Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

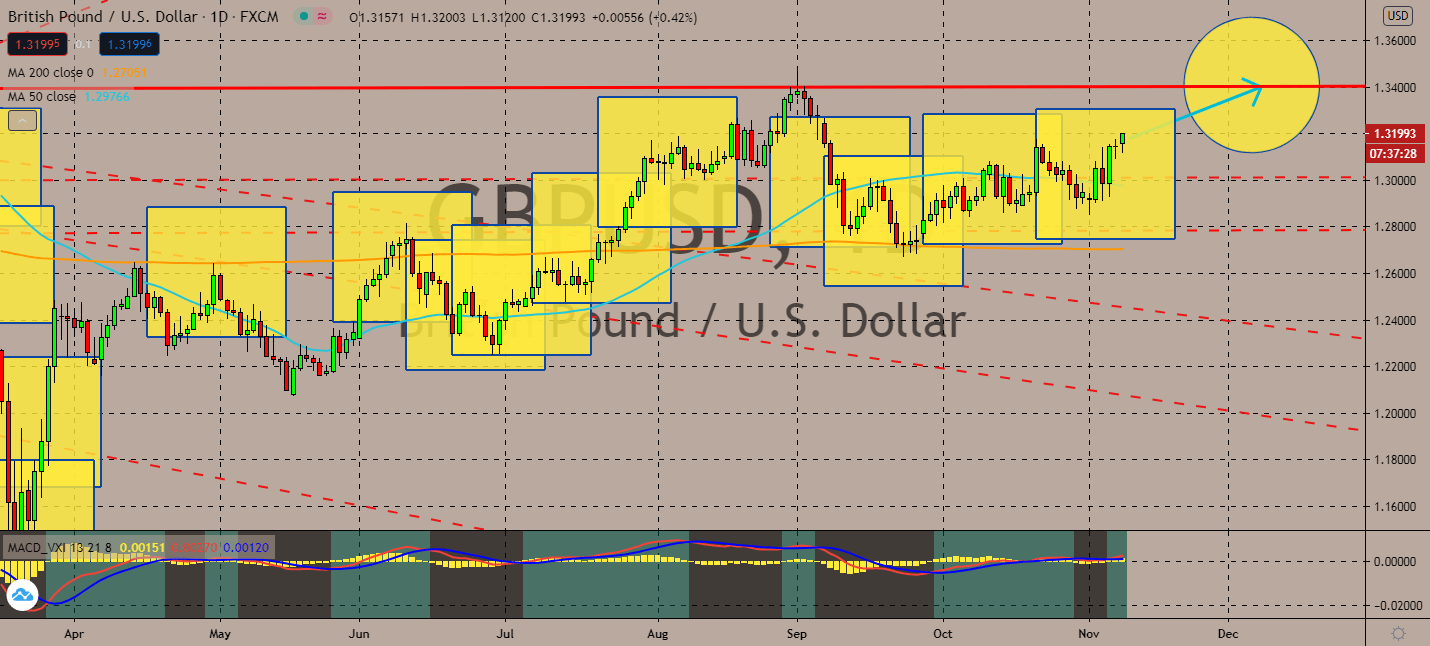

GBPUSD

Democrat Joe Biden’s victory in the US presidential elections is projected to continue Sterling’s nine-week high versus the dollar. Riskier currencies are projected to gain a bullish momentum as investors turned optimistic towards a bigger fiscal stimulus package for the United States, which could result in better relationships on global trade. The pair’s 50-day moving average is projected to continue driving above its 200-day moving average because of this. Bullish traders will continue their track upwards over-optimism from the Brexit deal as well, as Ireland’s foreign minister Simon Coveney said that the victory will have a positive impact on the country because of its good relationship with the new president-elect. British Prime Minister Boris Johnson and the European Union said that key differences remain, but the Bank of England’s 150 billion-pound bond-buying could help the market engaged in buying the currency in the near-term.

