Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

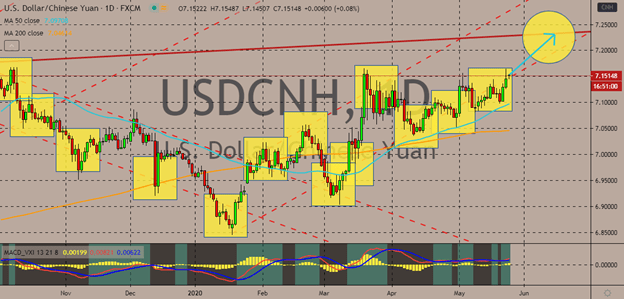

USDCNH

The nerve-racking trade tension between Washington and Beijing has propelled the US dollar to Chinese yuan exchange rate. Signs say that the pair will continue to head upwards, reaching its resistance and surpassing its highest levels from late last year. looking at the pair, it’s evident that it has just become bullish last month when the 50-day moving average climbed up against the 200-day moving average. The US dollar rises against a number of currencies in the market as mainland China accuses the United States of pushing geopolitical tensions to a new “cold war”. And the once again escalating anti-Beijing protests in Hong Kong is making it difficult between the two parties to patch up things. See, last week, China announced a newly published draft law that will remove the special administrative region status of Hong Kong and give the Chinese government more power in the Asian financial hub. A move that raised several eyebrows.

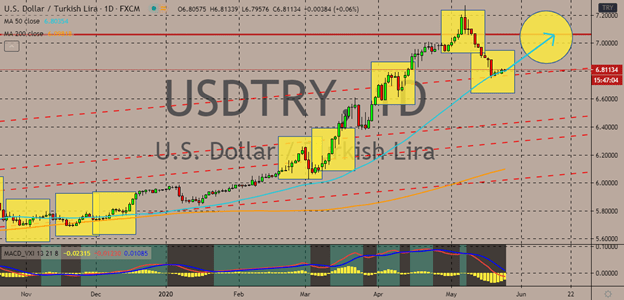

USDTRY

The recent rate cut from the Turkish central bank has stopped the recovery momentum of Turkish lira investors. As of writing, it’s seen that the pair is gradually gaining once again and this time, it’s believed that bulls will bring it back to its resistance. However, it’s still uncertain whether bulls will have enough strength to break the pair’s resistance as the Turkish economy gradually reopens. Meanwhile, late last week it was reported that the Turkish central bank eases its official interest rates, or otherwise known there as one-week repo rate from 8.75% to just 8.25% as expected prior. Bullish investors of the pair immediately saw an opening to gain again following the central bank announcement. However, as the move was still in line with expectations, it didn’t cost major losses for the Turkish lira immediately. Economists are still warning that the consecutive rate cuts are putting intense pressure on the Turkish lira and the country’s economy.

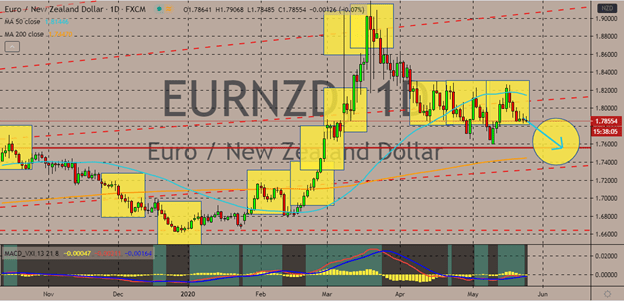

EURNZD

The New Zealand dollar rides the global market sentiment, rising thanks to the positivity from the coronavirus vaccine. On the other hand, the euro is weighed on by the concerns from the US-China trade war. Bullish investors are on the defensive as the eurozone gets battered by the ripples of the geopolitical tension between the two largest economies. Investors are really concerned about the possible impact of a tension that could further slow down the recovery of the eurozone. Looking at it, stock exchanges in the region last week ran roughly as the businesses that were benefiting from the reopening of the Chinese economy gets stuck in the escalating conflict. Although the kiwi is also pressured by the raging trade war, experts still believe that it will have the upper hand in sessions, forcing the bloc’s single currency to the support levels. If bulls continue to lose, the 50-day moving average could continue its descent towards the 200-day moving average.

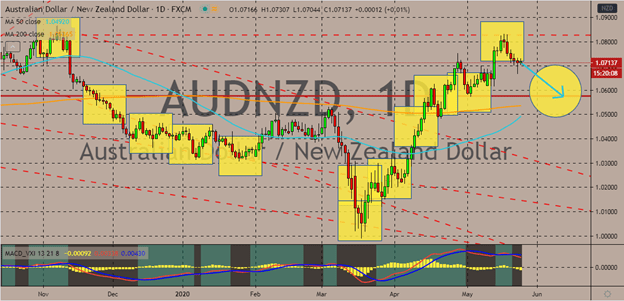

AUDNZD

Bullish investors of the pair weren’t able to hold on to the momentum and to their gains after the pair peaked to is resistance level earlier last week. Now, it’s believed that the pair will head down steadily to its support levels as the Australian dollar gets pressured by trade war-related news. Looking at the chart, it’s evident that the attempts of bulls to pull the 50-day moving average back higher against the 200-day moving average failed. The 50-day MA may have managed to make a reversal thanks to earlier gains, but it’s not expected to surpass the 200-day MA. The news about China slapping on tariffs to some Australian imports also pressured the Aussie. Local reports cite that Beijing inflicted an 80% tax on Australian barley over the next five years, threatening to disrupt the country’s annual AU$63 billion export market. Economists say that the battered country cannot afford to have a trade war with its biggest trade partner now.

COMMENTS