Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

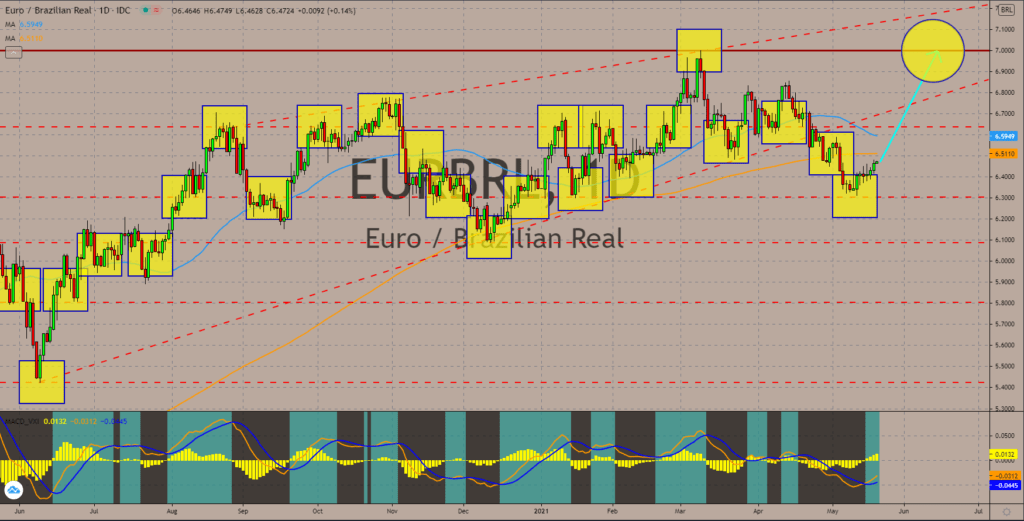

EURBRL

Analysts are expecting this week’s economic data to push the EURBRL pair higher towards March 09’s intraday high of 6.9992. The Eurozone’s numbers for the GDP and CPI were in line with the estimates. However, the reports lag compared to other developed economies like China and the United States. For the first three (3) months of fiscal 2021, the trading bloc contracted -1.8% year-over-year (YoY). This follows Q4 2020’s decline of the same figure. Meanwhile, consumer price index (CPI) in April was up 1.6% on an annualized basis. This has been the largest monthly increase in prices of basic goods for the past two (2) years. Still, the reported number is below the European Central Bank’s annual headline inflation target of 2.0%. The result was in reverse to the United States, which experienced a spike in CPI data in April at 4.2%. The MACD indicator signals a short-term increase in the EURBRL pair while the MAs act as key resistance areas.

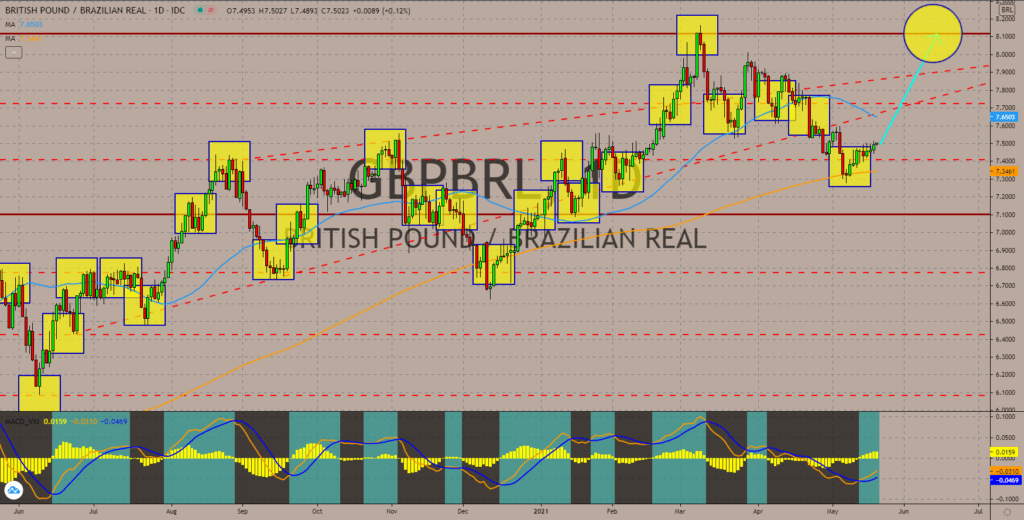

GBPBRL

The UK CPI soared to its highest level during the pandemic at 1.5% in April and beating estimates of 1.4%. However, the figure failed to reach the Bank of England’s 2.0% inflation target. While the S&P 500 Global anticipates a massive economic recovery this year, short-term risks remain which dampens investors’ optimism. According to the National Institute of Economic and Social Research (NIESR), the UK is at risk of losing around 700 billion British pounds in economic output due to COVID-19 and Brexit. Concerns over the coronavirus pandemic have been alleviated by the rapid vaccination program by the UK government. Around 57% of the entire population has received at least one (1) vaccine jab while 31% were fully inoculated. But the economic impact left by the country’s withdrawal from the European Union is expected to become more visible. The 200 MA prevented further decline in prices, which added to bullish sentiment on GBPBRL.

