Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

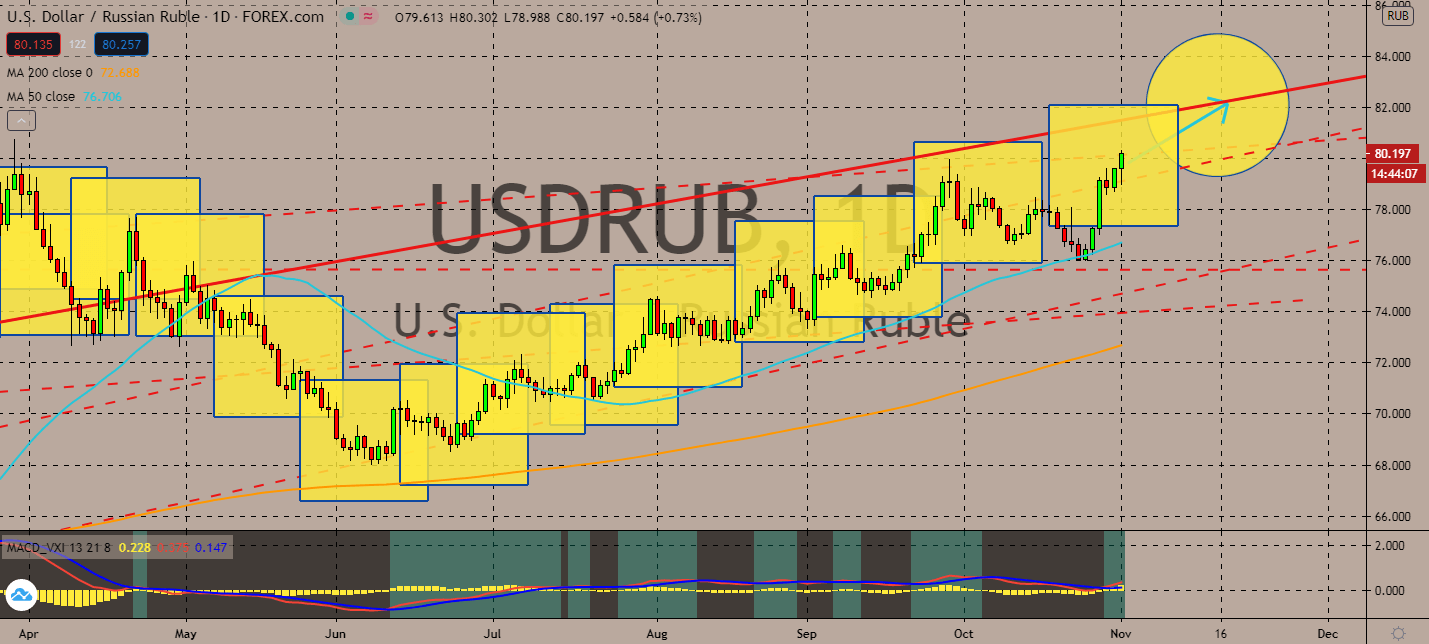

USDRUB

The bears are in full control of the crude oil this week. This will be the main driver of the pair’s bearish track in the near-term as the coronavirus continues to take over both the United States and the Russian economy. The market is agitated by the US presidential elections now, more than ever, which could lead to relative dollar weakness, but the Russian ruble’s state will be more detrimental. After all, the pair’s 50-day moving average has still been moving above its 200-day moving average counterpart. Bearish bias is likely to continue as long as energy demand and supply continue to suffer from Libya’s supplies alongside news that could bring Iran’s supply back into the market. Moreover, Covid-19 cases have been uncontrollably rising in remote states in Russia, which has been bringing the country’s health sector to a breaking point even while President Vladimir Putin disregarded economists’ urges for another nationwide lockdown.

