Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

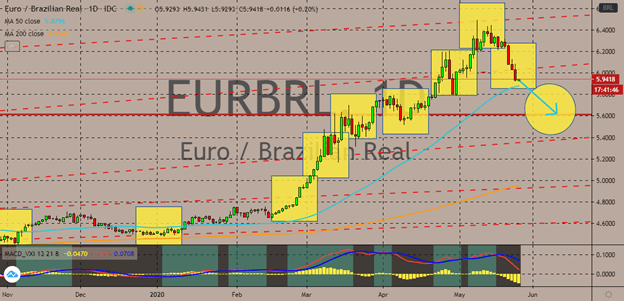

EURBRL

The Brazilian real gets a chance to recover thanks to the recently reported recession in German, the bloc’s biggest economy. The single currency steadies this Tuesday but is widely expected to contract in the coming sessions as investors worry about possible measures from the eurozone to save its powerhouse. Yesterday, the German statistics office reported that the country’s economy dropped from -0.1% to just -2.2% in the first quarter of the year thanks to the lockdown measures that closed businesses. The euro will continue to struggle as Berlin is also expected to see a deeper economic slump in the second quarter of the year. The news gives a much-needed opening for the Brazilian real who has also been struggling against most major currencies in the market, Bearish investors of the euro to Brazilian real exchange rate are hoping to force the 50-day moving average to make a downward reversal in efforts of minimizing prior losses.

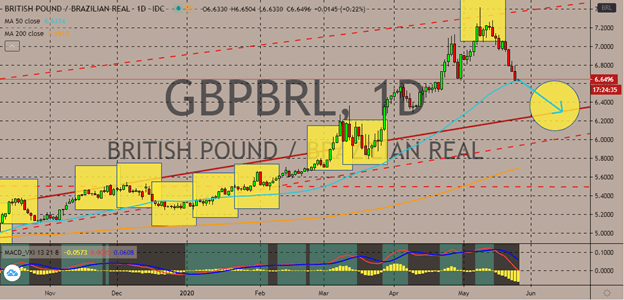

GBPBRL

The British pound to Brazilian real exchange rate slows down this Tuesday but is expected to continue to descend as bearish investors work to recover major losses from the pair’s first quarter rally. Looking at the fundamentals around the pair, the main factor that’s limiting the gains of the Brazilian real is the political headwinds that can be traced to Brazil’s president, Jair Bolsonaro. The recently reported Supreme Court investigation on Brazil’s far-right president, his family, and his links has caused the controversial resignation of the federal police’s head and Justice Minister Sergio Moro. The unending controversies about the President are weighing on the Brazilian real. On the other hand, the British pound is relatively quiet yesterday as the United Kingdom was off for a holiday. And there also no crucial reports scheduled for the British economy this week, suggesting that the pound would very much rely on other fundamentals.

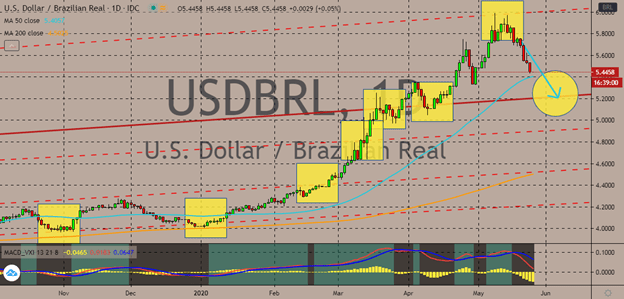

USDBRL

The US dollar continues to fall against the Brazilian real as bearish investors work to force the pair to hit its support. The safe-haven appeal of the US dollar isn’t working against the Brazilian dollar anymore. However, the political turmoil in Brazil is going to be a hindrance to the Brazilian real in the coming sessions. The controversies come from nonother than its far-right president that’s continuously advocating to keep the Brazilian economy working. There is a huge probability that the Brazilian real could weaken again against the US dollar once the pair reaches its support levels. Looking at the number of cases in Brazil, the country is suffering from an alarming surge in coronavirus deaths. As of writing, Brazil has now more than 375K confirmed coronavirus cases and the death toll is unfortunately over 23K. The make matters even more concerning, the number of new cases comes by thousands, putting more pressure on Brazilian President Jair Bolsonaro.

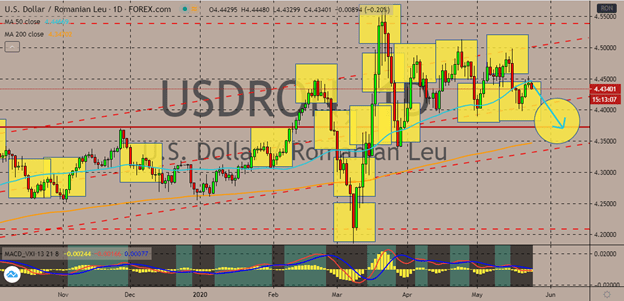

USDRON

Bulls and bears are having a tough time pulling the tides towards their favor. However, based on the descending wedge pattern that’s recently forming, the pair is widely projected to drop down to its support levels eventually. But the earlier rate cuts unleashed by the Romanian central bank this year is preventing the pair from plummeting sharply. Bearish investors are hoping to force the 50-day moving average to fall and get nearer the 200-day moving average. See, over the past two months, Romania’s central bank eased its official rates to support the virus struck economy. As of this week, there aren’t any important reports set for the Romanian economy. But the central bank’s monetary policymakers are expected to meet later this week and according to reports, local economists believe that the bank will most likely keep its rates unmoved. This suggests that the pair would mostly rely on the fundamentals affecting the greenback in the coming sessions.

COMMENTS