Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

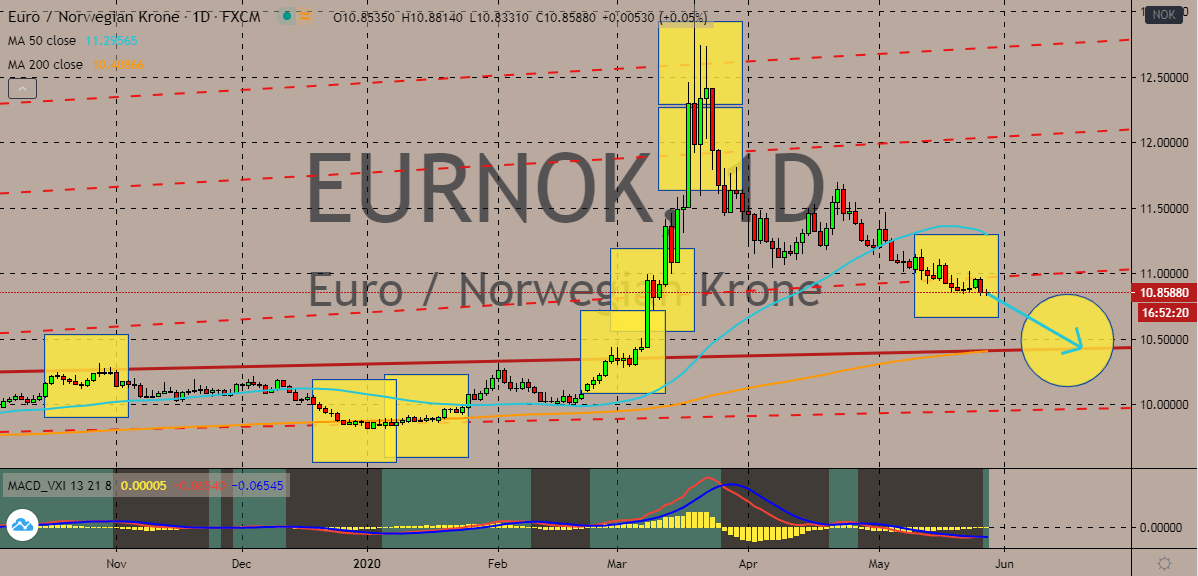

EURNOK

Right now, the fundamentals are mainly supporting the Norwegian krone, helping it to recover against the single currency. Technically speaking, the krone is a commodity currency, meaning that it’s very much affected by how the crude market moves. And looking at the current status of crude, it appears that prices are currently steady as of the moment. Another factor that’s supporting the Norwegian krone is its correlation with other currencies in the region which are also seen appreciating in the previous sessions. Also, experts believe that the Norwegian central bank won’t prefer negative rates. Instead, local economists believe that the Norges Bank will opt to boost liquidity in the market. With this momentum, bearish investors are widely expected to steadily and gradually push the euro to Norwegian krone exchange rate to its support level. Such a move will further force the 50-day moving average lower and nearer the 200-day moving average.

