Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

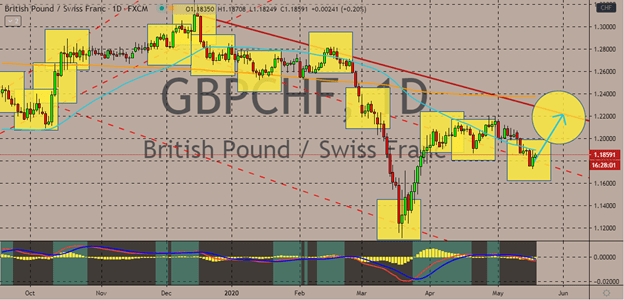

GBPCHF

The British pound rebounds against the Swiss franc thanks to the renewed optimism in the markets. It appears that bulls have finally regained their footing in the recent session thanks to new news about the possible vaccine for the coronavirus or SARS-COV-2. The news has caused a surge in the market mainly on stocks, commodities, and risk-on currencies. Unfortunately for the Swiss franc, the news will be rather detrimental to its strength as investors would most likely come out of hiding from safe-haven assets. Bullish investors of the pair are looking to prevent the 50-day moving average from further sliding lower against the 200-day moving average. However, the prospects and speculations of negative rates from the Bank of England are limiting the rally of the pair. With that pace and momentum, the British pound to Swiss franc exchange rate should hit its resistance by the end of the month or by the first few days of June.

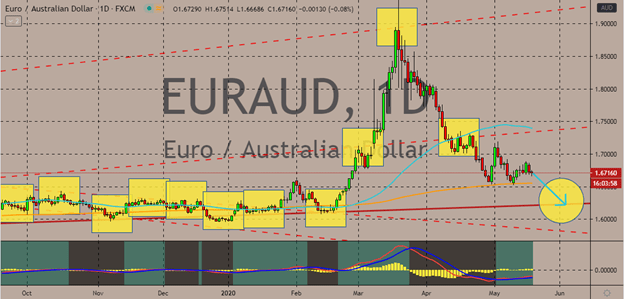

EURAUD

Looking at the fundamentals behind each currency, it appears that both are actually strengthening, making it a difficult tug of war between bullish and bearish investors. However, based on their prospects, the Australian dollar appears to have the upper hand in the pair. It’s believed that the exchange rate will eventually hit its support levels in the first week of June as the Aussie continues to surge. Bearish investors are hustling to force the 50-day moving average to take a U-turn and head lower towards the 200-day moving average. See, the Australia dollar’s direction is widely influenced by what is going on in mainland China and global growth. However, it’s worth noting that the main source of the risk on appetite in the market right now is the news about the vaccine, so, it’s worth noting that it will still take months for the reported biopharmaceutical companies to mass-produce them. Meaning that the risk-on appetite isn’t unstoppable.

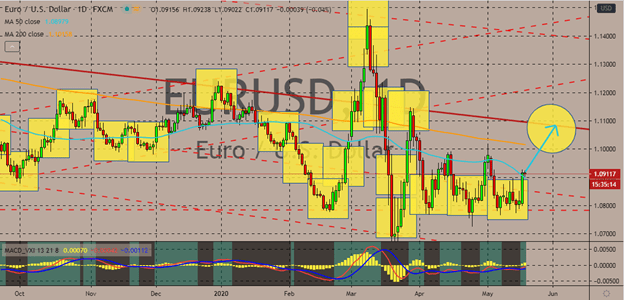

EURUSD

The odds are working in favor of bulls this time; the US dollar is losing some of its steam thanks to news about the coronavirus vaccine and the euro is strengthening thanks to recent news about the bloc and the revived risk-on sentiment in the global market. Looking at the chart, it appears that bulls haven’t had much success in propelling the pair higher. This time, the euro is looking to buoy the 50-day moving average once again and get near the 200-day moving average. Investors of the single currency are becoming more and more optimistic as the bloc takes a major step forward in creating a unified and consensus coronavirus stimulus program, or otherwise coined as coronabonds. Just recently, both France and Germany proposed a COVID-19 relief program worth $500 billion to support the recovery of the eurozone. The funds for the support program would reportedly be raised by the European Commission through bond-buying programs.

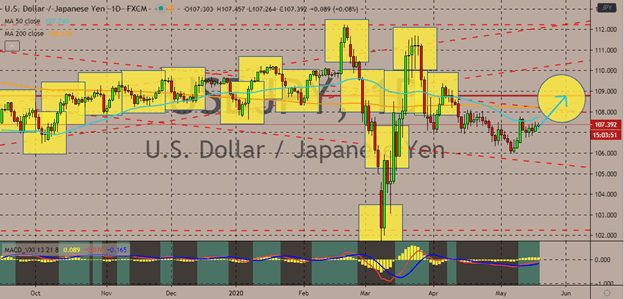

USDJPY

The Japanese economy has entered an unfortunate technical recession yesterday according to the recent data released by the country’s Cabinet Office. This will, of course, drain the strength and the safe-haven appeal of the Japanese yen. This gives the US dollar, also a beloved safe-haven asset, the upper hand despite the faltering demand for such assets. Looking at it at first glance, an economic slump might work well for the Japanese yen as it could attract more investors. However, it isn’t that simple. A technical recession means places the vulnerable Japanese yen on the defensive as the unstable economic status of the economy turns off investors. Also, the devastating recession should also prompt the Bank of Japan and the government to release more economic stimulus which could be very detrimental to the direction of the Japanese yen. It’s believed that the pair will climb to its resistance by the end of May or perhaps by the first few days of June.

COMMENTS