Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

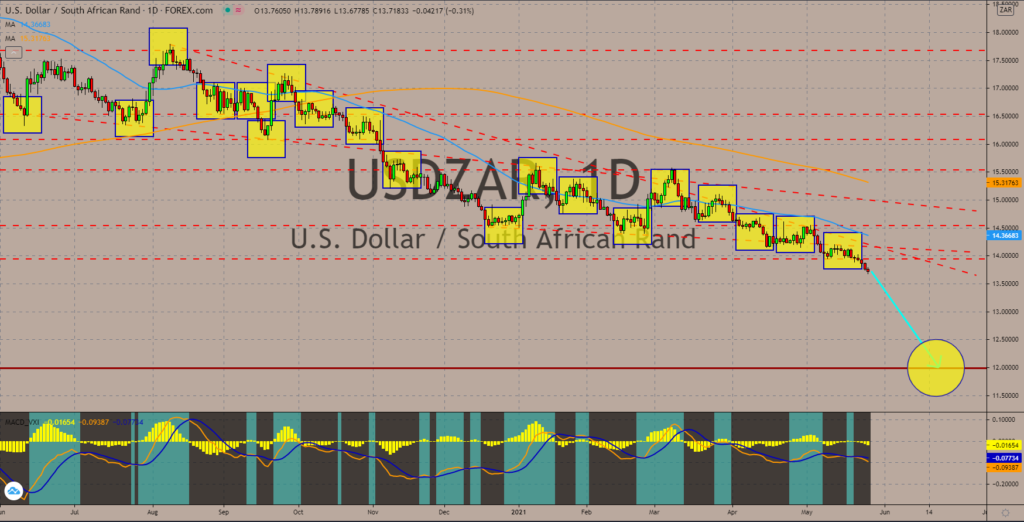

USDZAR

Despite the positive readings on US reports on Thursday, May 27, the strong demand for rand will outweigh the optimistic forecast. The catalyst for the bullish sentiment on South Africa’s currency was the credit rating from Fitch. The agency maintained a “Negative Outlook” in the short to medium-term and a “BB-“ grade. Johannesburg grapples with a more contagious COVID-19 variant that resulted in a new lockdown in Q1. The South African government has provided relief measures to keep the economy afloat but led to a high debt burden. Vaccines were also secured, but the delivery will only start in the second half of fiscal 2021. Fitch Ratings is not expecting full recovery anytime soon with 4.3% growth expected this year and 2.5% in 2022. Last year, South Africa slipped to the third spot of Africa’s largest economies after contracting -7.0%. The USDZAR pair will continue to trade below the 50 MA, which is supported by the MACD indicator.

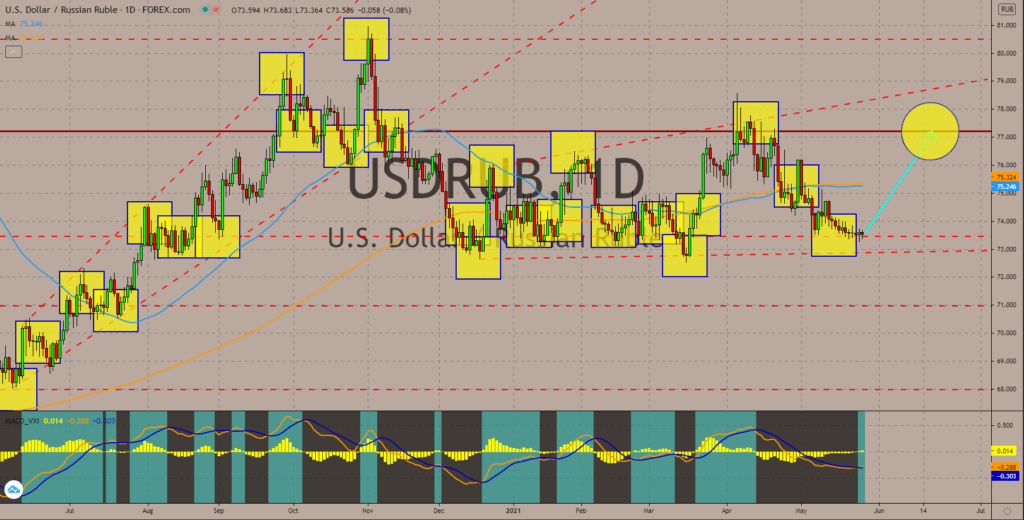

USDRUB

The World Bank sees the Russian economy accelerating at a faster pace in the current fiscal year with a 3.2% growth. Furthermore, a 3.2% economic expansion is also anticipated in 2022. The 2021’s consensus estimate is higher by 0.3 percentage points compared to the initial forecast of 2.9%. This is major news for investors and traders as Moscow contracted by 3.0% during the pandemic year. The World Bank added that economic sanctions imposed by western powers against Russia will have a minimal impact on the economy. Meanwhile, the country’s central expects GDP growth near 4.0% in 2021, which resulted in a 50-basis points hike to 5.0% in April. As for the technical, the 50-day and 200-day moving averages are still trading in a parallel direction around the 75.300 price area. As a result, the pair will continue to trade sideways until there is a clear trend. The MACD line, Signal line, and Histogram were also flat in the previous sessions.