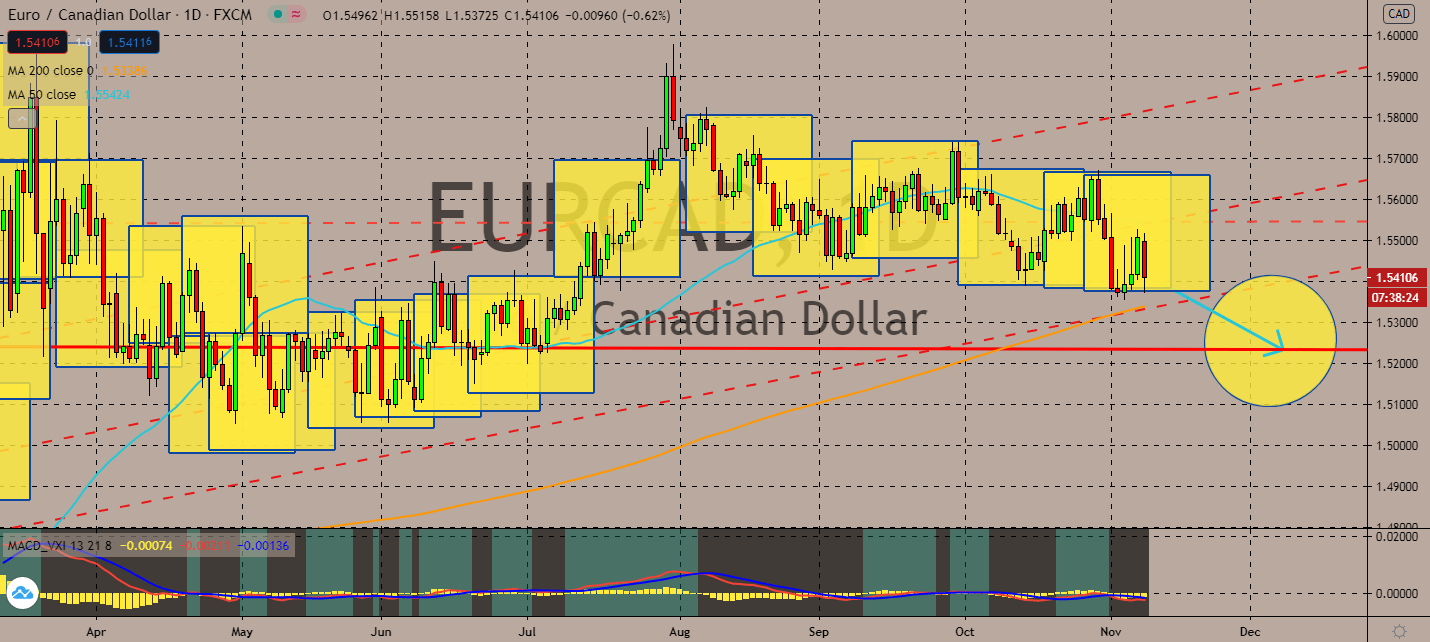

EURCAD

The euro’s bearish momentum is likely to bleed into the EURCAD pair in the near-term as its biggest economies, France, Italy, and Germany return to nationwide lockdowns, increasing the speculation that it could experience another wave of sluggish economic activity through the end of the year. Investors have also been considering a possible alteration for the European Central Bank to change its rates to a possible 10-basis point interest rate cut by the end of 2020. The pair’s 50-day moving average is still above its 200-day moving average, but the latter catching up to the former could mean that bearish traders have been more optimistic over recent reports about Canada’s immigration rates in the long-term. As the risk-sensitive country’s immigration rate is projected to help the country’s gross domestic product to increase annually by 34 billion Canadian dollars, or about 1.7 percent to 1.9 percent of its total GDP.