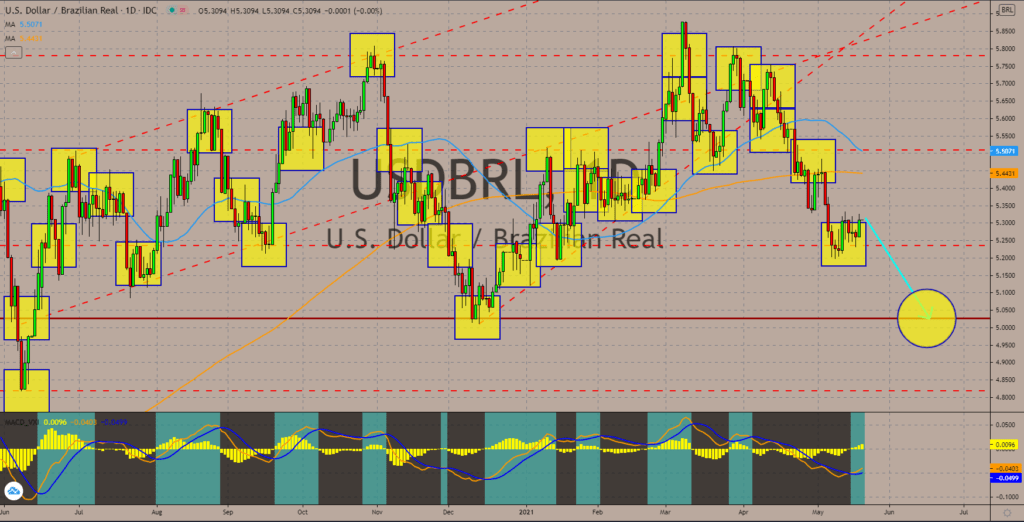

USDBRL

The Brazilian government revised its forecast for both the GDP and inflation for fiscal 2021. The expectations were 3.5% and 5.05%, respectively, which are higher from the 3.2% and 4.42% prior forecasts. While the economy is expected to have a more robust growth this year, risks will remain as higher inflation could push the central bank to raise rates which will slow down businesses. As a result, investors and traders will start to accumulate holding in the Brazilian real to hedge their portfolio against the rising inflation. As for the regional economic development, Colombia lifted its border restrictions with countries it shares borders with, except Venezuela. The free flow of people and services in South America could accelerate the recovery of the region from the coronavirus pandemic. The MACD indicator is expected to reverse the short-term trend to continue the downward momentum that started in April 2021. Meanwhile, a “Death Cross” is in hindsight.

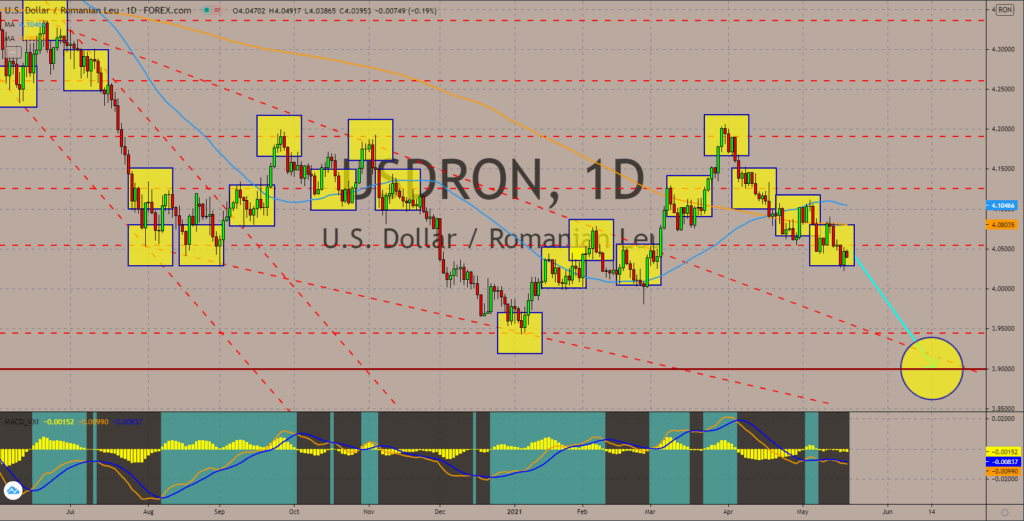

USDRON

The US dollar is under pressure over rising inflation. The latest consumer price index (CPI) data showed an increase of 4.2%, which was higher than the 2.0% annual inflation target by the Federal Reserve. While analysts believe that the US central bank will lift rates earlier than 2023, the short-term outlook remains uncertain. Earlier this week, US President Joe Biden unveiled a new plan to incentivized electric car manufacturers with a 174 billion budget. The amount is part of the overall 2 trillion infrastructure program that the president announced in March. Analysts worry that too much stimulus could lead to a surge in prices of basic goods, which, in turn, devalues the greenback. And to tame inflation, the Fed needs to increase the 0.25% benchmark rate. The USDRON pair broke down from the 50 and 200 moving averages despite the “bullish crossover” in April. Meanwhile, the MACD indicator shows the bears controlling the pair in the short-term.

COMMENTS