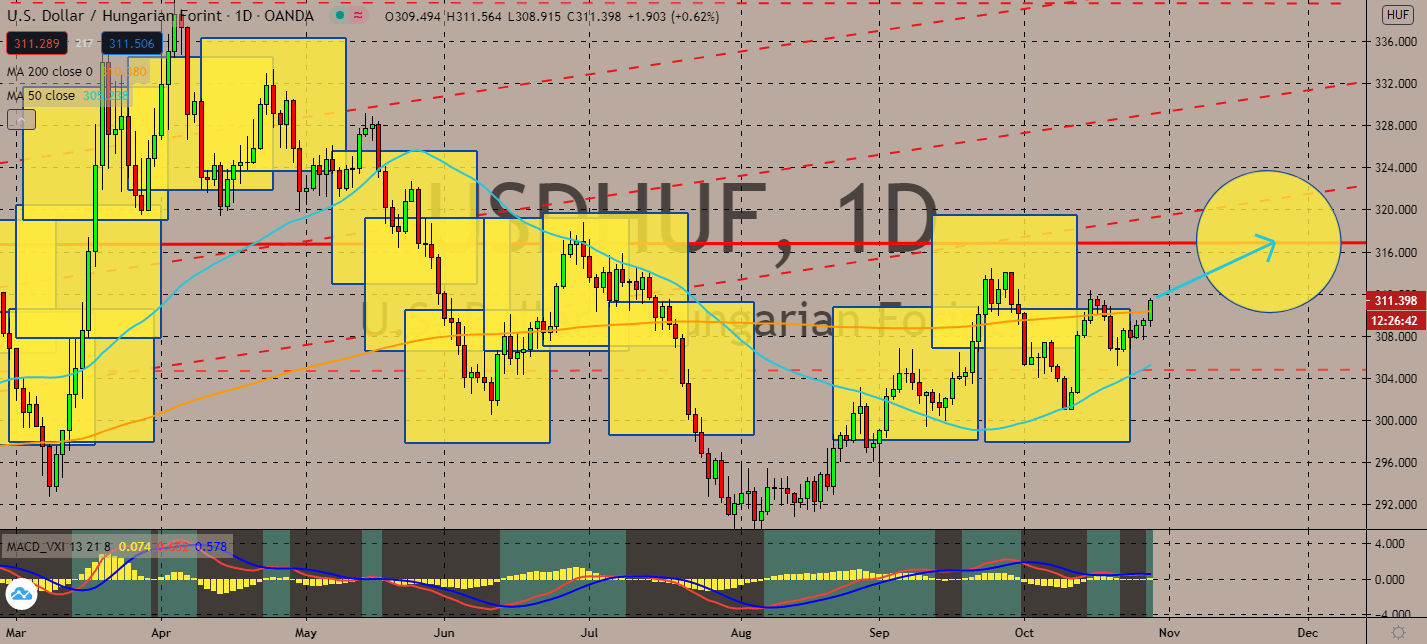

USDCHF

Switzerland’s central bank is well-known for its constant interference with the foreign exchange market, and it looks like its effort is about to come to fruition once again. The Swiss National Bank reported a third-quarter profit of 14.3 billion Swiss francs on gains made from its holdings of foreign currency investments, which came with a profit of 2 billion francs from the increased value of its gold holdings throughout the same quarter. The negative rates it charges commercial banks will continue to help appreciation boost for the franc throughout the year, considering that the pair’s 50-day moving average has been moving low against its 200-day moving average. It looks like the pair is preparing for a breakthrough in its current levels. It’s likely towards a lower market over uncertainties towards US stimulus package after the presidential elections wrap up, and a new president has been determined to continue the States’ recovery from coronavirus slumps.