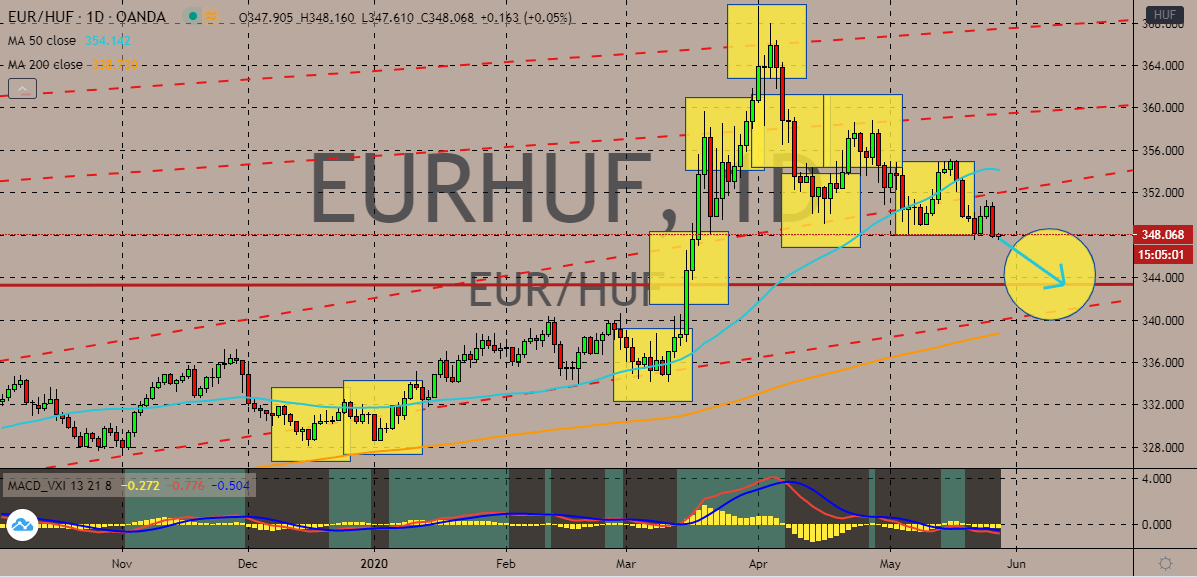

EURHUF

The euro continues to steadily slide lower against the Hungarian forint today after yesterday’s sharp fall. Bears are widely expected to take the pair lower to its support level in the coming sessions. Yesterday, it was reported that the National Bank of Hungary, or NBH, left its official interest rates unmoved at 0.9% this May. The NBH also didn’t change its overnight deposit rate of about -0.05% in line with prior forecasts from economists. According to the National Bank of Hungary, it will use government bond purchases instead of deploying interest rate changes. The NBH’s Monetary Council said that its assessment found that the deposit rate and interest rates were still appropriate and are also in line with the objectives of the national bank. After the news broke yesterday, the euro to Hungarian forint trading pair immediately dove in the sessions. Bearish investors of the pair are looking to force the momentum in favor of them.

