Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

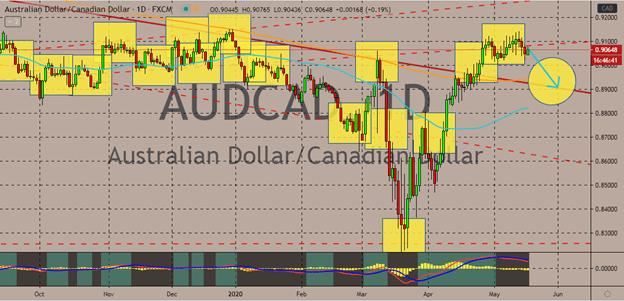

AUDCAD

The Australian dollar to Canadian dollar is gradually declining as the antipodean currency feels the strain of the looming recession and weak economic figures. To make things sweeter for bears, the stabilizing crude market is helping to buoy the Canadian dollar against the Australian dollar. Looking at the pair, it’s still considered bearish despite the recent surges and gains gotten by the Aussie. Technically speaking, the 50-day moving average may have slightly risen, it’s still notably lower than the 200-day moving average. However, investors of the pair are still holding tight this Monday, waiting for further guidance that could help determine the direction of the pair. See, the Reserve Bank of Australia is scheduled to release its meeting minutes today. Aside from that, Canada is also scheduled to release its consumer price index report for April, and it’s projected that the month-over-month CPI will improve slightly from -0.6% to -0.5%.

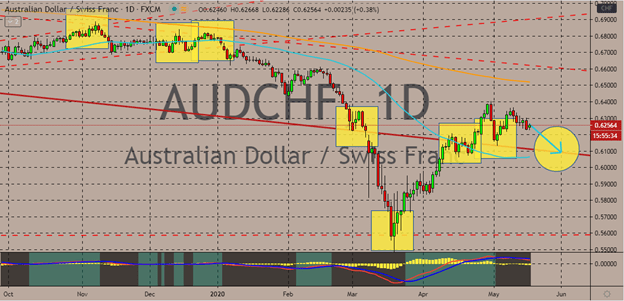

AUDCHF

As of writing, the Australian dollar is slightly gaining against the Swiss franc ahead of the scheduled RBA minutes today. However, the Australian dollar is widely expected to face a bearish track in the coming sessions as investors feel the immense pressure of the recession. Assets with similar risk profile as of the Aussie are also seen gaining, but the thing is, the global recession’s impact could easily wipe out the gains. It will be interesting whether the pair could gain from the scheduled RBA’s meeting minutes’ release as the bank recently left its rates unmoved after making sharp cuts earlier this year. Another thing to be concerned about for bullish investors is the possibility of other stimulus measures from the Reserve Bank of Australia. It appears that the prospects of tightening the official rates are not feasible at the moment. The Aussie’s main source of weakness is the catastrophic results and forecasts from the country’s labor force.

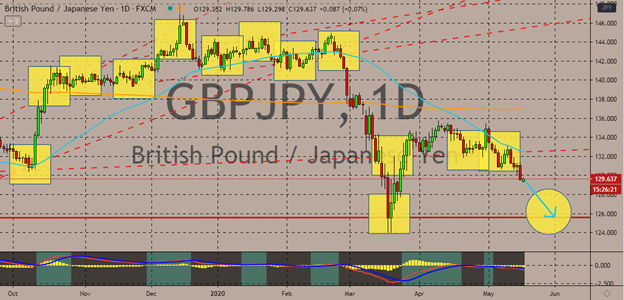

GBPJPY

The positive results from the Japanese economy are making it really rough for the British pound to force the pair to reverse. Although as of writing, the British pound to Japanese yen exchange rate is gaining. But things are expected to turn around soon as the Japanese yen receives a boost from the stronger than projected results of the country’s gross domestic product report for the first quarter. Yesterday, Japan’s Cabinet Office released the first quarter GDP report showing notable improvement from -1.9% to just -0.9% on a quarter-over-quarter basis. While on an annual basis, the Japanese GDP also rose from -7.3% to -3.4%, significantly surpassing projections of -4.6%. Investors of the British pound are bracing themselves for the upcoming employment change report for March and the claimant count change for April scheduled tomorrow. The claimant count change is expected to spike from 12.1K to 150.0K, a bearish sign for the sterling.

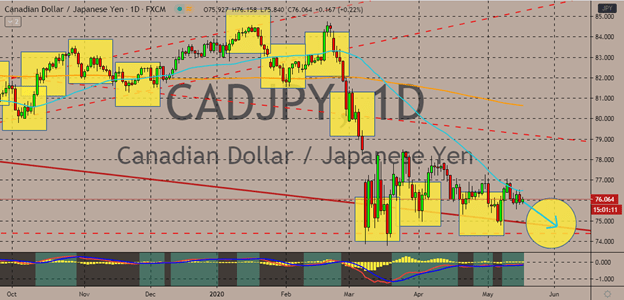

CADJPY

Looking at the fundamentals that are supporting the two currencies, it seems that it will be a rough tug of war between bulls and bears. See, the Japanese yen is backed up by the strong results from its gross domestic product report. Meanwhile, the steady and commendable come back of the crude market is supporting the Canadian dollar. As of the moment, the pair is seen steadying and slight inching as the Canadian dollar preventing the pair from dropping to its support. However, weighing those fundamentals, it appears that the Japanese yen should soon retake the momentum and actually force the pair lower towards its support levels. Bears remain in control of the pair as the 50-day moving average continues to dive deeper against the 200-day moving average. It appears that bullish traders are having a rather difficult time trying to buoy the pair once again. But the beloved Canadian dollar could actually see an opening to gain if the scheduled Japanese national core consumer price index for April falls deeper than projected.

COMMENTS