Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

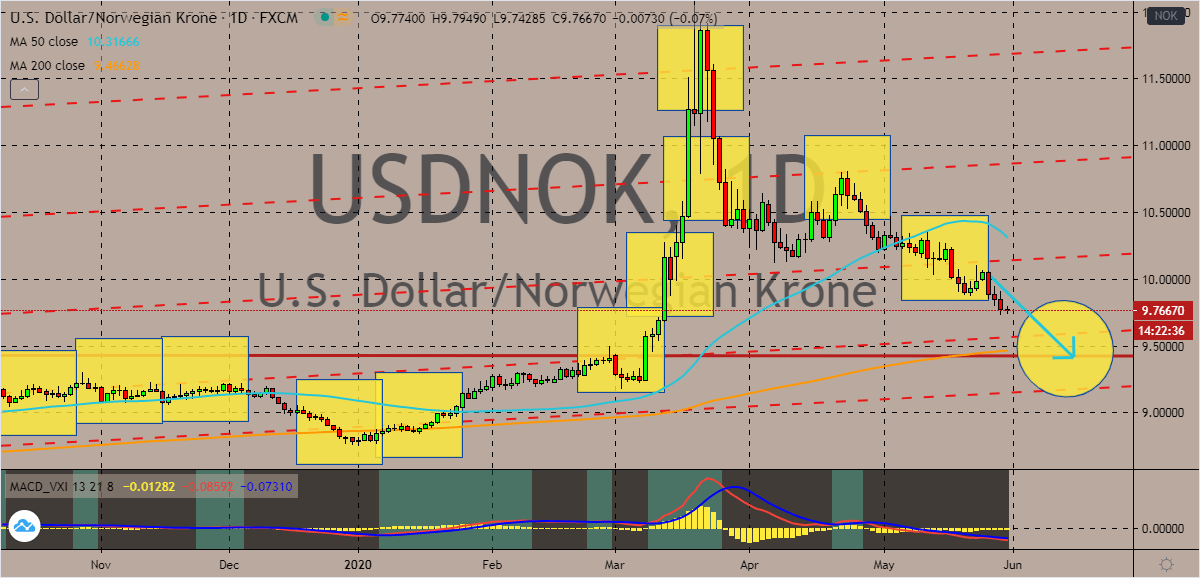

USDNOK

The better than expected conditions of the oil production in Norway is helping bearish investors to rally in sessions. The downward momentum is projected to last until the first half of June and potentially drag the USDNOK lower and lower. The Norwegian krone is strengthening thanks to the optimism in the country’s oil output and considering that the crude market is already steadying, the oil-linked currency will most likely continue its direction. Bears investors of the US dollar to Norwegian krone exchange rate are effectively pushing the 50-day moving average lower and closer the 200-day moving average. Aside from its relationship with oil prices, another factor that is supporting the krone in forex sessions is the unexpected increase in the country’s retail sales. Recently, Statistics Norway noted that the direction of spending is less on services but more on retail goods, a change in the country’s consumption pattern.

