Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

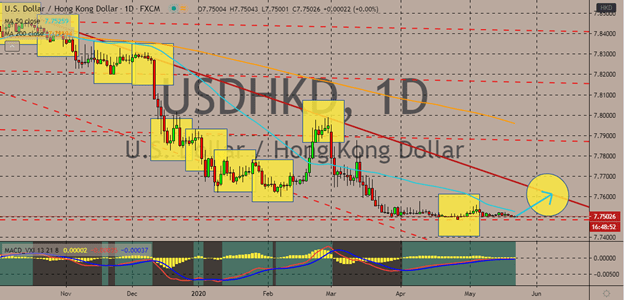

USDHKD

The US dollar continues to be on the defensive against the Hong Kong dollar. In fact, the greenback is seen struggling and losing against other currencies in the market but now it’s eyeing a broad recovery. However, it will have a rather complicated time as risk-on currencies receive a boost and the latest update about a coronavirus vaccine has eased the safe-haven appeal of the buck. It’s worth noting that the US economy is gradually reopening, which could mean a recovery opening for the beloved US dollar. Although the determination of US dollar traders may be strong, it’s really worth noting that the forces against its recovery are also strong. Meaning that the pair’s recovery could actually be short-lived, suggesting that if it reaches its resistance, it still has the chance to flatline again against the Hong Kong dollar. But considering that the virus will still take months before it could be released, it could still be a bullish signal for the USD.

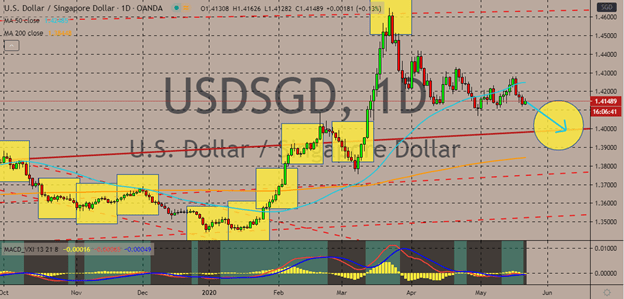

USDSGD

Based on the projections for Singapore’s gross domestic product due next week, it appears that the Singaporean dollar will get a much-needed boost in trading sessions. Bearish investors of the pair are working hard to prevent the US dollar to Singaporean dollar exchange rate from climbing even further. That means that the 50-day moving average will finally go down and touch the 200-day moving average. Also, the odds that are currently working against the greenback is paving the way for the pair to go down. See, the latest risk appetite renewal in the market has strained the strength of the US dollar, causing its safe-haven appeal to look less appealing. Earlier this week, the smaller than expected drop in Singapore’s non-oil exports for April gave the Singaporean dollar the upper hand. Official data from the country shows that the April year-over-year non-oil exports dropped from 17.60% to about 9.70%, better than projections of -5.00%.

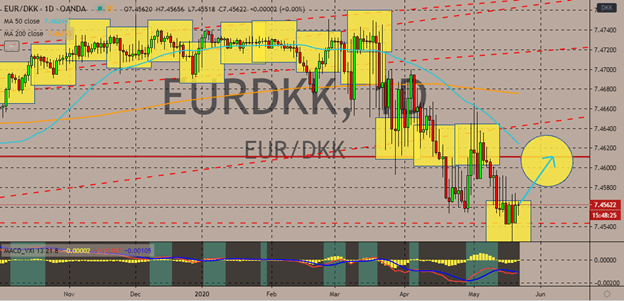

EURDKK

The pandemic has wreaked havoc and brought catastrophe to the eurozone and to the whole globe, but looking at it, it could be the key to fix the euro. The bloc could emerge stronger than ever before from the wreckages of the coronavirus pandemic. In fact, it could initially expose the difference of the members, but ultimately unite them for the cause of saving the region. This hope could bring strength to the euro now against the Danish krone and help it recover its losses. Bullish investors are eyeing the pair’s resistance level and possibly even forcing the 50-day moving average to make a U-turn and get back closer to the 200-day moving average. The main driver of the euro to Danish kroner exchange rate now is the recent news about Germany and France’s proposed €500 billion (or $543 billion) recovery fund to give grants to hard-hit sectors and will allow the European Commission to borrow on behalf of the European Union.

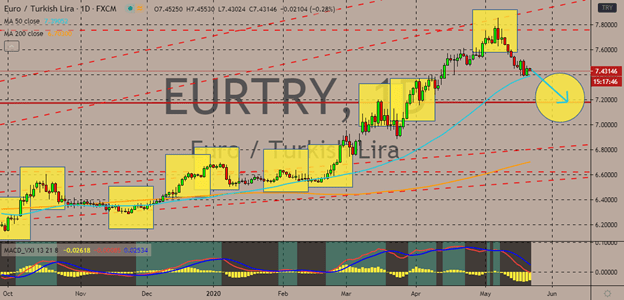

EURTRY

After reaching levels last seen during the country’s financial crisis two years ago, the Turkish lira finally surges, regaining its footing the trading sessions. Bears forced the pair to go down following the report that Turkey was nearing its $20 billion currency swap deal with the United Kingdom and Japan. In efforts to prevent the currency from plummeting, the Turkish government has stepped up its efforts and sought help from other countries to support the country’s reserves of foreign currency. Looking at it, the Turkish foreign currency reserves have greatly depleted by defense measures of the lira and to help support the economy amidst the ongoing coronavirus pandemic. According to local reports, the agreement between the two countries will amount to about $10 billion each. Meanwhile. Japan’s decision about the deal is expected to be announced by the Japanese Prime Minister Shinzo Abe later this Thursday.

COMMENTS