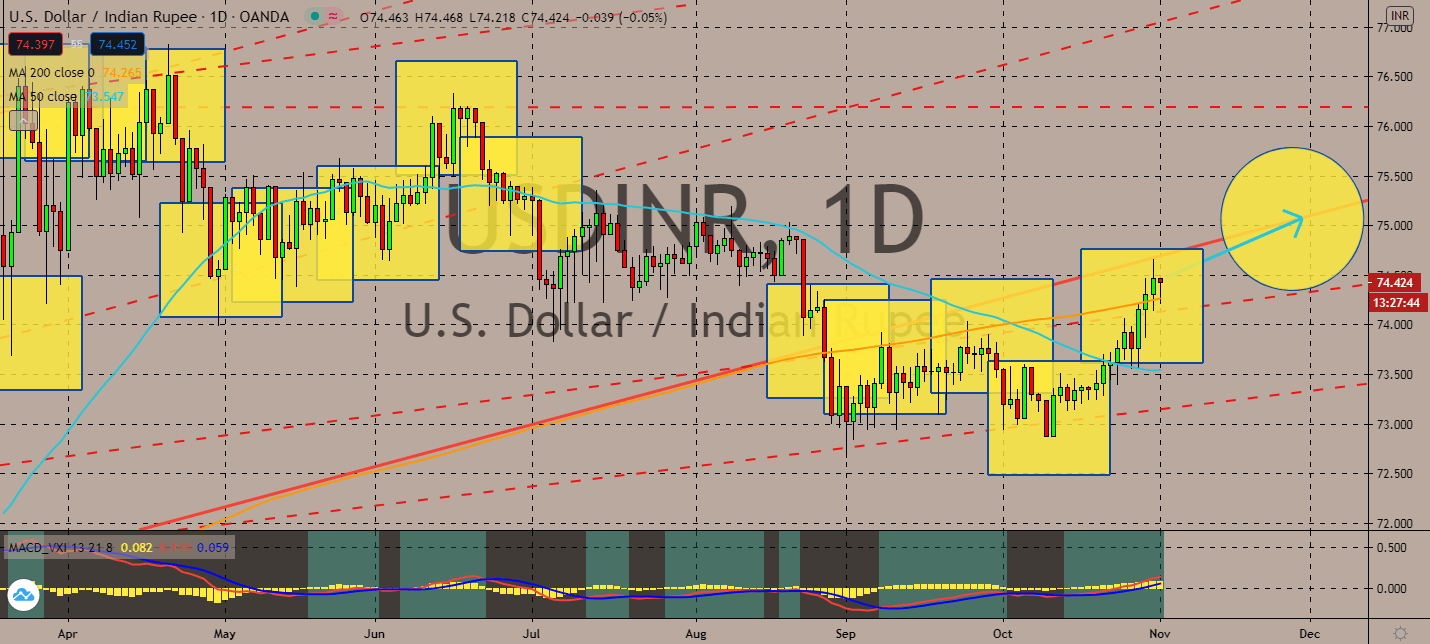

USDINR

It looks like the absence of progress towards a coronavirus vaccine is taking a toll on the Indian rupee’s near-term projection. The coronavirus pandemic’s growth has been increasing its pace, and investors fear that India’s economic conditions will worsen before they could get better. In fact, economists claim that India was the worst-hit among emerging markets. The US presidential election’s outcome is also likely to bring more uncertainty for the rupee, which could bring forth further risk aversion in the foreign exchange market. The pair is likely to keep its path upward, despite having its 50-day moving average below its 200-day moving average counterpart. Investors are now projected to keep the greenback up against its more uncertain opposite as the world awaits results for the elections and coronavirus cases force economies to close and pulling down demand for commodities and economies involving fossil fuels, such as commodities seen in India.

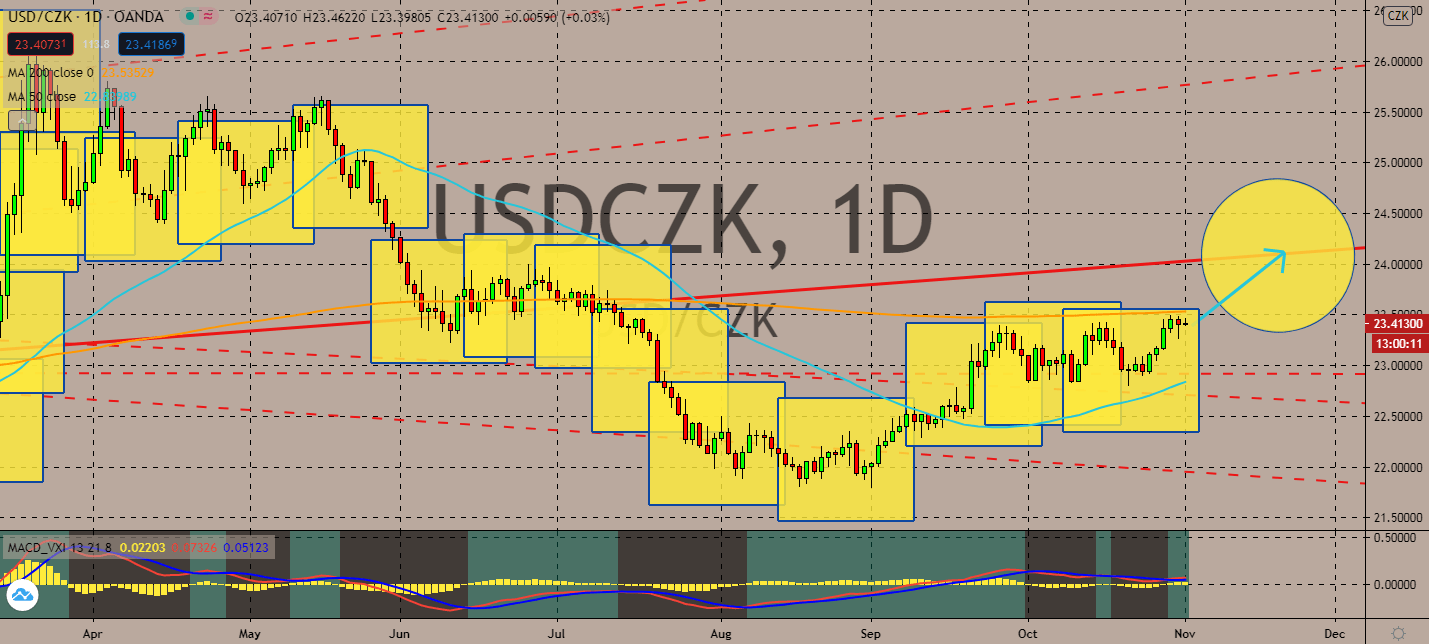

USDCZK

Czech Prime Minister Andrej Babis put a date on when the country’s health system would collapse if it fails to impose new regulations that could slow the virus’ spread across the country. The Czech Republic is on its third health minister within six weeks after Roman Prymula resigned for being spotted leaving a restaurant that should have been closed under the then-health minister earlier this year. The country remains as one of the worst-affected EU countries in terms of new deaths and infections per 100,000 inhabitants, which will be the more certain determiner of the crown’s fall against the greenback. The exchange’s 50-day moving average curved far upwards toward its 200-day moving average recently, showing signs that bullish traders are preparing to recover their momentum amid Covid-19 led uncertainties around the globe. Volatility is to be expected for the pair after the US wraps up its presidential elections within the week.

COMMENTS