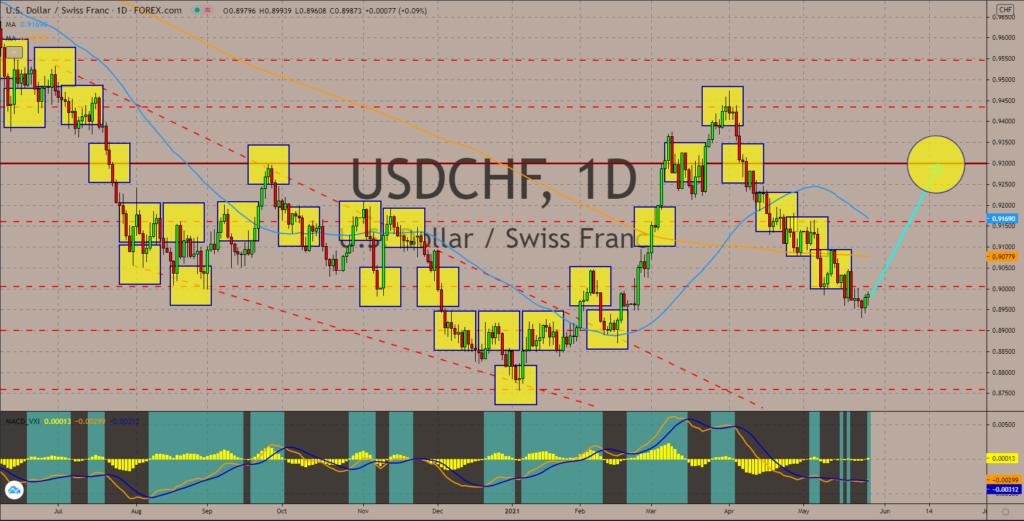

USDCHF

The recent economic data from Switzerland were all pointing to the weakness of the franc. Trade surplus in April was down to 3.837 billion from 5.732 billion the prior month. Also, there were fewer jobs in the first three (3) months of the year with 5.101 million. This is near the 5.095 million employed Swiss in the second quarter of 2020. These numbers made the Swiss franc an unlikely haven for investors. In other news, the Swiss government ended its negotiations with the European Union to redefine these parties’ ties amid changing geopolitical landscape. While surrounded by the 27-member states, Switzerland is not a member of the bloc. Its relationship with Brussels was created from a series of bilateral relations, which the recent negotiations plan to integrate into a single agreement. The implication is huge as the EU is Switzerland’s largest trading partner. The MACD indicator is expected to pick up with the recent crossover between MACD and Signal lines.

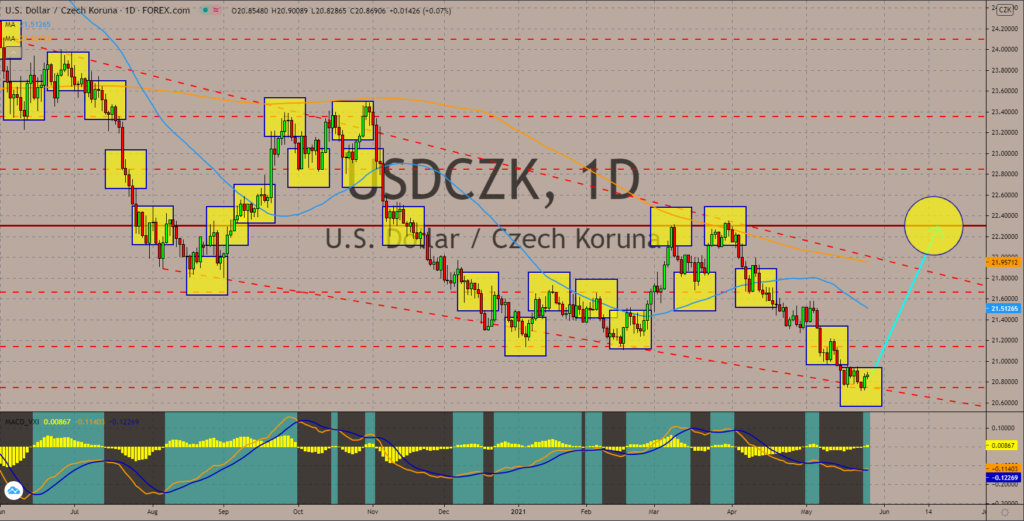

USDCZK

USDCZK

The pandemic has devastated each country’s fiscal plans. The study conducted by the Institute of International Finance (IIF) saw the debt burden of the emerging economies increase by an average of 15% over the course of the pandemic. However, this is not the case for Czech Republic. Prague’s debt was more than double the average at 35%. The United States has also injected trillions of dollars in stimulus and plans to add more debt with the proposed 2 trillion infrastructure program by President Joe Biden. But the increase in debt was supported by strong economic data from the world’s largest economy. America plans to score another streak of economic expansion in Q1 at 6.5%. For the same quarter, the EU’s largest economy saw its GDP shrinking by -1.8%. Moreover, the number of individuals filing for their unemployment benefits is expected to decline to 425,000. The MACD shows a possible trend reversal, which coincides with prices hitting a support area.

COMMENTS