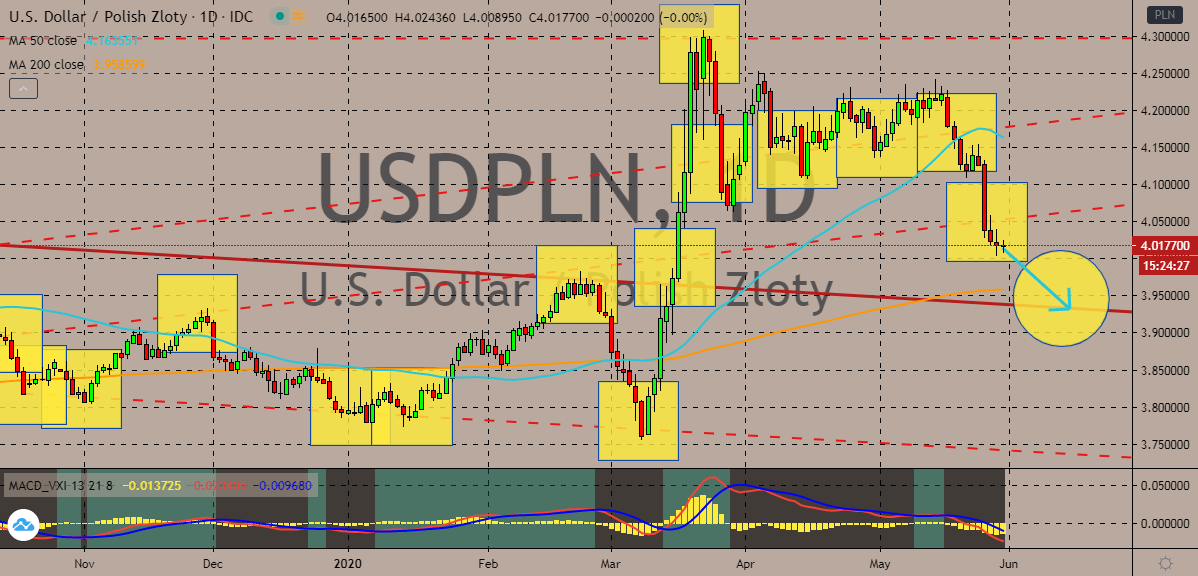

USDPLN

The Polish zloty’s rally has steadied thanks to the unexpected rate cut from the Polish central bank thank shocked the forex market. Earlier this week, the pair dropped sharply after the news that the National Bank of Hungary opted to leave its rates unmoved. That news gave hopes that the Polish central bank will relatively follow in the steps of its neighbor especially considering that some critics have already said that the previous rate cuts weren’t actually necessary. And just yesterday, the Polish central bank dropped the bomb which caused the pair to steady yesterday and today. However, judging by the fundamentals that are around the pair, it will continue to descend, but the zloty will have a tougher time thanks to the rate cuts. After all, the US dollar remains significantly weak against most currencies thanks to the improvement in the global financial market. Thanks to the reopening of economies around the world, the safe haven of the buck is faltering.