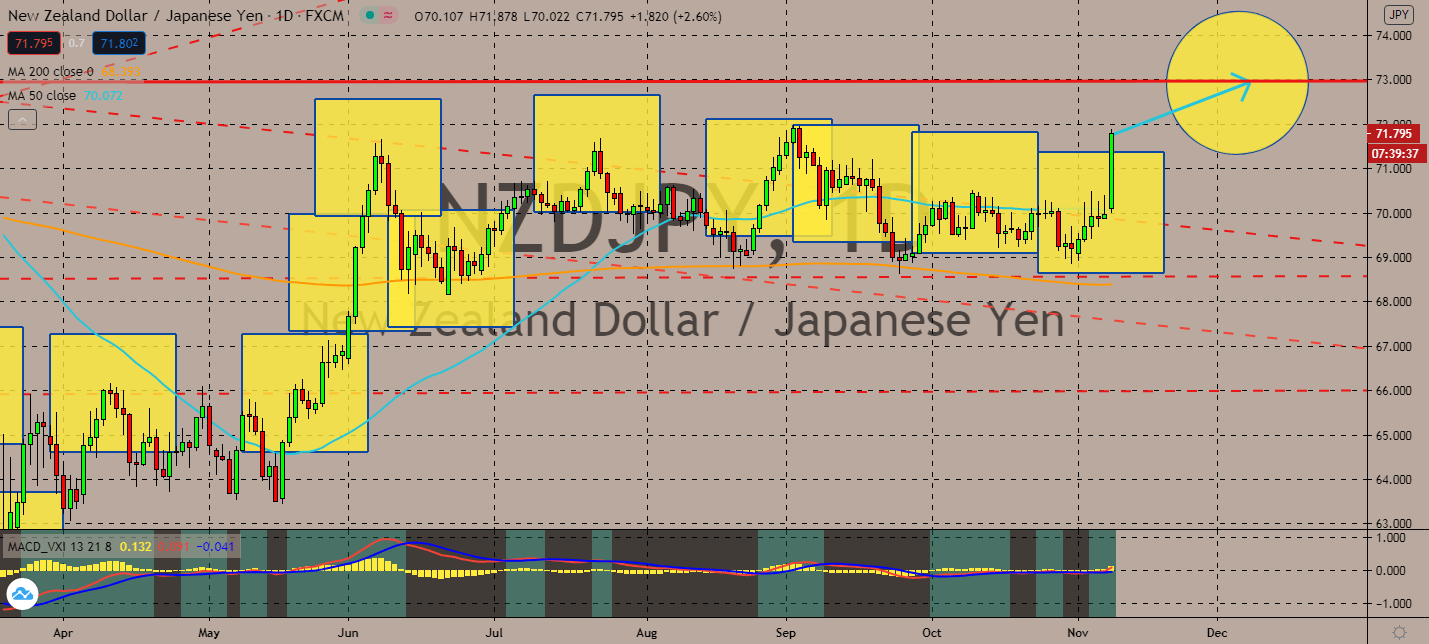

NZDJPY

New Zealand was one of the economies that acted the fastest against the coronavirus pandemic. Its initial aggressive stance on the health crisis had caused it about 900 million kiwi dollars in the earliest quarter of the year. But now that most of its restrictions had eased and the virus remains under control, business confidence has been returning in key sectors such as tourism and agriculture. The kiwi unemployment rate is projected to keep at its low of 5.3 percent seen in September with anticipation to have increased within the month later. The pair’s 50-day moving average is still well above its 200-day moving average, indicating that the kiwi dollar is likely to gain more momentum in the near-term as the Japanese enters an uncertain recession as its own outbreak continues to weigh into its economic activity. Fortunately, any growth seen in the coming month will pull Japan out of its worst postwar recession.

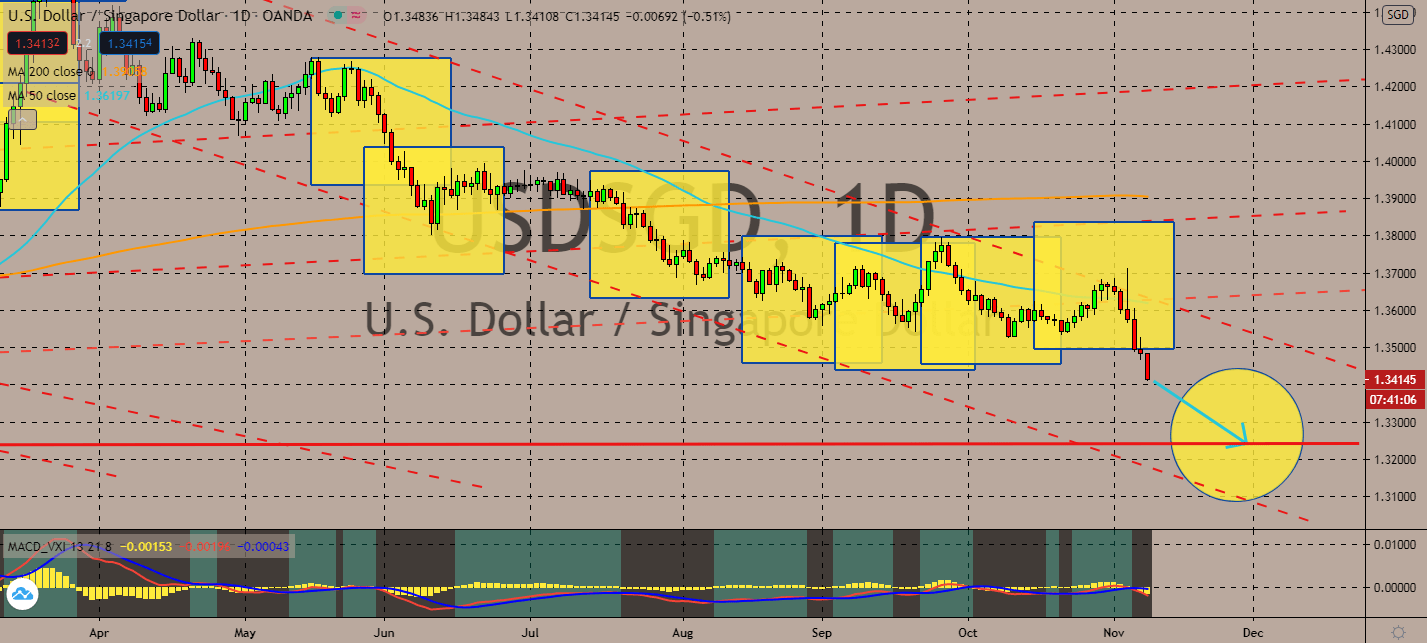

USDSGD

An improvement in Asian-American trade is projected to help Asian currencies like the Singaporean dollar. The greenback is likely to continue its 10-week low in the pair following Biden’s win in the presidential election, although with hesitance due to the anticipation that this week could still put Republicans in control of the Senate. Although, the most likely scenario will put a large monetary stimulus package under Biden’s demand, keeping US bond yields low and spur more investments in its opposite market. The positive risk sentiment will keep helping buoy the Singaporean dollar as the pair’s 50-day moving average keeps its fall against its 200-day moving average, indicating that the bearish momentum is getting more unlikely to halt in the near-term. Portfolio inflows are projected to keep flooding back in Asian markets as long as Biden keeps a less directly confrontational approach towards China.

COMMENTS