is under pressure as bearish investors continue to build up strength to gain momentum. See, the US dollar has received a boost thanks to the recent statement of Jerome Powell, Fed Chair, about the possibility of negative rates. Powell made it clear that the Federal Reserve is expecting the recovery of the American economy to be shaped like a U, not a sharp V that the markets have been getting on. The investors of the buck immediately brushed off the negative results shown on the weekly jobless claims report from the United States yesterday. This reaffirms that the buck is still the most dominant currency during this pandemic. Meanwhile, the Reserve Bank of New Zealand confirmed that it will continue to talk with other financial institutions about the preparation for negative interest rates in the near future. In the meantime, the kiwi reserve bank is also doubling down on its money-printing program to about $60 billion.

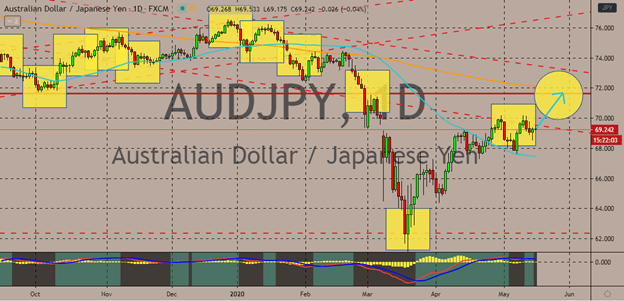

AUDJPY

Mixed signals from BOJ’s Haruhiko Kuroda has painted uncertainty on the direction of the Japanese yen. This gives an opportunity for the Australian dollar to gain against it. The pair is still technically bearish considering that the 50-day moving average appears to have plunged against the 200-day moving average. The BOJ head left questions in the market this week as he flashed mixed hints. The governor stood firm and ready to ease its monetary policy even further if deemed necessary. However, he also ruled out the need to cut the Bank of Japan’s official interest rates even further at the moment. This leaves questions as to when the bank will do so. However, as of writing, the Australian dollar is also bombarded with concerns mainly about the recently released employment change report for April. Yesterday, investors were left speechless following the massive plunged of the country’s employment change from 5.9k to a devastating -594.3k.

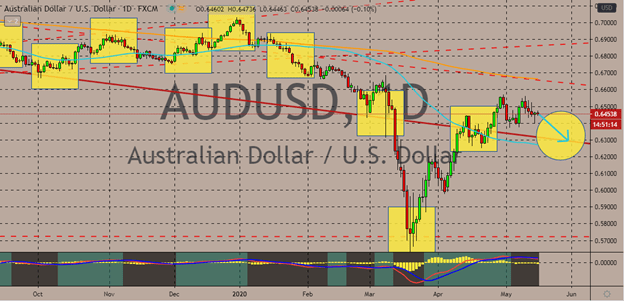

AUDUSD

The unfortunate crash of the Australian employment change report has placed the Aussie on its back foot. However, despite the broader strength of the greenback in the forex market, the pair remains relatively steady this Friday. Perhaps the recent improvement in the Chinese industrial production report for April has caused the pair to move gradually today. Moreover, as the US dollar continues to prevent the Australian dollar to recover. The pair continues its bearish path as the 50-day moving average trades significantly lower than the 200-day moving average. Apparently, the once again rising tension between Beijing and Washington, coupled with the concerns about the second wave of infections have strengthened the safe-haven appeal of the US dollar, fortifying it and sealing the fate of the AUDUSD trading pair. The Australian dollar was caught off guard as it was previously poised to continue its gains.

COMMENTS