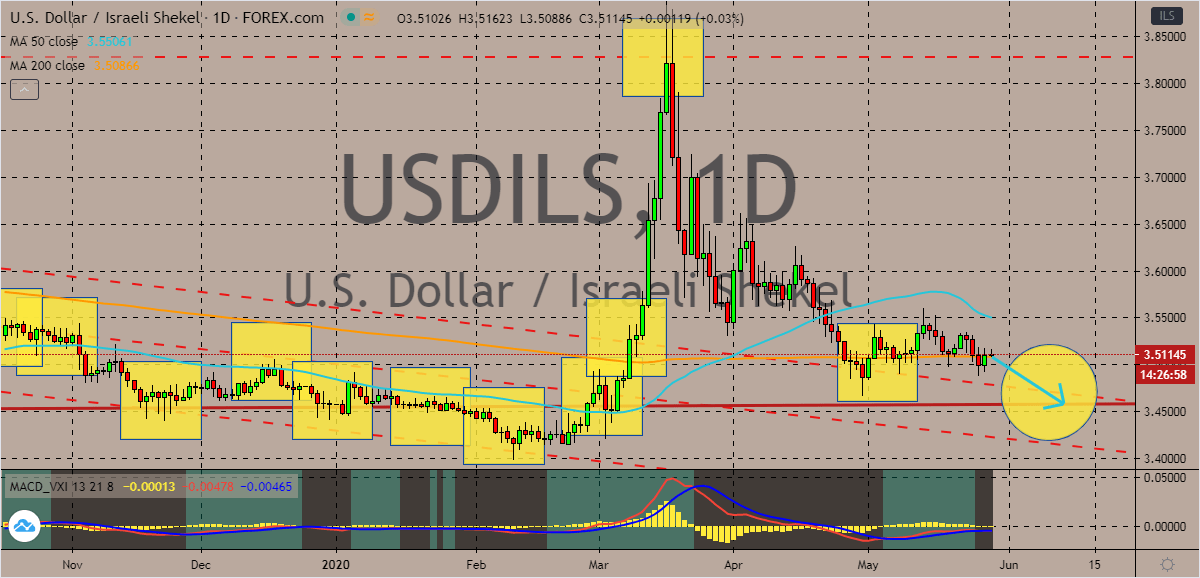

USDILS

Despite the struggling Israeli economy, the shekel remains strong and determined against the US dollar. The pair is bound to hit its support in the first half of June. Bearish investors are brushing off the concerns about Israel’s economy and are focused on taking advantage of the broader weakness of the greenback. Although this week was full of concerning news about the country’s economy. Local reports say that the country’s economy contracted at 7.1% in the first devastating quarter of 2020. The economic fall out surprised the local market as the Bank of Israel previously said that it expects the economy to shrink by 4.5%, and the 7.1% fall is interestingly bigger than projections. Moreover, the Bank of Israel also optimistically said that it sees the economy growing by 6.8% by next year after the coronavirus pandemic. However, USDILS investors still note that it’s smaller than previous forecasts of 8.7% growth just last month.

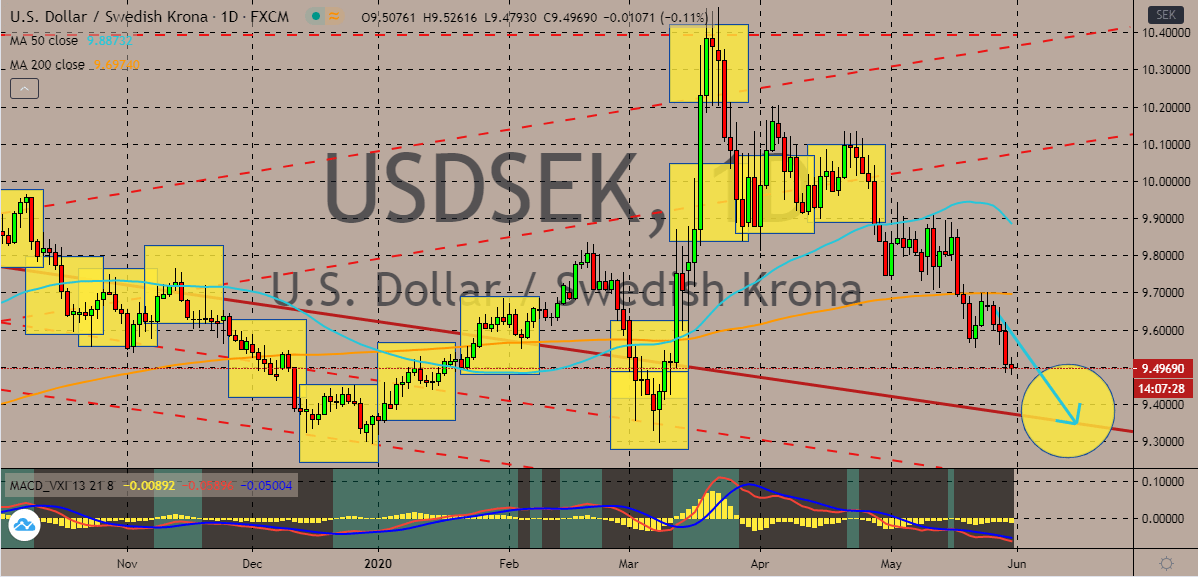

USDSEK

Thanks to the flat retail sales from Sweden yesterday, the USDSEK takes a breather this Friday as bulls prevent the crown currency from extending its rally. Despite that, the USDSEK pair is still projected to drop to its support as the US dollar remains widely vulnerable. Looking at the chart, the 50-day moving average appears to have taken a U-turn and is now heading downwards, towards the 200-day moving average. Moreover, sales in Sweden fell by -1.3% in April compared to its figures from a year ago. This is in spite of the fact that the country didn’t enforce harsh lockdown restrictions that would pressure the economy. However, the month-on-month sales report showed an increase of 0.2% in April, a slight improvement from the -1.5% slump from the month earlier. Perhaps it’s the main reason why the Swedish krona didn’t fall because economists and other experts previously projected that it would drop to more than -2% in April.

COMMENTS