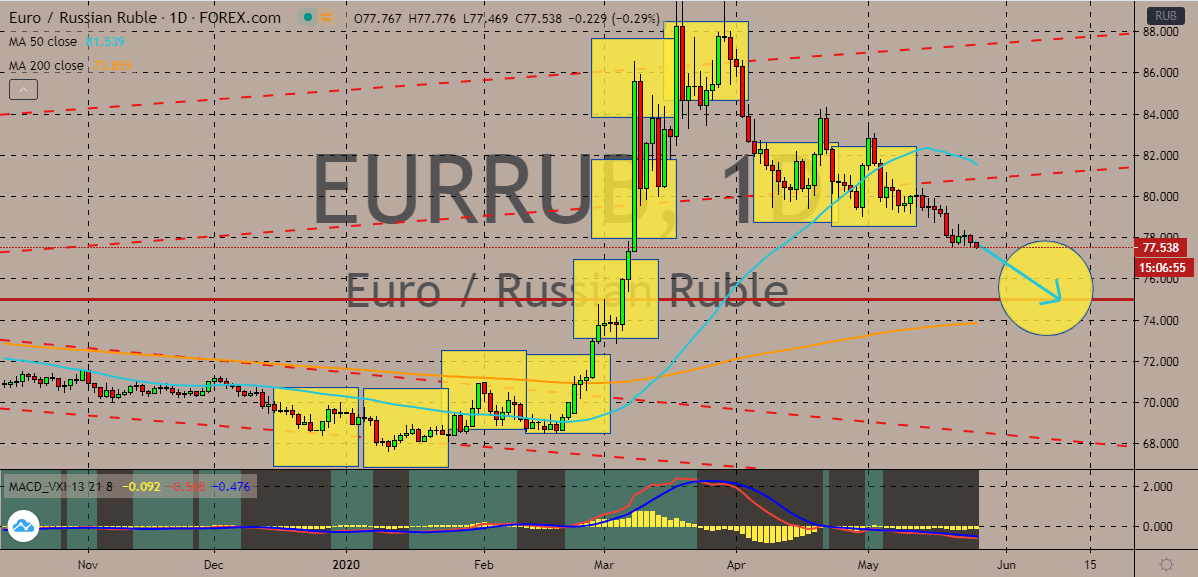

EURRUB

High optimism in the Russian market is helping the ruble to take down the euro in sessions. The pair is bound to go down to its support levels gradually. The higher investor confidence in Russia, plus the renewed risk appetite and the steady recovery of the global oil market is working in favor of bearish traders of the pair. The Russian ruble is performing well in the foreign exchange market, it’s seen gaining gradually against most major currencies, not just the euro. Meanwhile, the euro is bound to weaken thanks to the trillion-euro recovery plan to help the eurozone. Just recently, the German statistics office unveiled that the country is on a deep economic slump. In fact, the current recession is even worse than the financial crisis. So, just today, Ursula von der Leyen, the chief of the European Union, proposed the post-virus fund package for the region. Investors are waiting if other leaders will approve the massive and costly support plan.

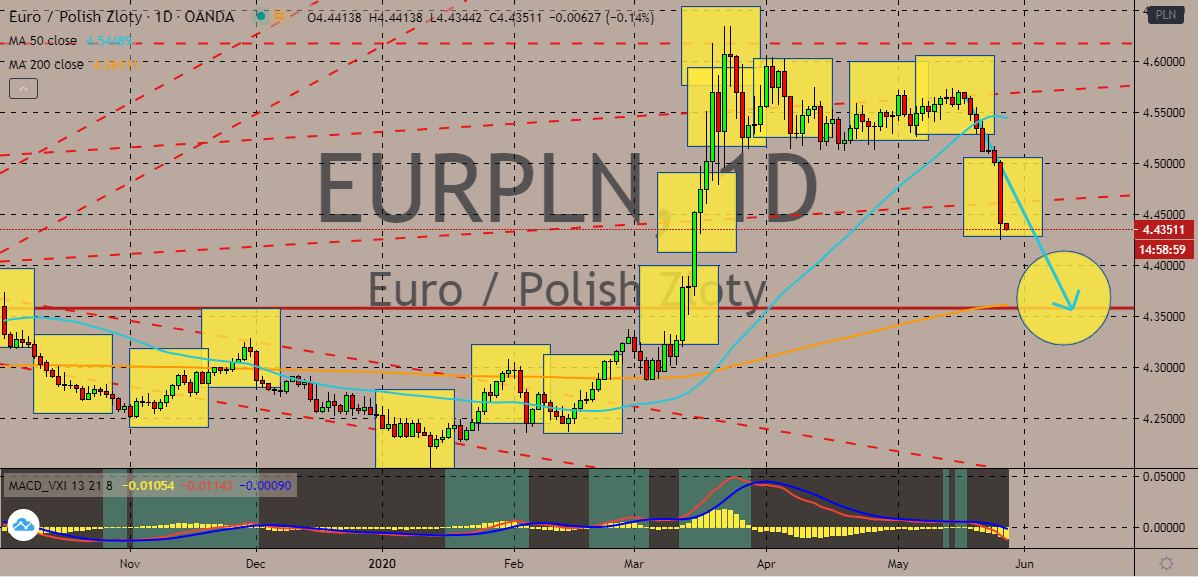

EURPLN

The Polish zloty surged against the euro yesterday as European economies start to reopen once again. Bears are looking to reel in the pair lower to its support area by the first half of June. The zloty is currently trading at its highest level since March against the euro this Wednesday. The zloty has regained about half of its losses against the euro. With most economies in the region starting to gradually reopen, the currencies are also recovering. But looking at the performance of the Polish zloty earlier this month, it’s evident that it had a rough time trying to redeem itself against the single currency. Luckily, bears were able to gather momentum to eventually force the pair lower. It appears that the recent decision of the Hungarian central bank helped boosted the Polish zloty, giving it strength to rally against the bloc’s euro. It was reported that the National Bank of Hungary left its interest rates unmoved, supporting the forint and zloty in sessions.

COMMENTS